On December 30, Midea Group issued an announcement that Yin Bitong, the company’s director and vice president, resigned. Not many people outside the home appliance industry have heard his name. But in my opinion, the “T+3” operation model he initiated is the most important change for the home appliance industry as the real estate industry enters the “Silver Age” and “Black Iron Age”. It is also because of the “T+3” model that Midea Group has maintained a steady growth in the first curve (home appliance business) before the growth of the second curve (to B business such as industrial automation, building equipment, and medical equipment).

1. What did “T+3” bring to Midea?

“T+3” originated from Little Swan, which is the washing machine division (2013-2016), and then did it again in the household air conditioner division (2017-2021). The two business units represent two industry scenarios: the washing machine is a weak seasonal product with a penetration rate that has reached the ceiling; the household air conditioner is a medium-high penetration rate and a strong seasonal product.

From the perspective of financial performance, it is the rapid growth of the profits and ROE of the two business divisions. Midea Group did not disclose the data of the household air-conditioning division separately. But Little Swan’s report can show the changes brought about by “T+3” at a glance: from 2013 to 2018, the compound revenue growth rate was 22%, the profit compound growth rate was 35%, and the ROE increased from 10.9% to 24.3%. From the perspective of market performance, Midea In 2015, the market share of the washing machine industry surpassed that of Haier, and in 2021, the market share of household air conditioners surpassed that of Gree.

2. The underlying business logic of “T+3”

The essence of “T+3” is to reduce costs and increase efficiency, and it is to reduce costs and increase efficiency for the entire value chain. Supporting this strategy are several underlying business logics of the major appliance industry:

1. Major appliances are a standard product. Fixed multiples (multiples between retail pricing and ex-factory cost) are low, and functional value is greater than sentimental value. The preferred strategy of most leading brand companies in the world is to achieve total cost leadership through ultra-large scale and extreme efficiency .

2. No matter in the washing machine industry in 2013 or in the air conditioner industry in 2016, the competition pattern faced by Midea is similar: due to the historical accumulation of product reputation and brand power, it is not as good as Haier washing machine/Gree air conditioner ( articles related to home appliance brand power) You can refer to the link ), so the two business divisions were unable to obtain higher gross profit margins and net profit margins through high premiums at that time. The improvement of product power and brand power is a difficult and long process, and reducing costs through improving efficiency is the short-term optimal strategy for catching up .

3. Regardless of whether it is a manufacturer or a dealer, the criterion for judging “whether it makes money” is not the net profit margin, but the ROE (Return on Equity). In the financial field, there is a golden formula used to disassemble ROE, namely the DuPont formula: return on net assets (ROE) = sales profit rate × asset turnover rate × equity multiplier (financial leverage) ; the most simple wish of all businessmen in China since ancient times It is: the goods are like a wheel, and you can make a lot of money. “All profits at once” is actually the appeal for high return on net assets, and “goods are in rotation” is actually the pursuit of high asset turnover to achieve high ROE. One of the core concepts of “T+3” is to squeeze the water out of every link in the value chain from suppliers to consumers, so as to improve turnover, reduce costs, increase sales profit margins, and ultimately achieve ROE improvements .

4. Regardless of Gree, Midea, or Haier, they all started from large-scale manufacturing and large-scale distribution. At that time, the offline distribution business was the basic market. Since about 2013, with the rise of e-commerce channels, the online penetration rate of major home appliances has gradually increased. If the brand side wants to gain a larger share, it must grow rapidly in the e-commerce channel to seize the share. Early online consumers were mainly price-sensitive and liked low prices. Because the transaction link is short, it is not bad for the brand side to make a profit at a low price. However, for brands such as Ge, Mei, and Hai that started out as offline distributors, directly making low prices online will “wash the Dragon King Temple”, impacting the interests of offline distributors and shaking their own business fundamentals. Midea has figured out one thing very early on: If it wants to spread its legs online, it must improve the efficiency of offline circulation, reduce the cost of offline circulation, and reduce the offline retail price. At the same time, the benefits of the circulation link can be guaranteed .

Due to the improvement of efficiency and the reduction of waste, Midea washing machines and air conditioners can harvest market share through substantial price cuts without affecting profitability . The increase in the share of washing machines in 2015 was mainly achieved by cutting prices to snatch the shares of a large number of second-tier brands, while the increase in the share of air conditioners in 2018-2021 was mainly due to taking the first step in e-commerce channels and eating most of the growth before Gree. volume market.

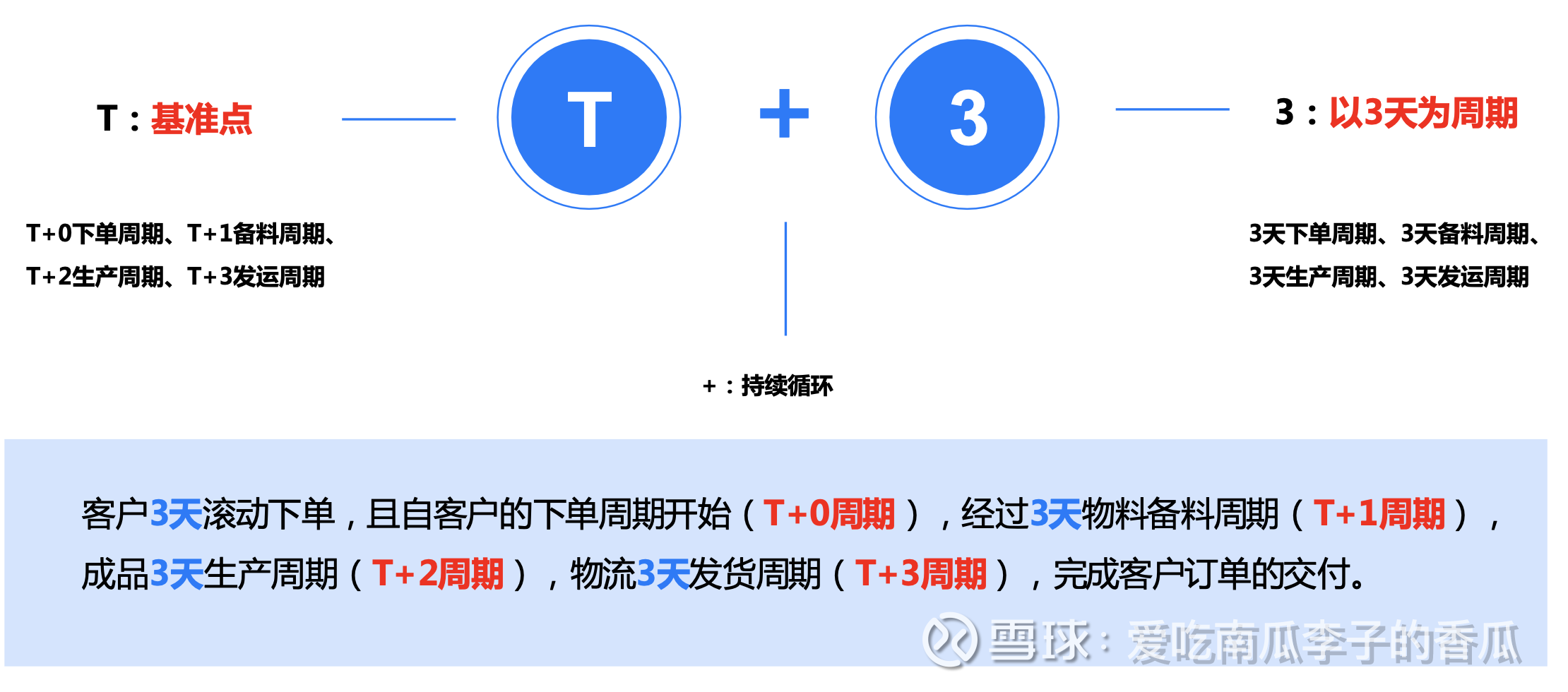

3. What is “T+3”?

Most people understand “T+3″ as a ” demand-oriented production and sales model that can achieve quick satisfaction “, which is what the industry says in the vernacular: “fast delivery” and “no overstocking”. , “High turnover”.

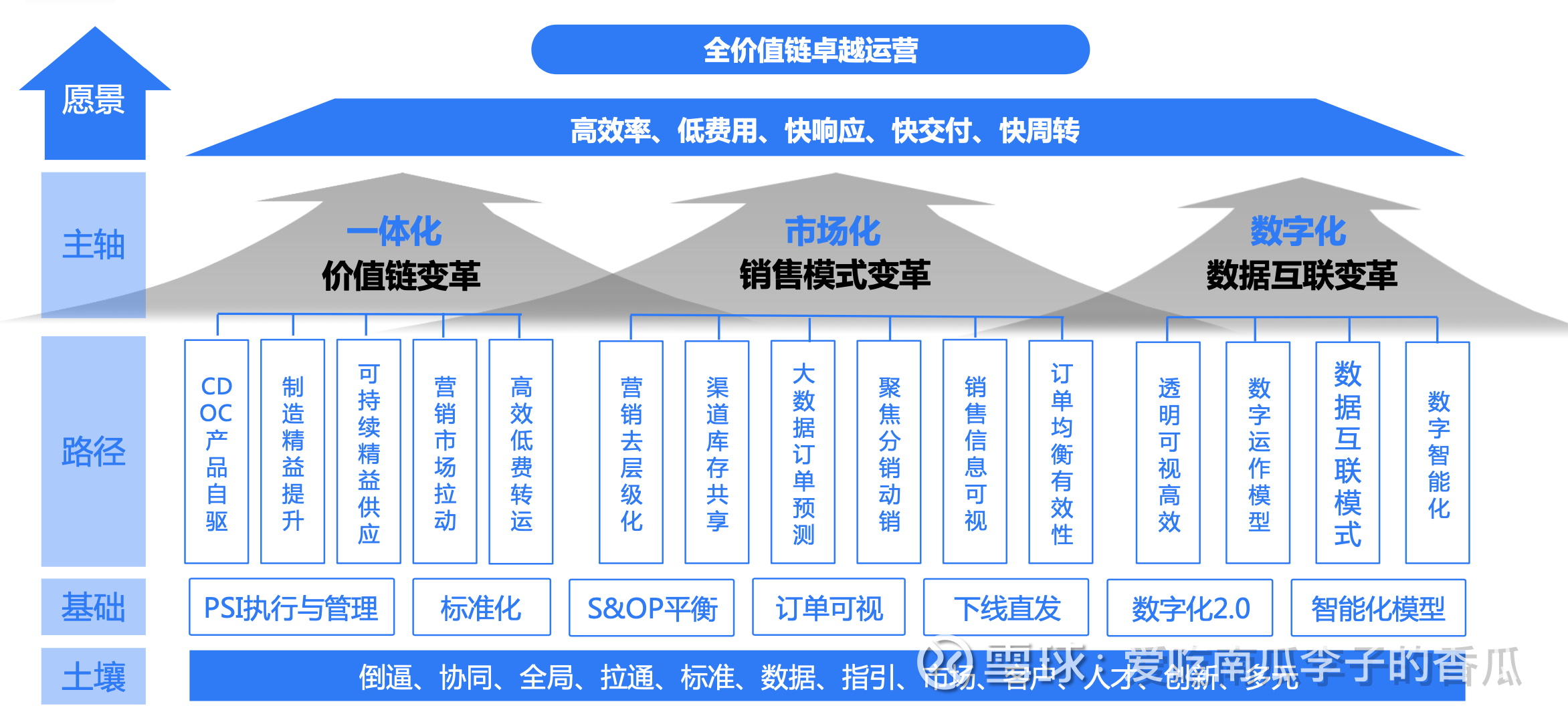

But the real “T+3″ is a larger business philosophy, which is ” to achieve excellent operation of the entire value chain through efficient collaboration and the connection of production and sales as the main axis “.

To sum up, the “T+3” style of play can be divided into three parts: anti-clutter at the front end, chaos control in the middle, and weight loss at the back end .

1. The front end is anti-miscellaneous. Many people think that “T+3” is to optimize the coordination of production and sales and achieve S&OP balance, but it is not the case. It is necessary to know that the reduction of supply chain efficiency often comes from the chaotic demand in the front line of the market, so it is necessary to reduce the complexity of business and demand fluctuations from the source. The source of “miscellaneous” comes from two aspects: too many SKUs and too many sales levels .

1) Streamlining SKUs: In the eyes of the sales team, the more SKUs, the better. Because each new SKU represents the satisfaction of a segmented demand, more sales and profit opportunities can be obtained. However, the effectiveness of SKUs has diminishing marginal utility. Too many long-tail SKUs will lead to a reduction in R&D and production efficiency. Inaccurate sales forecasts for long-tail SKUs will easily lead to redundant inventory, wasting storage, capital and marketing costs. Therefore, when Midea does “T+3”, it usually cuts SKUs drastically as soon as it comes up, and cuts SKUs at a rate of 30% per year for two consecutive years. During the period, new products will also be launched at the same time, but it is basically “the first one and the second one”. Introduced a new indicator system to evaluate SKU performance . At the same time, strengthen the modularization, standardization and universal design of products, reduce the number of core parts and components, and lay a foundation for improving the turnover rate of parts and components.

The picture below is the “Standardization Education Exhibition” organized internally in 2017 for the sales team and the R&D team. Let the front-line personnel experience the surge in core components due to the disorderly expansion of demand. After the reform, the models of core components have basically been cut by more than half.

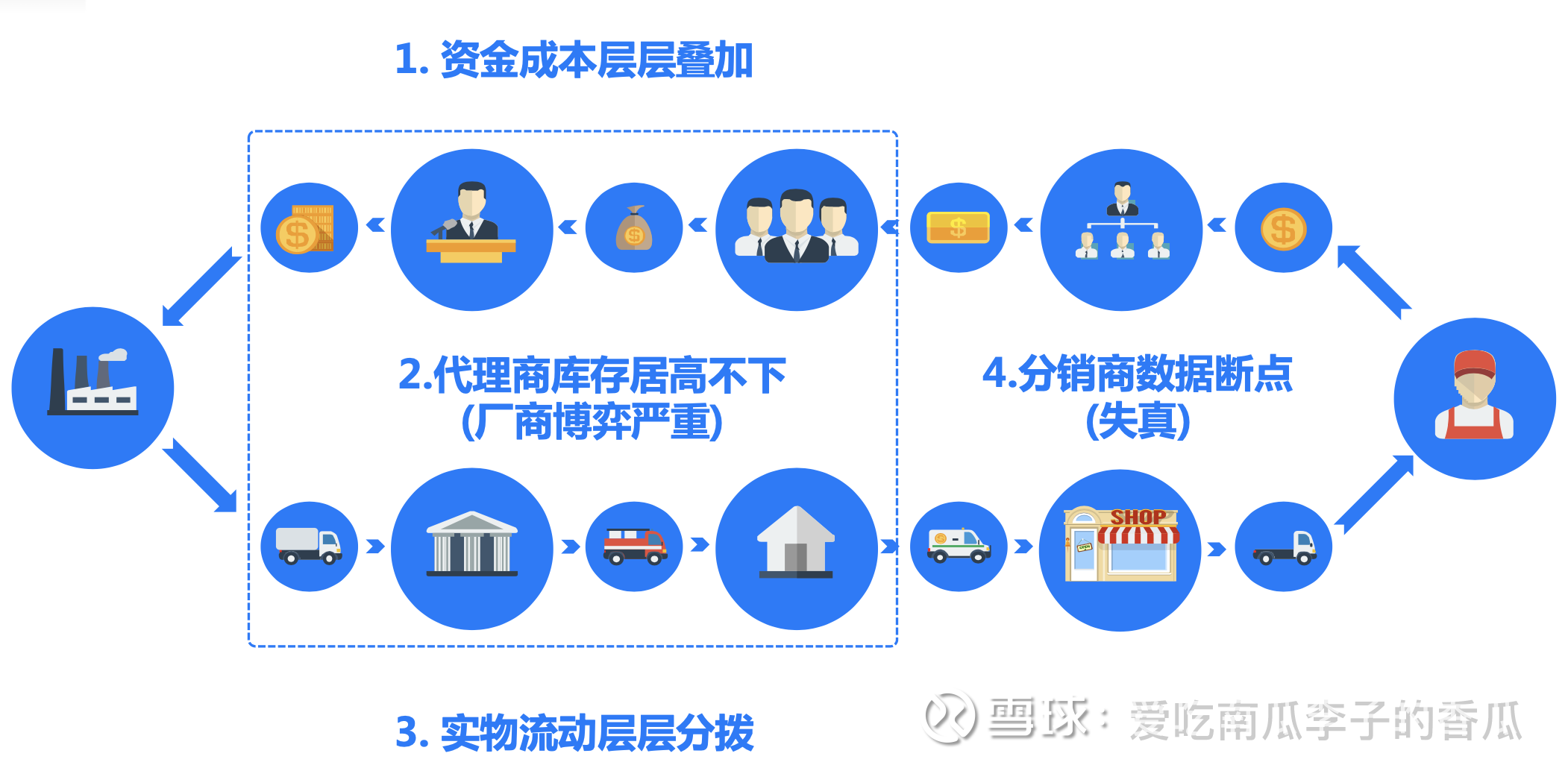

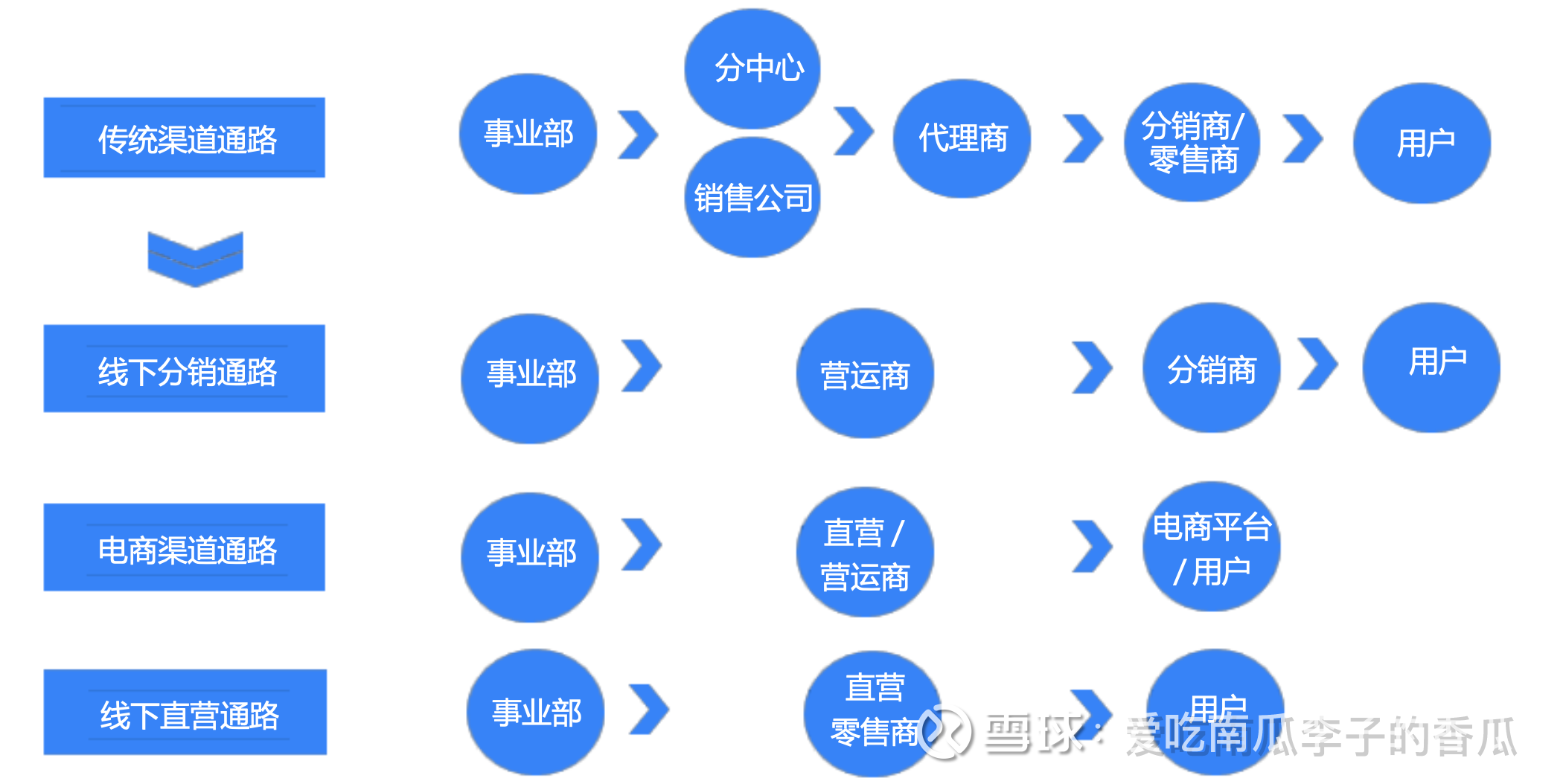

2) Channel change: Generally speaking, there are three layers between home appliance companies and consumers: provincial sales companies, agents (city and county levels), and distributors (stores). There is a transfer of cargo rights between each level. Following the transfer of goods rights in business flow, logistics and capital flow will also change simultaneously. This is not a problem in the high-growth era of the industry, but with the saturation of the market, the over-forecasting caused by insufficient demand will be reflected in the additional storage and capital costs of each link, which are waste generated in the circulation link .

As a result, the flattening of channels has been put on the agenda. The specific method is to change the business flow (transfer of cargo rights) from 4 times to 3 times. The previous business flow path was: the headquarters sold to the sales company – the sales company sold to the agent – the agent sold to the distributor – the distributor sold to the consumer, a total of 4 transfers of goods rights. After the reform, agents were skipped at the level of business flow. The headquarters sold to sales companies—sales companies sold to distributors—distributors sold to consumers. There were a total of 3 transfers of goods rights. Brand service fee (such as store image management). In terms of sales operations, more refined management has also been implemented. For example: forcing factories and channels to increase turnover by forcibly reducing the warehouse area; advocating “frequent entry and fast sales”, changing orders and promotions from large-scale low-frequency to small-scale high-frequency; Channel a plate of goods, reduce the waste of storage link in the circulation link.

There are many analysis articles on the transformation of leading white goods channels, so I won’t go into details here. What I have seen on Xueqiu so far is more thorough. It is ” Gree Electric Appliances: The Second Revolution after 15 Years ” written by @罗一个雪球. I recommend reading it.

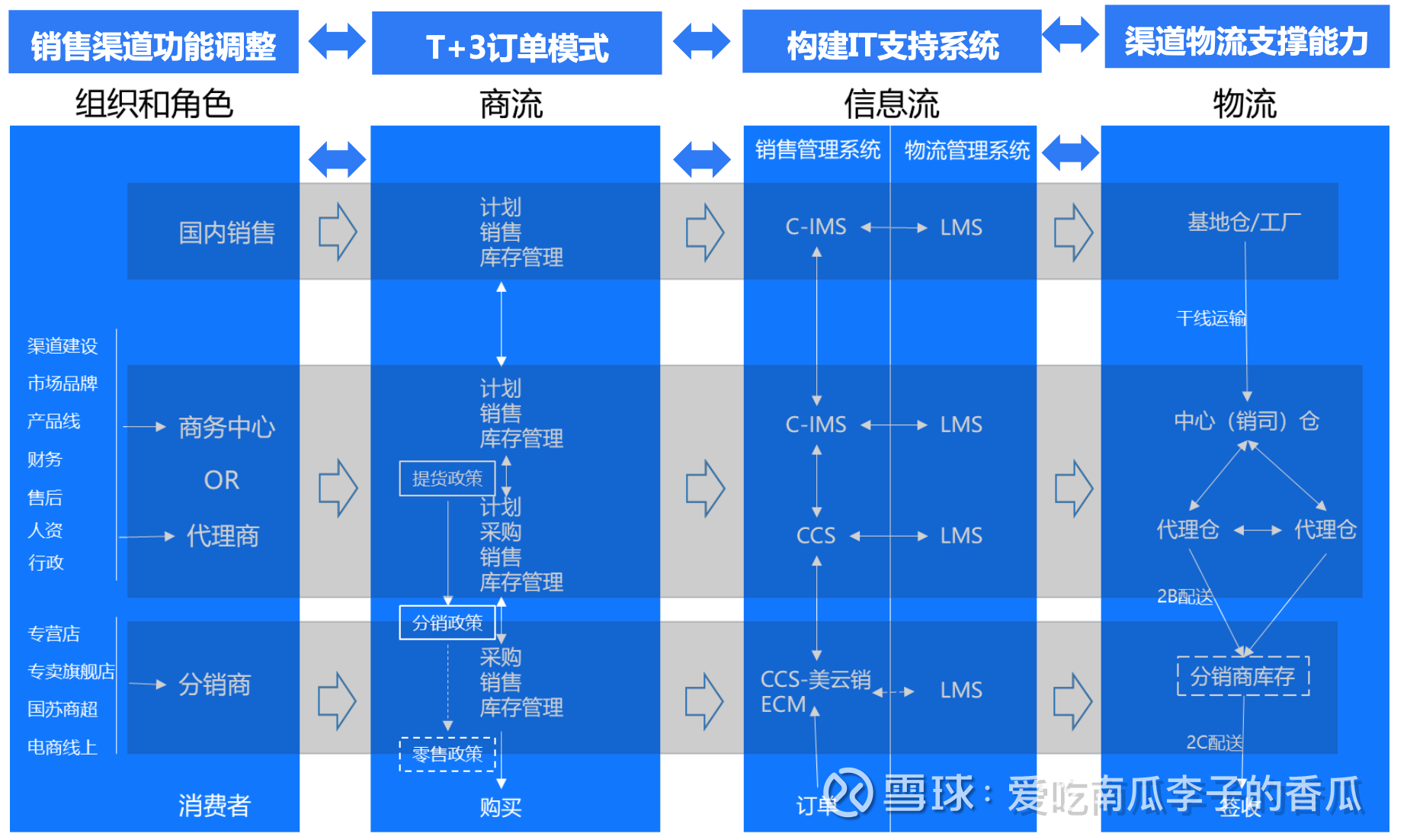

2. Disorder in the middle. It is the precise identification and management of demand fluctuations. It is mainly reflected in the efficient capture of information through a high degree of digitalization of channels and logistics, as well as a strict invoicing management system. In addition to the LMS and WMS systems of Ande Logistics, the physical logistics and information flow are completely connected to achieve lower channel inventory, fewer logistics links, faster turnover efficiency, and less capital occupation . Also through CCS and Meiyunpin to pull business flow information. This enables factories to have more information when making supply chain decisions. With the support of data, stricter inventory management can be implemented.

3. Rear end weight reduction. Refers to enhanced response to demand fluctuations. With the support of data, stricter manufacturing and supply chain management can be implemented. Including setting order balance indicators for sales (orders should not be lower than the time schedule) to force sales to improve order balance. Set the order receiving rate and complete set rate indicators for manufacturing to force the improvement of manufacturing management and planning capabilities, optimize the layout of production areas, and improve manufacturing flexibility. At the same time, in order to improve efficiency, we also vigorously cleaned up exclusive supplies and eliminated long-term materials (such as imported compressors) as much as possible.

4. What are the weaknesses of “T+3”?

No martial arts is omnipotent, and “T+3” also has its weaknesses.

1. In order to improve circulation efficiency, the storage tank will inevitably be reduced. The result is an insufficient response to rapid market changes, especially in seasonal products such as air conditioners. Once the weather is hot, it is easy to be out of stock. Therefore, in order to adapt to the special situation of the air-conditioning industry, the implementation of “T+3” air-conditioning in Midea was not as thorough as that in Little Swan, and some compromises were made to tolerate the existence of overstocking.

2. The contradiction between standardization and differentiation. I think Little Swan won the essence of Volkswagen’s platform when it landed on “T+3”. Through the logic of “different inside and outside”, a large number of SKUs are derived to serve different brands without affecting the efficiency of the supply chain. Many people complain about the Porsche Cayenne and the Audi Q7, which is nothing more than a shell-changed Volkswagen Touareg. In fact, the same is true for Midea washing machines. Under the assessment pressure of component standardization, R&D personnel have greatly reduced the adoption of differentiated structures and components, which has greatly suppressed product innovation. This is why the Midea series of washing machines briefly surpassed the Haier series in 2015. Reason for throwing away. Efficiency improvement can only solve the problem of “surviving”, but to “live well” for a long time, we still need the support of good products .

3. The impact on people. In the winter of 2020, I have already gone to work on an e-commerce platform, and I had tea with Wang Li, the then president of Haier Air Conditioning, in Hangzhou and chatted about the beautiful “T+3”. After I introduced the whole framework, Mr. Wang said: “Haier is also doing Midea, but why didn’t Haier succeed?” I replied: “Because you are not cruel enough.”

For Midea, “T+3” is a profound transformation. Many employees will have to change the business thinking and work habits they have been accustomed to for many years. Midea’s internal performance culture is high goals, high incentives, and high threats . Mr. Yin also has a famous saying internally: “In troubled times, use heavy codes, and correcting too much must go too far.” However, the side effects of the “three highs” are also obvious. When the external environment is good, it can be covered up. When the external market growth slows down, it will often deteriorate the collaborative relationship in the organization. Therefore, in the process, a large number of backbones resigned because they could not adapt to the huge directional change and work pressure. And many people who have been motivated by good performance after that period of time are not willing to go on this road again because their hearts are too tired. To paraphrase Deming’s words in “Deming’s New Economic Outlook”: All rewards, if the starting point is to “control” others, will eventually become various “forces that destroy life.”

5. Can “T+3” be copied?

A brief review of the past and present of “T+3”, in fact, many people are concerned about the extent to which the “T+3” model can be copied to other companies. I don’t have an exact answer to this question, but I can list a few elements:

1. The supply chain-driven standard product industry has a high industry penetration rate, low fixed rate, and a large amount of offline distribution burden. I think kitchen appliances, fast-moving household cleaning (detergents), beer, drinking water, household paper products, and room temperature milk can all be done again with “T+3”.

2. There is a certain foundation for digital construction. Because the smooth implementation of “T+3” requires the support of a large amount of business data.

3. A “ruthless” general manager, and a team that can withstand toss and build.

$Midea Group(SZ000333)$ $Gree Electric Appliances(SZ000651)$ $Haier Zhijia(SH600690)$

Extended reading: Look at the column of household appliances leading series

” Some Thoughts on the Major Appliance Industry “

” Looking at Home Appliance Leaders from the Perspective of Brand Power and NPS “

“Looking at Leading Home Appliances from the Perspective of Product Innovation” (Stay tuned)

“Looking at Home Appliance Leaders from a Management Perspective – Corporate Culture” (Stay tuned)

There are 12 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9986712027/239005743

This site is only for collection, and the copyright belongs to the original author.