Welcome to the WeChat subscription number of “Sina Technology”: techsina

Literature / Yixin Yongyang

Source: Bueryanjiu Research (ID:bueryanjiu)

Today, Hong Kong stocks ushered in the fourth “new car-making force”!

Zhejiang Leapmotor Technology Co., Ltd. (hereinafter referred to as “Leapmotor”, 09863.HK) was officially listed on the Hong Kong Stock Exchange, but it was broken at the opening.

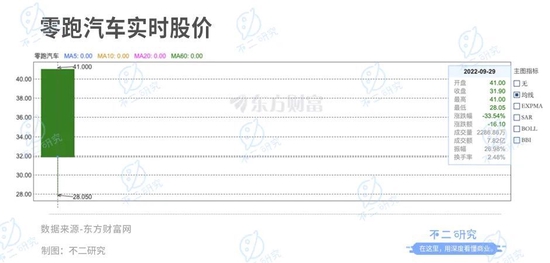

Leapmotor Motors issued 130.8 million shares globally in this IPO, at an issue price of HK$48 per share; it was broken at the opening and the opening price was HK$41 per share, down 14.5% from the issue price, and the lowest intraday hit was HK$28.05 per share.

As of the close of Hong Kong stocks on September 29, Leapmotor Motors closed at HK$31.90 per share, a drop of 33.54%, corresponding to a market value of HK$36.45 billion (market value equivalent to RMB 33.42 billion).

Leapmotor is an emerging electric vehicle company with global independent research and development capabilities.

From January to August this year, Leapmotor delivered a total of 76,563 vehicles, surpassing Weilai and Ideal, and ranking third among the new car manufacturers. Among them, the delivery of new cars of Leapmotor reached 12,525 in August, a year-on-year increase of 180%.

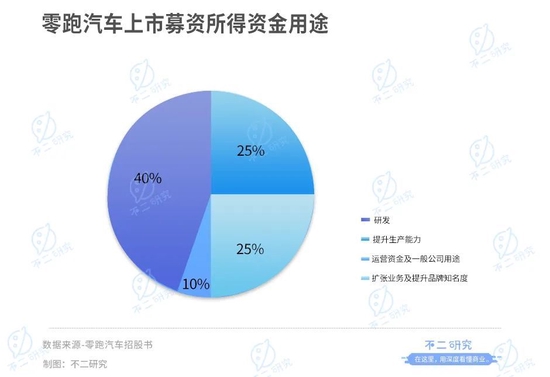

Leap Motor announced that about 40% of the funds raised from the IPO will be used for research and development, about 25% will be used to increase production capacity, about 25% will be used for business expansion and brand awareness, and about 10% will be used for operating capital and general corporate purposes. .

In its prospectus, Leap Motor quoted a Frost & Sullivan report saying that Leap Motor is the fifth largest pure electric vehicle company in the world and the four largest in China in terms of vehicle sales in 2021.

▲ Source: Leapmotor official micro

▲ Source: Leapmotor official microAccording to Leap Motor’s prospectus, ‘Buer Research’ found that in the first quarter of this year, Leap Motor’s revenue was 1.992 billion yuan, a year-on-year increase of 616.37%; in the same period, its adjusted net loss was 969 million yuan, a year-on-year increase of 161.04%.

From 2019 to 2021, Leap Motor’s three-year revenue was 3.88 billion yuan, and the loss was 4.847 billion yuan. Although Leap Motor’s annual revenue increased by leaps and bounds, it was still in a state of loss. Taking 2021 as an example, Leapmotor will deliver a total of 43,000 electric vehicles, with a loss of 2.846 billion yuan, which is equivalent to a loss of over 65,000 yuan per car sold.

In an old article in April of this year, we focused on Leap Motor’s continued “burning money” and expanding losses. As the “fourth stock” of a new car-making force, can Leapmotor really lead the “second echelon”? As a result, ‘Fuji Research’ has updated some data and charts of the old article in April, the following Enjoy:

The surge in oil prices has boosted the sales of new energy vehicles. Most of the new car-making forces sold more than 10,000 cars in March: Compared with the “Wei Xiaoli” in the first echelon, Nezha Auto and Leapmotor Cars in the second echelon are catching up. The trend is obvious.

According to Fuji Research, the new energy vehicle track has long slopes and thick snow, but the competition is fierce. Although Leap Motor’s revenue has grown rapidly, it has continued to lose money; not only is it still a certain distance from the “global self-research” it claims, but its sales are mainly low-end cars, and it is difficult to support the market.

Leapmotor urgently needs an IPO “blood transfusion”, but can it really “run” out of the second echelon with an IPO?

4.8 billion losses in 3 years

In December 2015, Zhu Jiangming, the then vice chairman and CTO (Chief Technology Officer) of the security giant Dahua (002236.SZ) and the co-founder of Dahua, joined Dahua and its main founders in Hangzhou. Leapmotor was founded, and the security giant crossed into the field of new energy vehicles.

▲Photo source: Leapmotor founder-Zhu Jiangming-Leapmotor official micro

▲Photo source: Leapmotor founder-Zhu Jiangming-Leapmotor official microUnder the background of Dahua and the high prosperity of the new energy vehicle track, Leap Motor’s financing process has been very smooth. According to Tianyancha data, Leapmotor has experienced seven rounds of financing from 2016 to 2021, and the publicly disclosed financing amount has reached 12.06 billion yuan. Investors include Sequoia China, CRRC, Hangzhou State-owned Assets, Shanghai Electric, etc.

At the same time, Leap Motor is also deeply bound to Dahua. According to its prospectus, Fu Liquan and Zhu Jiangming are acting in concert. The four hold a total of 31.01% of Leap Motor, while Fu Liquan and Zhu Jiangming respectively Holds 34.18% and 5.36% of Dahua shares.

With relatively abundant financial support, Leapmotor has also developed rapidly, launching its first model S01 in 2019, followed by T03 and C11 models. Its revenue has grown rapidly. According to the prospectus of Leap Motor, from 2019 to 2021 and the first quarter of 2022, Leap Motor’s revenue was 117 million, 631 million, 3.132 billion and 1.992 billion, respectively. In 2020 and 2021, respectively A year-on-year increase of 439.32% and 396.35%, showing a leap-forward growth every year.

However, from the perspective of net profit, Leapmotor is similar to most new car-making forces and is still in a state of loss. According to the prospectus of Leap Motor, in the first quarter of 2019-2021 and 2022, its adjusted net losses were about 810 million, 935 million, 2.629 billion and 969 million respectively.

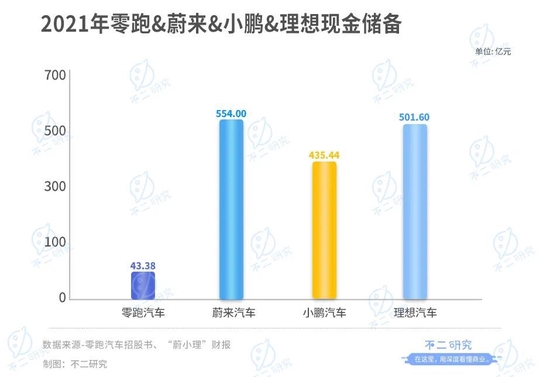

The continuous operation of Leap Motor, which has continued to lose money, can only rely on financing “blood transfusion”. The current book of Leap Motor is not optimistic. According to its prospectus, as of March 31, 2022, Leap Motor’s total current assets were about 8.286 billion yuan, and cash and cash equivalents at the end of the year were about 4.277 billion yuan.

Although Leapmotor has better cash reserves than in 2019 and 2020, it is dwarfed by other companies in the new car-making power. According to the financial report of Wei Xiaoli, the cash reserves of Weilai Automobile, Xiaopeng Automobile and Ideal Automobile as of the end of 2021 were 55.4 billion yuan, 43.544 billion yuan and 50.160 billion yuan respectively.

Therefore, according to ‘Buer Research’, Leapmotor urgently needs to refinance and replenish its working capital. IPO is the best choice for it, but its three-year loss is 4.8 billion yuan. Are investors in the secondary market willing to pay the bill? still unknown.

Global self-research is difficult

According to the prospectus of Leap Motor, it plans to use about 40% of the funds raised from the listing for research and development, about 25% for improving production capacity, about 25% for expanding business and enhancing brand awareness, and about 10% for operation. Funds and general corporate purposes.

Leapmotor attaches great importance to its research and development capabilities, and its research and development direction is also the most unique among the new domestic car manufacturers. According to its prospectus, Leapmotor claims to be the only new car manufacturer in China that has the ability to “self-research in all areas”. At present, the new car-making forces in the market are mainly doing “full-stack self-research”.

“Global self-research”, as the name implies, means that everything from hardware to software is independently developed, while “full-stack self-research” means that hardware is handed over to a third party, and car companies only develop applications and algorithms.

From the perspective of the long-term development of the automotive industry, self-research is a rigid demand for car companies, especially considering the rapid increase in car prices caused by the instability of the supply chain and the drastic cost fluctuations in the past two years. One of the key factors in winning.

▲ Source: Leapmotor official micro

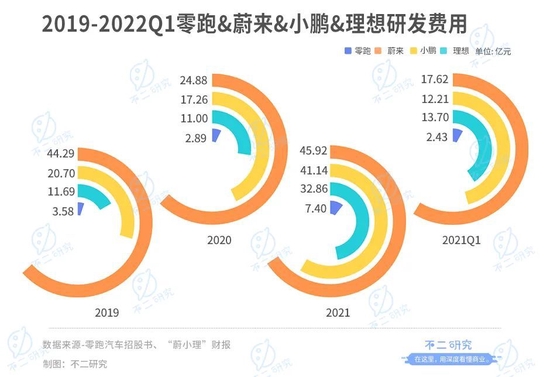

▲ Source: Leapmotor official micro“Global self-research” naturally means that more R&D investment is needed, but there is still a certain gap between the R&D investment of Leapmotor and the first echelon of new car-making forces. According to its prospectus, in 2019-2021 and the first quarter of 2022, Leapmotor’s R&D investment was 358 million, 289 million, 740 million and 243 million respectively.

According to the “Weixiaoli” financial report, in 2019-2021 and the first quarter of 2022, Weilai Automobile was 4.429 billion, 2.488 billion, 4.592 billion and 1.762 billion; Xiaopeng Motors was 2.070 billion, 1.726 billion, 4.114 billion and 1.221 billion The R&D expenses of Ideal Auto are 1.169 billion, 1.100 billion, 3.286 billion and 1.370 billion respectively.

The R&D investment of Leapmotor is significantly lower than that of “Wei Xiaoli”. Although Leapmotor has achieved autonomy in some core components, it has a certain cost advantage compared with other car companies that purchase hardware from outside, but there are still many links that have not been opened up. .

Moreover, global self-research means that Leapmotor needs to be fully maintained in various ports such as technology, design, and manufacturing. As more and more self-developed technologies and products are commercialized in the future, the cost of self-developed platforms will increase. It will continue to affect the efficiency of its self-developed platform.

From the perspective of ‘Buer Research’, Leapmotor has a long way to go for global self-research. If it can truly realize global self-research, it will naturally be its unique advantage. However, the new energy vehicle track is currently in a period of rapid growth. , other new car manufacturers and traditional car companies have used the “full-stack self-research” model to shorten the research and development time, so as to quickly gain market share.

At this time, Leapmotor is trying to continue self-research in all areas. In addition to the pressure of research and development funds and the efficiency of self-developed platforms, the competition of competitors is also a problem that needs to be faced.

Mid-to-high end meets ceiling

After several years of development, China’s new energy vehicle market has formed two distinct markets. One is the low-end market represented by Wuling Hongguang mini, which sells for 50,000 to 100,000 yuan per vehicle. In the mid-to-high-end market led by it, the price of a single vehicle is in the range of 200,000-500,000.

So what market is Leapmotor in?

Leapmotor stated in its prospectus, “We mainly focus on China’s mid-to-high-end mainstream new energy vehicle market with prices ranging from RMB 150,000 to RMB 300,000.” However, Leap Motor does not seem to have entered the mid-to-high end. According to its prospectus, Leap Motor will deliver 8,050 and 43,748 electric vehicles in 2020 and 2021, respectively. During the same period, its sales revenue of automobiles and parts will be 616 million yuan and 30.59 million yuan. After calculation, it can be concluded that the income brought by each car is 78,000 and 72,000, far from 150,000-300,000 yuan.

According to its prospectus, Leap Motor currently mainly sells four models of cars, namely the medium and large sedan C01, the medium SUV C11, the miniature car T03 and the coupe S01. The price of the miniature car T03 is 68,900-84,900. Yuan, the mid-size SUV C11 is priced at 159,800-199,800 yuan.

The prospectus shows that by the end of 2021, Leapmotor had delivered 3,965 and 46,162 C11 and T03 models, respectively, and the delivery of the mini-car T03 was significantly higher than that of the C11.

According to the data from the Passenger Federation, the sales of Leapmotor T03 will reach 39,100 units in 2021, and the sales of Wuling Hongguang and Euler will reach 427,000 units and 135,000 units in 2021. The gap between Leapmotor T03 and the first-tier Wuling Hongguang Mini and Euler is relatively large. In the low-end car market that wins by quantity, Leapmotor has obviously lost the opportunity.

Looking at the mid-to-high-end auto market, Leapmotor has placed high hopes on the “half-price Model Y”-C11 since its delivery in October 2021. The delivery volume is not optimistic, and the delivery volume in Q4 in 2021 is 3965 units. According to its prospectus, as of the end of 2021, the number of orders for the C11 was 22,536, and nearly 20,000 were not delivered.

▲ Source: Leapmotor official micro

▲ Source: Leapmotor official microIn the mid-to-high-end market, in addition to the C11, Leapmotor expects to launch the large sedan C01 in the second quarter of 2022, with deliveries starting in the third quarter, and is preparing to launch eight models by 2025, covering sedans, SUVs and MPVs.

According to ‘Buer Research’, Leap Motor still has a long way to go to expand in the mid-to-high-end market. At present, Leap Motor’s brand awareness is relatively low, and it is still comparable to the first-tier “Wei Xiaoli”. There is a certain gap. In the future, efforts in the mid-to-high-end market need to be developed in both product strength and brand strength.

Can Leapmotor Cars “Lead the Race”?

According to data from the China Passenger Transport Association, by 2025, the planned production capacity of new energy vehicles that have been built or will be built in China will reach 20 million. In 2021, the sales volume of new energy passenger vehicles will be 3.326 million units, and the dedicated production capacity of new energy passenger vehicles will already be 5.695 million units, with a capacity utilization rate of 58.4%.

In the future, if major car companies continue to expand their own production capacity, the competition in the new energy vehicle market will inevitably become more and more fierce. As the second echelon of new car manufacturers, Leapmotor has its unique “global self-research” advantage. In terms of penetration of high-end models, it is still difficult to match the new forces in the first echelon of car manufacturers.

If Leapmotor wants to get a bigger slice of the new energy vehicle market, it can only continue to “burn money”, and the IPO is just the beginning. As the “first stock” of the second echelon of new car-making forces, can Leapmotor really “run” out of the second echelon?

Some references for this article:

1. “Leapmotor car sprints for IPO, can the glory of the top-selling T03 continue? “, Sino-Singapore Jingwei

2. “Can Leapmotor Cars lead the way, and whether burning money for self-research can kill the road? “, Hexun

3. “Leap Motor is rushing to the market, and the gold owner behind it can’t bear it”, Wujian Finance and Economics

4. “Three years of huge losses of more than 4.8 billion and even talking about surpassing Tesla, what is the “leading” of Leapmotor? “, Hexun

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-09-30/doc-imqqsmrp1076635.shtml

This site is for inclusion only, and the copyright belongs to the original author.