@Today’s topic

#2022 General Meeting of Shareholders Research News# $Xin Litai(SZ002294)$

On April 18, 2022, when the 2021 Annual General Meeting of Shareholders of Xinlitai will be held once a year, it is time to perform the duties of shareholders. This is the 4th year in a row that I have participated in the general meeting of shareholders. The crazy Omicron virus, with its super transmission ability, has slowed down the entire city. It took a lot of hard work, and finally the society was cleared (in fact, there are sporadic cases), of course, the cost is also huge. Now that the epidemic has slowed down temporarily, you can go to the general meeting of shareholders. The exchange of information with management is the focus of this trip. This time, I want to praise the company, which is a bit biotech-like, and took the initiative to introduce the clinical pipeline of research and development. A lot of obscurity, finally lifted the veil.

The following is the introduction of the management:

Items 1-16 of the meeting agenda, a few words, skip it…

1. Xinlitai still has some preparations to deal with the epidemic. The clinical impact of the epidemic is still there. It will also affect the sales of some parts, such as the part of admissions.

2. See medical insurance for innovative drugs, and centralized procurement for generic drugs.

3. R&D accounts for 22%, and will maintain a high R&D ratio in the future.

The additional issuance of 420 million is fully guaranteed for future research and development.

5. Biomedical, may also introduce several strategic investors by the end of May. The current biomedical valuation is around 5 billion. Mainly considering listing on the Science and Technology Innovation Board. Listing under Article 5 can be a bit difficult, so use others to qualify for listing. At present, the funds are sufficient to maintain the research and development of the existing product line.

6. More than 4,000 people were admitted to the hospital.

7. Chronic diseases account for about 80% of national deaths.

8. The change of registered address is because Futian District has given a 6,000-square-meter land in the Hetao area, which can be used for innovative drug research and development. There are tax and policy concessions, which are more convenient to attract talents from Hong Kong, Macao and overseas. The company’s headquarters remains where it used to be. Just need to change the cost of registration.

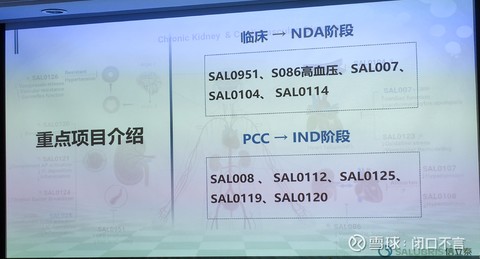

Introduction of Mr. Yan’s R&D pipeline: (The screenshot below is from the introduction of R &D pipeline at the general meeting of shareholders, and the copyright of the picture is owned by Xinlitai)

1. Product Pipeline – Chemicals

It seems that the research and development capabilities of small molecules are stronger. In addition to the original focus, cardiovascular (high blood pressure, heart failure, thrombosis, etc.), even arthritis, nephropathy, and colitis are also involved.

2. Product pipeline – biological drugs

Except for 007 and 008, the others are slightly thin. The pipeline of macromolecular drugs is still relatively weak. If there are good projects, you can still pay attention.

3. Key projects

There are mainly SAL0112 (diabetes), SAL0125, SAL0119 (), and SAL0120 are relatively unfamiliar. If you have time, study it again and give a detailed introduction.

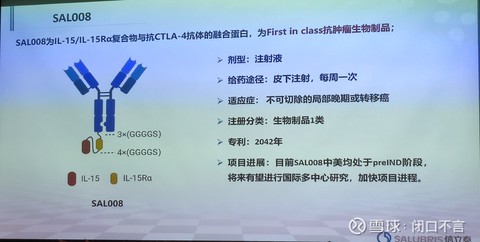

4. The specific target of JK08 is the fusion protein of IL-15/IL15Ra complex and anti-CTLA-4 antibody

JK008 will also be prescribed for clinical use in combination with PD1/PDL1.

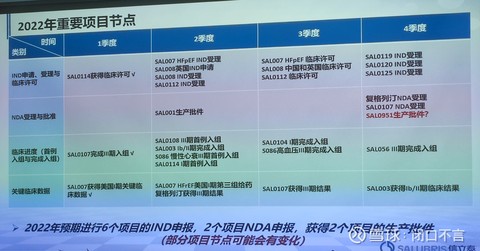

5. Important nodes of the R&D pipeline in 2022 (all are forecasts and may be affected by other factors such as the epidemic)

It seems that there will be a lot of announcements in the future. It is expected that teriparatide water injection is expected to be approved by the end of next month, and ennarstat is expected to be approved in the fourth quarter. Fudagliptin and NDA at the end of 107.

The following is the Q&A session of the exchange between minority shareholders and management :

Q: What are the specific data of the first batch of JK07 except the first patient?

A: With the lightest dose of 0.03 mg/kg in the first group, the improvement in ejection fraction was unexpected. Because the underlying diseases of heart failure are different, individual responses are also different. Regardless of China or the United States, the clinical benefit occurred in the treatment group . More data can only be seen in the second group and the third group. Existing data do not give much information. The key is good security. The clinical trial of the second group of doses is expected to be completed by the end of this month in the United States. The third group did not wait for unblinding, and continued. Experts in the United States predict that after completing 3 groups, the Phase 1 clinical trial will be completed ahead of schedule and the Phase 2 clinical trial will be entered early.

Q: When will JK07 propose a breakthrough therapy?

A: It mainly depends on clinical data. The current data is not enough. Let’s see whether the clinical data of the second and third groups fully reflect the efficacy. In the end, the clinical data has the final say. HFrEF, HFpEF, ALS will do.

Q: Is JK07 expected to do Phase 2 clinical trials by itself?

A: Yes. At present, the data is relatively good, and I am currently considering doing Phase 2 clinical trials myself. American Xinlitai also has very experienced CMOs, and we believe that we have the ability to do phase 2 clinical trials. (PS: I personally think it is mainly supported by 2-phase data, which can be sold at a good price)

Q: What is the sales target of Xinlitan this year?

A: We plan to increase sales by 60-70% next year. The epidemic has uncertainties on sales (PS: According to this statement, revenue growth is 12-19%)

Q: Xinlitai pays generous dividends, how to ensure future research and development?

A: R&D mainly depends on funding. The additional 1.93 billion issued last year were all used for R&D projects, and R&D is guaranteed. Now there are more than 3 billion in cash, and the funds are abundant.

Q: What impact will the price reduction of Nuoxintodaiwen have on Xinlitan? how to respond?

A: Although the price has dropped, the price is still quite high. Regardless of foreign companies or Chinese companies, in the Chinese market, the curative effect is good and the price is low. The proportion of medical care to GDP is 5-6% in China, 19% in the United States, and 10-11% in Europe and Japan. China still has a lot of room for improvement. …

Q: When will JK07 (HFrEF) complete Phase 1 clinical trials?

A: If the 3 sets of data can be resolved, then Phase 1 clinical trials can be completed this year. (PS: The clinical trial was originally expected to do 5 groups of dose escalation)

In conclusion , Xinlitai is currently on the right path, and it takes time to verify. The pipeline of chronic diseases is also becoming more and more abundant, and the future test will be more and more serious. It doesn’t matter if the road is rough.

There are 57 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7137989092/217411412

This site is for inclusion only, and the copyright belongs to the original author.