@Today’s topic $Wuliangye (SZ000858)$ $ China Merchants Bank (SH600036)$ $ Shede Wine (SH600702)$

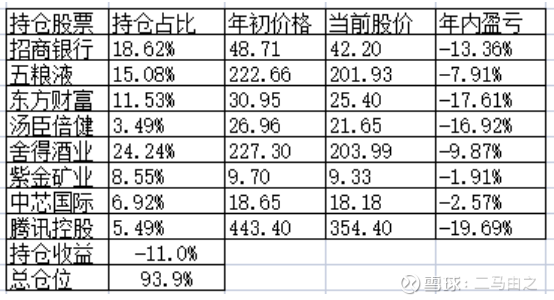

As of the end of June 2022, the yield on holdings this year is -11%. Compared with the end of May, the blood returned slightly by 7.8%.

This year has been the most difficult half year for Erma Investments over the years, with a maximum drawdown of about 25%. Several heavy-holding stocks have suffered accidents one after another, some of which have CEO accidents; some are regulated and have suffered continuous reductions by major shareholders; some have suffered from poor sales due to the epidemic. It’s really hard.

I’m thinking that maybe every investor needs to go through a moment like this, to feel the bleakness of a cold winter after a sunny day. Only through suffering can we cherish the good life.

1. Adjustment of positions and shares

In the first half of the year, there were very few overall trading activities, so that a small partner asked me if I would no longer announce the trading activities. It is not that they are unwilling to announce, but that there is no trading opportunity. My firm will insist on publishing, and I hope to measure my ten-year performance with public data.

There were not many transactions in January, April and May this year.

In January, it was willing to fill up its positions twice, and made up for the previously high-level lightening up, which was roughly 10%; at the same time, SMIC also added 2% of its positions;

Tencent transferred 2% of its positions to SMIC in April;

In May, China Merchants Bank, which reduced its position by 7%, added 3% Zijin Mining, 2% Oriental Fortune, and 2% Wuliangye.

2. Position stock trading strategy

In terms of trading strategy, some fine-tuning will be carried out recently. This issue will not be published for the time being.

3. Summary of some stock holdings

1. Zijin Mining

In 2021, Zijin Mining’s copper output will reach 584,000 tons, and the planned production capacity in 2022 will be 860,000 tons, a year-on-year increase of 47.3%.

Zijin Mining has been making frequent moves in the acquisition of lithium ore resources since 2022. Lithium will be an important force for Zijin Mining in the future.

The first phase of Argentina’s 3Q project will start in April 2022, and it is planned to be put into operation in 2023, with an annual output of 20,000 tons of battery-grade lithium carbonate;

The second phase of the 3Q project will start in 2023, and the overall production capacity will reach 40,000-60,000 tons.

On April 29, 2022, Zijin Mining acquired a 70% stake in Lagocuo Lithium Salt Lake in Tibet.

Zijin holds a 15% stake in the development of the world-class Manono lithium mine in the DRC.

On the evening of June 29, Zijin Mining issued an announcement that the merger and acquisition of new energy minerals “will be another city”. The company plans to invest about 1.8 billion yuan to acquire a 71.1391% stake in Hunan Houdao Mining, which holds 100% of Hunan Daoxian Xiangyuan rubidium-lithium polymetallic mine, and has 870,000 tons of lithium oxide resources, equivalent to 2.16 million tons of equivalent lithium carbonate resources.

After the completion of this transaction, the “two lakes and one mine” controlled by Zijin Mining will have more than 10 million tons of lithium carbonate equivalent resources, and the annual production capacity is expected to exceed 150,000 tons of lithium carbonate equivalent in the long-term plan, which will enter the top 10 in the world and the top 3 in China. .

For Zijin Mining, on the one hand, Erma is optimistic about its production capacity and category expansion in recent years; at the same time, considering the Fed’s interest rate hike to suppress copper prices. This could put pressure on Zijin’s share price. But I’m going to take it hard.

2. China Merchants Bank

2022 is a very difficult year for China Merchants Bank. The change of president in April and May has raised market concerns about whether China Merchants Bank’s retail strategy will be resolutely implemented. In the end, the original executive vice president took over, and the market’s concerns about the strategic stability of China Merchants Bank were released.

Fundamentals:

In the first half of this year, the sales volume of the top 100 real estate companies fell by 50.3%. As a development loan and mortgage loan account for more than 30% of the total loan, China Merchants Bank, the impact can be imagined. At the end of the first quarter, China Merchants Bank’s non-performing ratio of public real estate was 2.57%, up 1.18% year-on-year.

In January this year, the 1-year LPR was cut by 10bps, and the 5-year LPR was cut by 5bps. On May 20, the 5-year LPR was cut by 15bps, and the lower limit of the mortgage interest rate for the first home loan was lowered to LPR – 20bps. China Merchants Bank’s net interest margin encountered severe challenges.

The banking industry, including China Merchants Bank, was hit by asset quality shocks, with falling interest margins and asset shortages. This year can be said to be the most difficult time for the banking industry in the past five years.

The repeated impact of the economic cycle on the banking industry has made me plan to further reduce my position in bank stocks.

3. Wuliangye and Shede

Wuliangye will be more difficult this year, and the impact of the epidemic in East China on Wuliangye’s performance is real. In terms of performance, lower expectations.

We pay attention to the production capacity construction of Wuliangye. The following data comes from Wuliangye’s shareholders meeting.

At present, the production capacity of Wuliangye base wine is 100,000 tons. The new 100,000-ton capacity construction plan of Wuliangye is as follows:

The first phase of the 100,000-ton ecological project will start in April 2022 and be completed by the end of 2023, adding 20,000 tons of base wine production capacity;

Through technological transformation and the relocation of non-alcoholic projects in the park, the construction of 20,000 tons of base wine production capacity will be realized, which will be completed by the end of 2023;

The second phase of the 100,000-ton ecological project will be launched at the end of 2022 and put into production at the end of 2024, adding 60,000 tons of base wine production capacity.

If Wuliangye can achieve a 10% profit growth this year, I am actually quite satisfied.

Hede achieved a net profit growth of 75.6% in the first quarter of this year, which somewhat exceeded my expectations. Considering that the main sales areas of willingness have not been affected so much by the epidemic so far. I continue to give the expectation of a 50% net profit growth rate this year.

There is another very important thing that is willing to this year, that is, capacity expansion. Shede plans to invest 7 billion to build 60,000 tons of original wine production capacity and 340,000 tons of original wine energy storage in five years.

Many people do not understand the willingness to expand production capacity. Among so many liquor manufacturers, why did I choose Shede? It is because they are willing to have a very rich base wine reserve. And I have seen many other wineries, and quite a few manufacturers are ambiguous about the production capacity data. Under the rapid growth of these years, there are obviously small horse-drawn carts and lack of stamina.

4. Tencent Holdings

On May 18, Tencent announced its first quarterly report for 2022, in which the net profit attributable to shareholders of the parent company was 23.4 billion, a year-on-year decrease of 51%; the non-IFRS net profit attributable to the parent was 25.5 billion, a year-on-year decrease of 23%. It can be described as extremely bleak.

Under the dual pressure of the epidemic and supervision, Tencent is in a very difficult time.

So how to think about Tencent’s future, Tencent is still worth holding. I have the following thoughts.

A. On the whole, Tencent’s volume is already large enough, and it is difficult to have sustained high-speed growth;

B. In the long run, the domestic game business will slow down.

C. Tencent’s future focus is on video accounts, small programs, cloud business including enterprise services, investment, and foreign games;

At the current valuation, Tencent is still worth holding, but lower earnings expectations.

At the end of June, Tencent suffered another blow, and the largest shareholder has to continuously reduce its holdings of Tencent shares. In this regard, my view is to let the bullet fly for a while. If Tencent has a more extreme price due to this, I will partially adjust the position to Tencent.

5. Oriental Fortune

For a brokerage stock whose performance fluctuates with the market cycle, in a bear market like the first quarter of this year, the brokerage business income still has a 30% increase. I can only describe it as awesome. Fund sales revenue has declined, which is acceptable to me.

I am very satisfied with the 5% deduction of non-net profit growth in the bear market. Looking forward to the recovery of the market in the second half of the year, Dongcai will have a better performance.

4. Future Market Outlook

When looking at this year’s market in early 2022, I couldn’t be pessimistic at the time. My strategy for this year is “fight and retreat”, and I hope that I can gradually reduce my positions amid high selling. When I set that strategy, I was a little pessimistic and a little greedy. Reasons for Pessimism The index has risen for three years in a row, and it’s time for a pullback. At the same time, the epidemic prevention situation in 2022 will be more severe. But I’m just a little pessimistic, because the economic situation in the second half of 2021 is not good, and liquidity can be expected to be very loose this year. With loose liquidity against high valuations and a tight external environment, I think A shares may fall, but not too hard.

Therefore, the strategy I consider is to fight and retreat, hoping to obtain excess returns through “war”.

After thinking about it, I was still too greedy. Fight and Retreat should be changed to Retreat and Fight. Counter-attacking should be the better strategy. As a result, the first half of this year suffered a more serious retracement.

When the time enters the second half of 2022, how should we look at the subsequent market? My judgment is that in the second half of the year, the market will be: the road is blue, or there may be surprises. The general reasons are as follows:

The biggest factor affecting the economy and the stock market in the second half of this year is the epidemic. It is difficult for us to judge whether the epidemic prevention situation in the second half of the year will be more severe than that in the first half of the year. In this case, a lot of liquidity is released. Monetary policy will be very loose. Easy money will enter the infrastructure, major investment areas. At the same time, due to uncertainty, many companies will be more cautious about expanding their credit. Before seeing a certain trend or policy, it will be a normal choice for business owners to look more and do less.

This situation will lead to a large amount of liquidity without a suitable reservoir. Under the current circumstances, only the stock market can accommodate a large amount of funds, especially when the overall market valuation is relatively low, the stock market reservoir is relatively safe. Therefore, there are factors that support the bull market in the stock market. If at the same time we are fortunate to not encounter serious epidemic disruptions, people may gradually restore confidence. The stock market may really usher in a small wave of spring. But we also know that the possible calf market in the second half of 2022 is relatively fragile and may be disturbed by unexpected and uncontrollable forces at any time.

Combining these factors, on the one hand, I have great concerns about unexpected factors that are not controllable by human beings, and at the same time, I also have expectations (I won’t expand it here, everyone’s brains). I expect that with loose liquidity, the index may end up in the red this year. If this happens, it will be the first four consecutive positives in the history of A-shares. People say whether we are lucky enough to witness history.

In the first half of the year, besides stock investment, a more important thing for Erma was the publication of Erma’s book “Noise and Insight”, which is a book about how ordinary investors build a stock investment system.

This topic has 126 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/3081204011/224420155

This site is for inclusion only, and the copyright belongs to the original author.