The basic framework for the past two months is that the dollar will continue to strengthen, and many transactions have been made accordingly. But the dollar has fallen for four consecutive months, and this long-term difference of more than two weeks proves that my judgment is wrong.

In December last year, I thought that under the background of continuing to raise interest rates and shrinking the balance sheet by 95 billion per month, before the Fed turned around, the liquidity of the US dollar would still be gradually tightened objectively. But I didn’t realize that the calculation of net dollar liquidity required deducting the release of the treasury account balance! (Net USD liquidity = Fed balance sheet – Fed overnight reverse repos – Treasury account balance)

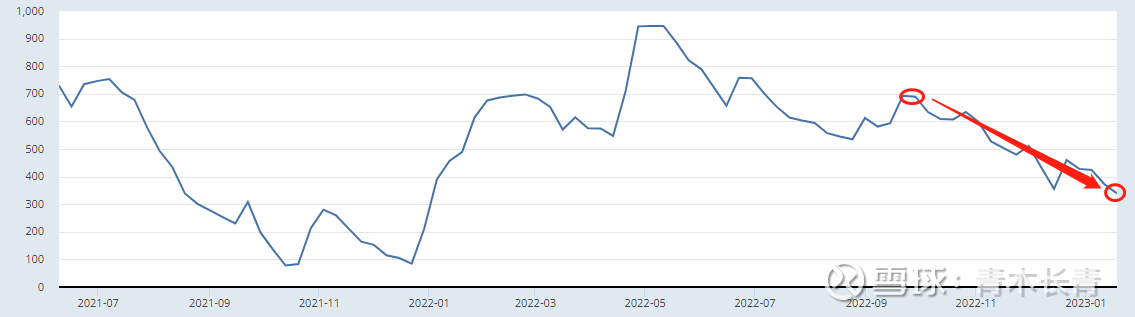

In the four months since September 28 last year, the balance of the U.S. Treasury has dropped from 690 billion to 340 billion, releasing a liquidity of 350 billion U.S. dollars (90 billion U.S. dollars in the most recent month):

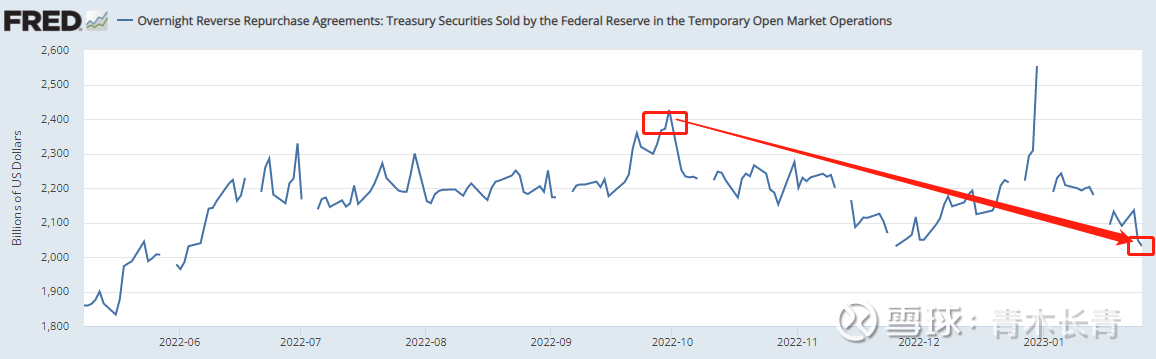

From September 28 last year to the present, the Fed’s overnight reverse repurchase has dropped from 2.37 trillion to 2.03 trillion, releasing 340 billion US dollars of liquidity (260 billion US dollars in the most recent month):

During the same period, the Federal Reserve shrunk its balance sheet by US$95 billion per month, withdrawing a total of US$380 billion in liquidity in four months (US$95 billion in the most recent month).

In other words, in the four months from September 28 to the present, the net liquidity of the US dollar has not decreased, but has actually increased by US$310 billion! This kind of dollar easing has reached its extreme in the last month: the overnight reverse repurchase that was added at the end of last year to comply with the Basel agreement was released in January, and the U.S. debt ceiling issue stopped issuing bonds, causing the Ministry of Finance to enter a stage of net liquidity release . If calculated from December 28, the net liquidity of US dollars has increased by about US$250 billion .

The release of US$250 billion in liquidity in one month is a scene that can only be seen in the era of large-scale flooding. The increase in reverse repurchase overnight at the end of the year coincides with the suspension of bond issuance due to US debt disputes. The Bloomberg U.S. Financial Conditions Index shows that liquidity has continued to improve since the end of September, and has soared in the past month :

This fundamental misjudgment of the direction made me underestimate the strength of the rebound of various assets in this round, including web3 in the currency circle, gold, and stock markets in various places, leading to early departure and premature shorting.

For those who are powerful enough, this big opportunity can be realized and grasped. Looking back, the logic from data push to market changes is quite clear. The mistake this time comes from the imperfect knowledge framework and cognition problems, and the road is long and long.

I see voices in the market starting to discuss the short-term liquidity brought about by debt disputes, which means that information is priced in the market; Liquidity will level off or start to decrease again. Therefore, I will not chase higher, but I will carefully consider lowering my expectations for this transaction, and will stop losses if necessary.

—————

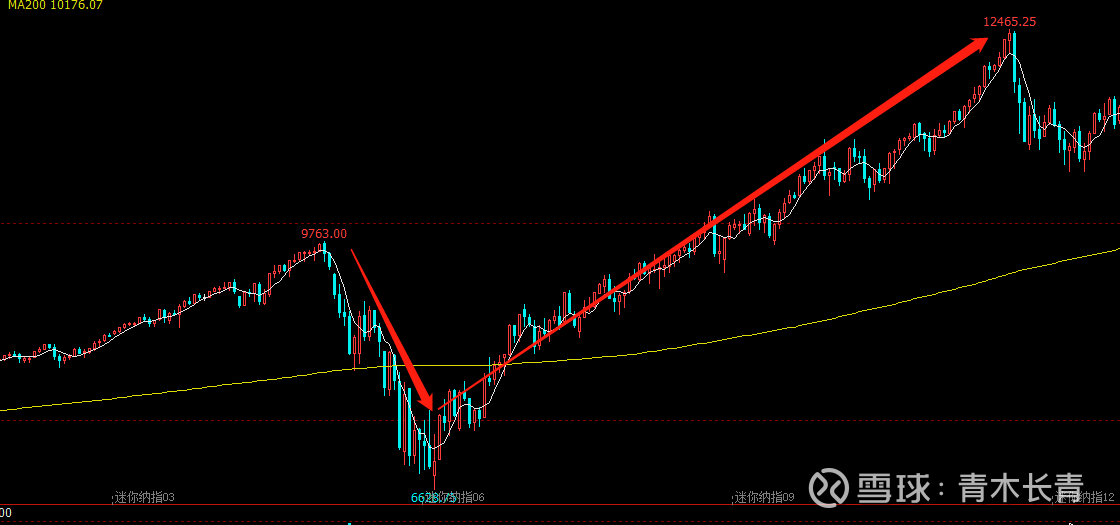

The big rebound of Hong Kong stocks is a bit like the Nasdaq in 2020, and similar situations will repeat in the future. That is to say, if a major factor suppresses the profit expectations and sentiment of the entire market, then after the core suppressing factor is resolved, the market will not only restore the valuation, but may rise above the ups and downs in one breath due to profit growth and sentiment swings.

Nasdaq:

Hong Kong stocks have just risen back to their starting and falling points. Since earnings and sentiment are still improving, they may not peak in the medium term:

The difference is also quite big. The U.S. stock market has risen for more than five months, and the Hong Kong stock market has been close to the same rate (S&P 500) in less than three months.

Current position: Short $Hang Seng Index (HKHSI)$ : Short $Nasdaq 100 Index (.NDX)$ = 30%: 40%

This loss is a matter of perception. In fact, there should be a callback, but I can’t predict how high the callback will be. The current plan is to wait until it stabilizes and set a stop loss at a new high.

There are 15 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/9903704439/240655814

This site is only for collection, and the copyright belongs to the original author.