The stock price of Kweichow Moutai is as high as 1,900 yuan, the minimum purchase is 1 lot, and the investment threshold is nearly 200,000 yuan . This investment threshold is too high for retail investors. Moutai is the company with the core assets of A shares and the largest total market value. The high stock price prevents retail investors from participating in investment, making it difficult for retail investors to share the dividends of core assets, which is unfair. So, are there any cheap alternatives to Moutai ?

Qualified cheap alternatives need to meet: 1) Highly similar stock price trends; 2) Low investment threshold; 3) Equivalent level of investment risk.

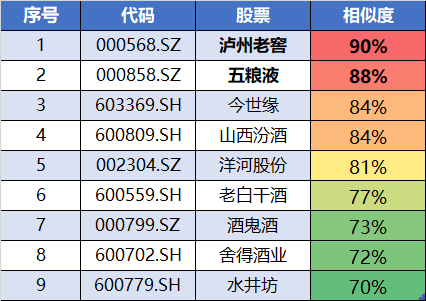

Let’s first look at the liquor stocks whose stock price trend is closest to $Kweichow Moutai (SH600519)$ in the last three months (Figure 1). Luzhou Laojiao has the highest similarity (90%), Wuliangye has the second similarity (88%), and Maowulu It is a well-known brand of high-end liquor in China. It can be expected that the stock price trend of Maowulu is relatively similar. The similarity between Jinshiyuan and Shanxi Fenjiu ranks third and fourth (both similarities are 84%).

Figure 1: Stocks most similar to Moutai’s stock price movement

Are Wuliangye and Luzhou Laojiao the best alternatives to Moutai? First of all, the similarity of 90% belongs to a relatively high level of similarity, but there is still room for improvement. The most important thing is that Moutai, Luzhou Laojiao, and Wuliangye are different companies, and their investments face different corporate risks. Although the trend of Maowulu has been similar in the past period of time, the similarity of the stock price in the future is uncertain.

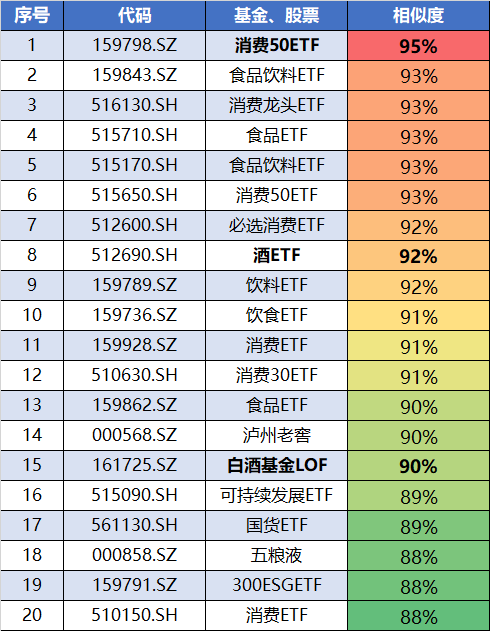

Index funds are a better substitute for tracking Moutai, because the proportion of Moutai in passive index funds is open, transparent and relatively stable, and the correlation between the two future stock prices can be expected. The 20 fund stocks most similar to Moutai’s stock price trend are shown in Figure 2.

Figure 2: Funds and stocks most similar to Moutai’s stock price trend

The index with the strongest correlation with Moutai’s stock price is not liquor, but consumption and food and beverage . The baijiu fund LOF (161725), which tracks the baijiu index, has a similarity of 90%, ranking 15th. This is mainly a matter of weight ranking. The largest weighted stock in the liquor index is Luzhou Laojiao (accounting for 16%), while Kweichow Moutai is only the fourth largest stock in the liquor index (accounting for 14%). Shanxi Fenjiu and Wuliangye account for Both are higher than Kweichow Moutai. Therefore, the trend of the baijiu index is closer to Luzhou Laojiao than Kweichow Moutai. In addition, the largest weight of liquor fund LOF (161725) is Shanxi Fenjiu (accounting for 17%), while Moutai is the third largest weight (accounting for 16%).

Consumption 50ETF (159798) is the most similar index fund to Moutai in recent times, with a similarity of 95%; this is not only because of the high proportion of Moutai (15%) and the high proportion of the liquor industry (39%), but more importantly, the The market style tends to be blue-chip, and the trend of some non-liquor industry constituent stocks is very similar to that of Moutai . In addition, funds that have a strong correlation with Moutai’s stock price include: food and beverage ETF (159843), with a similarity of 93%, and leading consumer ETF (516130), with a similarity of 93%.

In order to find the best cheap alternatives, we set several criteria: 1) The similarity with Moutai’s stock price trend is relatively high (more than 90%); 2) The higher the proportion of Moutai’s funds, the better. 3) The higher the proportion of funds in the liquor industry, the better. Figure 3 lists the index fund information that has a strong correlation with Moutai.

Figure 3: Information on index funds with a strong correlation with Moutai

Conclusion: The best alternatives to Moutai are: $Liquor Fund LOF(SZ161725)$ , $Wine ETF(SH512690)$ , both of which are passive index funds, with a high proportion of the liquor industry (over 87%) and a relatively high proportion of Moutai ( 16%), the stock price correlation between the two and Moutai is relatively stable. The stock price correlation between liquor ETF and Moutai is slightly stronger than that of baijiu fund LOF, mainly because of the weight ranking problem. Moutai is the largest weighted stock in liquor ETF, while it is the third largest weighted stock in baijiu fund LOF.

There are 25 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9450201277/240039811

This site is only for collection, and the copyright belongs to the original author.