——How to treat the floating and losing of your own funds

Are fund losses good or bad? It depends on two points, one is whether you want to continue to invest in the future? The second is whether the fund can rise back in the future.

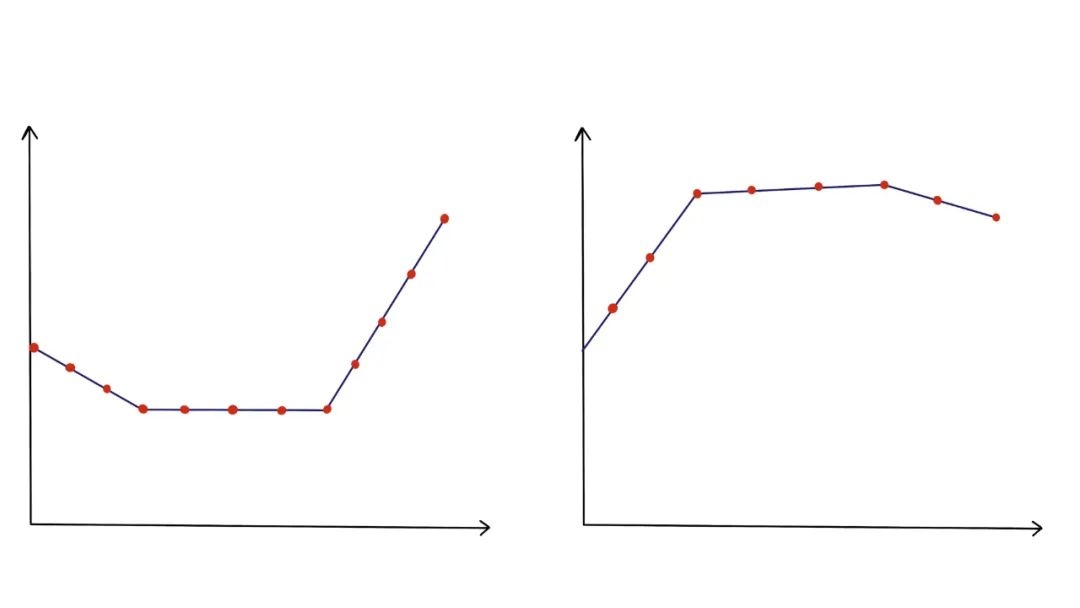

For a regular investment investor, which of the following funds has a better trend?

The answer is self-evident. So the decline is not terrible. On the contrary, the stock price has been running at a high level, which will be more distressing. High purchase cost, the final total income is not ideal.

So everyone should be happy to see that the funds they are optimistic about have fallen, and find a way to save more money to buy them.

Anyway, I have such a mentality, haha, this article will introduce some funds that I have serious floating losses, but insist on regular investment, and I believe that I will reap fruits in the future.

Luo Jiaming · CEIBS Fenghong Shanghai, Hong Kong and Shenzhen

I started to make a regular investment in December 2021, and I accidentally bought it at a stage high

This is the problem that ordinary retail investors tend to encounter when buying funds: the fund manager will only come out to publicize when the performance is good, so that we can understand his basic situation and investment philosophy, and then buy.

However, good short-term performance often has accidental factors, and the follow-up may face mean reversion, which makes us buy it as soon as we buy it.

Luo Jiaming’s performance last year was quite good, with a gain of 10.64%, but this year it was -23.44%, with a maximum drawdown of -40.6% (as of 2022-12-2)

Of course, this is not entirely a problem of fund managers. There is also a problem with the beta of Hong Kong stocks. The sharp correction of Hong Kong stocks this year has created a good buying point. The more they fall, the happier they should be.

Some people say that low valuation is not important, but I think it is very important. On the one hand, a cheap valuation means a margin of safety, and on the other hand, it also means greater room for growth. It is definitely good to buy cheap.

Especially in the third quarter of this year, under the influence of the Federal Reserve’s continuous interest rate hikes, foreign capital sold Hong Kong stocks substantially regardless of liquidity. As we all know, when your counterparty is forced to sell due to liquidity problems, they will often give you a better transaction price.

So I have been investing in Zhongou Fenghong Shanghai, Hong Kong and Shenzhen this year:

One is to believe in the long-term investment value of Hong Kong stocks. Most of the companies listed on the Hong Kong stock market are domestic companies, but it is mainly foreign investors who participate in the pricing. Many foreign investors do not understand China and regard Hong Kong stocks as a marginal market and do not pay much attention to them.

In fact, looking at the world, Chinese assets are very good in terms of growth, certainty and cost performance. The short-term pricing will be unreasonable, but the long-term will definitely reflect the value of the enterprise.

In addition, Hong Kong listed companies are more pro-cyclical. Under the current economic pressure, they will fall more. However, as the economy recovers, pro-cyclical companies may also show stronger performance flexibility.

The second is to believe in Luo Jiaming’s ability. In recent years, I have been looking for fund managers who are good at Hong Kong stocks, focus on Hong Kong stocks, and can do a good job in Hong Kong stocks, but there are very few such fund managers! After looking around, I think Luo Jiaming is a good choice.

I also agree with his investment philosophy – choosing a good company and a good management team. I believe that this investment philosophy can continue to create good returns in Hong Kong stocks.

Zhang Kun E Fund Asia Collection

Zhang Kun has managed this QDII for more than 8 years. It is definitely Zhang Kun’s big failure. The performance since he took office is really bad! In history, I have bought small-cap stocks in Hong Kong stocks, bought counterfeit stocks, and endured the beatings of the education industry and the Internet. Not only did it significantly underperform the Shanghai and Shenzhen 300 (blue line in the figure below), it also underperformed similar funds (red line). (as of 2022-11-18)

However, I think these are the past tense. The excellent performance in the past may not be able to continue in the future; the poor performance in the past may also be reversed in the future. The key still depends on the investment philosophy. I think there is nothing wrong with Zhang Kun’s investment philosophy. After so many years, he has paid enough tuition fees in the Hong Kong stock market.

At present, the allocation of the fund tends to be stable, with global high-quality Internet companies as the mainstay, plus the excellent leader of Hong Kong stocks, Baima. I think this fund is also a good beta hedge when placed in a portfolio.

I started to buy this fund gradually in July 2020. After riding a roller coaster, the retracement was huge. In fact, a large part of the reason was caused by the beta of Hong Kong stocks. I am firmly optimistic about Zhang Kun and Hong Kong stocks. The reasons are the same as above. .

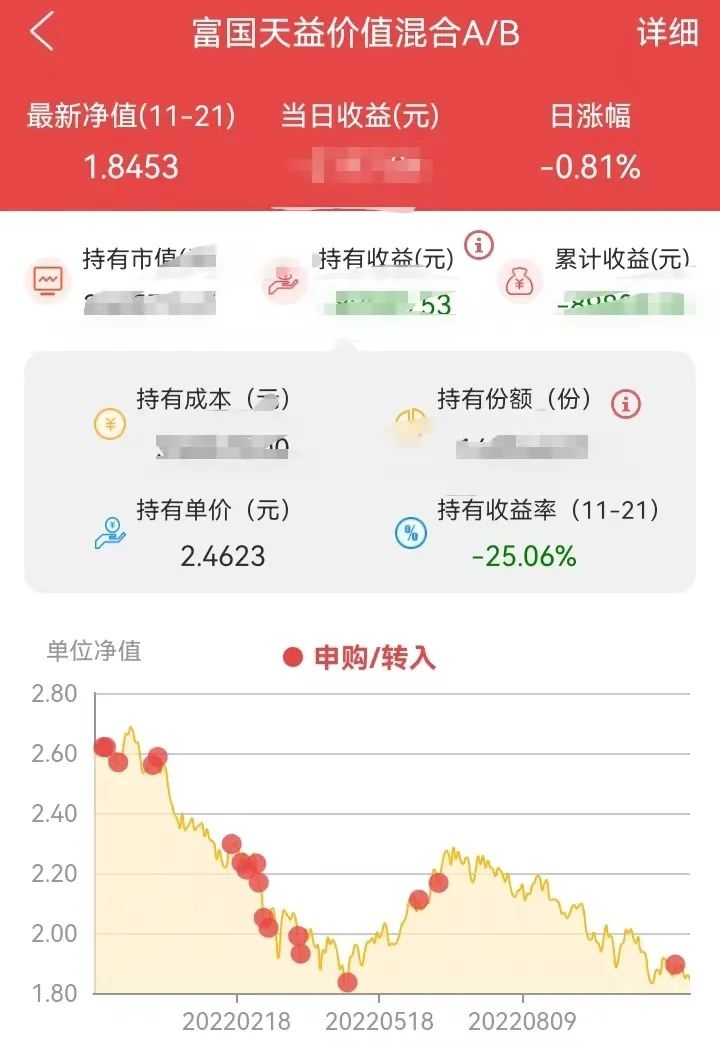

Tang Yiheng·Fuguo Tianyi Value

In terms of quality and style, Zhang Kun and Liu Yanchun, who I am most optimistic about, are already too large. so i chose

Fuguo·Tang Yiheng, Nord Luo Shifeng, E Funda·Guo Jie

3 people as substitutes, among which I am most optimistic about Tang Yiheng, who has the most positions, but I did not expect Luo Shifeng and Guo Jie to perform better ![]()

Tang Yiheng performed very well at the beginning, but then retreated a lot. The following table is the performance of quality style managers since the end of the core asset bull in 2021 (2021-2-10 to 2022-11-21).

Even if the retracement is large, I will still insist on holding it. I believe in her strength. I have watched her interview many times, and every time I read it, I think it is great. The previous performance in Ping An Asset Management was also good, and we should continue to trust it.

I think that when we choose fund managers, especially those funds that are going to be held for a long time, we should put in more effort and do enough homework before research ; hold firmly after buying, and don’t be caught by a small fluctuation. All previous studies were rejected. “Either don’t believe it, or believe it at all, and you can’t WeChat.”

Wu Chuanyan Hongde Fengze

Wu Chuanyan is also a manager that I am very optimistic about from a qualitative point of view. He is a quality style manager. He does not buy liquor and the Internet, and his positions hardly overlap with other quality style managers, and his positions are biased toward technology; he is not a quality style manager, but He also pays special attention to the company’s quality, management, and moat.

Wu Chuanyan’s retracement this year is also particularly large. Although there are short-term negatives or downturns in Haidilao, Yihai International, Hengrui Medicine, and Zhuo Shengwei, which he holds heavily, he did not reduce his positions to avoid them, but took a long-term view. The high point has been carried down.

I quite admire his determination. In his quarterly reports, he always talks about how to evaluate the long-term value of the company, not talking about short-term changes, so I also firmly hold and keep covering positions. But to be honest, I really don’t dare to allocate him too heavily, the fluctuation is too big.

Wu Chuanyan has also drawn back a lot this year, but the recent rebound has also been very fast, and I even almost returned my capital.

Conclusion: For optimistic funds, the more they fall, the happier we should be. Because most people make regular investment and buy every month after receiving their wages, rather than rushing at the bottom. We definitely hope to collect more chips at the bottom and soar into the sky in the future, and we don’t want to sell more and more expensive.

As for whether the loss-making funds can rise back in the future, this belongs to the research level, and it is the homework that needs to be done continuously in the process of buying and holding. Welcome everyone to continue to pay attention to me, and I will continue to share good funds.

In addition, the funds I have recently focused on increasing positions are Chen Jinwei’s Baoying Advantageous Industries, Dai Yunfeng’s China-Europe Quality Enterprises, and Zhu Hongyu’s Investment Core Competitiveness. If you are interested, I can talk about it again.

Writing an article is not easy, I hope everyone will “like, comment, forward” to support me three times, thank you!

Reminder: Funds are risky, investment needs to be cautious! This article is only for personal research and analysis, not as an investment basis, according to which the operation is at your own risk.

Related reading: Luo Jiaming , Tang Yiheng , Zhang Kun

$Zhongou Fenghong Shanghai-Hong Kong-Shenzhen A(F002685)$ $E Fund Asia Collection(F118001)$ $Hongde Foresight Return Mix(F001500)$

There are 8 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9290769077/237668572

This site is only for collection, and the copyright belongs to the original author.