Welcome to the WeChat subscription account of “Sina Technology”: techsina

Text/Zhou Mengting

Source: Mars Business (ID:ishijie2018)

Recently, insurance companies have urgently removed a number of products related to the new crown epidemic. For a while, consumers who had taken out insurance panicked. But compared to the embarrassment that it is difficult to settle claims, more people are worried about whether it will affect the subsequent purchase of other insurance after their “yang” passes.

Originally, she planned to buy double insurance for herself in case of a new crown diagnosis + isolation, but Xiaoxiao did not expect that after the two antigen tests showed two red lines, she would encounter difficulties in finding the insurance company to settle the claim.

“They said that a positive antigen is not a confirmed diagnosis. You must get a CT scan from the hospital to confirm that your lungs are infected.” Xiaoxiao said helplessly.

In the past three years since the COVID-19 epidemic lasted, the virus has undergone multiple rounds of mutations, and while the infectivity and immune escape ability have been enhanced, the toxicity has been weakened. Now Xiaoxiao is not sure whether CT can prove that she is infected with the new crown, and she does not know how to prove that she is really sick.

With just over a month left until the insurance expires, Xiaoxiao, who is struggling with a fever, told the city circles that she is ready to give up on claims.

“It’s only 3,000 yuan, so there’s no need to bother.” At the end of 2021, Xiaoxiao spent 56 yuan to purchase “Aiwuyou Epidemic Prevention Guarantee” on the Alipay platform. The insurance policy shows that if she is diagnosed with the new crown, the insurance payment amount is 3,000 yuan; if she is quarantined due to the new crown, she can receive a 200 yuan subsidy a day; if she dies due to the new crown, the maximum compensation amount is 100,000 yuan.

Although the premium of more than 50 yuan is not high, Xiaoxiao is angry that she “protects” her loneliness. Since the beginning of this year, she has been quarantined at home several times. The insurance company refused to pay the claim on the grounds that she was not isolated in a centralized manner and did not have a community certificate. Moreover, she is now positive for the antigen. If she wants to claim compensation, the procedures are still the same trouble.

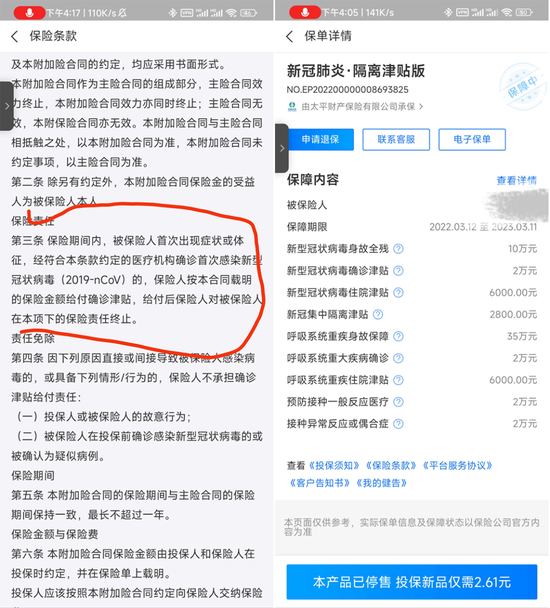

Li Wen, a college student, also had a similar experience with Xiaoxiao. In March this year, Li Wen spent less than 60 yuan to buy the “New Coronary Pneumonia-Isolation Subsidy Edition” of Pacific Insurance. The protection content includes: COVID-19 diagnosis, compensation of 20,000 yuan; COVID-19 hospitalization allowance of 6,000 yuan; COVID-19 centralized isolation allowance of 2,800 yuan, etc.

Although he heard that someone had received a new crown claim and made a small profit, more voices complained that it was too difficult to settle the claim. Li Wen glanced at his indemnity clause, which read, “The insured has symptoms or signs for the first time, and has been diagnosed with a new type of coronavirus (2019-nCoV) for the first time by a medical institution that meets the provisions of this clause.”

“How many positive patients are still with this virus? Aren’t they all mutants of the new crown?” Li Wen lamented that it is easy to get sick, but how to get the insurance company to admit that he has the new crown is too high a threshold.

(Photo source/provided by interviewees)

Insurance companies urgently remove “new crown insurance”

“If you can compensate you within two months, the insurance company will lose!” The classmate joked with Li Wen. When he heard that many insurance companies had withdrawn or adjusted insurance products that included the liability for the diagnosis of the new crown, Li Wen felt that claims might indeed be hopeless.

As early as 2020, when the new crown pneumonia epidemic first emerged, in order to meet the insurance protection needs of “frontline anti-epidemic” workers, insurance companies fulfilled their social responsibilities and launched “new crown insurance” in a timely manner. However, after the normalization of the epidemic, some insurance companies seem to see business opportunities.

Although in order to protect the rights and interests of insurance consumers and prevent the use of the epidemic as a marketing gimmick to hype insurance products, the China Banking and Insurance Regulatory Commission prohibits insurance companies from developing such exclusive single-liability insurance products for new crown pneumonia insurance. Products such as isolation allowances followed one after another, and became the number one “net celebrity” in the insurance industry.

However, recently, with the announcement of policies such as “Twenty Measures” and “New Ten Measures” to optimize epidemic prevention and control, people’s lives are gradually returning to convenience, and the risk of infection with new coronary pneumonia has increased. Insurance companies also urgently removed a number of products related to the new crown epidemic.

At present, on the Alipay platform, products such as “Zhongan Aiwuyou”, “Zhongan Epidemic Isolation Subsidy Insurance (Upgraded Version)” and “Pacific New Coronary Pneumonia Isolation Subsidy Edition” are no longer available. Meituan Insurance’s “New Crown Anti-epidemic Insurance” and JD Health’s “New Crown Epidemic Prevention Health Insurance” also show that they are off the shelves.

The staff of many insurance companies such as Ping An Insurance and Pacific Insurance told the market that they have completely removed insurance products related to the new crown epidemic.

According to Caijing, the anti-epidemic comprehensive insurance of Huanong Insurance, which was launched in the second half of this year, has also been removed from the shelves. A person close to the company said, “The products with confirmed and severe illnesses have all been taken off the shelves, and now only insurance products that cover death liability remain.”

In the midst of a wave of removals, as of December 12, PICC’s “Anxin Epidemic Prevention Insurance (including the new crown)” is still on sale, and the cost is 2.61 yuan/month. However, in terms of protection, the product is limited to a hospitalization subsidy of 100,000 yuan for severe/critical illness of the new crown; a hospitalization (including square cabin) subsidy of 100 yuan/day for infectious diseases (including new crowns). And it is indicated in the insurance notice: hospitalization subsidy is only for hospitals recognized by the insurance company, accompanied by a 15-day waiting period, during which the insurance company will not bear the guarantee responsibility.

New crown insurance, just a gimmick?

Talking about the reasons for the removal of products such as the new crown diagnosis liability insurance, most people in the industry said that with the increasing number of confirmed cases, the expected loss rate will become higher, and the emergency removal of products is in line with the profit-seeking tone of insurance companies.

“Insurance companies are more likely to promote the ‘new crown insurance’ as a gimmick.” A middle-level insurance company who has been engaged in the insurance industry for 10 years said frankly, “Insurance is an actuarial science and a business based on data. There will be no money-losing business.”

At the end of 2020, China Taiwan Insurance Company launched an epidemic prevention product. Because of its low premium and simple claim settlement rules, it sold more than 4 million copies within one month of its launch.

In May 2021, the epidemic situation in Taiwan, China increased sharply, setting off the first wave of claims for this policy. The amount of claims was as high as 1.96 billion yuan (NT dollars). Including salesperson commissions and other expenses, the company eventually lost 8 100 million (TWD), the company’s solvency has also been greatly affected.

In fact, “New Crown Insurance” has been accompanied by various disputes since its inception. Not only is the claim settlement procedure cumbersome, but the division of responsibilities is unclear. Many consumers do not know that there will be many compensation conditions at the time of purchase.

On September 28, the Consumer Rights Protection Bureau of the China Banking and Insurance Regulatory Commission issued the “Notice on Insurance Consumer Complaints in the Second Quarter of 2022”, showing that there were 2,434 complaints in the second quarter involving property insurance and other insurance disputes related to the isolation of the new crown epidemic. Consumer complaints from insurance companies accounted for 24.22%.

“Insurance products containing new crown liability contain some ‘implicit exemption clauses’ in the insurance exemption clause, and the key words are not clearly defined, so that this type of business has planted the seeds of controversy from the moment the insurance is signed. “Said Wang Min, senior consultant of Shanghai Jianwei Law Firm.

Therefore, it is not very accurate to say that the removal of products is all caused by insurance companies “fear of losing money”. Many insurance salesmen said that these restrictions made many consumers unable to meet the conditions for claim settlement. In fact, the compensation paid by the insurance company was not as much as the outside world imagined.

A staff member of Ping An Insurance told the city circle: “The new crown is no longer a serious disease. Now that the sun is positive, it is only a few days of isolation at home. It may be over by taking some antipyretics. Gradually, it is the same as a common cold and fever. There is no need for this insurance.”

Deng Zhidong, general manager of Hainan Boao Medical Technology Co., Ltd., said that with the release of the “New Ten Measures”, the epidemic prevention and control has entered a new stage of normalization. This stage is the stage of “herd immunity”. Everyone will face infection and the responsibility for the diagnosis of the new crown It can be removed from the shelves if the task of the era is almost completed.

Fu Jian, director of Henan Zejin Law Firm, also believes that because the previous insurance products containing the new crown liability were formulated and promoted in accordance with the epidemic prevention policy, the new coronavirus pneumonia diagnosis and treatment plan and other regulations at that time, most provinces and cities in the country have successively The introduction of policies and the gradual relaxation of epidemic control measures will lead to higher transmissibility, but compared with the original strain, the pathogenicity and virulence of Omicron have been greatly reduced.

“Combined with the fact that after the vaccination of the whole population, the symptoms after infection are not as severe as before, and the price of treatment has stabilized, so the new crown insurance is no longer necessary as an insurance product.” Fu Jian said.

However, for the insurance contracts that have been underwritten before, the insurance company cannot unilaterally cancel them at will. Wang Min reminded consumers that if the insurance company directly cancels the policy without notice, this is a violation of the relevant regulations of the “Insurance Law”.

(Photo source/Visual China)

How can the new crown insurance support the resumption of work and production?

The chaotic market of the new crown insurance has attracted the attention of the China Banking and Insurance Regulatory Commission very early. In the first half of this year, it conducted a thorough investigation of insurance products containing the new crown liability.

“At that time, such products had been reduced in the market.” Industry insiders said.

However, after the rectification, on December 9, the Beijing Banking and Insurance Regulatory Bureau issued the “Notice on Strengthening Financial Support for Resumption of Work and Production”, requiring insurance companies to speed up the development of insurance products related to the new crown virus infectious disease. Accelerate the design and development of new coronavirus infectious disease-related liability insurance with inclusive prices and suitable for a wide range of people to protect the risks of severe illness, critical illness and death caused by the new coronavirus; support insurance institutions to expand product insurance liabilities without raising premium rates, and increase The ability to guarantee the risk of severe illness, critical illness and death caused by the new coronavirus.

Under this circumstance, many insurance institutions currently classify the liability insurance related to the new coronavirus infectious disease into the scope of protection of “general medical insurance” and “critical illness insurance”.

Ping An Insurance once issued an announcement saying that if you get a serious illness due to the new crown, it is also included in the scope of claims for critical illness insurance, “But if you check the list of critical illness insurance, there is no word ‘new crown’ in it.” According to the staff According to the report, this public announcement also has legal effect.

It is reported that “Ping An Insurance e-Life Insurance 2023 Edition” (that is, general medical insurance) also includes the new crown, and there are special services for the new crown, that is, no waiting period (after the insurance takes effect, there is no need to wait another 30 days), 0 Deductible amount (within the scope of insurance, how much you pay for what you spend), no hospital restrictions, etc.

“In fact, ordinary medical insurance means that no matter what disease you have, as long as your expenses in the hospital reach the deductible amount, you can get compensation.” Ping An Insurance staff said, for example, that people aged 26 to 30 want to get 5,000 yuan For the above deductible, the annual premium is 480 yuan; for the 10,000 yuan deductible, the annual premium is 360 yuan. “This date is January 1, 2023.”

In addition, the staff of Pacific Insurance also told the city circles that the insurance company will not specifically launch “new crown insurance” in the future, “and there will be no more after that. If you want to buy it, it is recommended to buy general medical insurance or critical illness insurance. All the diseases caused are included in it.”

(Photo source/provided by interviewees)

Can I still buy critical illness insurance if I pass the “Yang”?

The new crown epidemic prevention insurance that was once popular has just changed its appearance in people’s lives as the epidemic enters a new stage. In the past two days, compared with the embarrassment that it is difficult to settle claims, many consumers are more worried about whether their subsequent purchase of other insurance will be affected after their “yang” passes.

According to the “Beijing Business Daily” report, amidst the trend of new crown-related insurance being removed from the shelves and adjusted, many insurance agents took advantage of the situation to market “the new crown positive cannot buy medical and health insurance”. In order to improve performance, they tell customers that “as long as the nucleic acid is positive once, the customer will refuse insurance for life” and “if they get the new crown, the critical illness insurance will be directly refused insurance”, and it is strongly recommended to configure critical illness insurance, medical insurance and other health insurance before “positive”. risk.

“The infection of children in this round of epidemic also means that many children have lost the right to purchase critical illness insurance and medical insurance for life.” Regarding this kind of salesmanship, a Pacific Insurance salesman said that this may be too exaggerated, but ” If a customer wants to buy critical illness insurance after the “positive” period, the insurance company first needs to check whether it was diagnosed in a hospital and what method of treatment was used, and the second insurance company will check whether there is a record of hospitalization for the new crown.

“If you are diagnosed in a hospital and have a hospitalization record, it will affect the review, but the company will arrange another lung examination. If there is no problem, it will not affect the insurance.” The above-mentioned salesman said.

The staff of Ping An Insurance said that if the new crown is serious enough to be hospitalized or very serious, the insurance company needs to be informed in advance, “because the risk of potential physical problems in the future may be very high. We used to stipulate that we cannot insure after being positive, but now it is so common. Didn’t specifically say no.”

The above-mentioned senior insurance practitioner said frankly: “Under normal circumstances, mild and moderate illnesses will not affect the purchase of critical illness insurance and medical insurance.” However, he also suggested that it is best to wait for the body to recover before purchasing related medical insurance. insurance and critical illness insurance.

According to Shell Finance and Economics, in Alipay’s million-dollar medical insurance – Good Medical Insurance. In the health notice for long-term medical care (guaranteed renewal for 6 years), there is currently no mention of COVID-19. It only examines “whether you have been hospitalized or operated due to illness in the past 2 years”, which is no different from conventional insurance. In addition, similar to Ping An Insurance, if there is a record of hospitalization due to the new crown, it also needs to be notified in advance. However, if it has been cured, it will not affect the normal insurance.

In other words, as long as people who have passed the “Yang” do not have a major impact on their bodies, they will not affect their medical insurance or critical illness insurance.

Li Wenzhong, deputy director of the Insurance Department of Capital University of Economics and Business, said that some experts currently estimate that 80% to 90% of people will experience infection. A ‘one size fits all’ approach to deny coverage to positive patients is impossible.”

Yang Zeyun, a teacher of the Finance Department of the School of Management of Beijing Union University, believes that the future national policy orientation will require insurance to cover more people. “Therefore, even if the COVID-19 positive patients have some conditions that seriously affect their health, with the development of insurance, there will be more and more insurance products that can meet their insurance needs.”

(Xiaoxiao and Li Wen are pseudonyms in the article.)

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-14/doc-imxwrqkr7528567.shtml

This site is only for collection, and the copyright belongs to the original author.