Introduction: This article attempts to analyze and discuss the sodium-ion battery industry, with the core issues as the sub-title for analysis. Due to the large amount of content, it may take several periods of time to gradually analyze. As a sodium battery with a certain industrialization and prospects, it is worth paying close attention to. . This article therefore welcomes intellectual and civilized exchanges.

Core point:

1. After solving the problem of high requirements for negative electrodes due to the large radius of sodium ions, sodium-ion batteries have gained an advantage at low cost in the face of skyrocketing lithium prices, and industrialization has really begun.

2. Through the calculation of two-wheeled vehicles, A00 passenger vehicles and energy storage, the demand for sodium batteries in 2023 is 10.3GW, the demand for sodium batteries in 2024 is 61.6GW, and the demand for sodium batteries in 2025 is 153GW.

3. Briefly introduce the situation of Chuanyi Technology and Veken Technology

1. Why has sodium-ion batteries been industrialized until now?

It was born at the same time as lithium batteries, and even sodium batteries, which have a similar industrial chain, why are they only starting to be industrialized now? There are two core reasons, one is the lag in the development of negative electrodes, and the other is that the price surge of lithium has only occurred in the past two years.

The first is the lag in the development of negative electrodes.

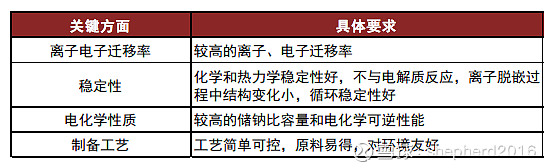

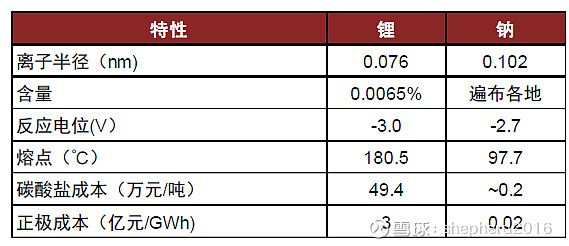

The development of sodium-ion batteries and lithium-ion batteries is synchronized, and the bottleneck of negative electrode materials causes the development of sodium batteries to lag behind lithium batteries. Both sodium-ion batteries and lithium-ion batteries originated in the 1970s, and simultaneously developed materials suitable for positive electrodes. In the 1980s, the mechanism of graphite lithium storage was discovered, and a rocking chair lithium-ion battery prototype was developed using this as the negative electrode, while the sodium ion radius (0.102nm, more than 40% larger than lithium ion) was larger, and the intercalation and deintercalation in the material were very important. The structural stability and dynamics of materials put forward higher requirements.

It was not until the development of hard carbon materials that the industrialization of sodium electricity began to restart. In 2000, a hard carbon anode suitable for sodium ion batteries was finally developed, but its industrialization progress has lagged behind that of lithium batteries. At this time, the demand for replacement of lithium batteries is insufficient, and sodium batteries have been criticized for their performance as inferior to lithium batteries. . With the supply bottleneck of lithium resources and the substantial increase in the market demand for cost-effective energy storage, sodium electricity is ushering in a turnaround.

The second is that lithium prices have risen wildly, and sodium batteries have gained certain advantages with excellent cost performance.

According to the calculation of the China Gold Nonferrous Metals Group, the global lithium demand is expected to increase from 769,000 tons of LCE to 1.633 million tons of LCE in 2022-25. The demand side of lithium resources continues to be strong, but the reserves of lithium in the earth’s crust only account for about 0.0065%, and most of them are located in remote areas, which increases the cost of lithium resources mining, extraction, transportation, processing and other links. As of January 2022, the total global proven lithium resources are about 89 million tons, and the developable reserves are about 22 million tons. Since 2021, with the rapid increase in the penetration rate of electric vehicles, the price of lithium has continued to rise. At present, the price of one ton of lithium carbonate has reached 494,000 yuan, and the average price of domestic lithium carbonate for batteries has risen from about 40,000 yuan/ton in 2020 to the present. The average price of industrial sodium carbonate is within 3,000 yuan/ton all year round. Considering only the cost of the positive electrode, the difference between the two is 150 times.

The large reserves of sodium elements are distributed all over the world, making the price of the main material of sodium batteries much lower than that of lithium batteries.

2. How big is the industry space for sodium batteries?

The potential market space for sodium-ion batteries is vast. First of all, it can be confirmed that the two-wheeler and energy storage fields will take the lead, and then with the advancement of technology, they may penetrate into the automotive field. At present, from a technical point of view, sodium-ion batteries are lithium-ion batteries. The addition of batteries cannot completely change the development direction of electric vehicle batteries, but it will have a certain impact on the current market pattern. In the field of miniature pure electric vehicles of 30,000-50,000 yuan, sodium-ion batteries will have great market prospects.

Since two-wheelers are inherently less valuable and therefore price-sensitive, sodium-ion battery penetration will proceed faster. In the field of energy storage, it is impossible for lithium batteries to gain an advantage over sodium batteries, so energy storage is another major application direction of sodium batteries.

According to the penetration of two-wheelers, A00-class passenger vehicles and energy storage, it is estimated that:

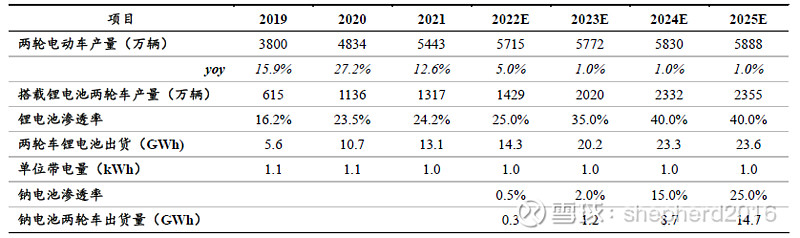

For two-wheelers:

In 2021, the number of electric two-wheelers will be 340 million. According to the 3-5-year replacement cycle, the demand is relatively stable. At the new product launch conference of Maverick Electric in August this year, CEO Li Yan said that the price of lithium batteries has increased by 60% this year, and the rise in raw materials has led to Products rose 600-700 yuan. Companies are looking for new technology to replace, such as sodium-ion batteries, and the pace of replacement may be in 2023. With cost and safety advantages, it is assumed that the penetration rate of sodium-ion batteries in 2022-2025 is 0.5%/2%/15%/25%, respectively. In 2023, 2024 and 2025, the demand for sodium batteries for two-wheelers will be 1.2GW, 8.7GW and 14.7GW.

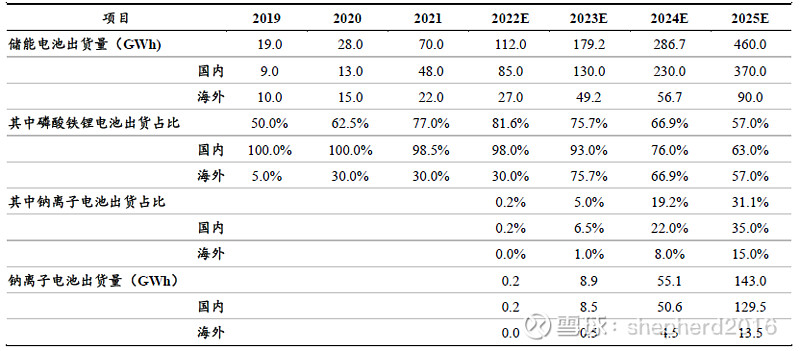

In terms of energy storage:

Sodium-ion batteries are gradually infiltrating the energy storage field with the advantage of kWh cost. Based on the midstream raw material capacity planning of the sodium-ion battery industry in 2022, the installed capacity of energy storage in 2022-2023 is estimated. In 2024-2025, as the industry matures, it is expected to accelerate the penetration , the penetration rate of the energy storage field is expected to be 0.2%/5%/19.2%/31.1% respectively in 2022-2025;

Based on the above assumptions, the shipments of sodium-ion batteries in the energy storage field are expected to be 8.9/55.1/143.0 GWh in 2023-2025, respectively, with a three-year compound growth rate of 300%.

For A00-class passenger cars:

Based on the R&D and product certification cycle of power battery products for passenger vehicles, it is expected that the sodium permeability will be 0.2%/5.0%/15.0% in 2023-2025, respectively. Based on the above assumptions, it is estimated that the installed capacity of sodium-ion batteries in the micro-vehicle field will be 0.1/2.3/8.8 GWh in 2023-2025, respectively.

So: 61.6GW of sodium battery demand in 2024 and 153GW of sodium battery demand in 2025.

I won’t say something like 10 times a year, the addition should be calculated.

3. Who are the new entrants?

The Ningde era is definitely the king of sodium batteries. After all, he is the king of lithium batteries. The production lines of sodium batteries and lithium batteries are relatively close. Of course, the Ningde era will be the king of sodium batteries.

What we need to focus on is the valuation improvement opportunities for new entrants, focusing on two companies: Tranyi Technology and Veken Technology:

Capacity planning

Both are 2GW next year and 8GW the year after.

schedule

Veken: Completion of pilot test in October 22, mass production of 2GW in June 23

Chuanyi: It has the conditions for pilot production, the pilot ceremony on October 27 + Na-ion product launch conference, 2GW mass production in February 2023, one energy storage, two two-wheelers

technology

Veken: Layered oxide circuit, energy density of 150, cycle times of 3000, cell price of 5 gross/Wh, 30% gross profit exceeding expectations, and expected to reach 3 gross/Wh in the future.

Tradition: Layered oxide circuit, energy density 145, cycle times 4000, reaching production within three months to less than 0.35 yuan/wh

Technical team

Veken: deeply bound with Natron (shareholding + supply), and began to cooperate in 2019. ATL’s outbound entrepreneurial team has a good relationship with ATL and CATL, and has industrial synergy (Natron’s strategic plan was adjusted in June, no longer using sodium batteries as the main product, and positioning it as a supplier of sodium battery materials)

Chuanyi: In cooperation with the Institute of Applied Electrochemistry of Shandong University of Technology, the chairman is a professor of industry at Soochow University

$ Chuanyi Technology (SZ002866)$ $ Veken Technology (SH600152)$ $ Ningde Times (SZ300750)$

There are 80 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1926044066/231144081

This site is for inclusion only, and the copyright belongs to the original author.