The pharmaceutical sector has risen sharply recently, and funds have been rushing to raise funds for 16 consecutive days. The $Hang Seng Medical ETF (SH513060)$ has risen by more than 20% from the bottom. Why do funds favor Hang Seng Medical so much?

To answer this question, I want to start from three aspects.

First, what is the long-term logic of medical treatment?

Second, what are the advantages of Hang Seng Medical?

Third, what is the valuation of Hang Seng Medical?

The following three aspects are analyzed in detail.

1. The long-term logic of medical treatment

The importance of medicine cannot be overemphasized, medicine has always played an important role in prolonging the average human lifespan and improving the quality of life.

With the development of biomedical technology and the aging of the population, a variety of new drugs and treatments have been introduced in recent years, and global medical and health expenditures have continued to grow, which has also brought considerable returns to pharmaceutical investors in the capital market.

Judging from the trends of developed countries such as the United States, Japan and China’s stock market in the past 10 years, the pharmaceutical industry is a long-distance champion, far outperforming the market.

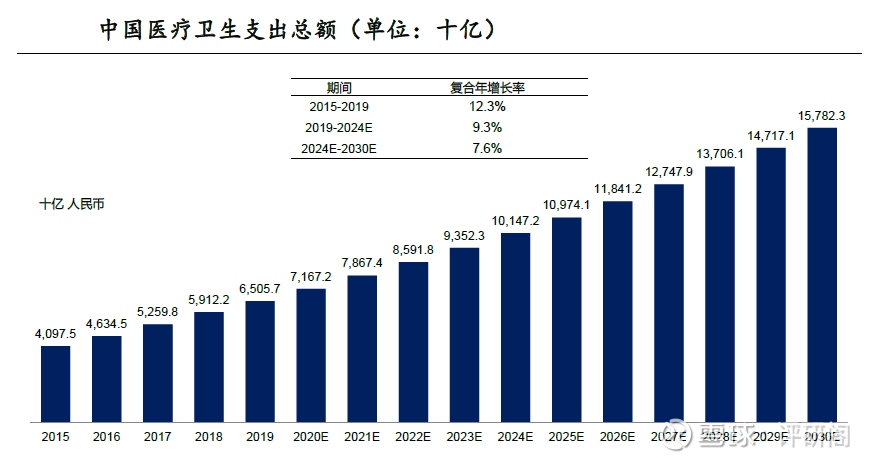

Medical and health expenditure is one of the important means to achieve social equity and protect residents’ health. In recent years, China’s total medical and health expenditure has been growing steadily: from 2015 to 2019, China’s total medical and health expenditure has increased from 4.1 trillion to 6.5 trillion. , with a compound annual growth rate of 12.3%.

China’s total health care expenditure is expected to reach 10.1 trillion in 2024, with an expected CAGR of 9.3% from 2019 to 2024, and the total health care expenditure in 2030 is expected to reach 1.58 billion, with a CAGR from 2024 to 2030 The rate is expected to be 7.6%.

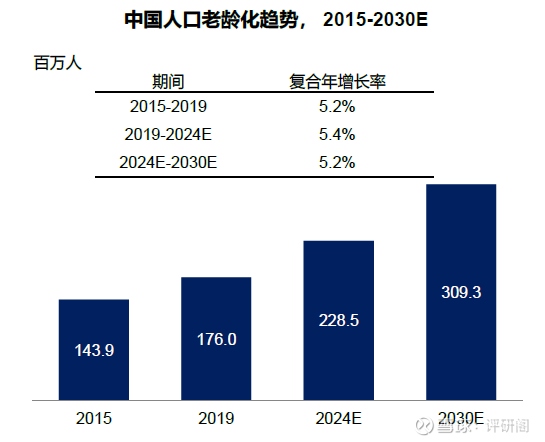

And with the accelerated aging of the population, the consumption of matching products and services for the elderly is also expected to accelerate.

There are 260 million people aged 60 and above in my country, including 190 million people aged 65 and above, and this proportion will continue to increase in the future.

On the supply side, compared with the global market, thanks to the growth of biopharmaceutical and innovative drug companies, as well as the impact of policies such as generic drugs entering medical insurance and volume purchases, China’s R&D of generic drugs and innovative drugs continues to grow.

In 2019, the total investment in pharmaceutical R&D in China’s pharmaceutical market was US$21.1 billion, accounting for 11.6% of global pharmaceutical R&D spending. With the continuous increase in R&D investment by domestic pharmaceutical companies and the implementation of a number of favorable domestic policies, it is estimated that by 2024, the domestic pharmaceutical industry R&D investment will reach 47.6 billion US dollars, and the compound annual growth rate from 2019 to 2024 is estimated to reach 17.7%.

From the perspective of rigid demand, the era of non-just-needed panacea has ended. Looking forward to the next 3-5 years, drugs/devices that are in strong demand, such as anti-tumor, diabetes/obesity-related, heart disease, and Alzheimer’s drugs, are expected to usher in even greater development of.

The change of disease spectrum contains the forward-looking context of great changes in industrial development. Judging from the historical situation at home and abroad, changes in disease spectrum will largely determine changes in pharmaceutical demand, and are also an important clue to guide pharmaceutical R&D, corporate strategic layout, and even pharmaceutical investment.

The most popular in the list of the world’s best-selling drugs in the past 30 years, from hypertension drugs in 1990 to blood lipid-lowering and antidepressant drugs in 2000, to autoimmune diseases and anti-tumor drugs in recent years, all can be seen from the spectrum of diseases. The clues can be seen in advance in the transition data.

From 1990 to 2017, among the top 25 causes of death among Chinese residents, heart disease (ischemia and hypertension), cancer (lung cancer, gastric cancer, esophagus cancer, colon cancer, breast cancer, etc.), Alzheimer’s disease and diabetes The YLL (life loss rate) ranking of China has improved significantly; among the top ten major risk factors for death and disability-adjusted life years (DALY) in the Chinese population in 2017, the proportion of overweight and obesity (+185%) changed the most.

The big logic of medical care has never changed because the demand has never decreased.

2. Advantages of Hang Seng Medical

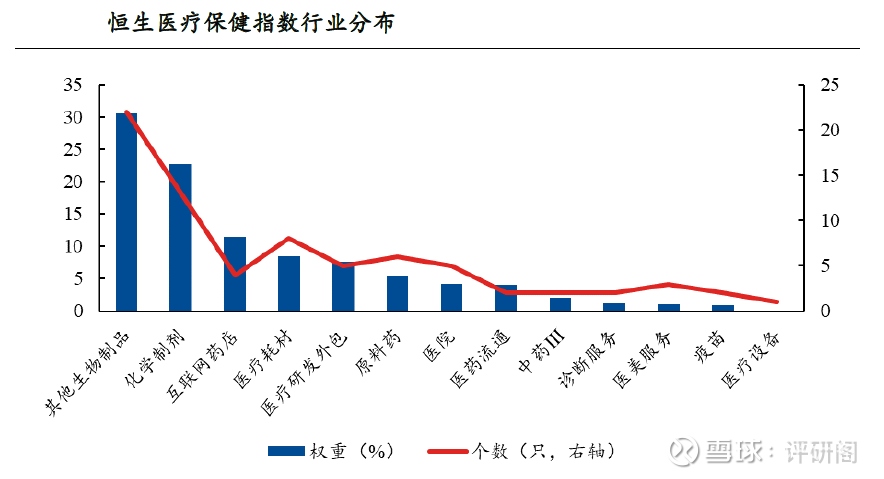

The Hang Seng Healthcare Index reflects the performance of the Hang Seng Composite Index companies with major healthcare businesses. The index includes health care companies listed in Hong Kong. As of October 14, 2022, according to the Wind three-tier industry classification standard, the constituent stocks mainly cover various segments of the pharmaceutical industry, including pharmaceuticals (38.8%), biotechnology (21.4%) %), Healthcare Technology (11.9%), Healthcare Providers & Services (9.7%), Healthcare Equipment & Supplies (9.4%), Life Sciences Tools & Services (8.7%), etc.

The top 20 constituent stocks of the Hang Seng Healthcare Index cover innovative medicine, CRO, Internet medical and other new economic medical industries, with a total weight of 70.3%, and each sub-track has a high degree of prosperity.

Index positions are characterized by high concentration, high innovation capability of constituent stocks, and strong industry representation.

Specifically, the top 20 heavyweight stocks include WuXi Biologics and WuXi AppTec, which are leading CXO companies in China, with a weight ratio of 10.3% and 4.2%, respectively; Innovent Biologics, a leading company in the field of innovative drugs, has a weighted weight of 10.3% and 4.2%. The proportion is 5.33%; it also includes Internet medical giants that are different from traditional pharmaceutical companies, JD Health and Ali Health, with a weight of 7.3% and 2.7% respectively.

On the other hand, among the top 20 heavyweight stocks, Cinda Bio, JD Health, Ali Health and other stocks have not been listed on A-shares, which shows the scarcity of the medical and health care industry in Hong Kong stocks.

3. Valuation of Hang Seng Medical

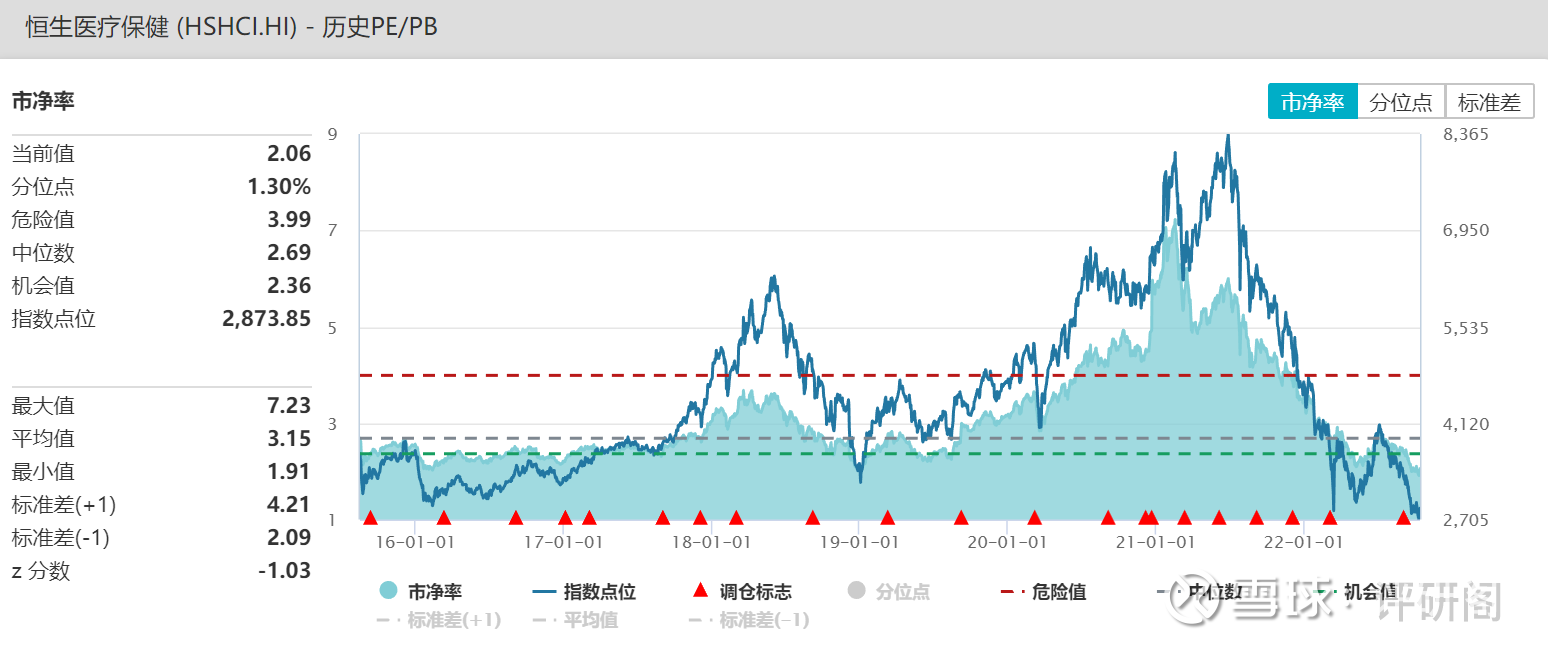

As of October 14, the latest price-to-book ratio of the Hang Seng Healthcare Index was only 2.06X, which is at the historical 1.3% quantile, which means that the current valuation of the index is lower than when it was 98.7% in the past 10 years .

At the same time, there is a valuation premium difference of more than 30% between the Hang Seng Healthcare Industry Index and the A-share pharmaceutical sector. All in all, whether it is an absolute valuation or a relative valuation, the Hang Seng Healthcare Index is already in a “depression” of value.

As the index fell to a historically low level, some foresighted funds have already deployed this golden track in advance. As the only ETF in the market that tracks the Hang Seng Healthcare Index, the Hang Seng Healthcare ETF has recently achieved a substantial increase in its share. As of 10 On March 14, the fund’s latest share reached 10.56 billion, an increase of 8.4 times compared with the beginning of this year .

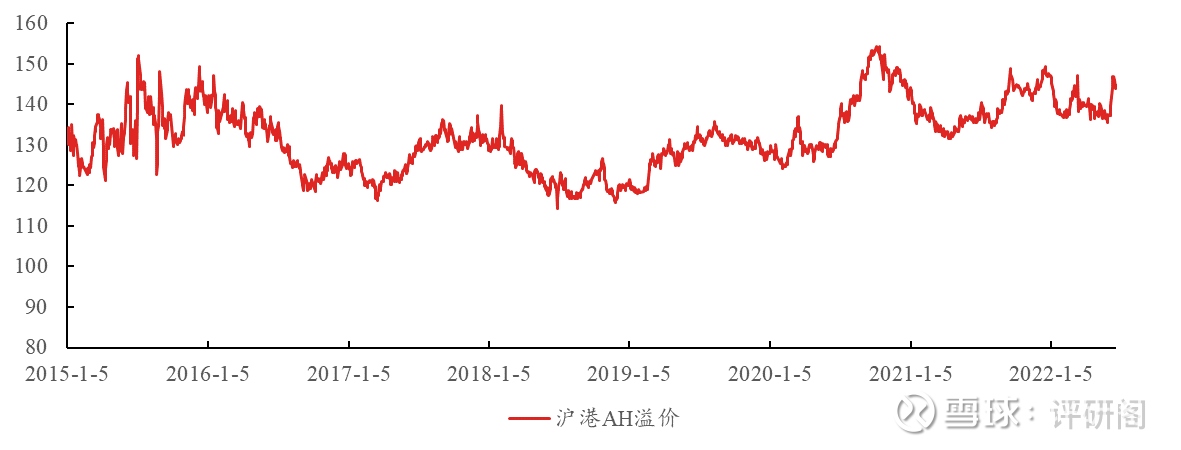

Compared with A shares, the overall valuation of Hong Kong stocks is lower, and the investment performance of Hong Kong stocks in pharmaceuticals is more outstanding. As of June 24, the AH premium index was 144.5, at the 92.4% quantile level since 2015 and at the historical high of the statistical range .

In 2018, the Hong Kong Stock Exchange launched the “18A” new policy, which opened the listing channel for qualified but not yet profitable biotech companies. Subsequently, the number of listed companies has increased significantly every year, broadening financing channels for a large number of innovative drug and innovative medical device companies. Compared with traditional pharmaceutical companies, biotech companies are usually not established for a long time and focus more on the development of innovative drugs, which is in line with the development trend of the industry and does not have the pressure to increase the performance of the stock generic drug business.

4. Summary

The long-term logic of medicine has not changed, and this round of two-year adjustment in the pharmaceutical sector has created a very large “golden pit” and also created a very good layout opportunity.

As the only ETF tracking the Hang Seng Healthcare Index in the entire market, Hang Seng Medical has entered a “right-side double bottom” pattern, and the real inflection point has come.

@ golf friend welfare @ today’s topic @ snowball creator center # investment overseas season: when will the inflection point of the Hong Kong and US market liquidity appear # $ S & P 500 ETF (SH513500) $ $ CSPC (01093) $

There are 19 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7516820417/234616204

This site is for inclusion only, and the copyright belongs to the original author.