I rarely mention some huge fund managers in my articles, but that doesn’t mean I don’t care about them. On the contrary, I have a lot of attention to them

Typical such as Ruxingquan Xie Zhiyu, Yi Fangda Zhang Kun, Fuguo Zhu Shaoxing, Ruiyuan Fu Pengbo, these top fund managers have a huge management scale and many holders, but their net worth has been falling for more than a year, and the drawdown is huge.

The characters of these veterans are actually quite good. They have excellent long-term performance, and they have never spammed funds at high positions. At present, there are only a few funds under their respective management. Zhu Shaoxing has become the only legend in China’s public fundraising arena by relying on only one fund for more than 20 years.

How to look at their net worth trend is the most concerned issue for many people.

These are the top cards of the public offering, and their abilities are definitely beyond doubt. The performance is not good, it must be the problem of the market.

And when will their funds bottom out? Here the author analyzes one or two for you

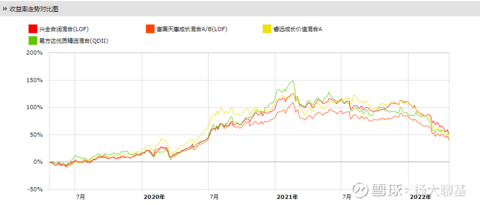

First of all, in the past three years, the trend of the net worth of their four representative works funds has a very high degree of convergence. Hiding the name, I thought it was several funds managed by a fund manager using the same investment strategy.

Yes, that’s right. These top players in public offerings all maintained their respective investment styles without drifting, and their holding styles were generally consistent. It doesn’t matter who buys

Xingquan Herun and Fuguo Tianhui have exchange-traded funds, and the trend of net value is basically the same as that of the CSI 300 Growth Index, with a high degree of convergence.

The top and bottom of the index also correspond to the top and bottom of the fund.

Therefore, when the index can bottom, it basically represents the bottom of these top funds.

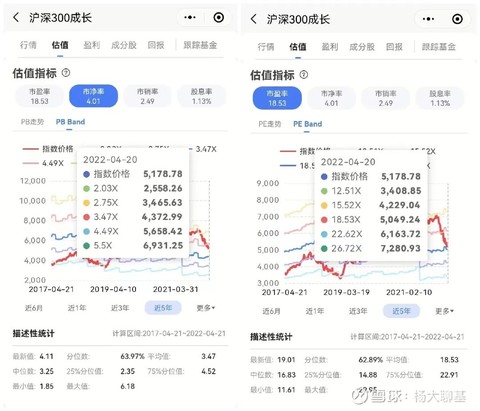

The lowest index in January 2019 was close to 3200 points, and the highest in March 21 was close to 8700 points.

5021 points now

Combined with the operation of the valuation, the bottom of this bear market probably corresponds to the bottom area of around 3400 points. According to gross estimates, there is still a limit of 30%+ room for decline in the future.

In other words, although these funds have fallen a lot now, they are likely to continue to stretch their hips in the future.

Of course, according to the urine nature of A-shares, the ups and downs will be too high. Therefore, according to my investment strategy, if I were to buy these funds, I would only consider buying them when the index fell to around 3400 points and start the fixed investment mode. .

Now it is still only watching from a distance, not intervening.

In addition, share the best investment opportunities in the market at this stage

still a value segment

Now is the best time to buy in

none of them

Structural Bull Market

Choice is more important than effort

@snowball fund @today’s topic @snowball creator center

#Snowball Star Project Public Fundraising Talent# #

This topic has 1 discussion in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/4076736586/217992276

This site is for inclusion only, and the copyright belongs to the original author.