The Fed’s balance sheet is interesting, with assets consisting primarily of Treasury bills and mortgage-backed securities. Liabilities mainly include bank bills, bank reserves and reverse repos.

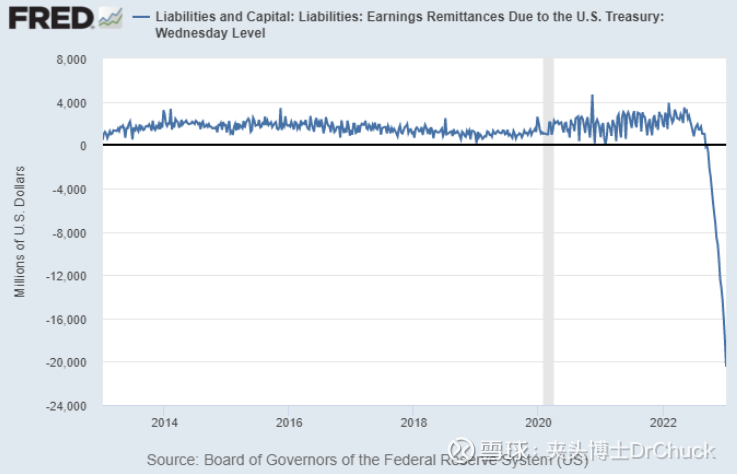

Historically, their return on assets was higher than their liabilities, with a positive net interest margin. Some of the profits earned by the Federal Reserve are used to pay operating expenses, and some are used to pay dividends, and then they remit the rest of the money back to the U.S. Treasury. However, in 2022, they ramped up interest rates from near zero, leaving the Fed unprofitable for the first time in the history of the modern era. Instead, what they submitted to the Treasury Department was a huge paper loss.

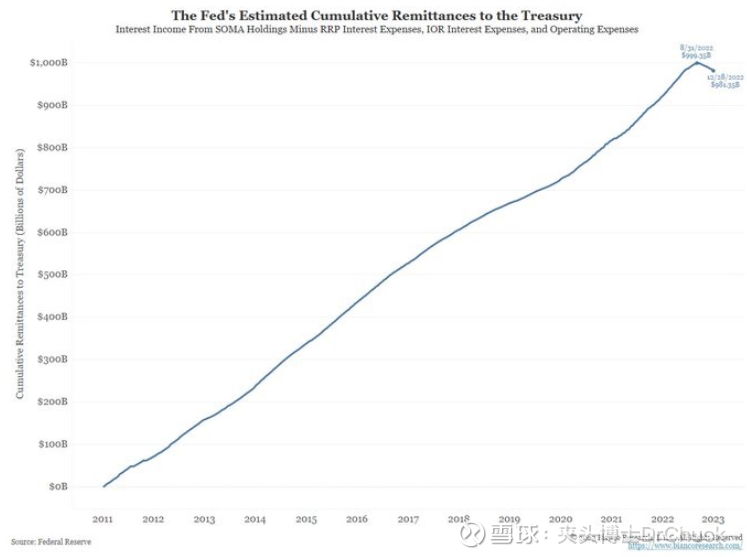

According to the statistics of scholars, the Federal Reserve has sent more than one trillion US dollars to the US Treasury in the past ten years. Now the situation is reversed, reporting losses of about 60-70 billion US dollars to the Ministry of Finance every year.

But in fact, the Treasury Department will not pay this loss to the Fed. The Fed records this loss as a “deferred asset.” If they make a profit again in the future, instead of immediately starting to pay the Treasury again, they have to repay these losses that they have accumulated first, and only when the losses are fully repaid, they start sending money to the Treasury.

As a result, the U.S. Treasury loses a $100 billion a year revenue stream for the foreseeable future. So, if the Treasury and the Fed are losing money, who is making money? The answer can be found by looking at the Fed’s high-yield liabilities, specifically bank reserves and interest-paying reverse repos.

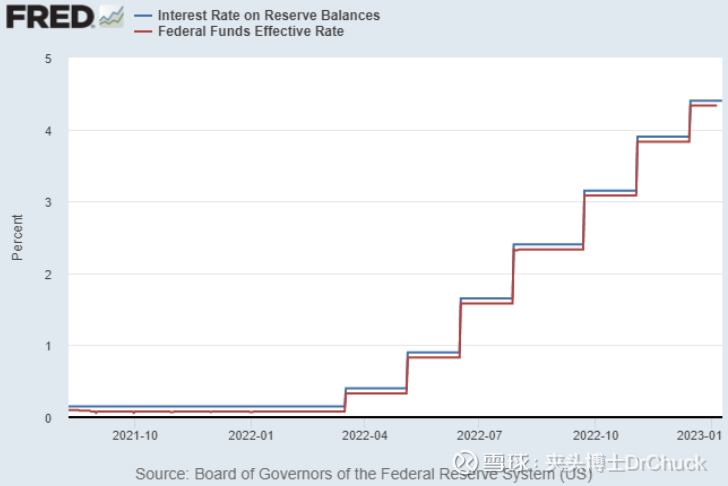

As part of the way it sets and enforces short-term interest rates, the Fed pays banks interest on their reserve balances. That rate is currently 4.4%, slightly higher than the Fed funds rate. Reserve balances are cash balances held by banks with the Federal Reserve.

Currently, U.S. banks collectively hold about $3.1 trillion in reserves, so their annualized risk-free return would total about $136 billion at current interest rates at a rate of 4.4%.

With such a high risk-free rate, it is clear that the Fed is encouraging banks not to take risks in lending, because banks can earn this rate without doing anything. If they want to do home loans, car loans, credit cards, business loans or margin loans, in order to offset the risk of bad debts, they can only increase the interest rate.

The theory behind these Fed tightening measures is that consumers will be less willing to borrow at such high rates, so the money multiplier will stagnate and money creation will slow, reducing consumer demand and inflation.

Meanwhile, U.S. banks pay customers pitifully little interest on their deposits. Banks have sufficient deposits and do not need to provide high interest rates to obtain as many deposits as possible. The work of banks is mainly to optimize the interest rate difference between assets and deposits.

At present, banks pay less than 1% interest rate for deposits from customers, and then a considerable part is deposited in the Federal Reserve at a risk-free rate of 4.4%, and the interest rate difference in the middle is profit.

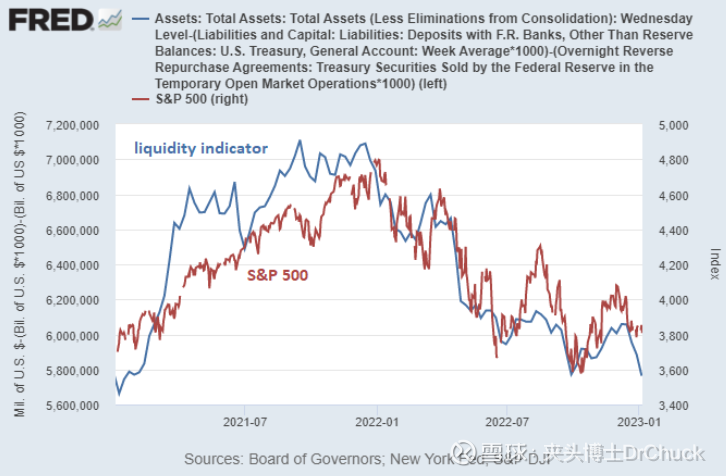

The Fed may slow down rate hikes in 2023, but the shrinking of its balance sheet is likely to continue. The liquidity of US stocks will be greatly affected, especially large-scale technology stocks.

Generally, the balance sheet of the Federal Reserve, minus the general account of the Ministry of Finance, and minus the reverse repurchase can be used to represent the liquidity of the market. It can be seen from the figure that there is a strong positive correlation with the US stock market.

If the U.S. economy enters a deep recession, as many fear, bank assets will suffer because of widespread defaults on loans. Although this risk is not small, it has been fully reflected in the bank’s depressed stock price. Many investors simply assume that every recession will be a repeat of 2008, but bank balance sheets are much healthier today than they were back then.

If the U.S. falls into a deep recession with huge loan losses and the Fed slashes interest rates, it will be better to hold cash and gold than bank stocks. If the U.S. enters stagflation with slow economic growth, bank stocks could be a good bet.

@Bank Screws @云蒙@王jian’s Angle

$Bank of America (BAC)$ $JPMorgan Chase (JPM)$ $Wells Fargo (WFC)$

There are 8 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/1039527614/239912074

This site is only for collection, and the copyright belongs to the original author.