Original link: https://blog.forecho.com/how-to-seize-the-rising-point-of-stocks.html

introduction

Today I mainly share with you a little trick I have in stock investment. This trick can help you grasp the starting point of the stock from the K-line chart, thereby increasing your investment income.

stock up sign

perfect bottom

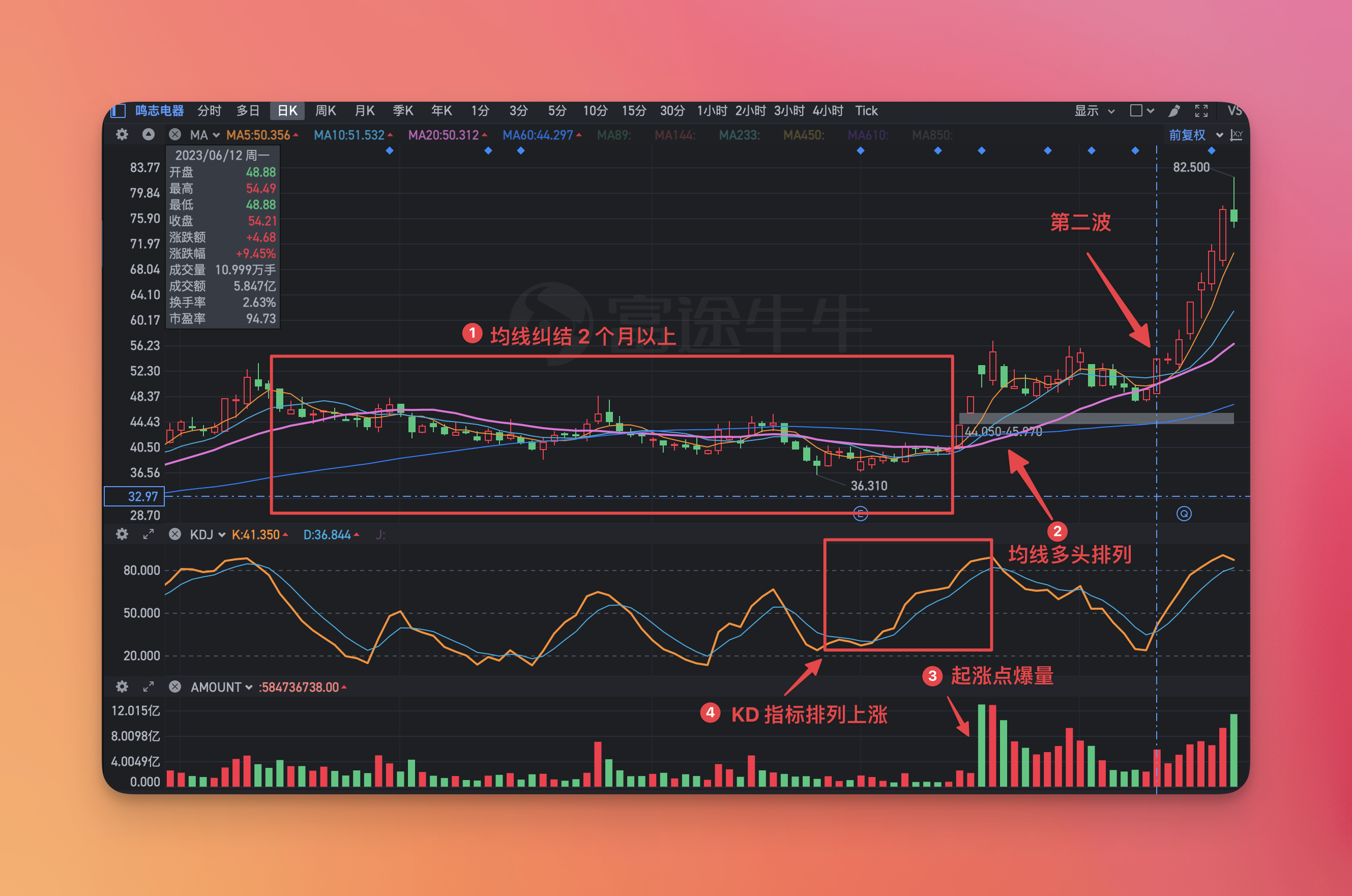

Perfect bottom, long-term consolidation, more than 2 months.

Long moving average arrangement

- 3 or 4 moving averages are arranged in long positions, and the long positions are arranged upwards.

- The short moving average must be above the long moving average.

- The moving averages look at the 5, 10, 20, and 60-day moving averages respectively.

Changhong K starts to rise and explode

- The red K rose with a sudden and long volume at the rising position, and the volume ratio was more than 2 times.

- KD golden cross or long arrangement.

KD indicator divergence

The divergence here means that the KD indicator is opposite to the trend of the stock price. The stock price is sideways, but the KD indicator is rising. In this case, you can buy.

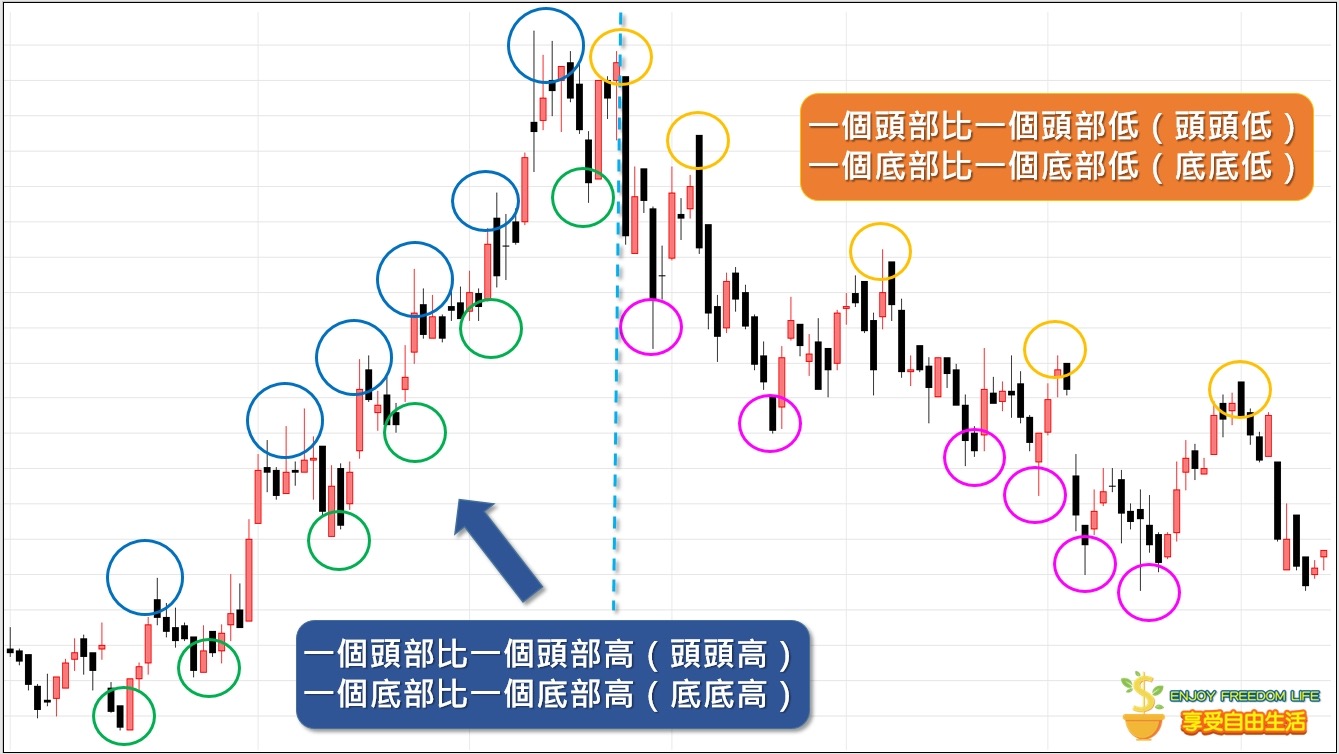

head high bottom bottom high

- Head high means that on the K-line chart of the stock price, the high point of the stock price is gradually rising.

- Bottom high means that on the K-line chart of the stock price, the low point of the stock price gradually rises.

don’t chase signal

The third wave of market

The rise of the third wave of market can be chased, but if it has risen for more than 3 days, don’t chase it, it is more dangerous. Sell when the third wave falls below MA5, and the third wave can only be short-term.

High explosive volume

Regardless of the first wave of the market, you can chase the explosive volume at the bottom, but don’t chase the explosive volume at the high position, which is more dangerous. The explosion volume here refers to the volume ratio of more than 2 times.

There is no long-term arrangement on the monthly line

The MA20 moving average at the bottom is not arranged by long positions, and if the stock price is lower than MA20, do not buy.

at last

Don’t rush in if you don’t catch the rising point, wait for the second wave, the second wave is usually bigger than the first wave, and the characteristics of the rising wave are the same as the first wave. In addition, if you rush in:

- Be sure to set a good stop loss, it is best not to let your loss exceed 5%

- The rising point must be the red K, and it cannot be driven high and low

- A skyrocketing rise must also be a red K, and it cannot be a high-volume explosion. The stock price must explode at a low level to be safe

- Don’t buy if the stock price is lower than MA60. If you are conservative, don’t buy if the stock price is lower than MA20.

This article is transferred from: https://blog.forecho.com/how-to-seize-the-rising-point-of-stocks.html

This site is only for collection, and the copyright belongs to the original author.