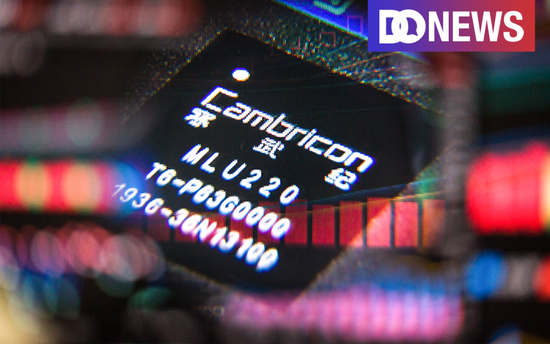

Title image | IC Photo

Title image | IC PhotoWelcome to the WeChat subscription number of “Sina Technology”: techsina

Written | Edited by Su Shu | Yang Bocheng

Source: DoNews

Two years after its listing, Cambrian’s losses continued to expand.

On October 26, two news came from the Cambrian, one was a large order of 500 million yuan for the Nanjing Intelligent Computing Center, and the other was a mixed financial report.

The financial report shows that in the first three quarters, Cambrian’s total revenue was 264 million yuan, a year-on-year increase of 18.86%; the attributable net profit was -945 million yuan, and the loss increased by 50.09% year-on-year.

The market is extremely responsive. On October 27, Cambrian stock rose slightly by about 2%, but on the 28th, Cambrian stock fell quickly.

The market’s reaction to a certain extent explains the current situation of the Cambrian. It can get large orders and revenue is also rising, but this still cannot cover the problem of losses, and it is difficult for the outside world to see its long-term value.

01.

Old problems: large losses, high R&D investment, slow payment cycle

Loss is a problem that Cambrian has always had to face.

In the first three quarters of 2022, Cambrian’s losses continued to expand. The financial report shows that in the first three quarters, the net profit attributable to Cambrian was -945 million yuan, and the loss increased by 50.09% year-on-year.

In the third quarter alone, Cambrian lost 322 million yuan, compared with 238 million yuan in the third quarter of 2021, the year-on-year loss was wider.

Since its listing, Cambrian has accumulated losses of 2.2 billion yuan.

The root cause of the Cambrian’s losses is the excessive R&D expenditure, and the revenue cannot be covered or even much lower than the R&D cost.

The financial report shows that in the first three quarters, Cambrian’s R&D investment was 964 million yuan, a year-on-year increase of 38.79%, accounting for 364.51% of the total revenue in the first three quarters. In the third quarter alone, Cambrian invested 334 million yuan in research and development, a year-on-year increase of 15.71%, accounting for 361.10% of revenue.

For the whole year of 2021, Cambrian R&D expenditure accounted for 157.56% of revenue. This shows that the ratio of Cambrian R&D expenditure to revenue continues to increase.

Why is there such a large and increasing R&D investment every year? This has to do with Cambrian’s changing core business lines.

Around the AI chip, Cambrian is exploring and trying different businesses every year, and its core revenue sources have also changed again and again.

From the establishment of Cambrian to the present, from the initial terminal intelligent processing IP to intelligent computing cluster system, to edge-end smart chips and accelerator cards, Cambrian’s core revenue sources are constantly changing. Not long ago, Cambrian was also exposed to enter the car smart chip.

It is understood that the main product lines of Cambrian cover cloud product lines, edge product lines, processor IP authorization and software. The products are mainly divided into edge smart chips and accelerator cards, training machines, cloud smart chips and accelerator cards, and terminal smart chips Processor IP, intelligent computing cluster system.

From this point of view, although Cambrian has a wide product line, its business core is different every year, and due to its technical attributes and other factors, each core business line is faced with the risk of high investment, customer loss and market changes. This industry risk has been mentioned many times in the Cambrian financial report.

In addition, in the Cambrian financial report, there is another problem that cannot be ignored – accounts receivable are still expanding, and the direct impact of accounts receivable is the payment cycle.

The financial report shows that at the end of the third quarter, the balance of accounts receivable of Cambrian climbed from 478 million yuan at the beginning of the year to 532 million yuan, far exceeding the total revenue of 264 million yuan in the third quarter.

This is also related to the Cambrian customer attribute. Since Cambricon broke up with Huawei in 2019, Cambricon’s core revenue business has changed from terminal intelligent processor IP to intelligent computing cluster system. At present, the customers of this business line are concentrated on the G side (government side). The common attributes of government customers are: long service cycle and slow payment collection.

Coincidentally, on the day the financial report was released, Cambrian announced that it had won the pre-bid for a 510 million yuan project of Nanjing Science and Technology Innovation Investment Co., Ltd. The project includes computing servers, intelligent computing units, and artificial intelligence computing power platform software. According to Tianyancha, the actual controller behind the purchaser Nanjing Science and Technology Innovation Investment Co., Ltd. is the State-owned Assets Supervision and Administration Commission of the Nanjing Municipal People’s Government, which is a government customer.

Cambrian stated in the announcement that if the project wins the bid and signs a formal contract and implements it smoothly, it will have a positive impact on the company’s business development and operating performance during the project implementation period.

Interestingly, this project did have a positive impact on the Cambrian, “there is a positive impact, but not much.” On the 27th, the stock price of Cambrian rose slightly, but soon, it fell again. As of press time, Cambrian’s stock price fell 3.86% on the 28th to close at 64.82 yuan, while yesterday’s increase was only 2.46%.

02. “Leave”

Against the backdrop of persistent losses, the market began to vote with its feet. Since the beginning of this year, more and more people have chosen to “actively leave” the Cambrian.

At the beginning of the year, before and after the announcement of Cambrian’s 2021 annual report, CTO Liang Jun, the backbone of Cambrian’s core technology, was exposed to the news of his resignation. Shortly after that, Cambrian issued an announcement to confirm the news, saying that Liang Jun’s reason for leaving was “differences with the company.”

Liang Jun had previously played a pivotal role in the Cambrian period. After Liang Jun resigned from Huawei in 2017, he joined Cambrian as CTO, and soon after Liang Jun joined, Cambrian started a “close” cooperation with Huawei. According to the Cambrian prospectus, almost all of Cambrian’s revenue in 2017 and 2018 came from cooperation with Huawei.

Although Huawei later chose to make AI chips and “break up” with the Cambrian, Liang Jun’s status in the Cambrian remains the same.

At the beginning of the year, Liang Jun’s sudden resignation caused speculation from the outside world. The official Cambrian explanation is that the difference between Liang Jun and Cambrian lies in the fact that “the company hopes to focus on the widespread implementation of products and seize the opportunity period, while Liang Jun hopes to make more investment and research in technology.”

In addition to the departure of Liang Jun, the technical backbone, many shareholders also chose to “leave”.

In July 2021, on the third day of the lifting of the ban on Cambrian stocks, shareholders holding less than 5% of Cambrian, including Paleozoic Venture Capital and Zhike Shengxun, announced plans to reduce their holdings. On the tenth day of the lifting of the ban, the Cambrian shareholder Ningbo Hangao and its concerted action SDIC Venture Fund also started a reduction plan.

Beginning in April this year, the original shareholders of the Cambrian, Nanjing CMB (Nanjing CMB Telecom New Trend Lingxiao Growth Equity Investment Fund Partnership) and Hubei CMB (Hubei Changjiang CMB Growth Equity Investment Partnership) also began to reduce their holdings .

In September, the shareholders of the Cambrian Institution, Suzhou Industrial Park Paleozoic Venture Capital Enterprise (Limited Partnership), Ningbo Hangao Investment Partnership (Limited Partnership), and SDIC (Shanghai) Technology Achievement Transformation Venture Capital Fund Enterprise (Limited Partnership) chose to reduce hold.

While institutions continue to reduce their holdings, Cambrian’s stock price and valuation are also becoming more and more sluggish. As of press time, the total market value of Cambrian is 25.981 billion yuan. Compared with the market value of 113.4 billion yuan in the peak period after the issuance in July 2020, the market value has evaporated by more than 80 billion yuan, and compared with the market value on the first day of listing, the market value has evaporated by more than 50 billion yuan. Yuan.

Someone once commented on the Cambrian, “The first half is a legend, and the second half is a controversy.” But now, in the Cambrian under the loss, executives leave, institutions reduce their holdings, and the stock price is sluggish. This once set off in the market. Heatwave’s “AI star startups” have become less and less controversial.

In addition to improving the financial situation, the current Cambrian needs to prove its long-term value to the outside world.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-11-04/doc-imqqsmrp4898354.shtml

This site is for inclusion only, and the copyright belongs to the original author.