Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text/Voltage Sensor

Source: Node Finance (ID: jiedian2018)

In November 2021, Xiaopeng Motors changed its logo. At that time, He Xiaopeng also talked about the difficulties of Xiaopeng Motors, “Fortunately, when the darkest moment of the electric vehicle industry came in 2019, Xiaopeng Motors did not give up.”

Compared with changing the logo, the community is more concerned about when Xiaopeng Motors will change its name. Even Li Bin persuaded He Xiaopeng to change the name of Xiaopeng Motors. However, He Xiaopeng’s attitude has always been firm: do not change.

Recently, He Xiaopeng’s attitude has undergone a 180-degree change. He once again responded to the controversy caused by the naming on the show, saying that if he could do it all over again, he would not use his own name as a brand name.

Just as He Xiaopeng regretted his name, JPMorgan also “regretted”: it reduced its shareholding in Xiaopeng Motors, and its shareholding ratio dropped from 5.19% to 4.96%. As of March 31, 2022, He Xiaopeng holds a 20.4% stake in Xiaopeng Motors, or about 35 billion yuan.

Controversy over brand names in the auto industry has always existed, both old and new. It is not the first time that the “changeable” capital has “abandoned” new forces, and an institution that believes in long-termism has also left Weilai, which is at the bottom. For a car company, capital can also be the icing on the cake. External factors are uncontrollable, and internal factors are controllable. As long as the user’s approval is obtained, it is enough to offset the impact of changes in external factors.

/ 01 /

Xiaopeng Motors fell out of favor as capital?

On June 28, according to the equity disclosure information of the Hong Kong Stock Exchange, Xiaopeng Motors (Xpeng for short) was reduced by 3.0208 million shares at an average price of HK$120.7484 per share by JPMorgan Chase on June 22. About HK$365 million.

In the context of this news, at the close of trading on June 28, Xiaopeng’s share price fell 2.1% to HK$135.1 per share, with a total market value of HK$231.6 billion. As of July 20, the company’s market value was 178.85 billion Hong Kong dollars, or about 23.3 billion U.S. dollars, which has dropped by nearly half from the highest point.

The two pieces of information are superimposed together, giving people a feeling of “Xpeng is about to finish”. But if you look carefully, you will find that this feeling is actually an illusion.

There have been signs of JPMorgan’s exit. In March not long ago, it lowered the target price of Xiaopeng Motors to 160 Hong Kong dollars from 240 Hong Kong dollars given in December last year. More telling is the reason why JPMorgan adjusted the target price of Xiaopeng.

When JPMorgan raised the target price of Xiaopeng in December last year, it mentioned Xiaopeng’s development priorities, such as the autonomous driving system will benefit and lead the trend of smart electric vehicles in China, and pointed out that the company’s development strategy is in line with the macro trend.

Among the reasons given by JPMorgan when it lowered Xpeng’s target price in March this year, changes in macro factors are also the main reasons, such as the supply chain tension in the auto industry, which will affect product delivery. This shows that the main factor affecting JPMorgan is not the fundamentals of Xpeng.

The performance trend of Xiaopeng can also provide evidence.

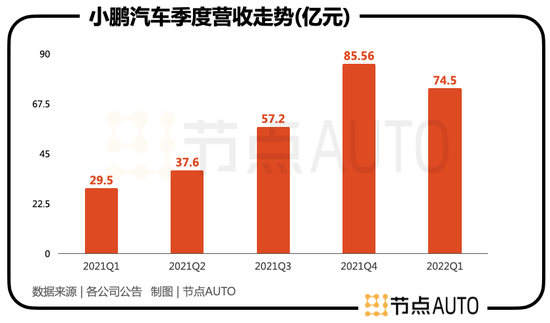

At present, Xiaopeng’s revenue sources are divided into two parts: car sales and other parts, of which car sales account for more than 95%. Xiaopeng’s revenue is only 2.95 billion yuan (RMB, the same below) in Q1 of 2021. By 2022, Q1 has grown to 7.45 billion yuan, an increase of 2.52 times. During this period, the quarterly growth rate has remained at 150%. above.

During 2019-2021, Xpeng’s cost of selling cars has been rising.

In 2019, Xiaopeng’s car sales cost was 2.717 billion yuan. Only the Xiaopeng G3 model was delivered that year. The annual sales volume was 16,608, and the average sales cost per car was 164,500 yuan. At the same time, its car sales revenue was 2.733 billion yuan, and the average revenue per car was 165,000 yuan. At that time, the subsidized price of Xiaopeng G3 was 143,800-196,800 yuan, which was basically the same.

By 2021, Xiaopeng’s average revenue per vehicle will increase to 204,000 yuan, and the cost of sales will increase to 187,100 yuan. Taken together, Xiaopeng’s efficiency is also improving, helping it offset some of the pressure from rising vehicle sales costs.

As for profit, although Xiaopeng is still not profitable, the gross profit margin has turned positive in 2020, reaching 4.6%. In 2021, Xiaopeng’s gross profit margin will further increase to 11.5%, and slightly increase to 12.2% in the first quarter of this year. Xiaopeng’s medium and long-term goal is to increase the company’s overall gross profit margin to more than 25%.

Overall, although Xiaopeng is still losing money, its revenue is in a stage of rapid growth, and high growth is still its main tone.

CICC released a research report on the 28th saying that it maintained Xiaopeng’s “outperform industry” rating, and the target price rose 43.9% to HK$177. And pointed out that with the optimization of Xiaopeng’s integrated die-casting technology and the mass production of the third-generation model platform, it is expected to drive the company’s profitability to improve.

/ 02 /

New sales manager

Different from Li Bin and Li Xiang, the two founders who devoted themselves to the company from beginning to end, He Xiaopeng did not participate in car building as the company’s founder at first. After being optimistic about the industry’s prospects, he “saved” a team and gave the team a sum of money to build a car, 100% of which is the investor’s mentality.

One of the premise factors is that he made two kinds of hardware after entering Ali, but both failed, so he thinks that Internet people do hardware is a near-death experience.

However, Xiaopeng is now farther from the “nine deaths” and is moving closer to the “life”. The most intuitive manifestation is the sales trend of Xiaopeng.

In April 2018, Xiaopeng released its first car “Xpeng G3”, which is positioned as a compact SUV and the price is controlled within 200,000. As soon as the Xiaopeng G3 appeared, it reflected two characteristics of Xiaopeng, focusing on intelligence and strong cost performance.

When G3 was launched, “smart driving” was regarded as the killer. It was equipped with the XPILOT 2.5 automatic driving system, with L2.5 level visual + ultrasonic fusion automatic parking function, and was equipped with the self-developed Xmart OS intelligent network connection system. . With a similar price band, Xpeng’s intelligent advantages make Xpeng G3 cost-effective.

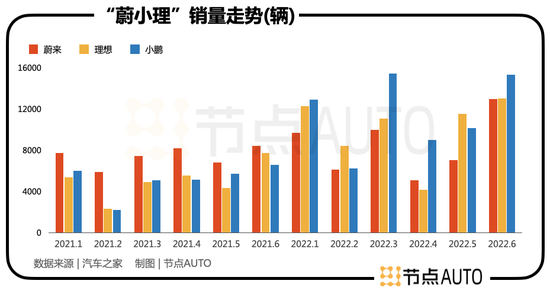

In 2021, the total sales volume of this model is nearly 30,000 units. Xiaopeng’s total annual sales volume is 98,155 units, which is higher than NIO’s 91,429 units and the ideal 90,491 units, becoming the new force in sales. At the same time, Xiaopeng’s sales growth rate is also the fastest among “Wei Xiaoli”.

In the first half of this year, Xiaopeng’s sales continued to improve.

Here we select two time periods in the first half of 2022 and the first half of 2021 for comparison. In the first half of last year, Xiaopeng’s sales performance was not good. The overall increase was not large and there were large fluctuations (2000-6000 vehicles).

The ideal performance is similar to Xpeng. In the first half of last year, the ideal sales stopped at 8,000 units, and the fluctuation range was between 2,000 units and 8,000 units.

In contrast, only NIO performed slightly better. Sales passed the threshold of 8,000 units, and the overall fluctuation range was smaller, between 5,000 units and 8,000 units.

In the first half of 2021, Xiaopeng’s performance can only be regarded as qualified among “Wei Xiaoli”.

In the first half of this year, Xiaopeng’s sales have fluctuated even more, but the scale has risen to a higher level, with monthly sales fluctuating between 6,000 and 15,000.

At the same time, Xiaopeng’s sales were also affected by the tight supply chain. In a horizontal comparison, the fluctuation range of NIO and the ideal sales volume is also increasing. For example, the monthly sales fluctuation range of NIO is between 6,000 and 12,000.

Even taking into account the impact of supply chain factors, Xiaopeng’s performance in the first half of this year was better than the first half of last year.

Dismantling the variables, Xiaopeng delivered the Xpeng P5 with a lower price and equipped with lidar after the first half of last year, and the Xpeng G3 also added a facelift, the coverage of the product portfolio is larger, and the product strength is stronger. powerful.

Xiaopeng has changed from one of the top three new forces in 2019 and 2020 to the number one in 2021, and its sales in the first half of this year have reached 70% of 2021.

However, Xiaopeng has not yet reached a stage where the more it sells, the more it loses. While becoming the top-selling new force, its loss is also the largest, increasing from 3.69 billion yuan in 2019 to 4.86 billion yuan in 2021.

/ 03 /

What should Xiaopeng worry about?

After the new forces have passed the two thresholds of PPT and delivery, there is only one assessment indicator left – sales volume. As long as the sales volume rises fast enough and the scale is large enough, a positive cycle can be harvested. Judging from the sales-performance trend of Xiaopeng, its fundamentals are gradually improving.

So, can Xiaopeng sit back and relax after getting out of the trough in 2019?

For a long time, benchmarking or even surpassing Tesla in intelligence has been the label of Xiaopeng, which is also its core competitiveness. At the same time, this also poses new problems for Xiaopeng.

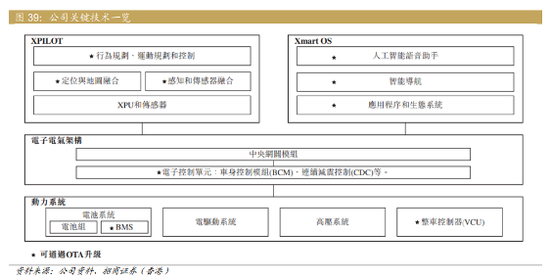

There are two manifestations of intelligence in the automotive industry, namely autonomous driving and smart cockpit. Xiaopeng has developed XPILOT and Xmart OS respectively.

Among the new forces, Xiaopeng’s R&D investment has always been the highest, which has brought greater financial pressure to it.

In 2020, Xiaopeng’s loss is the largest among “Wei Xiaoli”, reaching 4.863 billion yuan, which is 15.1 times the ideal and 1.2 times that of Weilai. From a quarterly perspective, its losses are also expanding. It is less than 800 million yuan in Q1 in 2021, and it has reached 1.7 billion yuan in Q1 in 2022.

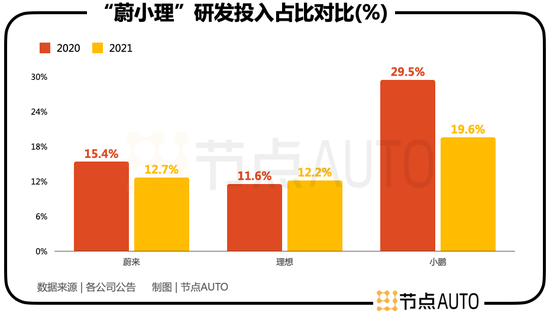

Observing Xiaopeng’s R&D efforts, the most important thing is to look at the proportion of R&D investment. Because Xiaopeng’s product structure causes its revenue scale to be lower than that of NIO and Ideal, the proportion of R&D investment can better show that the company’s strategic focus lies in where.

There are two stages to see here.

First, in the initial stage, almost all of the new forces increased their R&D investment in the early stage. In 2019, Weilai’s R&D investment accounted for more than 50%, while Xiaopeng’s R&D accounted for 89.2%. This makes Xiaopeng’s “technical spring” press even lower.

Second, after the annual sales volume is close to 100,000 units, Xiaopeng’s R&D ratio is still the highest among the new forces. In 2021, it will be 19.6%, 6.9 percentage points and 7.4 percentage points higher than NIO and Ideal, respectively. At the same time, Xiaopeng has the highest proportion of R&D employees among the new forces, reaching 38% by the end of 2021, with a total of 5,271 employees.

Another observation angle is how much return is gained from the investment in research and development.

The embodiment of “technology transformation” is that Tesla has been able to charge car owners subscription service fees with autonomous driving technology, and is at the forefront of the industry.

In 2021, Tesla’s total revenue will be $53.823 billion, of which services and other businesses, including autonomous driving software, will have revenue of $3.802 billion, or about 25.47 billion yuan, while Xiaopeng’s total revenue last year. Revenue was 20.98 billion yuan.

In theory, software services have the potential to recreate Xiaopeng, and the challenge is precisely here. On the road to rebuilding Xiaopeng, software services have to cross the three thresholds of delivery volume, price and charging method.

Currently, Tesla’s cumulative deliveries and sales are much higher than those of Xpeng. In terms of annual deliveries, in 2021, Tesla will be about 95.5 times that of Xiaopeng. Judging from Xpeng’s delivery in 2021, the scale of less than 100,000 vehicles per year lacks the foundation to support the development of software service business.

He Xiaopeng also revealed some situations in this regard. He said in the fourth-quarter 2021 earnings call that more than 50% of the owners who purchased the P5 had optional XPILOT 3.0 or XPILOT 3.5. Based on the Xpeng P5’s delivery volume of 5,030 units in December of that year, there are only 2,515 sets of optional equipment.

Meanwhile, XPILOT’s price is lower than Tesla’s FSD. The latter is divided into two versions: enhanced version and fully automatic version. The lowest price is 32,000 yuan and the highest is 64,000 yuan. The price of XPILOT3.0/3.5 is 20,000 and 25,000 yuan (May this year).

Fewer hardware sales + lower prices have restricted Xiaopeng in the matter of “software charges”.

The payment mechanism is also an issue that needs to be addressed. Xiaopeng’s XPILOT currently adopts a buyout system, where users pay a one-time payment (or installment payments within three years of buying a car) to buy out the service. Although this can lock in revenue in advance, in the long run, the subscription model is healthier. It can make it possible for the vehicle to generate revenue throughout the cycle. Tesla and Weilai both choose the subscription system.

Although software services have the possibility to recreate Xpeng and make more profits, compared with Tesla, Xpeng still has a lot to do in this regard.

As of June 21 this year, the cumulative delivery of Xiaopeng has exceeded 200,000. From the earliest PPT car manufacturing, the controversy caused by “the focus of car manufacturing is operation”, and then to being one of the top three new forces, Xiaopeng’s development can be said to be stumbling.

At present, although the development of Xiaopeng has gradually improved, the different routes require it to overcome one problem after another that is different from other peers. Whether Xiaopeng has the last laugh, let us wait and see.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-07-20/doc-imizmscv2757816.shtml

This site is for inclusion only, and the copyright belongs to the original author.