Cover Source | Figure Worm Creative

Cover Source | Figure Worm CreativeWelcome to the WeChat subscription number of “Sina Technology”: techsina

Text | Xi Rui

Source: Tech Planet

Zhang Xin, who is about to study in Europe, saw the news of the shortage of energy, and packed half a box of heating supplies in his suitcase: electric blanket, charging hand warmer, and heating mouse pad.

The cold winter and energy shortage in Europe are not only affecting Zhang Xin, but are also causing “fluctuations” in the domestic industry.

Since September, the most popular topic of Chinese electric blankets in Europe has been frequently searched. In more than a month, not only electric blankets, but also domestic “eight-piece winter sets” such as bare-leg artifacts and hand warmers began to be “buried” by European consumers. The Rainbow Group, a listed electric blanket company, has also become the focus of A-shares recently.

Export is not the main business of Rainbow Group. According to the company’s announcement, as of the end of June this year, Rainbow Group’s electric blankets and other heating products have achieved overseas sales revenue of 210,000 yuan, and the current order amount is about 1.33 million yuan, accounting for 0.13% of the company’s total operating income in the previous year.

However, this does not affect investors’ optimism about Rainbow. Since September, the total market value of Rainbow Group has increased by more than 2.5 billion. However, other heating equipment companies are not as lucky as the Rainbow Group, and they did not rely on this short-lived outlet to make a leap.

Cixi, Zhejiang is the largest heater export industry belt in China, and there are nearly 200 heater factories here. Some factories’ orders were lined up for the Spring Festival, but the total order volume did not increase significantly.

Despite the constant demand from European customers, reason tells them that it is too late for production.

The factory’s judgment is correct. Chen Ming, who is doing cross-border trade in Germany, has witnessed the whole process of domestic electric blankets from being out of stock to unsalable in Germany.

He told Tech Planet that there was indeed a wave of electric blanket rush buying in Germany in May and June, but the time was very short. Now that the electric blanket is re-entered, it is very likely to become a slow-selling inventory.

But there are still people who want to seize this tuyere. This is one of the few opportunities in recent years that has the potential to bring about a change in wealth. They only hope that this wind can blow a little bigger.

“The peak production season has been extended, but orders have not grown significantly”

The “affordable heating boom” in Europe is still transmitted to China.

According to the data of the China Household Electrical Appliances Association, in 2022, the export value of most home appliances in my country to Europe will decline, but the electric heater and electric blanket category will grow against the trend. From January to July, the cumulative export value will reach 490 million US dollars and 33.4 million US dollars respectively. , Among them, the growth of electric blankets reached 97%. According to data from the General Administration of Customs, in July this year, the 27 EU countries imported 1.29 million electric blankets from China, an increase of 150% from the previous month.

Cixi, Zhejiang is one of the four major home appliance industry bases in China. There are more than 2,000 home appliance factories here, and nearly 200 factories producing heating products.

It is also one of the largest exporters of electric heaters in China. Yu Xuehui, president of the Cixi E-commerce Association, told Tech Planet that the annual sales of head heater factories can reach 20 million to 300 million. In addition, 60-70% of the factories have been export-oriented in the past ten years, selling to the United States, Russia, Brazil and other countries. Recently, he has frequently received cooperation calls from European customers.

But that didn’t excite factory owners. “The retail side is lively, but it is not realistic for the factory side to receive large orders now,” Yu Xuehui explained.

The bosses all understand that the current boom in purchasing spare heaters in Europe is the demand for temporary seasonal heating. “Because Europe is worried that the lack of gas in winter may affect heating, everyone will give priority to price for this temporary demand. On the other hand, the whole consumer confidence is insufficient, so low-priced products are more popular,” Yu Xuehui told Tech Planet.

But at this point in time, there is no factory that will accept large orders from Europe.

“It’s very late now,” Yu Xuehui explained to Tech Planet. “Because of the production cycle, although there is demand in Europe, it may not be able to be produced on our side.”

The peak order season for traditional heaters is March and April each year. Because of the time cycle of production and shipping delivery, it is already after Christmas when orders are placed in the hands of European consumers. In addition, exporting to European countries also takes time to obtain relevant certification qualifications, and the entire delivery cycle is again lengthened.

According to Yu Xuehui’s statistics, the European export orders of Cixi Heating Factory have not increased significantly. However, the “affordable heating boom” in Europe still makes it rare for heating factories this year to show that October is still the peak of production.

After the outbreak of the Russian-Ukrainian conflict, customers who should have placed orders in March and April every year began to wait and see and delayed placing orders. This has reduced a large number of orders for the factory. “The peak season for receiving orders from four months has changed to three months,” Yu Xuehui said.

From June to September every year, it is the peak season for the production of heating products. Some customers temporarily add orders, extending the peak season that should end in September to October. At this time of the past, heating factories began to look for customer orders for summer fans. But now, the factory is still working overtime to catch up with the construction period of the heater, and some factory orders have even been placed in the Spring Festival time.

“The factories whose overall sales have dropped by less than 10% this year are considered very good,” Yu Xuehui told Tech Planet, “Compared to other small appliances, the overseas sales of heating products have increased, but when we communicated, it was still I think it’s already very good to be able to keep the overall level this year.”

From “seeking electric blanket factory resources” to “reselling goods at low prices”

Years of experience in cross-border trade told Chen Ming that the best time to enter the market has long passed, and the idea of an electric blanket can no longer be used.

In May and June of this year, due to the international situation, German oil prices began to rise, and Chen Ming could not even buy kitchen oil. And electricity prices have tripled. “It used to be about 0.2 euros per unit of electricity, but now it costs more than 0.6 euros,” Chen Ming told Tech Planet.

German residents, who do not yet know how much heating bills will rise, began to stock up on more heating products to withstand the winter that has yet to come. In those two months, China’s electric blankets and electric heaters became popular for a while.

Chen Ming has many colleagues who sold thousands of electric blankets in May and June. He told Tech Planet, “Those traders who can sell are actually selling electric blankets in Germany before.”

Although the profit was attractive, Chen Ming was not moved. He is well aware that business opportunities are fleeting and belong only to those who are prepared. “Friends around me were able to seize the demand because they happened to have inventory at the time,” Chen Ming told Tech Planet, “and they had brands, supply chain resources, and certifications before, and they just needed to place an order for production.”

Wang Li is one of the lucky ones.

Wang Li, who has been doing cross-border export trade, has his own warehouse and brand in Germany. Before that, Wang Li sold electric blankets under OEM. This time, the sudden demand allowed him to successfully clear the inventory that had accumulated for many years. An electric blanket that usually costs 60-70 euros can rise to 80-90 euros at that time. Wang Li never imagined that the backlog of inventory would allow him to make a small profit.

Seeing the opportunity, Wang Li immediately contacted domestic factories to temporarily produce a batch of electric blankets. But after this batch of goods was snapped up by German wholesalers, Wang Li did not add any more to the factory. He also knew that the sudden upsurge would not last long.

In winter in Germany, there are not many days when the temperature goes below zero. In Chen Ming’s impression, a windbreaker and a down liner can survive the whole winter.

In September, some cities in Germany have already experienced the first snow. In October, Germany has already started urban heating. The 20% increase in heating costs makes Chen Ming not worried about this winter at all. “The heating costs for a month have risen by about 20%. It’s not that exaggerated. Everyone can bear it. Maybe Luxembourg has risen a bit more.”

Soon, the news in the trader group changed from “seeking electric blanket factory resources” to “selling electric blankets in stock at low prices”. “Some people have already shipped goods in the group in August and September,” Chen Ming recalled.

“There is a seller in Spain who is selling a whole container of goods at a low price, which means that this batch of goods has never been sold in Spain,” Chen Ming told Tech Planet.

Looking at the anxious group friends, Chen Ming was very glad that he didn’t step on the pit.

Don’t want to “miss” an opportunity: better than a production line suspension

Chen Ming has calculated that the cost of heating with electricity is no lower than that with heating. As long as the heating is not turned off, basically no one will consider using electricity for heating. “Before, everyone was afraid that the heating bill would double in winter, or that the heating might be cut off, so they stocked up some electric blankets and the like,” Chen Ming explained.

“The Germans I know don’t buy much, but some Chinese are stocking up on electric blankets.” Chen Ming found this interesting detail, “German families who have installed solar panels or geothermal energy are not too worried about being able to survive the winter. .”

“Because most of the Chinese people are involved in the import of electric blankets,” Chen Ming analyzed, “During this period of time, customers are constantly delivering goods, and the circle of friends knows that electric blankets are selling well, and everyone will want to stock up. , it’s not expensive anyway.” But the hot sales are limited to products such as electric blankets that consume less power.

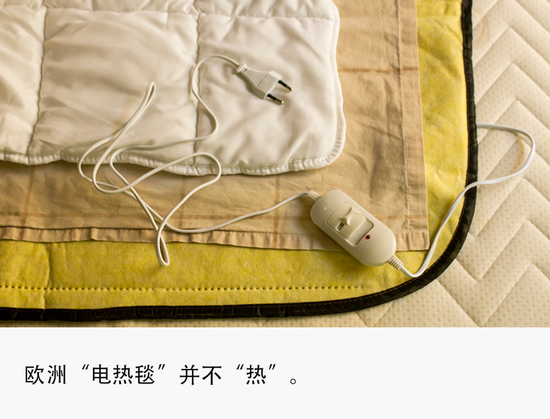

In fact, local brands in Europe already have electric blanket brands that meet different needs. According to Jiemian News, the electric blankets that can squeeze into the sales list in Germany are the Beurer brand in Germany and the Dr. Watson brand in the United States. Chen Ming also told Tech Planet that families who do not pursue cost-effectiveness may give priority to buying local brands that are much more expensive.

Yu Xuehui also counted that in the past few months, the sales volume of small heaters with an ex-factory price of 4-5 US dollars in Cixi is far greater than that of heaters with a high unit price.

But in China, many people still do not want to let this opportunity go. In order to receive European orders, Liu Yang temporarily went to apply for relevant product certification for entry into Europe, although it has now reached the end of October.

“I am now applying for relevant certification according to the scale of a small company. If there is a large order and the relevant certification of a large company is required, then I have to apply again,” Liu Yang told Tech Planet. He calculated that the cost of the two certifications is nearly three times different, and the application fee for a large company is about 30,000 yuan.

Although taking overseas orders requires reinvestment of costs, it is better than the suspension of production lines. Liu Yang’s factory in Hebei, mainly produces vertical heaters and small industrial heaters. In the past 4 years, he has never had contact with overseas clients. But in the past few years of the epidemic, he had to turn his attention to foreign countries.

In June of this year, Liu Yang just finished 3 or 4 containers of goods. In the first half of the year, Liu Yang did not receive any orders. In order for the factory to “survive”, Liu Yang is willing to take more risks in certification and shipping.

Liu Yang doesn’t care which country in Europe those containers are sent to, he only cares whether his production line can be turned around. Not only Liu Yang, but also cross-border platform service providers and cross-border logistics providers also don’t care which country the electric blanket is sold to. They only care if someone wants to ship the electric blanket to Europe.

They all tried desperately to make the wind blow even bigger, just to “live” themselves.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-10-22/doc-imqmmthc1719086.shtml

This site is for inclusion only, and the copyright belongs to the original author.