On January 31, Hang Lung Group Co., Ltd. (Hang Lung Group, 00010.HK) and Hang Lung Properties Limited (Hang Lung Properties, 00101.HK) released their 2022 annual results.

For the fiscal year ended December 31, 2022, the total revenue of Hang Lung Group was the same as in 2021, at HK$10.941 billion, while its operating profit fell by 2% to HK$7.683 billion. The total revenue of Hang Lung Properties will be the same as in 2021 at HK$10.347 billion, while the operating profit will drop by 2% to HK$7.253 billion.

In the second half of last year, the rental income in the Mainland increased by 8% compared with the first half of the year

Hang Lung Group’s property leasing revenue decreased by 3% to HK$10.625 billion, mainly due to the depreciation of RMB against Hong Kong dollar and the impact of the epidemic from the second quarter of 2022. Property sales revenue of HK$316 million was recorded during the year. The basic net profit attributable to shareholders remained at HK$3.002 billion, and the basic earnings per share also remained at HK$2.20. In the second half of 2022, the rental income in the Mainland will still increase by 8% compared with the first half of the year, and even match the historical high in the second half of 2021.

Hang Lung Properties’ property leasing revenue decreased by 3% to HK$10.031 billion, property sales revenue of HK$316 million was recorded during the year (2021: nil), and basic net profit attributable to shareholders decreased by 4% to HK$4.199 billion

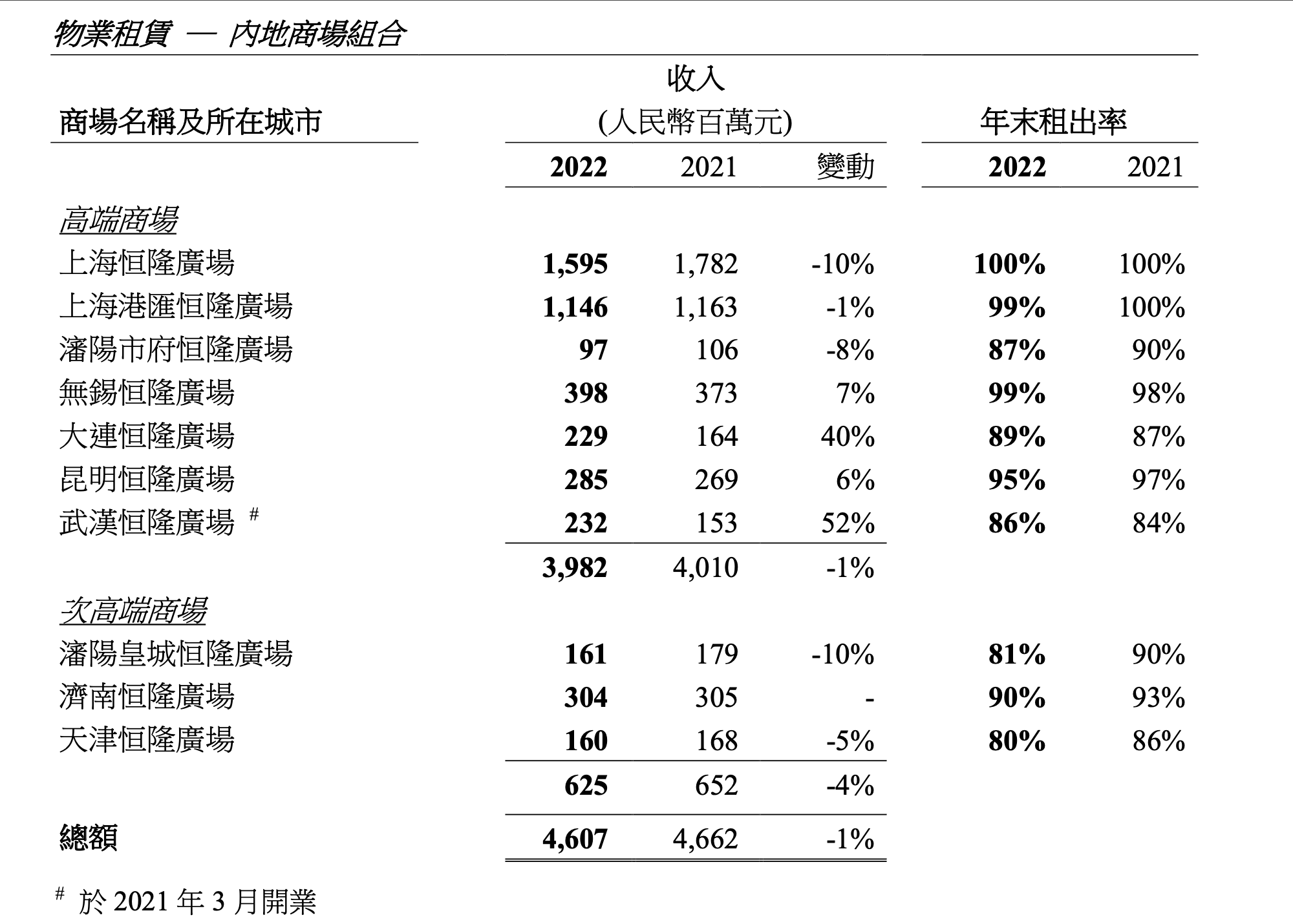

The leasing income of Hang Lung Properties and Hang Lung Group’s mainland business increased slightly by 1% to 5.79 billion yuan and 6.19 billion yuan respectively.

Hang Lung Group said the performance of its shopping mall portfolio remained solid in a challenging year. The performance of high-end shopping malls outside of Shanghai and Shenyang has steadily improved, with revenue increasing by 6% to 52% year-on-year respectively, mainly driven by the continuous increase in occupancy rate and the optimization of tenant mix, which largely offset the closure of shopping malls in these two cities during the epidemic Among the impacts, Wuxi Hang Lung Plaza stood out, with revenue and tenant sales up 7% and 1% respectively, mainly due to its leading position in the high-end retail market and benefiting from strategic marketing activities. Dalian Plaza 66 has continued to perform brilliantly since its successful transformation into a shopping mall gathering luxury brands. Revenue climbed 40% year-on-year to RMB 229 million, and tenant sales also increased by 67%. Kunming Plaza 66 recorded a 6% increase in revenue, driven by rent increases and higher base rents. Although Wuhan Plaza 66 was closed for three weeks from October to November due to the epidemic, its revenue still increased by 52% to 232 million yuan, and tenant sales also increased by 158%, continuing to rise steadily.

Despite the weak market sentiment, the high-quality office building portfolio performed well during the year, bringing strong and stable income to the company. The total income of Hang Lung Properties and Hang Lung Group from the office building portfolio increased by 11% to 1.110 billion yuan and 9% to 1.361 billion yuan respectively. The increase was mainly driven by the increase in the occupancy rate of office buildings completed in Wuxi, Kunming and Wuhan in recent years.

In Hong Kong, the epidemic at the beginning of the year had a continuous impact on business and consumer sentiment, resulting in a relatively weak business environment. The HKSAR government launched a new round of e-voucher schemes during the year, boosting consumer sentiment. Compared with 2021, the overall rental income in 2022 will only drop by 3%, which is less than the 4% drop in the first half of the year, showing that the year-on-year gap is gradually narrowing.

Mr. Chen Qizong, Chairman of Hang Lung Group and Hang Lung Properties, said: “Our property portfolio in Shanghai’s leading market is growing satisfactorily, and our business has returned to a healthy track in the second half of 2022. Our high-quality office building portfolio has further consolidated the business’s resilience to adverse market conditions. Defensive ability. With the epidemic gradually receding, coupled with China’s emphasis on economic development and boosting consumption, we firmly believe that the Group’s high-quality property portfolio and unique market positioning of diversified businesses put Hang Lung in the best position to grasp when the market recovers pent-up demand.”

Mainland “Hang Lung Mansion” projects will be sold successively

Hang Lung Group said that although the market is still full of uncertainties, looking forward to 2023, the company is still optimistic about the prospects of the mainland and Hong Kong. In terms of property development, the Mainland’s high-end serviced apartment brand “Henglong Mansion” projects (including Wuhan “Henglong Mansion”, Kunming Junyueju and Wuxi “Henglong Mansion”) will be launched for public sale in succession according to market conditions.

The Hong Kong project The Aperture has pre-sold 126 residential units since its launch in December 2021, with a total sales revenue of HK$1.108 billion, which is expected to be recorded in 2023 after the completion of the sales transaction. At the same time, a mansion on Blue Pool Road in Hong Kong will record sales revenue of HK$316 million after the transfer is completed in 2022. Property sales will record a total operating profit of HK$87 million in 2022.

The company expects that the rental property portfolio in the Mainland will achieve another record high, and the growth momentum is expected to continue. Hong Kong will benefit from the mainland’s optimized epidemic prevention and control policies and gradual customs clearance. The company’s rental property portfolio in Causeway Bay and Mong Kok and the Peak Plaza business will benefit the most, while overall consumer sentiment picks up, also benefiting its two community shopping malls, Kornhill Plaza in Hong Kong Island East and Amoy Plaza in Kowloon East Continue to bring stable income.

In 2022, Hang Lung Group’s total borrowings will be HK$45.953 billion (HK$45.883 billion on December 31, 2021), 28% of which will be denominated in RMB as a natural hedge for net investment in the Mainland. Hang Lung Group’s fixed-rate debt mainly includes medium-term notes and bank loans, which are converted into fixed-rate loans through interest rate swaps.

In addition, after Hang Lung Group redeemed a medium-term note worth US$500 million in June 2022, the ratio of fixed-rate debt to total debt fell to 38% on December 31, 2022.

Hang Lung Group’s net debt balance was HK$40.168 billion (HK$36.743 billion on December 31, 2021). The net debt-to-equity ratio was 25.9%, and the debt-to-equity ratio was 29.6%. The increase in net debt-to-equity ratio was mainly due to capital expenditures in the Mainland and Hong Kong. The average repayment period of Hang Lung Group’s overall debt portfolio is 3.1 years, and the repayment period of the debt portfolio is distributed over 10 years. About 71% of the loans need to be repaid after two years.

Excluding the balance of Hang Lung Properties, Hang Lung Group’s net cash balance is HK$127 million, and the undrawn balance of the standby bank’s committed credit amount is HK$3.415 billion.

media reports

interface interface surging news

related events

- Hang Lung Group: Last year, the income from the rental business in the Mainland increased slightly by 1%, and the income in the second half of the year increased by 8% compared with the first half of the year 2023-01-31

- SF REIT plummeted 16.47% on the first day of listing 2021-05-17

- Shenzhou Holdings’ net profit in 2020 will reach HK$613 million, a year-on-year increase of 103.1% 2021-03-31

- TCL Electronics’ revenue in 2020 will be HK$50.95 billion, and Internet business revenue will increase by 74% year -on-year 2021-03-25

- HKEx’s 2020 revenue and net profit hit record highs 2021-02-24

This article is transferred from: https://readhub.cn/topic/8n1u6s3VZtI

This site is only for collection, and the copyright belongs to the original author.