Welcome to the WeChat subscription number of “Sina Technology”: techsina

Author | Dawn Editor | Ai Xiaojia

Source: Shentu

With just over 2 months left in 2022, it is time to take stock of the completion of the annual KPIs of car companies.

On the 1st of every month, the new car-making forces will announce the new car delivery results of the previous month; in the middle of each month, the Passenger Federation will announce the sales of all car companies last month. As of now, the data for the first three quarters of this year have come out. Through the data of these nine months, we can roughly see whether the KPIs of various car companies in 2022 can be completed.

Taking BYD as an example, the sales target of new energy vehicles this year is 1.5 million units, and 1.18 million units were sold in the first 9 months, a shortfall of 320,000 units. And BYD can now sell 200,000 vehicles a month, and the annual KPI can definitely be achieved.

Another example is Xiaopeng, this year’s goal is to secure 250,000 vehicles and hit 300,000 vehicles. The results in the first nine months were less than 100,000 vehicles, and the monthly delivery volume was around 10,000 vehicles. So this year’s KPIs cannot be completed.

According to the operations of previous years, car companies will sprint for a wave at the end of the year, especially in December, but the overall pattern has basically been determined.

Shentu took stock of the KPI completion rates of major auto companies in advance, and made a prediction on the completion of the year. We will check again at the end of the year to see which car companies are worthy of praise and which still need to work hard.

At the end of the year, the KPI will be rushed, and some are happy and some are sad

Generally speaking, car companies will set KPIs at the beginning of the year. When determining the specific value of KPI, the sales volume of the previous year will be referred to.

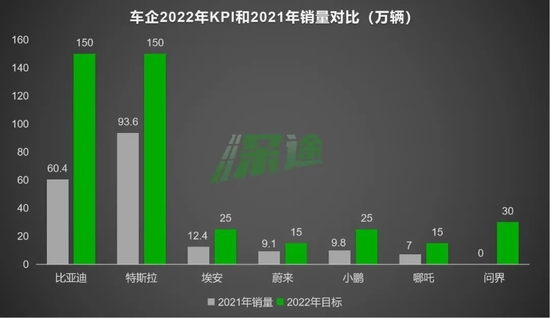

Shentu has counted car companies that have clearly disclosed their sales targets in 2022. The following is a comparison chart between their KPIs in 2022 and sales in 2021.

As can be seen from the figure, BYD and Tesla have the largest sales volume, and the targets for 2022 are both 1.5 million units. But BYD is more aggressive. Last year, BYD only sold 600,000 (new energy vehicles), while Tesla sold 936,000. It is equivalent to BYD’s growth rate of 1.5 times this year to catch up with Tesla.

The three brands of Aian, Xiaopeng and Wenjie have all set their goals on the line of 250,000 vehicles. Aian and Xiaopeng are going to double, and Wenjie is going from zero to 300,000.

NIO should be conservative, with a target increase of 65%, which is the lowest among them. Nezha and Weilai set the same target of 150,000 vehicles. Nezha only sold 70,000 vehicles last year, and wants to double it by 2022.

The remaining new car-making forces, Ideal and Leapmotor, have not publicly announced their goals for 2022. Ideal said that they will achieve a market share of more than 20% of China’s smart electric vehicles by 2025, and Leapmotor will achieve an annual sales volume of 80% in 2025. 10,000 vehicles. This belongs to the big cake of the future, it is not a thing, and I will not discuss it in this article for the time being.

Smaller new forces such as Ji Krypton, Jihu, and Lantu have also announced their own sales targets, which we will talk about later.

So, in the past three quarters of 2022, how are the KPIs of these car companies?

Please see the table below.

The three companies of BYD, Nezha and Aian have the highest performance completion rate in the first nine months of this year, all exceeding 70%, among which BYD is the highest. At their current pace, they should have no problem hitting their full-year 2022 sales targets.

Tesla has only completed 61% at present, and the completion rate is slightly lower than expected, and there is no small pressure to complete the annual target. However, Tesla has always been unconventional, and its deliveries in the fourth quarter of each year are significantly higher than in the first three quarters. And now that Tesla’s Berlin plant in Germany has been put into production, the production capacity is guaranteed to a certain extent, and it is very possible to rush to a wave of sales by the end of the year.

Both Ji Krypton and Weilai have just completed more than half of their goals. They belong to the type that should not be completed in principle, but there may be accidents. After Ji Krypton replaced the 8155 chip for Ji Krypton 001 for free in July this year, sales rose immediately, and the possibility of a big outbreak in the fourth quarter cannot be ruled out. Several of NIO’s new cars were delivered in the fourth quarter, which is also worth looking forward to.

The four companies, Xiaopeng, Wenjie, Lantu, and Jihu, have a high probability of not being able to achieve their goals. Xiaopeng delivered less than 100,000 vehicles in the first three quarters of this year. Even if it delivered another 100,000 vehicles in the remaining quarter, it would still be 50,000 vehicles away. Lantu’s 2022 target is the lowest of these new car companies, with only 31,000 vehicles, but even so, it currently seems impossible to achieve.

It is impossible for Jihu and Wenjie to complete the sales target set at the beginning of the year. There are only 3 months left, Jihu is still 75% behind, and the world is 85% behind. Even if the orders keep up, the production capacity can’t keep up.

Interestingly, both companies are associated with Huawei. Jihu is the first brand equipped with Huawei’s full-stack smart car solution, and Wenjie is the first brand to implement Huawei’s smart selection model. It can be seen that although Huawei has strong technology, wide channels and large traffic, it is not easy to convert it into real orders.

Now it is Yu Chengdong who is actually in charge of Huawei’s auto business. At the beginning of the year, Yu Chengdong said that the industry would challenge the annual sales of 300,000 vehicles. Many people thought he was bragging. In mid-April of this year, he admitted that, “It is impossible to do 300,000 vehicles at all. It is a miracle to complete 100,000 to 200,000 vehicles in the first year.” But his reason is the shortage of chips.

Overall, the new car companies are happy and sad in the completion of the annual sales KPI. BYD is very strong, Tesla doesn’t talk about martial arts, Nezha is terrifying, Weilai is under great pressure, and Lantu Jihu is still struggling.

Who might overtake? Who is falling behind?

Next, we disassemble the KPI gaps of car companies to more clearly see their current situation and find those variables that may affect the final result.

The figure above lists the KPI gaps of car companies, and calculates the average minimum number of vehicles that need to be delivered each month in the three months of the fourth quarter to complete the annual target.

Let’s look at the last four, Lantu, Xiaopeng, Jihu, and Wenjie. The data has told us very coldly that they cannot achieve their goals. In the next three months, it is impossible for Lantu to sell 5,800 cars a month, and now its average is more than 1,500 cars a month. It is impossible for Xiaopeng to deliver 50,000 vehicles a month, and it is even more impossible for Wenjie to deliver 85,000 vehicles.

Let’s look at the top three, BYD, Nezha, and Aian. Their characteristics are obvious, that is, the sales volume is increasing every month, from the beginning of the year to the present. While on average it’s a bit low each month, it’s definitely going to be high for three months in the fourth quarter. So the goal will definitely be achieved.

It is worth mentioning that the three companies in the middle, Tesla, Ji Krypton and Weilai, whether they can achieve their goals or not, there are still variables.

Tesla’s sprint to 1.5 million vehicles is not impossible, but the challenge is enormous. But what is clear is that this year’s global new energy vehicle sales champion will not be Tesla, but BYD. Of course, if you only look at pure electric models, Tesla is still the champion, and half of BYD’s sales come from plug-in hybrid models.

Weilai still has a gap of 67,600 vehicles, which will be completed in 3 months, with an average of 23,000 vehicles delivered per month. This means that NIO will hit a new high every month. Weilai’s bargaining chip is that the new model ET5 has begun to be delivered in batches. This is a volume model, and the second factory in Hefei Xinqiao guarantees production capacity. In addition, the NIO ES7 and the redesigned “886” model will also bring increments.

But delivering 20,000 a month is still challenging. At present, among the new car-making forces in China, a group has entered the camp with monthly sales exceeding 10,000, but no one has achieved monthly delivery of 20,000. Li Bin, chairman of Weilai, said that he is confident to complete the annual target, but the pressure is very high.

Jikr is still 31,000 vehicles short, and it needs to deliver more than 10,000 units every month. After the free replacement of the 8155 chip by JK 001, the market responded enthusiastically. The delivery volume of JK 001 has grown rapidly in the past three months, reaching a new high every month. In September, 8,276 vehicles were delivered. As long as Jikr maintains this momentum, it is possible to complete the KPI for the whole year.

The completion of sales KPIs is related to the company’s determination and strategy on the one hand, and products and channels on the other. KPI is not just a number, it can reflect the style of the car company.

Looking back at these car companies now, when formulating KPIs at the beginning of the year, the styles were different.

Tesla’s style is very casual. Tesla has previously said it expects deliveries to grow by 50% annually over the next several years. In fact, the market situation is different every year, and the base of sales is also changing, but this just shows that Tesla is very confident, because it is difficult to maintain an annual growth rate of 50%.

Tesla’s goal for 2020 is 500,000 vehicles and 1 million vehicles in 2021, all of which have been basically completed. In this way, the next KPI can be easily calculated, 1.5 million vehicles in 2022, 2.25 million vehicles in 2023…

Some car companies are the exact opposite. Lantu’s 2021 delivery target of 13,000 vehicles is only half completed. At the beginning of 2022, 46,000 vehicles were set. Later, I couldn’t finish it. In July, it was lowered to 31,000 vehicles. It is still unfinished.

When car companies set sales targets, they generally set an approximate, rounded number. It is very rare to have zeros and wholes like Lantu. This looks like it has been carefully calculated, it should be very rigorous, and Lantu also corrected the target halfway. But what is puzzling is that the difference between the actual completion of Lantu and the goal is as high as 50%. This makes people unable to understand what the meaning of this goal is.

Perhaps the only explanation is: the ideal is very plump, the reality is very skinny?

Aian also adjusted the goal in the middle, but it was not because it could not be completed, but because the goal was set low. At first, Aian wanted to “guarantee 200,000 vehicles and challenge 250,000 vehicles”. As a result, 180,000 vehicles were completed in the past 9 months, and the KPIs will be completed ahead of schedule in October. So Aian adjusted to “guarantee 250,000 vehicles and challenge 300,000 vehicles” to put a little pressure on the team.

Xiaopeng misjudged the situation. Xiaopeng was the annual sales champion of China’s new car-making power last year, delivering 98,000 vehicles. This is largely due to the hot sale of the P7. This year, Xiaopeng has set a target of 250,000 vehicles, more than doubling it, which is obviously overconfident.

The Xiaopeng P5, which was delivered in the fourth quarter of last year, did not sell very well. Now there are only more than 2,000 units delivered per month, which failed to take over the momentum from the P7; Search, urgently changed the price, the current situation is not very favorable.

There are also some car companies that have already fallen flat, such as Weimar. Weimar has not announced its sales for a long time, and the Weimar M7, which was originally planned to be launched this month, has also disappeared for a long time.

More important things than KPIs

Sales are important, KPIs are important, it can tell a lot, but not all. For new car companies, there are some things that are more important than KPIs.

NIO entered the Norwegian market last year, established an overseas CEO, adopted a direct sales model, and did not set sales KPIs. This month, NIO held a press conference in Berlin, Germany to continue its layout in the European market. Going overseas is something that Weilai has been planning for a long time. It is a strategic consideration and does not focus on short-term sales.

Xiaopeng has been vigorously developing intelligent driving. From high-speed NGP to urban NGP, the difficulty and challenges are increasing. For many people, intelligent driving may not be the decisive factor affecting car purchase, and its contribution to sales is far less obvious than the 10,000 discount. But Xiaopeng chose to insist on investing and did not back down.

The ideal is more realistic. It opened the market through the popular model Ideal ONE, and through the new car L9, it brought the experience and configuration of many luxury cars in the past to ordinary people. Balanced sales and word of mouth.

Whether it is the strategy of going overseas, insisting on self-research, or innovating in user experience, they cannot be directly classified into KPIs, but in the long run they will definitely help to complete the KPIs.

In addition, there are many car companies who want the brand to rise, but they are a bit at a loss. This is also something that requires long-term investment, but it is difficult to achieve short-term results.

The brand images of Nezha and Leapao have always been relatively low-end, and their sales have been on a par with Wei Xiaoli, but the outside world always thinks they belong to the second echelon. Even if they sell more Nezha V and Leapmotor T03, they still can’t shake Wei Xiaoli’s position.

Nezha’s launch of the higher-priced Nezha S and Leaprun’s launch of the C01 are both strategic moves and shoulder the heavy responsibility of brand improvement. This is much more significant than selling a few more cheap cars.

So did Aian. From the point of view of sales, Aian’s performance is not bad. Aian became independent from GAC two years ago and underwent asset restructuring last year. It is one of the brighter sub-brands launched by traditional car companies.

Aian challenged the new forces, and also released the sales results of the previous month on the 1st of each month. Feng Xingya, general manager of the group, said that the pattern of “Wei Xiaoli” should be changed to “Ai Xiaowei”. But in the eyes of many people, the Aeon brand still belongs to the faction of traditional car companies, and it is not enough “new force”.

How to reverse external stereotypes and establish a brand image is a long-term issue faced by these car companies.

As for financial profitability, it is a KPI that is more difficult to achieve than sales. Among the new car-making forces, except for Tesla, they are basically in the stage of losing money. None of them has achieved annual profits, and most of them do not have a clear profit timetable.

Leaphorse, which was just listed on the Hong Kong stock market this year, saw its stock price plummet at the opening. Weimar, which has submitted an application for listing, is still waiting for review. Huge losses are all important factors affecting their listing and valuation.

Building a car is a difficult thing, and the final sales are the result, and there are many factors that cause this result. Any problem in any link may lead to changes in the results.

It is necessary to set reasonable KPIs. Although we don’t judge heroes based on sales, the sales that can be achieved are the foundation of everything such as profitability, listing, and competition.

Building a car is like a long-distance race, and there is no short-term decision. For car companies, as long as they are still at the poker table, there will always be opportunities. It is hoped that the car companies mentioned above can complete the annual sales KPI.

*The title image is from pexels.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-10-19/doc-imqqsmrp3116955.shtml

This site is for inclusion only, and the copyright belongs to the original author.