Welcome to the WeChat subscription account of “Sina Technology”: techsina

Text/Yang Lei

Source/AI Lanmeihui (ID:ID:lanmeih001)

On Double 11 in 2018, the brand Perfect Diary, which has just been established for two years, entered this annual promotion for the first time, and sat on the Tmall Double 11 makeup list as the runner-up.

For the next two years, Double 11 was the annual party of Perfect Diary. Even in 2021, Perfect Diary’s strength in the Tmall Makeup List has declined, but it barely enters the top five.

This first-generation champion of new consumption is like an actor under the spotlight. When the light is turned on, the perfect diary is highlighted; now that the light is off, it disappears from the view of the “audience”.

This year’s Double 11, the top 20 on Tmall’s beauty list, and Perfect Diary failed to squeeze in.

At the same time, this year’s Double 11, Perfect Diary is no longer the guest of Li Jiaqi’s live broadcast room.

You know, once upon a time, Li Jiaqi was the most important “spotlight” of Perfect Diary. In the Yixian e-commerce prospectus, Li Jiaqi is a KOL mentioned separately. “We often work with Austin Jiaqi Li, a beauty product livestreaming KOL with over 34 million followers.” Perfect Diary stated so in the prospectus.

In fact, not only on this year’s Double 11, but also on this year’s 618, Perfect Diary is also exhausted.

As early as 2021, the fact that it cannot be sold can be traced. According to the 2021 annual report of Yixian E-commerce, Yixian E-commerce achieved operating income of 5.840 billion yuan, a year-on-year increase of 11.60%, which was far less than the 72.65% in 2020; the net loss was 1.547 billion yuan.

The Q3 financial report just announced not long ago also confirmed this point. In Q3 of 2022, Yixian e-commerce achieved revenue of 858 million yuan, of which skin care brands achieved revenue of 269 million yuan, an increase of 33% over the same period last year. The revenue from the cosmetics business, including Perfect Diary and Little Odin, fell by 48% compared with the same period last year.

What is certain is that Yixian E-commerce has lost the high-growth traffic brought by Perfect Diary, the main brand of make-up category, but whether Yixian E-commerce can create the next “Perfect Diary” is still unknown.

“Big name replacement” invalid

“There have been several waves of layoffs. Looking at the changes of the times, it has fallen from the peak to the altar. At present, the new retail department in 2022 has been in a state of losing money. The new retail here is the department of offline stores. I advise everyone to apply for the offline department. Don’t come here, it’s really not a joke.” In mid-2022, Huang Lingling, a retail employee of Perfect Diary, complained about the current state of Perfect Diary.

The coldness of Perfect Diary’s offline retail sales is also a side of Perfect Diary’s traffic failure.

As we all know, Perfect Diary can become a hit in a short period of time, relying on online marketing. Xiaohongshu notes + Li Jiaqi’s delivery + Zhou Xun’s endorsement = perfect diary.

Therefore, its founder Huang Jinfeng was hesitant to open an offline store at first. Until Zhang Lei, the founder of Hillhouse, reassured him: “Let girls become beautiful quickly.”

According to official data, as of August 2020, Perfect Diary has opened 160 stores across the country, of which 120 were added that year.

However, fast offline retail stores did not bring about high growth. The financial report shows that in the first three quarters of 2020, the offline experience store of Perfect Diary only contributed 8.5% of the total revenue.

In fact, Perfect Diary is marketing “Big Brand Replacement” online, and the cost-effective label has been branded in the minds of consumers.

The opening of an offline experience store, to a large extent, does not add luster to Perfect Diary, but is a kind of disenchantment.

AI Blue Media Hui visited the offline store of Perfect Diary. Under the epidemic situation, the store was empty. There are relatively few consumers who place orders offline, and most of them focus on experience.

The reason behind this is not difficult to understand: driven by marketing, research and development has not kept up.

According to financial report data, from 2018 to 2021, Yixian’s marketing expenses were 309 million yuan, 1.251 billion yuan, 3.412 billion yuan, and 4.006 billion yuan. In the past four years, the proportion of the company’s marketing expenses in annual revenue has continued to rise from 48.2% in 2018 to 68.6%.

From its financial report, from 2018 to 2020, the research and development expenses of Yixian E-commerce were 2.64 million yuan, 23.18 million yuan, 66.51 million yuan and 142 million yuan, accounting for 0.4%, 0.8% and 1.3% of net income respectively. And 2.43%, can be said to be negligible.

From the perspective of R&D investment, although the investment is showing an upward trend year by year, the word-of-mouth on the consumer side has not significantly reversed.

Consumers can pay for the “big brand replacement” for a while, but it won’t last long.

Under the pursuit of “product is king” of domestic brands, consumers have been educated from “cheap and poor quality” to value for money and high quality. However, the 0.8g small heel of Perfect Diary is priced at 89 yuan, while the big-name lipsticks that cost more than 200 are at least 3g.

On Xiaohongshu, there are not a few notes about “stepping on thunder” about the perfect diary.

Under the general environment of the epidemic in 2020, as L’Oreal, Estee Lauder and other international big brands have lowered their attitudes and cut prices, and the prices of duty-free shops have frequently dropped, consumers have also locked their eyes on the “big brands themselves” that are much cheaper, further compressing The market space for the perfect diary of “big brand replacement”.

Driven by high marketing, instead of a perfect diary with high investment in products, it can only fall into a vicious circle of traffic exhaustion and become an “abandoned child”.

Skin care into the second curve?

The fact that Perfect Diary has become an “abandoned child” is not only reflected in the consumer side, but also in Yixian E-commerce.

A turning point is that Yixian began to lighten up makeup and focus on skin care.

This is also another strategic attempt by Yatsen to get rid of the quagmire of losses under what is considered to be “highly driven by marketing”: increase the price of high-end skin care.

When Huang Jinfeng, the founder of Yixian E-commerce, mentioned the transformation publicly, he firmly said that “skin care must be done”. In Huang Jinfeng’s view, the profit of the skin care business is much higher than that of make-up. Only by shifting the focus to the skin care business can Yixian E-commerce change its face. Lu Peipei, vice president of Yixian E-commerce, also said bluntly at the performance communication meeting that the skin care sector can go through cycles and has stronger profitability.

How to do skin care? There is no better way for Yixian E-commerce, either to incubate or acquire. Yixian’s choice is to spend money to eat ready-made.

This is also a common method in the consumer market. For example, Anta has acquired international brands to enhance its overall brand layout; and in the beauty and skin care market, platform companies such as L’Oreal and Procter & Gamble have always followed the logic of buying, buying and buying.

In 2020, Yixian E-commerce has made plans for the skin care market. In that year, Yixian E-Commerce completed the acquisition of the French high-end cosmeceutical brand “Kelanli”. Sales.

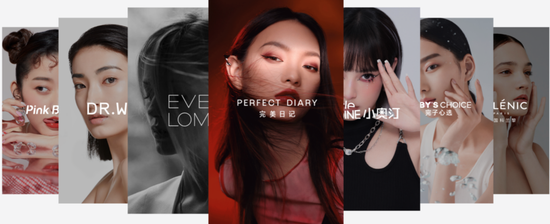

In 2021, Yixian E-commerce will once again increase its skin care track, spending a total of 1.12 billion yuan, and successively won the Chinese mainland business of Dr.wu, a Taiwanese functional skin care brand, and EVE LOM, known as “Hermes in the makeup remover industry”. Through several acquisitions, Yixian E-commerce has expanded its brand matrix in the skin care category and owned high-end brands.

An interesting phenomenon is that it was not Yixian E-commerce that left Li Jiaqi’s studio, but Perfect Diary left Li Jiaqi’s studio.

In the Jiaqi live broadcast room, Yixian e-commerce repeatedly pushed Kelanli’s flagship product “Antioxidant No. 1 VC Essence” to consumers. In the variety show “offer2” planned by Li Jiaqi during the Double Eleven Lan Li also gained a lot of popularity.

On Xiaohongshu, Dr.wu has also become one of the representatives of functional skin care, and its mandelic acid essence is strongly promoted by planting grass bloggers.

There are opinions in the market that the skin care line is the “second growth curve” of Yixian e-commerce; in the view of AI Blue Media Exchange, Yixian e-commerce is quite likely to go to “pro sons” and “adopted sons”. Skin care line It may become the highlight of Yixian e-commerce to stop losses.

Today, the strategy of exchanging beauty makeup for skin care has not yet achieved obvious results, but there are already signs of improvement.

In the third quarter of this year, its skin care business achieved revenue of 269 million yuan, a year-on-year increase of 33%, accounting for 31.4% of total revenue from 15.1% in the same period last year, accounting for more than 30% of total revenue for two consecutive quarters. Among them, three mid-to-high-end skin care brands, including DR.WU, EVE LOM and Galénic, recorded revenue growth of 69% year-on-year.

From the perspective of Yixian E-commerce, the skin care business has indeed achieved relatively high growth.

However, compared horizontally in the big track, the audiences of DR.WU Daerfu, EVE LOM and Galénic France are still obviously weak. This year’s Double 11, Winona and Proya have been listed in the top three of Tmall’s domestic skin care list, while the brands under Yixian E-commerce are not on the list and have not yet been released.

It is still unknown whether Yixian E-commerce will win the next “Perfect Diary” in the skin care industry.

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-05/doc-imqqsmrp8676932.shtml

This site is only for collection, and the copyright belongs to the original author.