Recently, the market has rebounded strongly, and many small partners said that the funds they purchased before have already paid back their capital!

But what amazes me is that they said: Redeem after the return!

For a stock market veteran like me, it’s no surprise. I am surprised that these little friends often read my articles, but their thinking has not changed, and they are still driven by their own humanity.

The fact that the fund is sold back at its original price is not a big deal. Many small partners also swear that they will never buy the fund again after they have sold it back at the original price!

Is this the same with many shareholders? After being beaten by the stock market, many investors often make such naive vows, but the actual situation is very sad.

Whenever the stock market enters a period of accelerated sentiment, they forget all their previous vows and rush into the stock market regardless.

If you ask them why they are back, they will say: I make a small sum and run away, such a good market cannot be wasted!

You see, this is human nature. So don’t make any oaths easily. The stock market is sometimes the same as drugs. Once you get it, you will always be hooked up.

The reason is very simple. When the bull market comes, you see that everyone around you is making money, and it is difficult for you to overcome your greedy nature!

Therefore, I advise these small partners who want to sell it back to be sure to think carefully and analyze rationally. There should be no “return to capital” in your reason for selling the fund.

If you sell now, I’m sure you have a 90% probability of buying it back in the future, but if you buy it back then, you will step on the end of the bubble and continue to be a leek in the eyes of others!

Next I will talk about:

1. Not only should the fund not be sold, you may even buy another lot;

2. Under what circumstances to sell the fund.

1. Is the fund sold at a return? Maybe on the contrary, you should buy another hand!

You can think about it carefully. Is the investment market a place where the vast majority of people lose money and only a few people make money?

If your fund is sold at return, your behavior is highly conformist. Can highly conformist behavior still make money?

You can only make money if you go the way of the few. So, maybe when your fund is repaid, instead of selling, you should buy another lot.

We can turn out two indexes to illustrate this problem, one is the stock fund index and the other is the mixed fund index. See below.

The two indices track the average returns of all active equity funds and hybrid funds, respectively. Over the past 20 years, both indices have risen more than 10 times. The return of the mixed fund index is slightly higher!

Moreover, the long-term trend of these two indexes is constantly making new highs. Even if they bought at the high point in 2007, they would have already solved the problem.

In other words, even if you bought at the highest point in 2007 and made a return in 2015, if you don’t sell it at this time, you will have more than double the income now. If you buy a lot more at the time of repayment, the return will be even higher.

Of course, masters will definitely not do this. First, masters will not enter the market when the stock market is crazy, and secondly, masters will hold heavy positions in the bottom range.

The example I gave just wanted to show that selling at a return is often a wrong decision in the field of active funds!

However, different types of funds must be treated differently. Next, I’ll talk about when you should sell a fund.

2. The fundamentals have changed, you should sell the fund

Do funds also have fundamentals? It depends on what fund you are buying.

If you buy cyclical funds, such as coal, non-ferrous metals, steel, chemical and other funds, when the cycle is nearing the end, you must sell it, otherwise it will take a roller coaster!

If you buy at the high point of 2007, you may not even be able to solve it for the rest of your life!

Similar funds are also commodity funds, such as funds that track crude oil prices and food prices. Their net worth is closely related to the prices of commodities. When the prices of commodities are about to fall firmly, they must be sold.

However, it is difficult to judge the selling points of these two types of funds, because the relationship between supply and demand is too complicated, and sometimes the rhythm is disrupted by completely unpredictable emergencies such as epidemics, geopolitical conflicts, and political games!

Therefore, little white friends, it is best to be cautious, and don’t be arrogant about things you don’t understand!

In addition to cyclical categories, there are certain industry funds that also involve fundamental deterioration.

For example, this is the case with education funds. If you hold on to education funds, when the education and training industry is destroyed by the group, it will be appalling.

Similar to medical and pharmaceutical funds, because this industry may become a public utility, of course, this is just one possibility. Since we have this concern, it is better for us to change to an industry that we can see clearly, and there is no need to fight to the death.

3. When the stock market is crazy, you should sell

This article is especially suitable for small partners who invest in broad-based indices. As long as the index reaches the overvalued area, they can gradually reduce their positions.

We are talking about gradually reducing your positions, not selling them all at once, because many times the stock market will go crazy beyond your imagination. If you liquidate your positions in advance, there may be a big increase in the future.

It’s just that many people also go crazy when the stock market is crazy, and their greed swells all of a sudden.

If you buy an active fund, this one is also suitable!

But sometimes the stock market is not absolutely crazy, there will be a big drop! Like this year.

Many people may think that the stock market has fallen inexplicably this year. It is true. If only from the perspective of valuation, at the end of February, the valuation is actually not high.

But the stock market often encounters black swans, triggering a liquidity crisis and causing the stock market to fall without a clue.

This kind of decline is difficult for most people to take precautions against in advance, so it is necessary to keep a certain cash position at any time. Don’t think of yourself as a stock god, you can understand every fluctuation of the stock market!

4. When you don’t understand the fund you invest in, you can sell it

Many small partners are hot-headed when they buy funds. They usually buy them after listening to other people’s recommendations, or looking at the recommendations of fund sales platforms.

This is where the problem comes from, since you bought a fund, at least you should know why and when to sell.

If you don’t even know these two most basic problems, then you can sell it at a cost, and then you can talk about it when you figure it out.

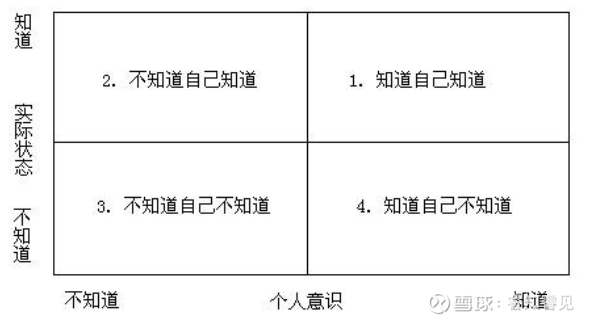

But many times, we do not know that we do not understand, but feel that we understand everything.

This is even worse! People who don’t know they don’t know anything are the ones who suffer the most.

You can ask yourself a few questions to verify:

1. If the fund you bought fell 20%, or even 50%, what would you do?

2. Under what circumstances do you intend to sell the fund?

3. Can you name three possible risks? Do you have a strategy for dealing with these risks?

4. What role does the fund you buy play in your portfolio, and how much is a reasonable position?

5. Do you really know the fund manager? Would you still trust a fund manager if it fell 20%?

If you can’t answer these questions, then it’s best to sell when you’re back and invest after you think about it.

5. When you find a more cost-effective fund, you can sell it

The market is constantly changing, but investors often accept the truth and are always reluctant to give up their own funds.

For example, at the beginning of this year, it was no problem to hold a bank, because it is a defensive asset. It has also been proved that since the beginning of this year, the bank is indeed very resilient. Those hot spots have fallen by nearly 50%, but the bank has only fallen by about 5 points. .

But when the index is oversold, it is obvious that the price/performance ratio is much higher than that of banks.

The so-called price-performance ratio means that the probability and magnitude of future rises are much greater than those of declines.

So I suggested in mid-May that everyone switch banks to broad-based indices. If you do, then you have very little to lose on the plunge and another fortune on the rally.

Of course, this is not to say that the bank will not rise in the future, but its expected rate of return is not as good as that of the broad-based index.

When we invest, we constantly compare different assets. If there is a certain asset with a significantly better price/performance ratio, then of course it can be replaced. Even if the fund in hand is temporarily losing money, it should be replaced.

It’s just that people are loss-averse, that is, they don’t sell if they don’t return it. It is not easy to overcome this human nature.

In fact, among the reasons for selling, this one is the best reason. You can think about it carefully.

This also requires our eyes to keep an eye on certain assets with higher returns in the market at all times. Be sure to pay attention to the word “OK”. Many opportunities look attractive, but in fact we can’t seize them, which is uncertain. Then it can’t be easily replaced!

6. When you need to adjust the stock-to-debt ratio, you can sell

If you are investing through asset allocation, then under different market conditions and different valuation backgrounds, we will use different stock-to-debt ratios to deal with the market.

For example, when the valuation is very low, our stock fund position can even increase to 70% or 80%.

However, when the valuation is higher than the median, the position of the stock fund will drop to 50% or 60%, and as the valuation continues to rise, the position of the stock fund will continue to decline.

This is to use positions to respond to market changes, rather than always guessing ups and downs.

Therefore, when your stock-to-debt ratio needs to be adjusted, you can sell stock funds and buy bonds or currency funds.

7. Summary

For the fund, it is a disease of leeks that needs to be cured. Whether we sell the fund or not has nothing to do with the return of capital.

Of course, if you have been tortured by the stock market to the point of being unable to sleep, and endocrine disorders, even if you don’t make money, you should probably sell. Your health is important.

If this is not the case, we usually sell the fund under the following conditions:

1. The fundamentals have deteriorated;

2. When the stock market is crazy and the valuation is too high;

3. When you do not understand;

4. When a fund with a higher cost performance ratio is found;

5. When adjusting the stock-to-debt ratio.

As the stock market rises, you can think about this question carefully, should you really sell after returning to your capital?

In addition, if you don’t understand the fund you bought before, it’s best to understand it now. If you still don’t understand it, it’s best to switch to a fund that you can understand. Otherwise, it will be torture both physically and mentally.

Investing is to make life better, this is the biggest principle!

Reward is voluntary, 1 cent is silent support, haha!

There are 18 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1843761023/223639575

This site is for inclusion only, and the copyright belongs to the original author.