This paper is mainly divided into three parts, namely the global fertilizer supply and demand pattern, the recent overseas demand and domestic phosphate fertilizer production. Progressive layer by layer, the previous knowledge facilitates the understanding of the following content. This article is a learning post, and exchanges and corrections are welcome.

1. Global fertilizer supply and demand pattern

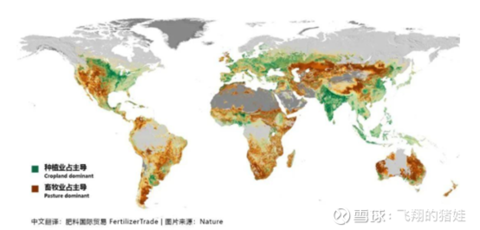

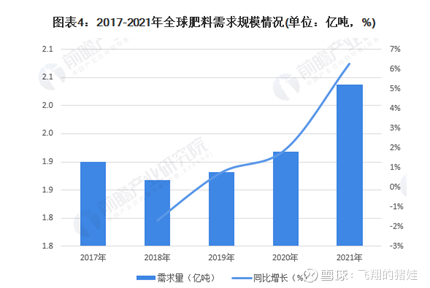

In 2021, the total global fertilizer consumption will be 203.8 million tons, a year-on-year increase of 6.3%. The world’s fertilizer production is mainly concentrated in Asia, North America and Europe. The three continents account for more than 90% of the total global fertilizer production, while Latin America, South Asia and other places are the net inflow areas of global fertilizers . People take food as their heaven. Since ancient times, human beings have relied on the management of land to produce food. Today, nearly one-third of the Earth’s land surface is used for agriculture.

Knowledge is popularized here. There is no low and peak season for global fertilizers. The main reason is that the climates of countries with different dimensions are quite different. The application period of phosphate fertilizer in China’s latitude is from April to May, the application period of phosphate fertilizer in Southeast Asia and South Asia is in November, and the application period of phosphate fertilizer in South America is in November. In September, why fertilizers must be exported The main demand for phosphate fertilizers is global. Only exports can ensure the full production of phosphate fertilizer companies and produce cheap fertilizers for global use.

1. The proportion of various types of fertilizers

According to IFA (International Fertilizer Association) data, global fertilizer consumption (N+P2O5+K2O) in 2021 will total 203.8 million tons, an increase of 6.3% over 2020, which is the largest increase in mineral fertilizers since 2010.

In terms of fertilizer types, the global demand for nitrogen (N) fertilizer in 2021 will account for about 55.8%, followed by phosphorus (P2O5) fertilizer and potassium (K2O) fertilizer, accounting for 24.4% and 19.8% respectively. Global fertilizer consumption in 2021 will increase by nearly 12 million tons compared to 2020. Among them, the demand for nitrogen fertilizer increased by 5.0% (5.5 million tons) over the previous year to 113.7 million tons; the demand for phosphate fertilizer increased by 6.8% (3.1 million tons) over the previous year to 49.7 million tons; the demand for potash fertilizer increased by 9.1% over the previous year (3.40 million tons) ton), to 40.4 million tonnes, with potash consumption growing particularly strongly after falling in 2018/19 (-0.9%) and stagnating in 2019/20 (-0.2%).

2. The supply and demand pattern of phosphate fertilizer

The main investment is in phosphorus chemical industry. The following will focus on the analysis of the supply and demand pattern of phosphate fertilizers. Others will be discussed later.

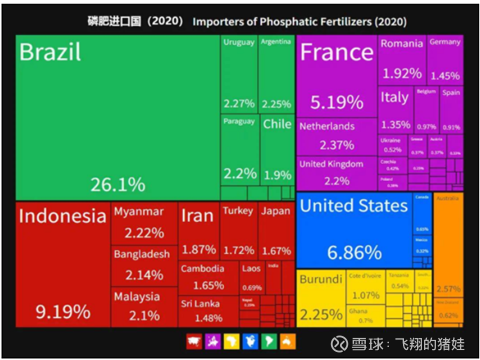

In 2020, the global trade volume of phosphate fertilizers is about 1.43 billion US dollars. The top ten importers of phosphate fertilizers in the world are Brazil, Indonesia, the United States, France, Australia, the Netherlands, Uruguay, Argentina, Burundi, and Myanmar.

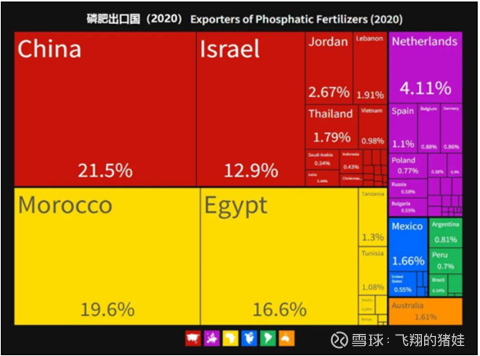

China and Morocco are the most important exporters of phosphate fertilizers. China is currently the world’s largest producer and exporter of phosphate fertilizers. Morocco has the world’s largest reserves of phosphate rock. The top ten exporters of phosphate fertilizers in the world are China, Morocco, Egypt, Israel, the Netherlands, Jordan, Thailand, Lebanon, Mexico and Australia.

From January to March 2022, the total domestic export of monoammonium phosphate was 202,300 tons, and the cumulative export value was 146.2698 million US dollars. The export volume decreased by 39.99% month-on-month and 65.57% year-on-year. In terms of exporting countries, the products are mainly exported to 35 countries or regions including Australia, Argentina, Brazil, India, Mexico, Japan, and Malaysia. Among them, 121,700 tons were exported to Australia, accounting for 64% of the total, followed by 20,000 tons to Argentina, accounting for 11% of the total; 17,600 tons to Brazil, accounting for 9% of the total. The export volume of other countries is less than 10,000 tons.

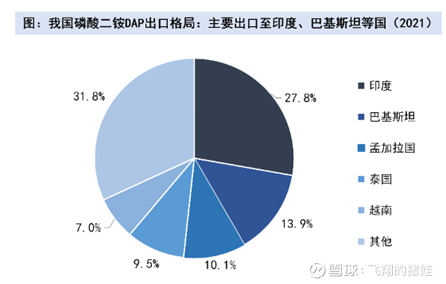

From January to March 2022, the export volume of diammonium phosphate was 742,700 tons, and the cumulative export value was 517,681,100 US dollars. The export volume decreased by 22.14% month-on-month and 19.1% year-on-year. In terms of exporting countries, the products are mainly exported to 22 countries or regions including India, Bangladesh, Thailand, Japan, Nepal, Australia and Vietnam. Among them, 189,500 tons were exported to India, accounting for 27% of the total, followed by 159,900 tons to Bangladesh, accounting for 22% of the total; 123,500 tons to Thailand, accounting for 17% of the total; exports to Japan 67,700 tons, accounting for 10% of the total; 37,700 tons were exported to Nepal, accounting for 5% of the total.

2. Recent overseas demand

It can be seen from the above analysis that my country’s diammonium exporters are Southeast Asia and South Asia. These regions are close to my country. Countries such as Laos and Vietnam can be transported by rail, and the transportation cost is low. The main application time of phosphate fertilizer in the countries in this region is November, and it has entered the fertilizer preparation period. Fertilizers are distributed layer by layer. It takes a lot of distributors and time to finally deliver fertilizers to each farmer. In Southeast Asia and South Asia, the procurement time has become later than in the past, and the time is relatively tight. Recently, India, Pakistan, Bangladesh and other countries have concentrated on purchasing DAP. It is very important to study the purchasing policies of these countries to judge the export of phosphate fertilizers.

As the world’s largest purchaser of diammonium, India used to have a lot of power to speak, but in this year’s period of shortage of fertilizers, he can only follow the market. At present, India’s offer is more than 970 US dollars / ton, that is, it will not be accepted, and it claims that the domestic inventory exceeds 3 million tons. But the market thinks that the third brother is bragging, his inventory is far lower than his rhetoric, and it is predicted that it will only be used near the summer. November is the peak period for fertilizer use in Southeast Asia and South Asia, accounting for more than 80% of the year. Next week, Pakistan and Bangladesh will purchase diammonium one after another. If the price exceeds US$1,000, India will also have to accept high-priced phosphate fertilizers. At present, the lowest domestic quotation is US$1,030, and the Moroccan Phosphate Fertilizer Company (OCP) directly quoted US$1,100 (there is only one fertilizer company in this country, and the quotation is more united, and many Chinese companies are bidding against each other). Therefore, India’s attempt to short phosphate fertilizers failed.

At present, Russia is vigorously promoting the export of phosphate fertilizers to Brazil, but all three export routes need to pass through Europe. Before being excluded from the swift system, the exported goods can be insured, and the detained swift system can communicate or compensate in full. After being eliminated now, Russia does not dare to export easily, and there is a greater policy risk.

3. Domestic phosphate fertilizer production

1. Raw materials

At present, the three major raw materials of phosphate fertilizer have risen sharply, which has led to the upside down of domestic phosphate fertilizer and the low operating rate.

The 30% grade of phosphate rock has reached 830 yuan / ton. It is said that the price would have to increase, and it will continue to increase by 50 yuan in June for fear of being guided. The increase in Guizhou is even more exaggerated, and it has exceeded 1,000 yuan. This year, due to the mine disaster, the upgrade of Kailin phosphate mine and the expansion of phosphorus chemical industry to purify phosphoric acid, this year’s phosphate rock is abnormally short, and the domestic phosphate rock grade continues to decline. Coupled with the scramble for new energy, the phosphate rock is easy to rise and hard to fall. To give you a few examples to let everyone feel the shortage of phosphate rock in Chengdu, the export of phosphate rock this year has changed from 7 million tons last year to 1 million tons this year; Yuntianhua does not sell phosphate rock to the outside world; The output of ammonium has changed from 180,000 tons/month in the past to 160,000 tons/month. Now it can be said that the man who owns the phosphate rock is the master. I have calculated that Yuntianhua does not need to produce chemical fertilizers. Selling all the phosphate rock will make a profit similar to the current one.

The arrival price of sulfur in Hong Kong is 470-520 US dollars, and the synthetic ammonia is also more than 5,000 yuan. Without considering financial expenses, the cost of monoammonium phosphate is 4,200 yuan/ton, and the cost of diammonium phosphate is 4,870 yuan/ton. It can be said that one ton of export production is a loss of one ton.

2. Legal inspection

At present, the domestic legal inspection is the card time but not the card amount. I am slowly understanding why the legal inspection is required. I think the reasons are as follows:

(1) Legal inspection has become a means of maintaining high export prices of chemical fertilizers. Recently, foreign phosphate fertilizers have a downward trend. The state directly issued an extension of legal inspections for 15 days, which directly raised the price of phosphate fertilizers and made India’s short-selling phosphate fertilizer attempts to explode.

(2) Most of the cost of chemical fertilizers, especially urea, is energy. The domestic coal and natural gas prices are regulated, which are much lower than those of foreign countries. If the export is liberalized, it is equivalent to the country’s export of energy at a low price in disguise, and at the same time, it will raise domestic inflation. would like to see.

(3) The legal inspection will not change in the past two years, but it will allow enterprises to export fertilizers in a single season in China, subsidizing the loss of domestic fertilizer enterprises in disguise.

Originally, exports in May should have been good, but the 15-day extension caused many fertilizers to be exported in June (no effect on profits in the second quarter). According to the judgment of experts, exports from June to September are relatively loose, and the performance of fertilizers in the second and third quarters is still worth looking forward to.

Summary: Yuntianhua’s second quarter is still very worth looking forward to. Not only is the export relaxed in the second quarter compared with the first quarter, but also the fertilizer price in the second quarter of last year is still low, and the year-on-year and month-on-month profits will increase.

Finally, I will leave an easter egg to tell you about the various strategies that chemical fertilizer companies have come up with and want to export more fertilizers. I have the opportunity to share them with you in the message area. ![]()

![]()

$Yuntianhua(SH600096)$ $Hubei Yihua(SZ000422)$ $Xingfa Group(SH600141)$ @Today’s topic

There are 17 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1334009554/220188112

This site is for inclusion only, and the copyright belongs to the original author.