1/6, the price increase cannot be retained

In the A-share market, the price increase is the most common market, because the threshold is low, there is no need to study the industry chain, and there is no need to analyze the fundamentals.

But the “price increase market” is also the most game market. Sometimes the commodity price does not rise but the stock price falls, and sometimes the commodity price does not rise and the stock price keeps rising, and the profits from the price increase are realized. The rules are not very obvious.

If you want to grasp the “price increase market”, you must understand the two underlying logics of the price increase market.

One of the underlying logics of price increases: price increases are profits given to companies by the market

According to the theory of microeconomics, price is a spontaneous adjustment mechanism of the market . The core of this process is to remove unqualified demanders from the market. Potential suppliers who were originally inefficient have entered the market to increase supply. The price increase has increased the number of merchants engaged in scrap metal recycling, allowing many outdated small production capacity to resume operation.

The price increase is both the result of an imbalance between supply and demand, and the reason for the future rebalancing.

All price increases are profits given to enterprises by the market, rather than their own efforts , which leads to the second underlying logic of price increases.

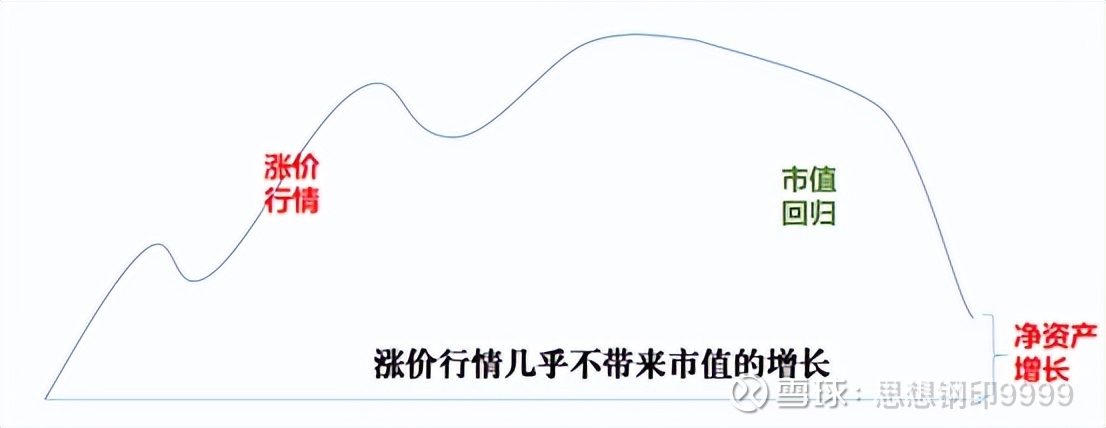

The second underlying logic of the price increase market: the increase formed by a simple price increase will eventually fall back

The valuation of a company is formed by the discount of long-term cash flow. The increase in price is not a reflection of the profitability of the company. Naturally, it will not change the future cash flow, nor will it change the valuation of the company . It just adds a sum to the company. net worth only.

The profit of the rising market can only be valued at a little more than double the PE. This is also the reason why the market value of Jiu’an Medical, which made 16 billion in the first three quarters, is only 25 billion, and it is also the reason why Inke Medical, which has made 14 billion in two years, has a market value of only 30 billion at the end of last year.

The price increase hardly increases the intrinsic value, but in reality, the price increase will almost always cause the stock price to rise, so most of the increase caused by the price increase will eventually fall back , which determines the basic nature of the price increase market – pure game , does not belong to the category of value investing.

But we shouldn’t ask everyone to make money for value investing, everyone needs to make money within their own limits. If you understand the game nature of the price increase market, and can also gain insight into the changes in the supply and demand relationship of a certain industry in advance, or track the high-frequency industry data of a certain product, then you should find a way to make this money.

These are the two core elements of this article:

1. Three stages of price increase

2. How to make money in these three stages?

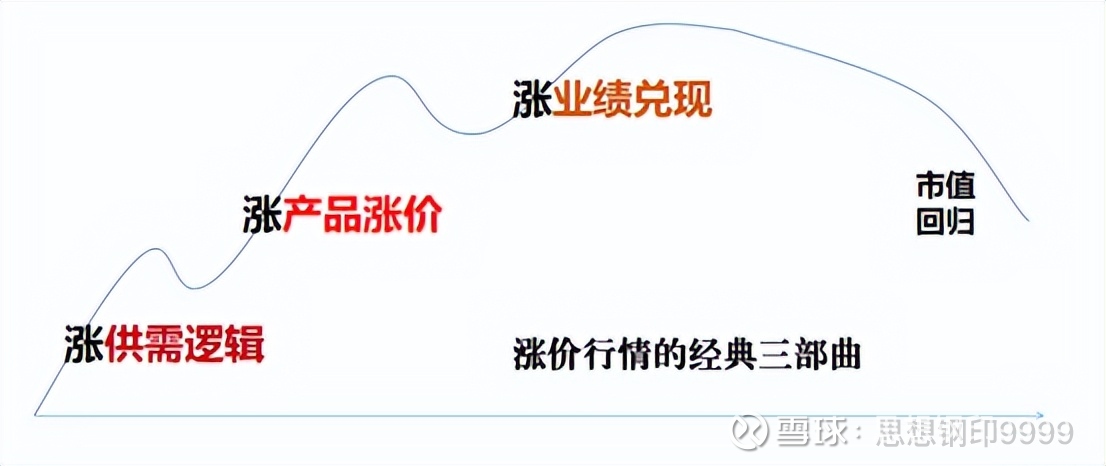

2/6, “Classic Three Waves” of Price Increases

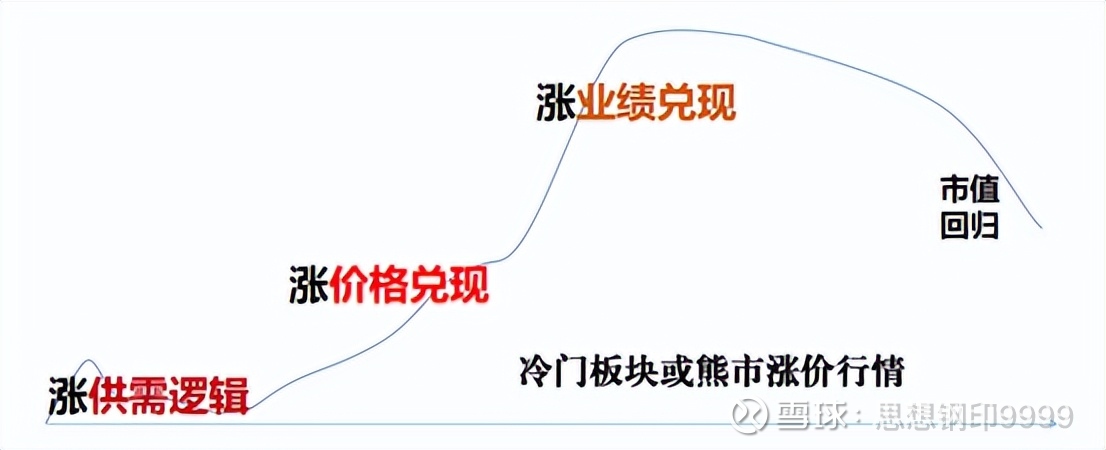

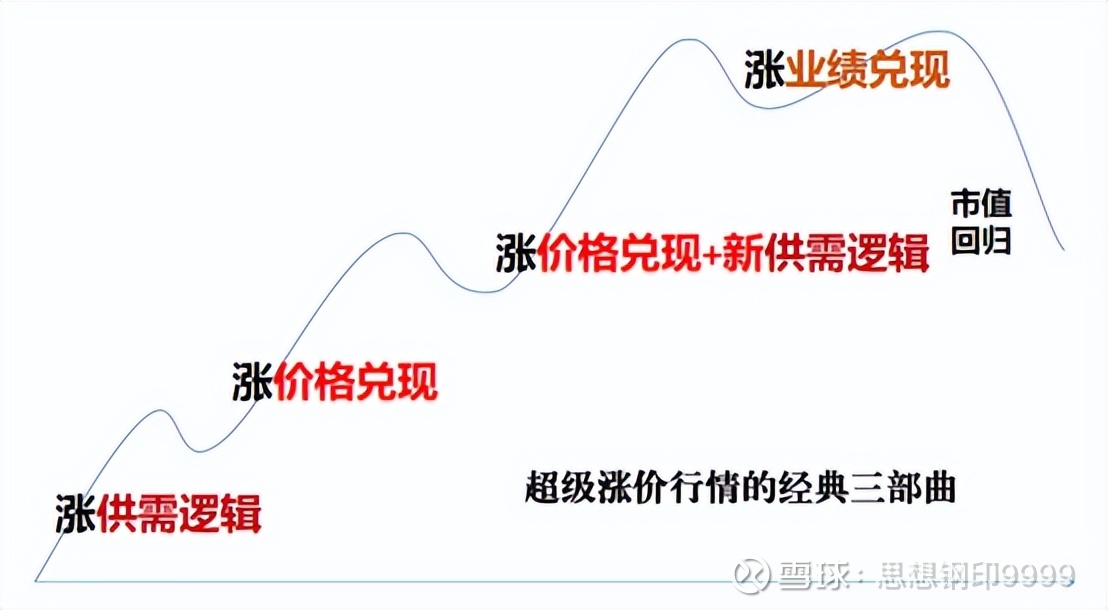

The key point of the previous article must be drawn first: the price increase market is a game around the cognition of supply and demand and price information. From this perspective, a round of price increases can be divided into three stages. After the three waves of volatility are realized, the last is the return of market value.

The first wave is to increase the “supply and demand logic”.

The so-called supply and demand logic, according to the relationship between the upstream and downstream of the industrial chain, production capacity, demand, etc., speculates that there may be a contradiction between supply and demand in the future, so as to deduce that a certain link may have to raise prices and ambush in advance, also known as “speculation expectations”.

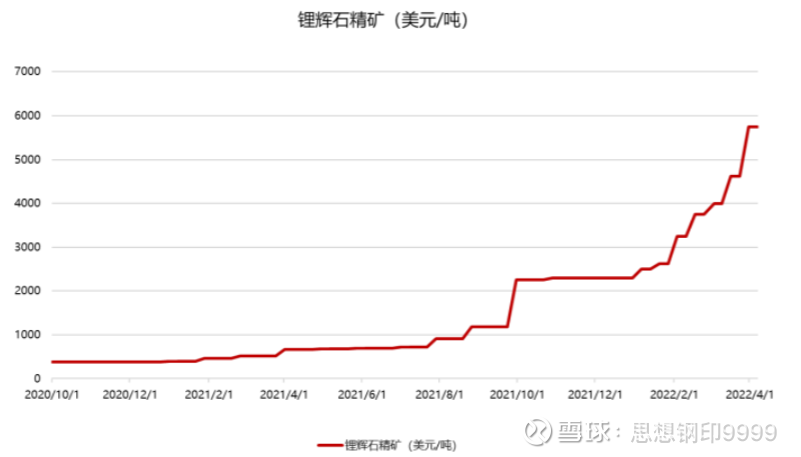

From the second half of 2020 to the beginning of 21, the price of lithium continues to bottom out. Ganfeng Lithium has risen 5 times from the bottom. It is because of the lack of supply flexibility of lithium resources, the previous lithium battery industry cycles. , the experience of lithium prices will rise sharply.

The second wave is rising “price cashing”

This wave of increase is a verification of the previously proposed logic of supply and demand. The price increase derived from the relationship between supply and demand is uncertain. The stock price will not increase all the space, but will first rise and then fall back until the product is really on schedule. Increase, and then realize the remaining upside space according to the increase of the product.

After the lithium mine finally rose from the beginning of 2021, investors found that this wave of lithium resources was a super market that far exceeded expectations, so the second wave of the stock prices of a large number of second-tier lithium resources rose far more than the first wave;

On the contrary, at the end of 2020, the price of copper, which was also expected to rise due to the logic of electric vehicles, only rose to April 2021, and the increase was not as expected. .

The third wave is rising “performance cashing”.

Commodity price increases may not all be reflected in performance. There are many uncertainties about whether the company will release performance and how much performance it will release. Therefore, in the financial season, if it is finally reflected in performance, there will be a wave of increases.

For example, in Tianqi Lithium, investors are most worried that due to corporate governance issues, profits cannot be realized, and the valuation has been relatively low. Until the mid-term report in 2021 begins to fall badly and profits are released on a large scale, the stock price will enter the main rise.

The three waves of the classic price increase are generally the second wave with the largest increase, because there are high-frequency industry data that can be tracked and verified at this time, and the certainty is the strongest – but since it is a game, of course it will not be so simple.

We also need to analyze the characteristics and changes of each wave more carefully.

3/6, the first stage: the logic of increasing supply and demand

The earliest wave, because the stock price has not yet started, has the largest upward space, but the product price has not started, and the uncertainty is also the largest – even if the supply is less than the demand, it will not necessarily lead to a price increase.

The first reason not to raise prices is the pressure of competition. In the real business world, in order to maintain customer relationships, many companies do not easily raise prices , and even keep prices unchanged to snatch customers when their peers raise prices, forcing other competitors to return to their original prices.

The most classic case is that in March 2019, the Xiangshui chemical plant exploded. The market expected that Zhejiang Longsheng, the largest producer of phenylenediamine, would raise its price. With the help of the bull market atmosphere at that time, the stock price rose by 150% in two weeks. In fact, Zhejiang Longsheng In the end, Longsheng did not increase the price, and the stock price eventually returned to the original point.

Another example is photovoltaic film, the growth rate has been lower than the pace of downstream expansion and lower than investors’ expectations. The reason is also that leading companies try to control the growth rate as much as possible in order to maintain customer relationships and prevent their peers from expanding their market share.

The second reason for not increasing prices is substitutes. Some products have different grades. Once the price increases, customers may lower the standard, or there are substitutes for the product, which are only abandoned because of cost. Once the price increases, customers may choose substitute products.

For example, the upstream photovoltaic-grade EVA particles of photovoltaic film, the supply and demand relationship shows that it is the most in short supply of photovoltaics in 2023, but how much its price can rise, there is a very big uncertainty: POE resin is photovoltaic-grade EVA particles. The alternatives were only uncompetitive due to insufficient localization and high cost, but POE localization is being carried out in chemical giants such as Wanhua Chemical and Satellite Chemical, which will inevitably limit the growth of photovoltaic-grade EVA particles in the future.

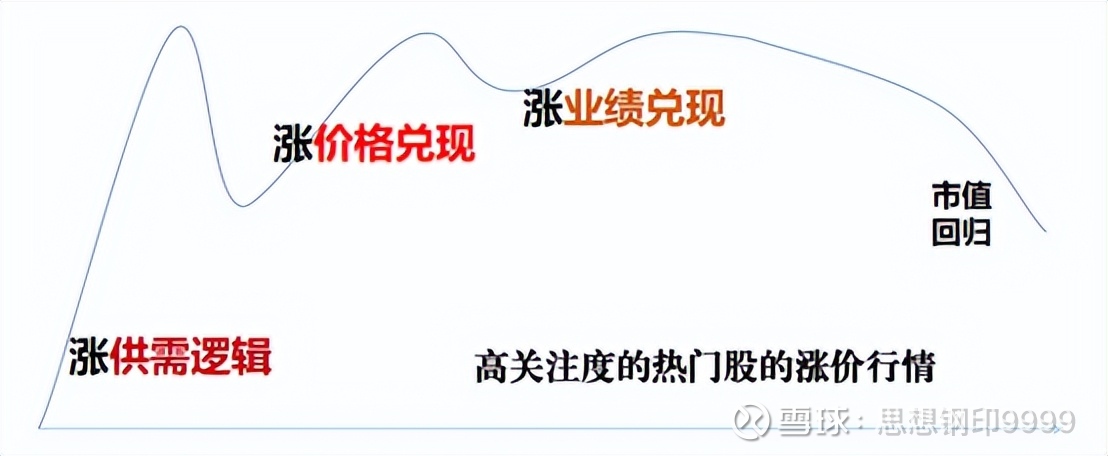

In theory, the first wave should have the smallest increase, but if it is in the atmosphere of a bull market, or in those hot track sectors, this wave will be the most hyped.

The biggest supply and demand logic of photovoltaics this year is the large-scale release of silicon production capacity (the word is very important) , and part of it is the “price increase expectation” of some upstream links, including quartz, trichlorosilane, EVA, and even film. , Industrial silicon, which were fried last year.

However, repeated information bombardment often makes many retail investors mistakenly believe that silicon material production capacity has been released, prices have been reduced, and upstream prices are already rising – but this is not true, silicon material production capacity will not be until the end of the year at the earliest, and prices are still rising slightly In the middle, EVA fluctuated at a high level, and trichlorosilane was all the way down.

Therefore, the biggest misunderstanding at this stage is to take logic as fact, to take the advance prediction of the future that has not yet happened as “what has already happened”.

When you usually read news or research reports, you must make a conscious judgment. Here is logic or industry verification. Here are some examples:

As far as we know, in June, the proportion of photovoltaic materials produced by Zhejiang Petrochemical, Yuneng Chemical, Sierbang, Lianhong and other installations almost reached the upper limit (fact). In this context, the price of EVA continued to remain high (fact), which proves that downstream demand has a relatively high level. Strong support (logical).

It is expected that the supply of EVA particles will continue to be tight (logical) from Q4. As the price of EVA particles enters an upward cycle, the plastic film sector is expected to benefit from the inventory premium (logical) and gradually release profit elasticity. With the gradual release of new production capacity of silicon materials (logic), the increase in component production will drive the growth of film demand (logic), and the excess capacity in the film segment is expected to ease, which will drive cost transfer capability and increase in shipment growth (logic). The profit of the film is driven upward in stages. (logic)

(Excerpted from a research report on EVA and film analysis, does not represent my point of view)

In these two sections of analysis, basically only “the proportion of photovoltaic materials has almost reached the upper limit” and “EVA particles are at a high level” are facts. .

In the first wave, if the most optimistic people can’t count the space, the stock price will stagnate, and when it encounters a suitable negative atmosphere, it will plummet.

Of course, we should also know that many price hikes do not have the first wave . It is especially obvious in the bear market. The so-called “weight quality when falling”, when the best companies have fallen horribly, not to mention speculation logic, even in the early stage of real price increases, many stock prices did not respond.

In addition, whether there is a market situation in the expected stage is also related to the investor’s awareness of the commodity. Countless people have made money in the pig cycle, so the pig cycle has the first wave of the market, and it is very likely that the first wave of the market before the pig price has risen is the most violent.

After this stage, the stock price will slowly fall back again, waiting for the verification of industry fundamental data.

4/6, the second stage: increase the price to cash

The second stage has the support of industry data, which is characterized by the fact that the stock price rises with the actual price increase of the product, so almost all price increases always have the same increase in the stock price and the commodity in a certain period of the second stage. , which is the happiest time for investors based on high-frequency industry data.

But such a happy time does not last long. There is a big difference between the rhythm of commodities and stock prices: commodities tend to rise faster and faster, while stock prices generally rise slower and slower.

This is because, in the early stage of product price increases, some manufacturers have to clear their inventories, and also need to observe the price increases of their peers to determine their own prices, and downstream manufacturers will also slow down the speed of incoming raw materials due to price increases; When it feels that the price increase is inevitable, the downstream will speed up the hoarding speed, and if there are suppliers, hoarding is even more unusual, causing the price to rise faster and faster.

However, this kind of hoarding itself brings false demand, which becomes the driving force for stock prices to fall after supply and demand reverses in the future, and these are also expected by the capital market. Therefore, when commodity prices accelerate in the last stage, the stock prices are often stagnant. Up – unless it’s a big bull market or track sector.

When stock prices do not rise as fast as commodity prices, investors are worried that commodity prices are “inflated”.

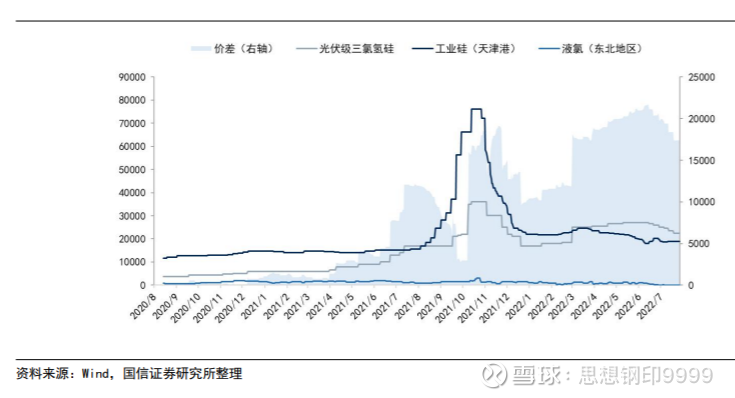

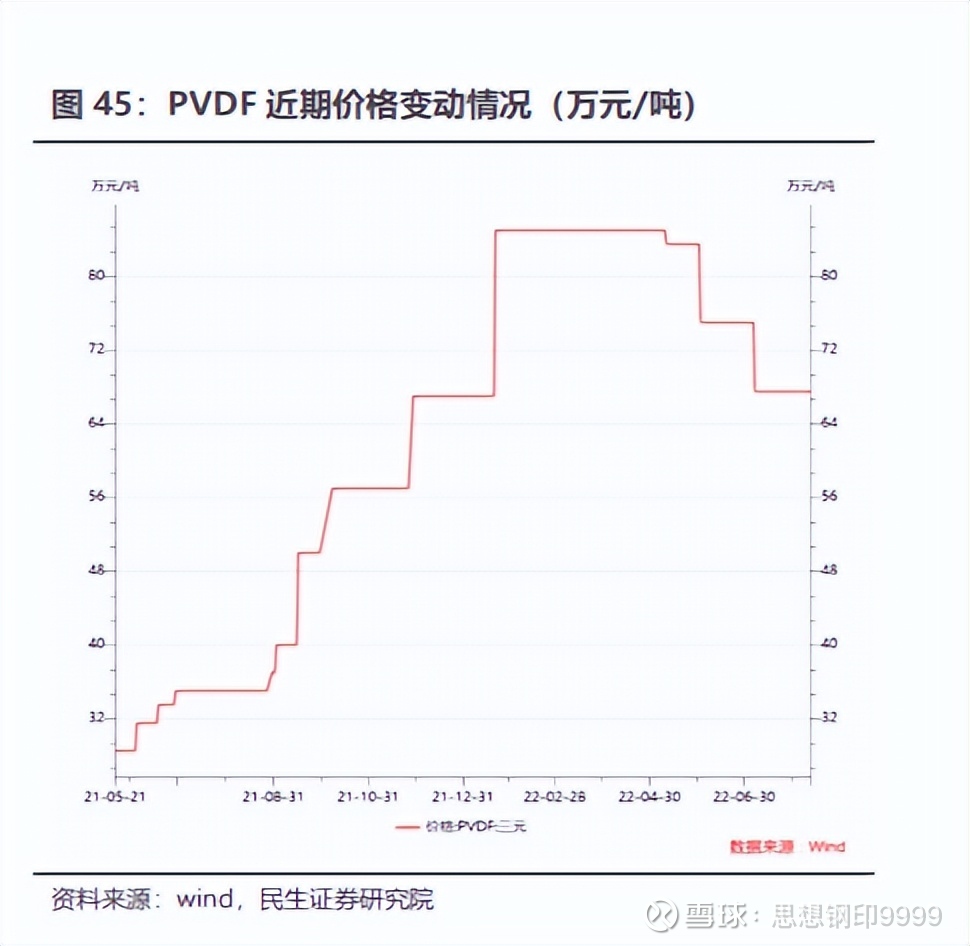

Last year, the price of PVDF, the most in short supply of lithium battery materials, peaked at the beginning of 2022, and was still accelerating from September to October last year, but the stock prices of related listed companies have peaked and began to fall in November, raising the commodity price by nearly three times. months.

The second situation is that the actual increase in commodities is less than expected.

If the expectations in the first stage are too strong, and the expected increase in speculation is too large, overdrafting the increase in the second stage, the final increase will not exceed the height of the expected stage, and it is easy to form a double top in the end.

In fact, in A-shares where liquidity is flooded, the most optimistic pricing feature will always lead to a situation where expectations are too full, and it is difficult for the second wave of most price hikes to significantly exceed the first wave.

The third scenario is that the continuation of the commodity rally is far more than expected.

Although the division of the three stages is very clear, this is only theoretical, and the actual situation is more complicated. In a particularly large industrial trend, the commodity price hike lasted for a long time, which led investors to expect a more violent price increase in the future because of the price increase . supply and demand logic” stage.

Such increases, driven by a combination of expected and actual price increases, tend to be very violent. In July last year and April this year, lithium mines were driven by this “realistic superimposed expectation”.

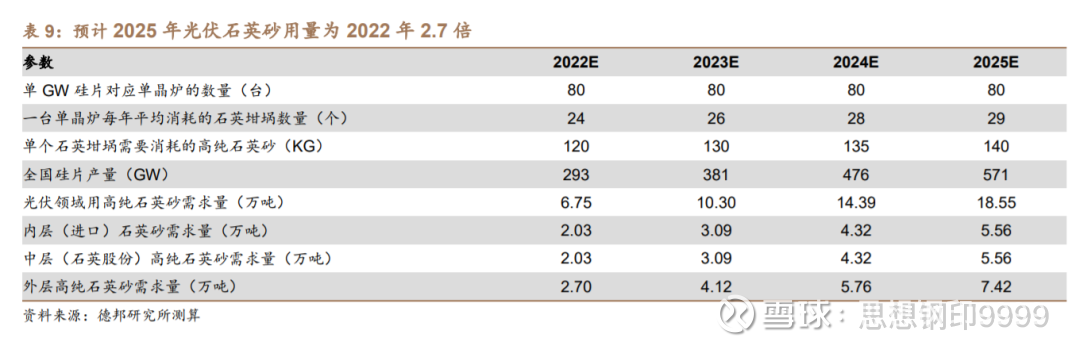

Another example is high-purity quartz sand in photovoltaics. The market expects that after P-type cells are converted to N-type cells, the demand for high-purity quartz sand will rise, and the product barriers are extremely high, so there will be shortages in the next two or three years starting this year.

Quartz shares rose 95% this year on the basis of the 170% surge last year, especially this year’s rise, which is a typical dual logic of “expectation + reality”. The shortage of quartz is real, and the price has also risen, but it has not reached the 100,000 yuan logically deduced, so the driving factor for the stock price is always “expectation > reality”.

However, even this kind of price increase that continues to exceed expectations still cannot escape the basic law. The last wave of commodity prices rises, and the stock price is likely to fail to respond.

This judgment is very simple, but the difficulty is that the “last wave” is a concept verified after the fact, and no one can judge whether it is the last wave or not.

Investing should make choices with higher probability. The higher the commodity price, the more intense the game of the market, the more like picking up coins in front of a road roller . There are often tragedies in which the price rises the day after the price increase information. Quartz shares yesterday.

If you do not have a solid grasp, you should not participate in the second wave of commodity price increases, and try to stay away from the third wave of commodity price increases.

5/6, the third stage: increase performance to realize

As mentioned earlier, the reason for the stage of increasing performance is because many companies are not transparent in their operations, and investors are worried that the profits from price increases will not be reflected in the financial statements. .

Therefore, the stock price still has a small increase, and there is room for the earnings season to be realized.

However, this period of increase is not only small, but also very dangerous, because after that, the market value will return and continue to decline . Many novice retail investors who only look at PE are particularly prone to lose money in this type of company.

More importantly, for those companies that make a lot of money in the short term by raising prices rather than trying to make a lot of money in the short term, instead of giving normal valuations, they must be careful.

These companies will use this huge sum of money for new investments. If he invests in an industry that is already at the top of the cycle, it will be a long and severe winter waiting for companies and investors in the future; if he invests in a completely new industry that is completely unfamiliar, it is equivalent to an entrepreneurial enterprise and still cannot give normal Valuation.

In either case, it is a huge uncertainty, so if we are doing a price increase, we must not wait until the profit has been reflected in the financial report before considering whether to sell.

6/6. Summary

Summarize the three stages of the “price increase”:

1. The price increase market will eventually fall back to most of it, which is a game around supply and demand cognition and price information;

2. The first wave: the logic of increasing supply and demand, with the largest space and the highest uncertainty, in a bull market atmosphere or in the track sector, this wave of hype is the most ferocious;

3. The second wave: the price increase is realized, and the stock price rises with the commodity price, but when the commodity price rises rapidly, the stock price tends to be stagnant, unless it is a super big market for the commodity;

4. The third wave: The performance is fulfilled. This period of increase is not only small, but also very dangerous.

This topic has 30 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9277793488/229965796

This site is for inclusion only, and the copyright belongs to the original author.