Welcome to the WeChat subscription number of “Sina Technology”: techsina

text / road words

Source: Lishi Automobile (ID:lishiqiche2016)

Sales stagnant, stock prices plummeted, competition continued to intensify, and he was still facing huge financial losses and a large amount of cash being consumed. Wei Xiaoli was faced with less and less living space.

1

New car manufacturers represented by “Weixiaoli” have attracted the most attention from the domestic auto industry for a long time. But all that has been quietly changing in recent months.

According to the latest sales data released by various automakers, Li Auto delivered 11,531 units in September, NIO delivered 10,878 units, and Xiaopeng Motors delivered 8,468 units. The year-on-year and month-on-month growth in monthly deliveries of the three companies has been stagnant.

At the same time, the new energy vehicle brand Aian has completed the delivery of up to 30,016 units; the AITO brand has completed the delivery of 10,142 units, which is the fastest record for domestic new energy vehicle brands to deliver over 10,000 units in a single month in August. Delivered more than 10,000 units for two consecutive months; under the condition that only one model of Jikr 001 was on sale, the Jikr brand completed the delivery of 8,276 units, and the average order amount exceeded 336,000 yuan.

It is worth mentioning that the three brands of Aian, AITO and Jikr are not new car-making power brands, but are all new sub-brands launched by traditional car manufacturers focusing on the field of new energy vehicles. Among them, AITO is a cooperative brand between Chongqing Xiaokang (now renamed Celis) and Huawei’s smart terminal business, Aian is a sub-brand of Guangzhou Automobile Group, and Jikr is a sub-brand of Chinese private automobile giant Geely Holdings.

The above-mentioned performance of the three brands Aian, AITO and Jikrypton is unexpected. Few people would predict that traditional car manufacturers will catch up with or even surpass those new car manufacturers with magical halo above their heads so quickly.

In addition to the counterattacks of the above-mentioned traditional domestic car manufacturers against the new forces in car-making, overseas multinational auto giants are also aggressively attacking. Among them, the German Volkswagen brand is the best performer, and its ID series focusing on pure electric models is delivered monthly. The volume has exceeded 20,000 units for two consecutive months, achieving a substantial surpassing of “Weixiaoli”.

In addition, joint ventures such as Toyota, Honda, GM and Ford are also gearing up. Among them, the most vigilant is that the world’s number one Japanese auto giant Toyota Motor has launched the bZ series of pure electric models, and the first model bZ4 has been officially launched. Not surprisingly, Toyota will soon occupy its place in the new energy pure electric market with its extensive channel layout and long-term user reputation.

2

As the above-mentioned brands have successively overtaken Wei Xiaoli, the stories that happened in the smartphone and smart car industries in the past have begun to repeat themselves in the field of new energy vehicles.

In the early stage of the development of the smartphone industry, a number of emerging Internet mobile phone manufacturers appeared in China. Many people predicted that these new Internet mobile phone forces would dominate the future Chinese smartphone market, and the previous traditional mobile phone manufacturers would lose their competitiveness. But today, apart from Xiaomi, other Internet mobile phone brands have died out, and the market is still dominated by several old traditional mobile phone manufacturers such as Huawei, Oppo and vivo.

The same is true in the field of smart TVs. After LeTV took the lead in launching smart TVs, a number of new TV brands emerged in China. As a result, looking back, in addition to Xiaomi, most of the other Internet TV brands in the smart TV market have already Disappeared, and traditional TV giants such as Hisense, Skyworth and TCL still occupy most of the market share.

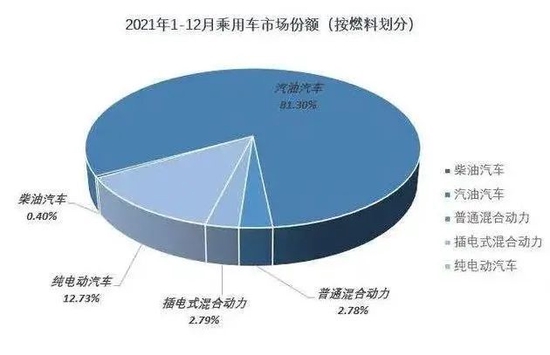

In the automotive industry, unlike smartphones and smart TVs, which replace most feature phones and feature TVs, new energy vehicles currently only account for less than 30% of the overall automotive market, and they are sold at low and medium prices. of models.

Judging from the current overall industry pattern, in the field of fuel vehicles, which account for more than 70% of the market, mainstream traditional automakers at home and abroad such as Toyota, Volkswagen, GM, Ford, Geely, Great Wall and Chery are still performing well. In the field of new energy vehicles, which accounts for less than 30% of the market, most of the market is occupied by two leading companies, BYD and Tesla. September data shows that BYD’s sales have reached a terrifying 200,000+, and Tesla’s sales are also at the level of 80,000+, and both are still growing.

In addition to BYD and Tesla, there is a small new energy vehicle market. Weilai, Ideal and Xiaopeng also lost their early pioneers in the face of the sub-brands of traditional car manufacturers such as Aian, AITO and Krypton. develop an advantage. In addition, the new car-making forces such as Nezha and Leapao, which were mainly low-cost models before, not only achieved the surpassing of Wei Xiaoli’s overall sales, but also achieved certain breakthroughs in mid-to-high-end models. According to public data, Nezha and Leapmotor completed the delivery of 18,005 and 11,039 new cars respectively in September.

3

An important factor that people often overlook when researching businesses is that business competition is dynamic. The advantage of a company at a certain time may only be the first-mover advantage brought about by the time difference. With the implementation of competitors’ response strategies, the previous competitive situation may soon be reversed.

A very typical case is being staged in China’s new energy vehicle industry.

In the early stage of the development of the new energy market, Wei Xiaoli made some achievements by virtue of his first-mover advantage, so he attracted much attention from the industry. But when other forces responded well, Wei Xiaoli lost his early first-mover advantage, but was exhausted in front of powerful competitors and struggled to deal with it. Moreover, these competitors are only just beginning their efforts, and as more and more competitive products are launched in the future, they will put more pressure on Wei Xiaoli.

The pressure that Wei Xiaoli faced has also begun to be passed on to the capital market, making investors more pessimistic.

According to data from the most recent trading day, NIO’s U.S. stock price fell from a previous high of $66.9 per share to $13.29 per share, with a market value of $22.49 billion; Li Auto’s U.S. stock price fell from its previous high of $47.7 per share. The stock fell to US$20.72/share, with a market value of US$21.59 billion; the most dismal is Xiaopeng Motors, whose US stock price plummeted from the previous high of US$74.49/share to US$9.87/share, with a market value of only US$8.51 billion, already less than 100%. 100 million.

The sales volume is stagnant, the stock price has plummeted, the competition intensity has continued to intensify, and it is still faced with huge financial losses and a large amount of cash being consumed, leaving less and less living space for Wei Xiaoli.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-10-13/doc-imqqsmrp2420057.shtml

This site is for inclusion only, and the copyright belongs to the original author.