Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Juchao WAVE

Source/Connection Insight (ID: WAVE-BIZ)

Under the big sale of new energy vehicles, the supporting industry has risen. In particular, charging piles are the most direct and immediate needs of every vehicle.

In 2021, the entire charging pile industry has set off a wave of financing. A total of 30 financing events occurred throughout the year, an increase of 150% over 2020; the total financing amount was 18.303 billion yuan, an increase of 432% over 2020.

The various capitals entering the game are also famous:

Cloud Quick Charge completed the B1 and B2 rounds of financing in 3 months, and the investors included CATL, Weilai Capital, etc.;

Special call plans to introduce strategic investors such as GLP, State Power Investment Corporation, China Three Gorges Group, etc. through capital increase and share expansion. The estimated value of charging piles after investment is about 13.6 billion yuan;

Xingxing Charge announced that it has won the B round of financing led by Hillhouse, IDG, Taikang, Powerlong and Sino-Ocean Real Estate, etc., with a valuation of 15.5 billion yuan after the investment.

As an indispensable supporting industry for new energy vehicles, in the eyes of capital, the charging pile industry is at the forefront.

In terms of actual operation, the industry is full of problems.

One of the most typical representatives is that during this year’s National Day, “electric dad” has become a hot topic.

A man from Guangdong drove his Tesla back to Hunan. He had to enter the service area to charge due to a high-speed traffic jam, but he encountered a hardship and continued to drive forward. As a result, the “lying nest” was at high speed. The man had to pay 2,000 yuan out of his own pocket to call a tow truck, and drag it to Hunan with the person and the car.

Another owner of a new energy vehicle who returned to his hometown in Hunan from Shenzhen during the National Day spent more than 5 hours charging the vehicle in the expressway service area, of which 4 hours was spent in the queue alone. superior.

The two short stories are ridiculous, and it seems that they have not stopped the upsurge of new energy vehicle purchases. However, if the charging pile package cannot be followed up quickly, similar situations will only increase.

Realistic car pile contradiction

Today, the growth of the number of charging piles in my country is far from keeping up with the strong driving force for the growth of new energy vehicles.

Since the rapid increase in the number of new energy vehicles, listed companies related to charging piles have benefited greatly.

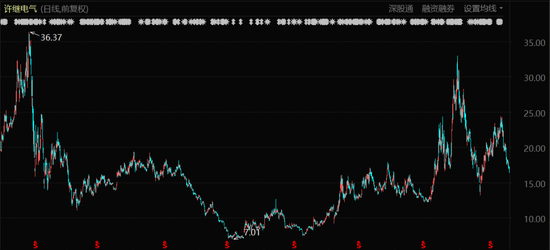

As a charging pile manufacturer, Xuji Electric has listed the intelligent charging and swapping system for electric vehicles as a separate product category since 2016. According to the annual report of the year, the operating income of this product in 2015 was 551 million yuan. By 2021, the revenue of this product has grown to 1.176 billion yuan, an increase of 113.43%.

XJ Electric’s share price performance (January 2015 to present)

It also takes new energy vehicles and charging facilities and equipment as a separate product category. From 2015 to 2021, with its revenue growth of only 16.7%, its new energy vehicles and charging facilities and equipment business Revenue has increased from 95.2 million in 2015 to 171 million in 2021, an increase of 80%.

KSTAR’s new energy charging products mainly include: charging pile modules, integrated DC fast charging piles, split DC fast charging piles, wall-mounted AC charging piles, column-type AC charging piles, charging cloud platforms, etc. From the separate statistics in 2015 to 2021, the growth of such products has exceeded 100%, which is higher than the revenue growth rate.

Although the charging business of these companies has not grown explosively, it has maintained a stable growth rate and has benefited from the increase in the number of domestic charging piles for a long time.

According to data released by the China Charging Alliance, from January to September 2022, the increase in charging infrastructure will be 1.871 million units, a year-on-year increase of 245%. As of September 2022, the cumulative number of charging infrastructure nationwide was 4.488 million units, a year-on-year increase of 101.9%.

These figures may seem high, but if you compare the growth rate of new energy vehicles, you will find that they are quite different.

Highway congestion and charging difficulties are a nightmare for new energy vehicle owners

Highway congestion and charging difficulties are a nightmare for new energy vehicle ownersFrom January to September 2022, the sales volume of new energy vehicles is 4.567 million, and the incremental ratio of pile vehicles is 1:2.4.

This number, not only has not reached the expected 1:1 development quantity, but also the quality has not been high. By the end of September 2022, there were 704,000 DC charging piles in my country, accounting for only 43% of all public charging piles.

This shows from the side that the growth of the number of charging piles in my country is still far behind the strong driving force for the growth of new energy vehicles. This is the current deficiency of charging pile manufacturers, and it is also the direction of their development.

“Water sellers” can’t make money

Heavy asset investment, single income, and long return period.

Among the charging piles added from January to September this year, the increase of public charging piles was 489,000 units, a year-on-year increase of 106.3%. However, the increase was more of private charging piles built with vehicles, an increase of 1.382 million units, a year-on-year increase of 352.6%.

As of the end of September, a total of 2.852 million private charging piles were built with vehicles in my country, a year-on-year increase of 141.9%. However, the cumulative number of public charging piles was 1.636 million units, an increase of only 56.6% year-on-year.

Residential parking space charging piles are still the mainstream of charging

Residential parking space charging piles are still the mainstream of chargingThis is the root cause of the problems the car owners described at the beginning of the article encountered when traveling. Why are public charging piles so unpopular? This may stem from the difficulty for operators to make profits.

For example, the head charging pile operator Tedian has been in a state of loss for a long time since its establishment in 2014. Its 2019-2021 revenue was 2.129 billion yuan, 1.925 billion yuan and 3.104 billion yuan respectively, and its net profit was -75.1226 million respectively. yuan, -171 million yuan and -51.3208 million yuan.

Another leading operator, Xingxing Fast Charge, has not disclosed relevant business figures, but its chairman Shao Danwei once proudly revealed: “Xingxing Charge is the only charging company that has continued to make profits so far.”

At the same time, Shao Danwei also said: “Currently, the unprofitability of charging piles is the status quo of the industry.”

The reasons for unprofitability are not difficult to understand: heavy asset investment, single income, and long return cycle.

After the penetration rate of new energy vehicles gradually increases, the infrastructure attributes of charging piles will become increasingly prominent. This determines that the operation of charging piles cannot have high profits, and can only win by scale.

But at the same time, the construction of charging station is a heavy-asset investment industry. According to estimates, building a small and medium-sized charging station with 10-20 charging piles requires an investment of millions of yuan. However, there is a single source of operating income, and the main income is charging fees.

The reason why people buy new energy vehicles is that the electricity bill is cheap is a very big consideration and basis. Therefore, building charging piles, especially public charging piles, must be a “drudgery”, and it is very difficult to operate and make profits. It is necessary to continuously optimize site selection, expand scale, and reduce costs. Gradually gain market position.

However, in the face of the low profit and long cycle of charging piles, some operators can only find coping strategies.

In 2021, Yu Dexiang, the chairman of Terad, declared: “The special calls are not charging, let alone building piles, but weaving a network with charging piles as connection points. Selling electricity through a large system, selling cars on a large platform, Big cooperative car rental, big data car repair, big payment finance, and big customer e-commerce have formed an ecosystem based on car charging.”

Yu Dexiang, chairman of Trid, has been investing in charging piles for a long time

Yu Dexiang, chairman of Trid, has been investing in charging piles for a long timeSuch a plan is very similar to the former Internet company.

In addition, Xingxing Quick Charge is also “hands-on” on the “Internet”.

In 2020, the Ministry of Industry and Information Technology notified a batch of APPs that violated the rights and interests of users. Among them, the Star Charge APP involved illegal collection of personal information; the problem of illegal use of personal information has not been rectified.

In addition, due to the pressure on profitability, the operation of many charging piles can save money. Kaimax New Energy Technology Co., Ltd. has tested nearly 80,000 charging piles and more than 6,000 charging stations. About 40% of charging piles are unavailable.

Among these 40%, 12.7% are hardware problems, that is, the charging pile cannot be charged normally, or the charging is terminated; about 27% are operational problems, and users cannot charge due to multiple slots.

Such problems are also part of the reason why car owners are “hard to find” during the long holiday.

Infrastructure properties

Charging piles are among the seven major areas of “new infrastructure”.

If the problem of charging is not solved, new energy vehicles can only be used as scooters for urban commuting, and there is no way to upgrade and replace fuel vehicles.

At this time, the appearance of the “national team” is crucial.

The charging pile has obvious infrastructure attributes, which has been officially recognized by the government. In 2020, the central government proposed to develop “new infrastructure” to provide new impetus for economic growth, and charging piles are ranked among the seven major areas of “new infrastructure”.

On August 25, 2022, the four national departments issued the Action Plan for Accelerating the Construction of Charging Infrastructure along the Highway, proposing three-stage goals:

Strive to provide basic charging services in expressway service areas in areas other than high-cold and high-altitude areas across the country by the end of 2022;

By the end of 2023, qualified general national and provincial trunk highway service areas (stations) can provide basic charging services;

By the end of 2025, the charging infrastructure of expressways and ordinary national and provincial trunk highway service areas (stations) will be further optimized and optimized, and rural highways will be effectively covered.

Such planning goals are difficult to achieve by market-oriented third-party operating companies alone.

At present, the difficulty of charging new energy vehicles lies in the lack of expressway coverage, the general national and provincial trunk lines and rural roads have not yet fully started, showing the characteristics of “the more remote, the more difficult”.

The vast township road network is still difficult to cover charging facilities

The vast township road network is still difficult to cover charging facilitiesFor example, according to data from the China Charging Alliance, as of the end of August, 16,700 charging piles had been built in 3,819 high-speed service areas, accounting for less than 2%.

The payback period for the construction of charging piles is very long, and a large amount of capital expenditure will be incurred in the early stage. If you rely solely on private enterprises for profit-driven construction, some remote areas and weak areas will be “the weaker the weaker” due to the Matthew effect.

At this time, more administrative power is needed to intervene.

At present, the power grid sector is the most enthusiastic to participate. The four national ministries that jointly issued the Action Plan mentioned above include the Ministry of Transport and the National Energy Administration, State Grid Corporation of China and China Southern Power Grid Corporation.

At the same time, as of September 2021, there are 4 charging piles operating more than 100,000 charging stations across the country, and the State Grid operating 196,000 charging stations, which is the only “national team”.

However, only the participation of the power grid department is not enough. In the face of the trend of “electricity + car”, the power grid department is good at constructing from the perspective of electricity, while some “national teams” are better at intervening in operation from the perspective of vehicles, such as “Three Barrels of Oil”.

The history of the development of gas stations in China can actually be called the “previous teacher” of the construction of charging stations.

In the early days of the founding of the People’s Republic of China, there were only about 70 gas stations in China. In the subsequent development, the state-owned gas stations represented by PetroChina and Sinopec supported the capillaries of road transportation.

Statistics show that there are currently about 120,000 gas stations across the country. Among them, the number of state-run gas stations under the banner of three barrels of oil is still more than 50%.

The implementation of charging facilities for three barrels of oil is still very limited

The implementation of charging facilities for three barrels of oil is still very limitedUnder the big wave of oil-to-electricity conversion, the gas station that is most familiar with the highway driving ecosystem is obviously one of the best candidates for the construction of charging facilities.

International giants in the petrochemical industry, including Shell and BP, are re-planning their layout in the Chinese market. In addition to expanding gas stations, adding charging piles at gas stations is also a key consideration.

The layout of domestic three barrels of oil for charging piles is somewhat “half-covered”. Although it has long been announced in a high-profile manner that it will actively deploy the charging pile business, there are still few actual implementation actions.

Involving more administrative power may be the key answer to completely solving the “hard-to-find” problem in the future. Because since charging facilities are regarded as infrastructure, it is inevitable to face the real problem of insufficient enthusiasm of social enterprises to invest.

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-10-21/doc-imqmmthc1629643.shtml

This site is for inclusion only, and the copyright belongs to the original author.