Step by step to today, I have changed several times in my thinking about stock speculation. According to my current thinking, most of the stock social networking does not produce positive feedback on stock speculation, so I set a benchmark for myself. I used to be more active and now make a silent roasted leek.

Pick up yesterday’s topic and recall the history of the second big bear market. A friend said that yesterday’s post was harmful. I didn’t understand it a bit, and I didn’t understand it. I’ll make a record and take a look at it if you’re interested.

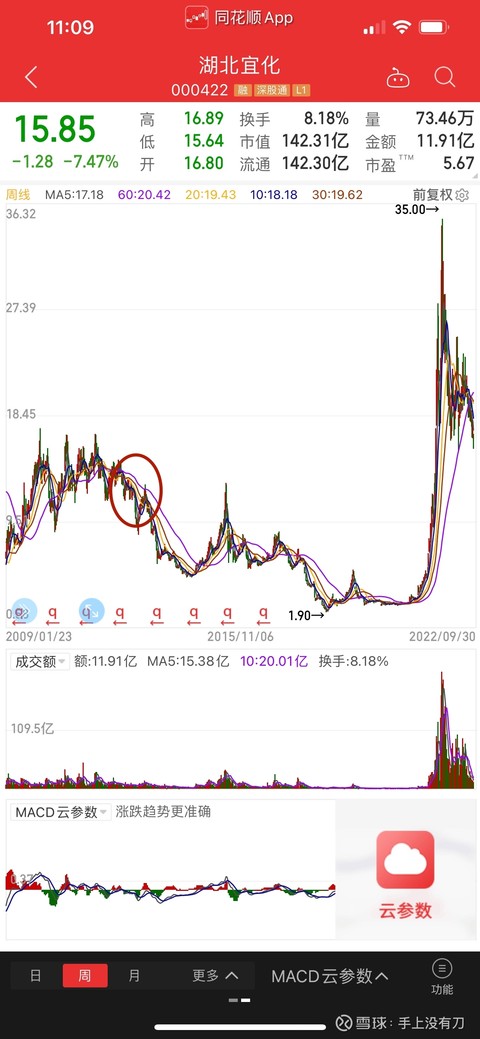

2. The bear market that started in 2011 and the Hubei Yihua that I will remember for a lifetime

The first big bear had a bit of twists and turns. After hiding for a while, it was also cut in half. In the end, he came back. He was a little confused. , planted the seeds for the second big bear to enter the big pit.

At this time, there are several major hidden dangers in the method of investing in stocks, which will erupt later. Let me talk about it first, and friends who see it can take a warning.

The first one is basically a full position of one stock. Sometimes 90% of the position is one stock, and the rest of the position is bought sporadically. If there is not much capital, this method does not matter. After the capital is large, the defects will be obvious, and the market value will fluctuate too much. The conference affects the mentality and ultimately affects the deformation of the operation, and it is impossible to achieve the unity of knowledge and action. Position management is one of the most important stock trading tools.

The second one is that the warehouse is full around the clock. I am afraid that leaving a little money will affect my money making. I won’t say much about this. Anyway, I don’t think it’s good. According to my current understanding, the medium and long-term trading should be based on half positions, and the short-term trading should be based on short positions.

The third point is the concept of buying. At first, I liked stocks that went down and then went down. Later, I liked to buy stocks that went up and up again when I knew a little about the trend. I have suffered from both, and those that fell and fell easily fell by 30%. %, a short-term sharp correction that rose and rose again.

The fourth is to add funds after earning, rising by 1 million, and falling by 2 million. This is a full fund routine.

My second bear market pit has all four faults, and it is impossible to lose money.

Then I will talk about cyclical stocks. Now, everyone should know about cyclical stocks, so I will not go into details. But more than ten years ago, there are not as many people who know cyclical stocks now. At least I am ignorant. I feel It’s easy to see demon stocks in Shanghai Chemical Industry. This is the negative knowledge asset left to me by the bull market in 2007.

In 2011, I had a lot of money and entered the stock market again. After Wuliangye came out, I had no good choice. I occasionally saw the stock of Hubei Yihua. What attracted people was not the so-called cyclical stock, but as a fertilizer and chemical company. , it began to deeply participate in the development of Xinjiang coal, which will lead to its very low cost, laying the foundation for future performance to take off, and then buy the whole warehouse. Looking at today’s Hubei Yihua, friends thought that they could make a fortune again, but it’s a pity I can’t help it, the stock market is such a pit. The position of buying is relatively high, and it has been fluctuating at 10 points above and below the cost. For the stock market at that time, it was relatively strong, and the market fell into a dog early, because the stock market cycle stocks after 2010 have always been relatively strong, and they were speculated later. Put phosphorus chemical.

Until the second half of 2012, the trend has been unsatisfactory. It has lost more than a dozen points. It is OK to compare with the general market. However, a performance forecast overturned the logic of Xinjiang. That day, the limit fell and I did not sell.

Compared with the previous round of Wuliangye, I did not sell it. The biggest reason was that Wuliangye was profitable at that time, and Hubei Yihua had already lost 20 points at that time, so it was difficult to cut meat. From that day on, I stopped reading the market again. The second time I traded stocks, I didn’t watch the market. I can imagine the bad mood. I missed the next opportunity to fight back violently and escape.

It has been two years since I returned to the stock market. Those two years were very painful. Only those who have passed through will understand that my bad stomach should have something to do with my depression at that time.

Most of the bull stocks in the last round will not work in the next round. The bull market in 1415 basically had nothing to do with Hubei Yihua. Until the last few months, unfortunately, the capital has not returned, and the stock market crash has begun…

The 15-year stock market crash and the subsequent circuit breaker are my third round of big bears, which will continue tomorrow.

Looking back at the second round of the big bear market, it was bad, bad.

There is not much profit in the front, there is no profit pad

A lot of money has been added to the high

The whole warehouse eats a big drop

The resurgent bull market performed poorly

The bottom time is very long, and the loss is only one-third. It is not enough to return all the profits from the last bull market to him. Even if the last sell after the rebound, he will lose half of it, and his mood is extremely low. . So far, for nearly ten years, I have gained nothing from investing in stocks, I have suffered a lot of losses, and all my efforts have been abandoned. Looking back on those ten years, I have seen a small loss, a big profit, a big loss, and a return to the highest market value, increased investment, and huge losses…

I think this vicious circle is a portrayal of many investors.

Tomorrow I will recall my third big bear market, and my transformation. $Shanghai Index(SH000001)$

There are 17 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/8301095923/232037036

This site is for inclusion only, and the copyright belongs to the original author.