Original link: https://shoucang.zyzhang.com/%E8%B6%85%E7%BA%A7%E4%BA%A4%E6%98%93%E5%91%98%E7%9A%8410% E6%9D%A1%E6%B3%95%E5%88%99/

3 keys to great performance

- Big money when it’s right.

- Continued profitability.

- Avoid big losses when you’re wrong.

Rule 1: Focus, don’t scatter

- Centralized positions make positions easier to manage.

- Concentrated positions keep you focused.

- Concentrating your positions allows you to be patient.

Focus on the best targets!

Rule 2: Increase Turnover

- Forget about the tax issues (if any) that arise from the transaction.

- Don’t think about the next new high.

- If you’re wrong, admit your mistake, don’t be persistent .

If there is a decent profit, it is necessary to stop the profit in time!

Rule 3: Timing

- Timing is money.

- Learn to read pictures.

- Learn to recognize the VCP pattern (The Volatility Contraction Pattern).

Sit back and wait for the opportunity to present yourself!

Rule 4: Manage Profit-to-Loss Ratios

- Calculate the profit/loss ratio of the trade.

- Do not trade with a profit/loss ratio of less than 1.

- Regularly monitor the floating profit of the position.

- On a target, don’t let a loss eat up all the profits, you must stop the loss after taking back 1/2.

- Do trades with high profit-to-loss ratios so that you can even out trade wear and tear.

risk first

- Plan your trades and place a stop loss before opening a position.

- Write it down, or open a position with a stop loss.

- Cut your losses without hesitation.

Not firm stop loss is the most devastating mistake.

Rule 5: Go with the flow

- Trade with the trend.

- Don’t flatten your stop loss.

- Confirm trends with multi-period analysis.

Learn to tell if a trend is healthy.

Rule 6: Increase the position with floating profit

- Enter in batches , not a single win or lose.

- On the basis of profit, increase risk exposure.

- Our goal is to have the largest position when the transaction is the most successful, and the smallest position when the transaction is the worst.

Why add to a position if it doesn’t make a profit after putting in 25% or 50% of the position.

Rule 7: Do parity protection as soon as possible

- When to do parity protection? When the floating profit reaches a profit-loss ratio of 2 to 3 times, or when it is higher than the average profit.

- Don’t let a decent profit turn into a loss.

- At the beginning of the bull market, if the 50-day moving average is not broken, you can continue to hold positions.

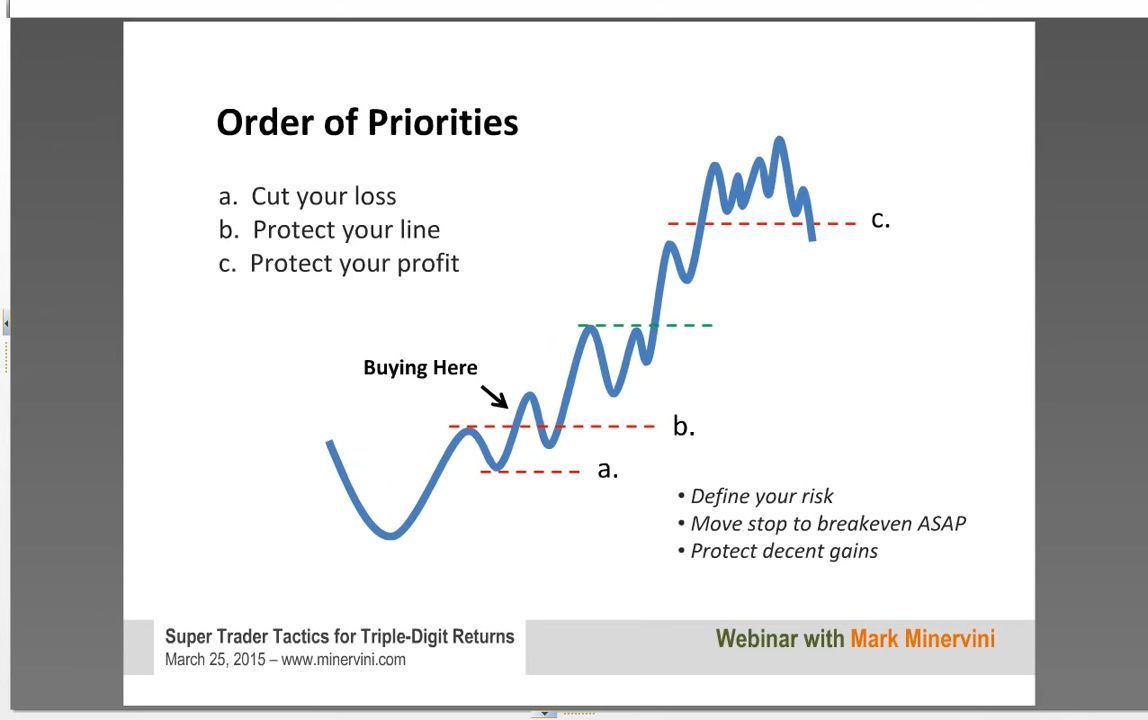

The priority of the operation:

a. Cut losses.

b. Affordable Protection.

c. Protect profits.

Rule 8: Sell on rallies

- Selling when prices are strongest is often the best price in the short term.

- Selling early is better than selling late.

- No matter whether the price rises or falls later, selling half of it can be invincible.

Rule 9: Review regularly

- Because trading performance doesn’t lie.

- Look for commonalities in failed deals.

- Correct your weaknesses.

Know the truth about your trade!

Rule 10: Avoid Style Drift

- Start by defining your own trading style.

- Stick to your style and be willing to sacrifice other trading opportunities.

- Do it repeatedly and become an expert.

Conclusion: Take responsibility for your own transactions

- If you don’t get the results you want, don’t complain, take responsibility, learn, and act!

- The important thing is: believe in yourself, you are more capable than you can imagine.

- Rules are useless unless you follow them. Many traders don’t have rules, and some traders have them but don’t follow them.

Source: Super Trader Tactics with Mark Minervini

This article is reproduced from: https://muyexi.im/chao-ji-jiao-yi-yuan-de-10tiao-fa-ze/

For personal collection only, the copyright belongs to the original author

The 10 Rules of a Super Trader appeared first on Haowen Collection .

This article is reproduced from: https://shoucang.zyzhang.com/%E8%B6%85%E7%BA%A7%E4%BA%A4%E6%98%93%E5%91%98%E7%9A%8410% E6%9D%A1%E6%B3%95%E5%88%99/

This site is for inclusion only, and the copyright belongs to the original author.