Erma uses logic to talk about investment. You can disagree with my point of view, but please consider my logic. In stock investment, opinions are not important, logic is the most important. Only by mastering logic can you have your own point of view.

——————————————————–

Stock investors have three profit (loss) methods when holding stocks, namely value release, cognitive bias, and market fluctuations. The following two horses are introduced separately.

1. Money released by value

From an investor’s point of view, the income of holding a company is future dividends and the residual value of the company’s bankruptcy liquidation. We say that buying stocks is buying a company. According to this thinking, this is the benefit we get from buying this company.

Buying a stock is buying a company is not a fancy term. He has real meaning.

According to the concept that buying stocks is buying a company, how can investors obtain income? There are two calculation methods here. Note that the difference is only in the calculation method, but the essence is the same.

method one:

The income of investors holding the company is the annual dividends and the residual value of bankruptcy liquidation. This is the income that investors get when buying stocks is to buy companies. However, this income is not obtained at one time, but is obtained in batches over the years.

Method Two:

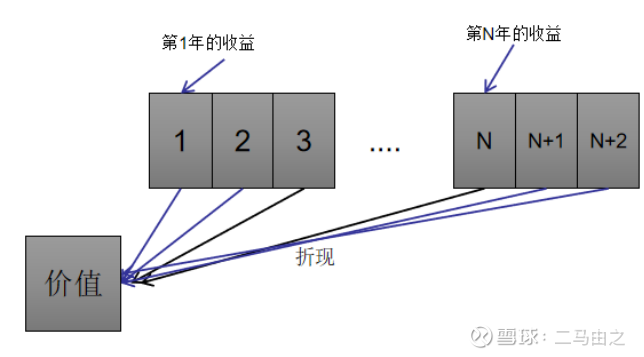

So how much is the income in different years in the future equal to today’s income? This involves discounting. The discounted result is its current value.

The value of the company is obtained by discounting the future earnings obtained by investors holding the company until its bankruptcy to the present (provided that investors can accurately know the future earnings they can obtain). If the investor buys at the same price as the value, then its future annual compound rate of return is the discount rate.

It’s not easy to understand about this. Readers need to have a full understanding of the concept of discounting. Discounting the future earnings of stocks is similar to holding debt and calculating its current value, except that the future earnings of debt are certain, while the future earnings of stocks are uncertain and need to be estimated.

Whether investors use the discounted value or use the annual cash received to calculate the income of their holding companies. This part of the money is the money released by the company’s value.

2. Cognitive bias

When we refer to unlocking value, we are referring to calculating the value of a company. But for each company, we actually cannot know exactly how much we can get from the company every year in the future. Therefore, we need estimates, a process called valuation. For example, a company held by an investor in 2022 will go bankrupt in 2050. At that time, we can calculate its value in 2022 based on the investor’s annual income. But at the moment of 2022, we can only estimate its future value.

This estimate will deviate from the actual value of the company.

The deviation between investors’ perception and the company’s actual value will make investors make more money or lose money. For example, an investor expects the current value of a certain company to be 10 billion, and buys it at this price. But the actual value of the company is 5 billion. Then investors will lose money because of cognitive bias.

Only by surpassing the public’s cognition can we obtain more benefits. This income does not come from the company’s performance, it can be said to come from one’s own cognition, or it can be said to come from the market. From cognition beyond the market.

3. Market volatility

Investors can estimate the value of a company, but the market trades on price. Price will deviate from value. This is called the law of value.

For the same company, the performance has not changed, but the price-earnings ratio may be doubled in the bull market and the bear market. If investors can buy in a bear market and sell in a bull market. Then make money from market fluctuations. Otherwise, you will lose money.

Four, three kinds of income analysis

These are the three benefits we get from owning a company. Only the first type is a positive return, and the latter two may have a positive return or a loss.

The first is the money we can actually get by holding a business until it goes bankrupt. Regardless of whether we can accurately predict the value of a certain enterprise, this money can also be obtained.

Due to our cognitive biases and the fact that the market trades on price rather than value, our buying price will deviate from the actual value. This may cause us to lose money or make money.

Regarding cognitive bias gain and loss and market volatility gain and loss, let us make a simple explanation.

Cognitive bias gains and losses are gains and losses that combine personal cognition and market effects. If personal cognition cannot surpass the market, investors will not be able to make this money. For example, an investor thinks Moutai is good, but if the whole market thinks Moutai is good. At this time, the market’s valuation of Moutai may exceed its actual value.

Therefore, it is difficult to earn the benefits of cognitive bias. Cognitive bias benefits need to be combined with enterprise analysis, so many people call this part of the money the money that makes the enterprise. What we want to declare is that this cognition is wrong. If the market is efficient, there is no excess return for investors to hold any business. If you want to make money with cognitive bias, you must have cognition beyond the market, that is, the market as a whole does not recognize the true value of an enterprise, so the price given to the enterprise is lower than its actual value. Investors who surpassed market cognition bought at this price and obtained excess returns.

The price and value deviations caused by market fluctuations often have little to do with corporate fundamentals and little to do with cognitive biases. Mostly because of long-term and short-term emotional and financial disturbances.

We think it is relatively easy to make money with market fluctuations. Especially when this kind of market fluctuation is not a short-term fluctuation of a single company, but a systematic valuation change. This is relatively easy for ordinary investors to judge. This is why I emphasize that money in the market is easier to earn.

Erma investment album recommendation:

1. Liquor Enterprise Analysis Album

There are 29 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/3081204011/239258213

This site is only for collection, and the copyright belongs to the original author.