I believe that many people will have such a sigh in the past two years,

First, I have never felt that equity investment is so difficult; second, I have never felt that stable happiness is so important.

The investment market enters the darkest moment

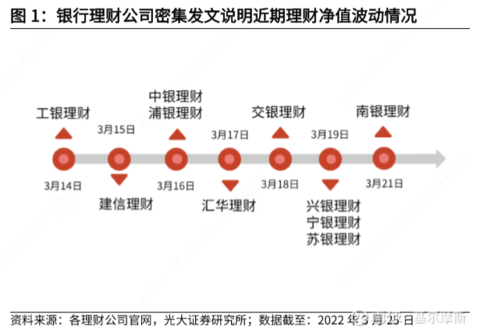

Especially since the beginning of this year, both stocks and bonds have fallen, and bank wealth management products, which are known as “synonymous with stable wealth management insurance”, have also frequently “dropped below the face value of 1 yuan”.

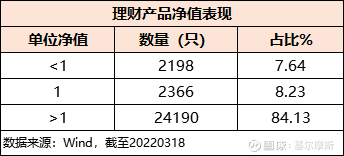

The data shows that after excluding products with no net worth in the past 6 months, there are 28,754 products in the wealth management market. Among them, there were 2198 units with a net value of less than 1, accounting for 7.64%, which increased again compared with the beginning of the year.

The institutions involved include wealth management subsidiaries of major state-owned banks, wealth management subsidiaries of stock branches, wealth management subsidiaries of city commercial banks, and joint venture wealth management subsidiaries and other banking and financial institutions.

In the darkest hour of the investment market, what else can protect our pocketbooks?

At this time, fixed income assets have become a sweet pastry, especially pure debt-type short-term debt products.

What is a short-term debt fund? What are the benefits and risk characteristics?

Short-term debt funds are a special kind of pure debt fund products.

It mainly invests in short-term bonds and money market assets, and the portfolio duration is usually less than 3 years.

According to the duration of the investment bond portfolio, it is divided into ultra-short-term bonds, short-term bonds and short-term bonds:

Ultra-short-term bonds: The duration of the bond portfolio is generally within 270 days.

Short-term debt: The duration of the bond portfolio is generally within 397 days.

Short- and medium-term bonds: The duration of the bond portfolio is 1-3 years.

Since 2012, the short-term pure debt fund index has achieved positive returns every year .

Data source: Wind, statistical interval 2012.01.01-2021.12.31

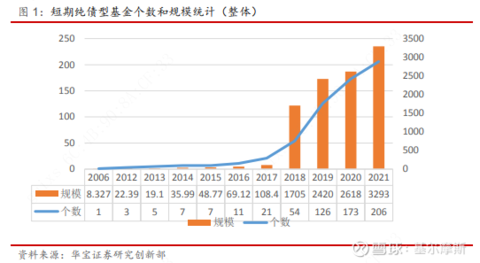

In fact, short-term debt funds have existed for a long time, but it was not until 2018 that due to the promotion of strict supervision, the restrictions on the redemption of currency funds and the gradual decline in income, short-term debt funds began to be widely known by investors, and the scale and number of short-term debt funds broke out. growth.

And it has been dubbed the positioning of “currency enhancement” or “financial management replacement”.

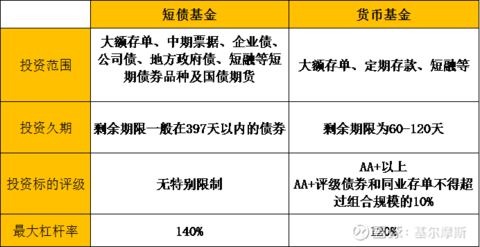

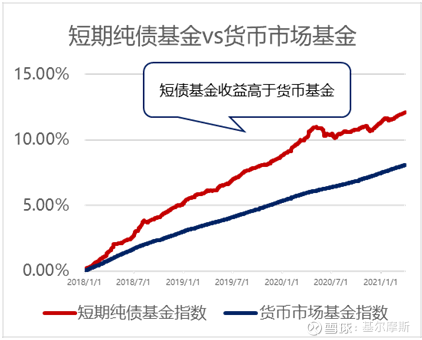

Compared with currency funds, short-term debt funds have indeed expanded in terms of investment scope, duration, and leverage ratio.

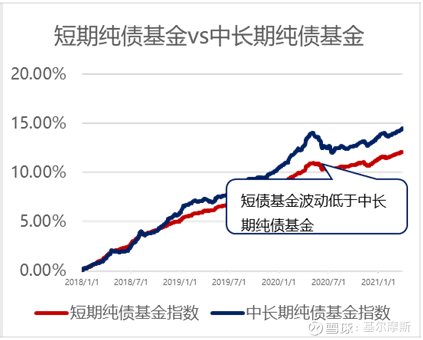

In terms of income, it is higher than money funds; the volatility is lower than that of medium and long-term pure debt funds.

Data source: Wind, using Wind short-term pure debt fund index, money market fund index, medium and long-term pure debt fund index rise and fall statistics; data range: 2018/1/1-2021/3/31

It can be said that short-term debt funds are better in terms of stable income, small drawdown, low correlation with stock funds, lower costs and better liquidity. In the turbulent capital market, it brings us a stable ” Happiness”!

How to choose?

High-quality short-term debt funds are “three good” funds selected by combining qualitative and quantitative indicators.

The so-called “three good” refers to “good company, good fund manager and good product” .

A good company means that a fund company should be an excellent company with the highest management scale and excellent investment and research capabilities;

A good fund manager means that the fund manager has rich product management experience, top historical performance rankings, and stable investment style;

A good product means that it should be compared and evaluated from the two dimensions of return and risk based on historical performance. Those products with absolute good performance, top ranking in the same category, low investment risk, and small maximum drawdown are good products.

Screening of short-term debt funds in the whole market, Bosera Anying Bonds (Class A 000084) performed well.

How are Bosera Anying Bonds made?

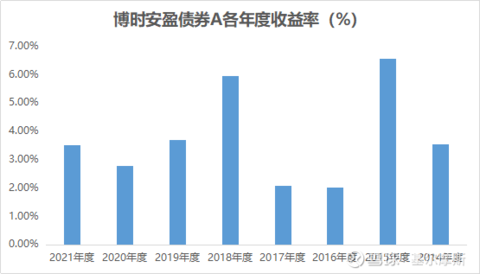

Good product: the earliest short-term debt fund, experienced bulls and bears, and its annualized income ranks first in its class

$Bosera Anying Bond A(F000084)$ was established on April 23, 2013. It is the earliest short-term debt fund established in the whole market. (Source of the earliest short-term debt fund established in the whole market: Galaxy Securities three-tier classification, 3.1.5 Bond Fund – Pure Debt Bond Fund – Short-term Pure Debt Bond Fund (Class A))

Source: Choice, as of 20211231

As of April 14, Bosera Anying’s annualized revenue ranked first in its category (source Wind).

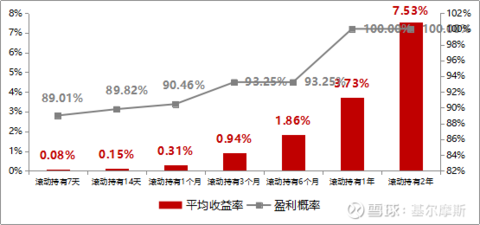

Even more strikingly, buying and holding for 1 year at any point in time has a 100% chance of a positive return .

Some friends here will notice that the minimum rate of return during the period is negative.

Please note! Although short-term debt funds are called “enhanced version of currency funds”, their valuation methods are different from those of currency funds.

Short-term debt funds are net worth and fluctuate daily.

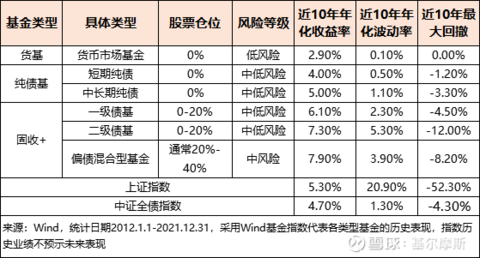

The above picture shows the common low-risk public offering products on the market. You can see that the annualized volatility and maximum drawdown of short-term debt funds in the past 10 years are all available, but they are only between cargo-based and medium- and long-term pure funds. between debt funds.

For example, in the first quarter of this year, due to the disturbance of the international situation and overseas markets, combined with the poor expectations of domestic funds and monetary policy, the short-term interest rate of the bond market has risen since February this year. It hit the biggest drawdown this year, and more than 20% of the short- and medium-term debt funds had the biggest drawdown this year.

Here we want to praise Bo Shi An Ying. In the first quarter of this year, it also gained a positive income of 0.61%.

Therefore, we cannot regard short-term debt funds as a complete replacement for money-based funds .

However, for those investors who are not satisfied with the yield of goods based, but can bear certain fluctuations in the low-to-medium risk appetite, short-term debt funds are more suitable as daily “spare money” financial products .

Good company: Jinniu Dachang

Bosera Fund is one of the first five fund companies to be established. Fixed income product management has always been its strong point, and has repeatedly won the “Fund Industry Oscar” Golden Bull Award, Golden Fund Award and other awards.

In the past 12 years, the fixed income department of Bosera has won a total of 11 golden bull awards for individual products. It has won the Golden Bull Fund Award for Fixed Income Investment issued by China Securities Journal for two consecutive years, and it has also won the Golden Fund and Product Award from Shanghai Securities News. 2 individual awards, 2 gold fund and bond investment return fund management company awards.

According to data from Haitong Securities, as of the end of the fourth quarter of 2021, Bosera Fund ’s fixed income fund yield in the past ten years was 188.21%, ranking second in the industry (2/52); the performance of fixed income funds in the past seven years was 50.96%, ranking 15/68 .

Good Fund Manager: Fixed Income “Old Driver”

According to public information, Huang Haifeng has worked in Shenzhen Rural Commercial Bank, Bosera Fund, Yinhua Fund, and Dacheng Fund successively since 2004, and joined Bosera Fund again in September 2016.

At present, Huang Haifeng mainly manages two types of products, one is short-term debt and short-term debt fund products like Anying, and the other is fund products that only invest in interest rate bonds such as government bonds and policy financial bonds.

The bond funds under management have achieved good results, with considerable annualized returns.

For bond investment, Huang Haifeng pointed out that the income of bond assets mainly comes from two parts, the first part is the interest income brought by the coupon of the asset itself, and the second part is the capital gains income brought by the falling interest rate.

The level of interest rates is mainly determined by the monetary policy of the central bank, and monetary policy is mainly concerned with changes in macroeconomic fundamentals, so the basis for bond investment decisions is top-down.

First, there is a judgment on macro fundamentals and monetary policy , and based on this judgment, the duration and leverage level of the portfolio are determined.

Then, go to the specific investment varieties to choose .

Industry and individual bond research is the premise of controlling credit risk, and the decentralized investment and stop-loss mechanism can fully reduce the downside risk of the portfolio.

In the selection of bonds, some short-duration bonds with high yields will be selected .

Looking at the future from the present, Huang Haifeng, the fund manager of Bosera Anying, said,

“In the short term, the bond market still has some room for gaming. Affected by the epidemic, economic data from March to April will likely be under pressure. Real estate sales data fell sharply year-on-year. However, the huge debt pressure and lack of hematopoietic ability of real estate enterprises will not improve in the short term, and real estate investment is still a drag on the economy; in addition, under the influence of the epidemic, consumption will be greatly affected, especially optional consumption and experiential consumption may be greatly affected. Under the fiscal force, infrastructure investment may be the most important starting point for supporting the economy. Under the circumstance of increasing fundamental pressure, there is the necessity and possibility of further easing of monetary policy, and the choice of specific policy tools remains to be seen. However, maintaining the overall liquidity in the market should be the bottom line. Therefore, the market will continue to play against fundamental pressure and further loosening of monetary policy in the short term.

However, it should also be noted that under the annual economic growth target of 5.5%, the policy of stabilizing growth in the second quarter will definitely increase its efforts, especially the continued relaxation of the real estate control policy and the preemptive development of finance should be a must. This will continue to put pressure on the bond market; at the same time, the Fed will continue to raise interest rates, and domestic monetary policy will also face certain constraints. Therefore , although short-term games are possible, we need to pay attention to the space and odds. Once the easing policy is implemented or the expectations are fully reflected, the bond market will face the adjustment pressure brought by loose credit .

For the management of Bosera Anying, it will still maintain a relatively short-to-medium duration, focusing on the control of net worth drawdown and the management of portfolio liquidity; considering that the liquidity environment is still relatively friendly in the short term, it will maintain a medium-term duration, while ensuring liquidity Under the premise of safety, more income from spreads can be obtained. In the selection of credit varieties , short-term urban investment in areas with standardized debt management, good financial endowment and high debt repayment willingness are mainly used to avoid industrial bonds with weak qualifications . At the same time, flexibly adjust the portfolio duration and leverage according to portfolio redemption and changes in market conditions. “

Risk reminder #Bank financial management has broken down on a large scale, which funds can be replaced# # Snowball Star Project Public Offering Talent # #Creator Center#

The fund has risks, past performance does not indicate future performance, investment should be cautious. The above views only represent the author’s personal opinion, do not represent the position of the fund company, and do not constitute investment advice for readers. The content of the article is for research and learning purposes only, and the stocks, funds, etc. involved do not constitute any investment advice. @snowball fund @today’s topic @snowball creator center

This topic has 4 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1762638610/217293730

This site is for inclusion only, and the copyright belongs to the original author.