Everyone’s impression of ETFs is generally diversified investment, low volatility, and low risk. However, the ETFs in the two graphs above on Friday plummeted by nearly 9%, which is even more volatile than normal individual stocks. what happened?

It turned out that the top two heavy positions in this ETF accounted for 18%, and they were two real estate storm stocks, which had been suspended for a long time. For example, Shimao Group, which was 4.42 Hong Kong dollars when trading was suspended, is now valued at a price of 1.34 Hong Kong dollars. Therefore, 9% of Shimao Group in this ETF is equivalent to a sudden drop from 4.42 Hong Kong dollars to 1.34 Hong Kong dollars, so the entire ETF is GG.

So, what lessons can we learn from this?

Be cautious with financial stocks

Banks, insurance, and real estate are all big financial stocks. Their financial reports are generally very professional and knowledgeable. Ordinary people can’t understand them, and I can’t understand them either. Therefore, when investing in bank insurance, you must be cautious about the systemic risks of finance, unless you are a finance professional. Alternatively, buy in the company of a finance professional.

As the saying goes, don’t vote if you don’t understand. The articles I write are generally consumer, pharma, tech, and broad based. Consumption is to eat, drink and play; medicine is to cure diseases and health; science and technology are mainly written in China Internet, and the corresponding products are usually used by everyone; the broad-based index is to invest in national transportation, and the relative risk is smaller. Therefore, I try my best to write investment logic that everyone can understand. I also hope that everyone will think clearly about their reasons for buying and whether they understand investment logic when investing in people and varieties.

Be wary of low valuations

Undervalued fixed investment is a common investment method. Its core principle is valuation and value return. However, the thunderous companies in the Hang Seng Dividend ETF, such as Shimao Group, have very low valuations:

The price-earnings ratio is only double, and the price-book ratio is only 0.14. Does that mean that you can buy Shimao Group? Or the entire undervalued real estate sector? The answer is obviously no. So why does underestimation fail?

This requires everyone to think about the reasons for the low valuation and whether it has an impact on the investment logic of this industry.

For example, the low valuation of real estate is not because of market sentiment, but because my country’s urbanization rate has reached the top area, the golden age of real estate has passed, and its financial attributes have disappeared. . Real estate cannot go back to the past, and the previous high valuation has no reference value for the current real estate.

The medical biology I wrote recently has a low valuation, so let’s think about it, has its investment logic changed? No, as I have analyzed before, centralized procurement will not change the logic of medicine, but will be beneficial to high-tech R&D pharmaceutical and biological companies. Superimposed on the acceleration of my country’s aging process and the people’s increasing pursuit of health, pharmaceutical biology is still a sunrise industry, and the logic has not changed significantly. In addition, centralized mining is nothing new. my country has experienced six batches of centralized drug procurement, but the pharmaceutical and biological sector has reached a new high after each time. That’s right, the new high is not like the Shanghai Composite Index, which is still 3,000 points for more than ten years.

To sum up, buying low valuations requires thinking about the reasons for low valuations. If this reason changes the investment logic of the entire industry, then don’t buy it. If there is no change in logic, but only affects short-term risk appetite and market sentiment, then greedy bottom-hunting.

Will it affect dividend ETFs?

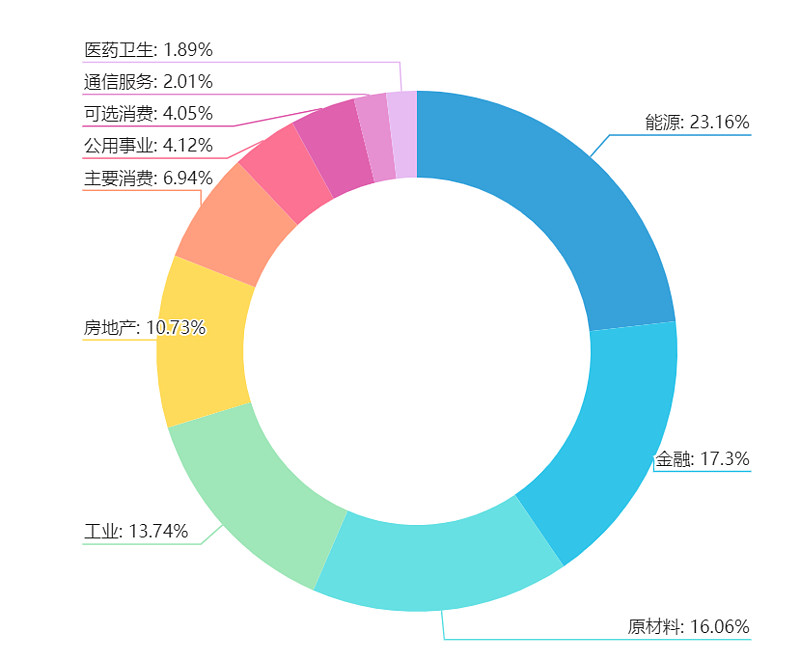

No, because the types of positions are completely different. Dividend ETFs are mostly coal steel:

Coal steel is definitely a sunset industry, but it is also a necessary industry for industry. Coal and steel will definitely continue to be used in recent decades. There is no systemic financial risk like real estate, and there is no need to be afraid.

Will it affect Hang Seng Technology and Hang Seng Medical?

There’s no direct impact, because it’s two completely different things. However, this incident also reflects the inadequacy of the Hang Seng Index Company in compiling the index, and some filtering conditions should be added. For example, the Hang Seng Technology Index was included in the extremely overvalued SenseTime, which plummeted by 40% in one day, but fortunately its weight was less than 1%.

Dividend-eating lay-flat investing

Finally, I will introduce you to a different way of investing – eating dividends.

Dividend-eating Dafa is suitable for investors with low risk appetite, but not too low, and at the same time want to outperform capital-guaranteed financial management. For example, high dividends generally exceed 5% interest, which is much higher than bank financing. You can also use the dividends you get to continue buying stocks to accumulate more chips. Stocks rise, you can also enjoy the benefits of the broader market. To sum up, the rate of return of high-dividend stocks comes from the dividends of companies higher than bank wealth management + the additional income from the rise of the broader market.

However, since it involves the extra income of the broader market, it means that its risk is higher than that of bank financing. If you buy at a particularly high valuation, the interest you receive will not be enough to offset the decline in the share price. However, fortunately, the market is still in the lower-middle position, especially the high-dividend companies, which are basically undervalued. Dividend ETFs are also seriously undervalued.

So what specific targets can you choose?

First of all, you can choose a dividend ETF. The holdings of the dividend ETF are relatively scattered, and there is a basket of high dividend stocks. If you are worried about the risk of individual stocks, you can choose a dividend ETF. Rest assured, there is only 10% of the real estate in it, and it has not collapsed:

Courageous students can also choose individual stocks, but I suggest that you must choose companies that are unlikely to fail, such as the four major banks, Yangtze Power, and China Shenhua. Because if they go out of business, the cash in your hand is useless.

Okay, so that’s just taking a little time over the weekend to chat with you about this news.

$ Bonus ETF(SH510880)$ $ Shanghai Composite Index(SH000001)$ $CSI 300ETF(SH510300)$ @Today’s topic @snowball creator center

There are 37 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5760078642/224892631

This site is for inclusion only, and the copyright belongs to the original author.