Autoplay

Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Zhichao Xiaokui

Source: slightly larger reference (ID: hyzibenlun)

JD Logistics has identified several major trends: the sinking of e-commerce, the gradual improvement of transportation infrastructure to improve logistics efficiency, and the demand for logistics specialization and integrated services brought by industrial segmentation.

In history, no company’s success has been separated from “fortune”, but when this factor falls in the logistics industry with supporting facilities and even infrastructure attributes, it will be particularly significant.

In the 1990s, the traditional economic growth in the United States slowed down, and the logistics industry began to pursue cost reduction and efficiency improvement, squeezing profits. At this time, UPS and DHL launched more cost-effective third-party logistics services and quickly won the market. The rise of Nippon Express from the 1970s to the 1990s was based on the fact that Japan replaced the United States as the new high-end manufacturing center in the world, and the rapidly developing automobile industry brought new logistics demands.

The commonality of these world-leading logistics companies is that they have accurately grasped the changes in market demand during the critical social and economic transformation stage, thereby establishing market positioning.

JD Logistics is replicating these stories. From independence in 2017, Liu Qiangdong established for it that “the income from JD.com must be less than half within five years”, to the clear development of the integrated supply chain and the implementation of the decoupling strategy, it has bet on several major trends: electricity Business sinks, transportation infrastructure is gradually improved, logistics efficiency is improved, and industry segmentation brings logistics specialization and integrated service needs.

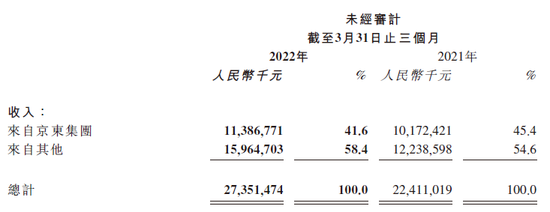

Reflected in the recently released financial report for the first quarter of 2022, it is the growth of several key figures: the proportion of revenue from external customers has increased to 58.4%, the proportion of revenue from integrated supply chain customers has increased to 65.5%, and, in logistics Against the background of the overall decline in the industry’s growth rate, JD Logistics achieved a year-on-year growth of 22%.

How did the growth happen? Besides “fortune”, what else did JD Logistics do right?

01

increase

The logistics industry is facing one of its biggest challenges in recent years.

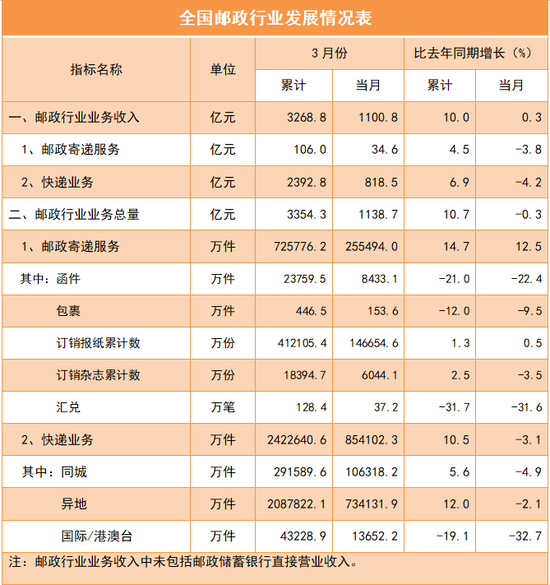

Data from the State Post Bureau shows that in the first quarter, the total business volume and business income of the postal industry were 335.43 billion yuan and 326.88 billion yuan, up 10.7% and 10.0% year-on-year respectively. In the last quarter, the year-on-year growth of these two indicators was 25% and 16.9% respectively, and the growth rate slowed down significantly. In addition, affected by the epidemic, the national express delivery business volume fell by more than 10% in April, and the business volume of SF Express and the “Tongda Department” both experienced a 5%-20% decline.

However, the growth rate of JD Logistics is still higher than that of the industry. According to the financial report data released on May 17, the revenue of Jingdong Logistics in the first quarter was 27.35 billion yuan, a year-on-year increase of 22%.

Among them, it is worth noting that the revenue of integrated supply chain customers increased by 16.2% year-on-year to 17.9 billion yuan, accounting for 65.5%.

Integrated supply chain logistics services have become the core competitiveness of JD Logistics. With the logistics infrastructure all over the country, six subdivided logistics networks have been established, coupled with the “trinity” supply chain technology of software, hardware and system integration, and the business insights accumulated by long-term service industry customers, JD Logistics can provide Customers provide solutions covering the entire supply chain process.

At present, the integrated supply chain of JD Logistics has withstood the test of the epidemic. Due to the strategy of “replacing warehouses with storage” and the flexibility of warehousing, JD Logistics has a higher ability to resist risks and is relatively less affected by special circumstances such as the epidemic. A large number of customers choose to cooperate with JD Logistics. Since March, JD Logistics has The business volume of the East China Branch of Logistics has reached several times the usual amount.

While the effect of “increasing efficiency” is remarkable, JD Logistics has not “reduced costs”. Employee benefits and salary expenses are the largest cost source of JD Logistics. In the first quarter, the expenses were 10 billion yuan, a year-on-year increase of 10.8%.

Jingdong Logistics is still expanding its layout in the future. In the first quarter, R&D spending increased by 9.4% year-on-year to 740 million yuan. The layout of logistics infrastructure is also still in progress. As of the end of March, JD Logistics operates about 1,400 warehouses with a total management area of more than 25 million square meters.

In March of this year, Jingdong Logistics acquired 66.49% of Debon Logistics for 8.976 billion yuan. The intention of this move is obviously to continue to make up for shortcomings and expand advantages in the logistics network.

In addition, JD Logistics has made frequent moves overseas. The “14th Five-Year” E-commerce Development Plan pointed out that by 2025, the cross-border e-commerce transaction volume will reach 2.5 trillion yuan, an increase of 47.93% compared with 1.69 trillion yuan in 2020.

The turnaround in the second half of 2021 has proved the profitability of JD Logistics, but from the perspective of JD Logistics’ investment layout, short-term profitability is obviously not the focus of its pursuit.

02

big test

Before the outbreak of the epidemic this year, “reducing costs and increasing efficiency” became an important proposition in the logistics industry.

Compared with the United States, China’s logistics cost rate has always been high. In 2019, my country’s freight volume per unit of GDP was 3.7 tons per thousand US dollars, four times that of the United States in the same period. This is because, on the one hand, my country’s primary and secondary industries account for a relatively high proportion of GDP, while the United States’ tertiary industry accounts for a higher proportion. On the other hand, the overall efficiency of the domestic logistics industry is low. In 2019, China’s The logistics cost rate is nearly double that of the United States.

Some data show that every point reduction in my country’s logistics cost rate can save about 1 trillion in costs for the society.

The integrated supply chain service of JD Logistics is in line with the industry trend of “cost reduction and efficiency improvement”. Xu Lei, CEO of Jingdong Group, mentioned in the first quarter financial report meeting: “The complex and severe epidemic prevention and control situation has caused many companies to re-examine their sales and supply chain performance systems, and more and more companies are aware of the integrated supply chain. The irreplaceable and important value of logistics services. This further promoted the revenue of JD Logistics’ external customers to continue to maintain rapid growth in the first quarter and reached a record high.”

In the first quarter, the number of integrated supply chain customers and unit customer revenue both increased, the number of customers increased from 49,000 to 59,000, and the average revenue per customer reached 110,000 yuan. JD Logistics revealed that during the first quarter, JD Logistics further deepened the scope of cooperation with many leading customers in the industry, such as Muji and Yunmi Technology.

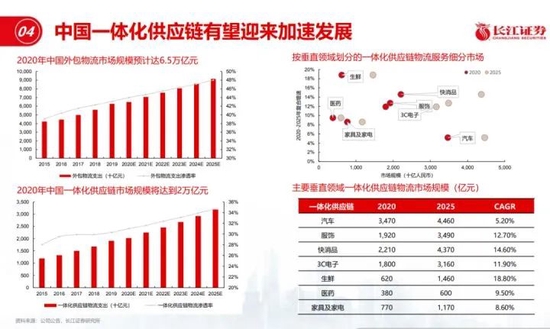

CIC data shows that in 2020, the market size of China’s integrated supply chain logistics service industry will reach 2 trillion yuan, and it is expected to further increase to 3.2 trillion yuan by 2025, with a compound annual growth rate of 9.5%. An integrated supply chain is the future trend, and the epidemic will undoubtedly accelerate this trend.

Falling into specific business cases, the advantages of the integrated supply chain model become a more direct user experience.

“Look at my order, the walnuts haven’t been delivered for half a month, the sausages have been stuck in Shandong for a week, and the beef jerky seller has refunded me directly.” Xiaoyu, an online shopping expert living in Beijing’s Chaoyang District, complained to his family that he has been affected since the end of April. Due to the impact of the epidemic, she has had nearly 10 orders that have not been delivered successfully. The few express deliveries were delivered by SF Express and JD.com.

Since March this year, cities such as Shanghai and Beijing have encountered a new round of epidemic challenges, and the national express delivery network has been forced to “decelerate”. Data from the State Post Bureau shows that in the first quarter, domestic express delivery slowed down by an average of 2.78 hours. However, JD Logistics still maintains a good distribution efficiency in most regions.

Adventurers are keen to look for opportunities amid uncertainty, but for companies, certainty is the basic premise of business development and the key point that needs to be guaranteed.

In Shanghai, after Longrich’s warehouse was blocked in March, JD Logistics opened its warehouses in Hangzhou and Wuxi, and delivered 200,000 orders within 3 days, providing timely relief. During the subsequent period of the epidemic, Longrich also maintained a daily shipment volume of 7,000-8,000 to minimize the impact of the epidemic.

In addition, in the complicated epidemic situation, JD Logistics has flexibly innovated the delivery method of materials in addition to the “basic package” according to actual needs. For example, the “Jiuxianqiao” model, that is, after the community is closed and managed, JD Logistics cooperates with relevant streets and communities to complete the last 100 meters of material security through the “short-distance connection + volunteer service” model. This model has now been replicated in many communities across the country.

When the “infrastructure” centered on the integrated supply chain becomes more mature, more imaginations that follow will become possible.

For example, seize the opportunity of the rise of more industries.

In the history of the development of the logistics industry, there are many such successful cases of “following the trend”. The rise of Nippon Express is inseparable from the development of the Japanese automobile industry. It has created a circular pickup service model, which has greatly improved the supply efficiency of production in the automobile industry. Later, when Nippon Express became the leading logistics company with “everything,” automobile transportation accounted for nearly 50% of its business.

JD Logistics is also extending its reach to the automotive industry where supply chain management is extremely difficult. In January this year, it reached a cooperation with Volvo Cars. Based on the infrastructure and technology accumulation of warehousing and logistics, it upgraded Volvo’s after-sales supply chain network and improved the overall synergy efficiency. In addition, according to the different consumption frequencies of different accessories, JD Logistics also customized the front fast-flow warehouse, fast-medium-flow warehouse and slow-flow warehouse for Volvo to meet different replenishment needs.

The number of SKUs involved in automotive logistics is numerous and the unit value is relatively high, forming a higher threshold for warehousing logistics. However, with the gradual penetration of new energy vehicles in China, the accompanying logistics demand will continue to increase. Most of the new energy startups with limited energy will choose third-party logistics services.

Obviously, the transformation and upgrading of national industries represented by the automobile manufacturing industry may bring a new pattern to the logistics industry.

03

stock and increment

As early as 2017, Liu Qiangdong proposed a goal: JD Logistics’ revenue from JD Group must be less than half within five years. This vision has been realized ahead of schedule in 2021. By the first quarter of 2022, the proportion of revenue from external customers of JD Logistics will further increase, reaching 58.4%, with 59,000 external integrated supply chain customers.

While improving its own capabilities, finding more external customers is obviously the focus of JD Logistics at this stage. Compared with the mature leading enterprises, the mid-waist enterprises in various industries lack a modern supply chain management system, and the demand for third-party logistics is also stronger.

Especially under the influence of uncertain factors such as the epidemic, more and more companies realize the importance and irreplaceability of the supply chain.

A more agile and cost-effective supply chain logistics solution has also become an urgent need for more enterprises. JD Logistics has launched a decoupling strategy since last year, that is, dismantling its own capabilities into modules and assembling them like building blocks to adapt to different needs. Compared with a completely personalized solution, the cost of decoupling is low and it has a reproducible foundation. Up to now, there are middle-waist customers in 8 sub-sectors, including beverages, snack food, and mother and baby, which have become the key service targets of the decoupling strategy.

Successful examples are often the best “endorsements” for companies to enter new fields. While deepening cooperation with existing users and further expanding the scope and content of cooperation, JD Logistics is also actively exploring incremental users to serve more industry customers.

In March this year, Huiyuan Group reached a cooperation with JD Logistics, which reduced costs by at least 20% through the decoupling of standardized products and personalized services. In addition, by reducing the number of transshipment and unloading through the national sub-warehouse model, the breakage rate of Huiyuan products has been reduced by 90%, and the proportion of one-day and next-day deliveries has increased by 80%.

Some newer integration methods are put into practice. For example, the “one-package” model, that is, no matter which channel consumers buy goods from, they can be aggregated into the supply chain system, and delivered to consumers through the integration of warehouse and distribution.

In addition to the changes in the above figures, more indirect improvements are taking place, such as customer service pressure.

Usually, damaged goods will directly increase the workload of customer service, and even lead to negative comments from users. Especially in relatively emerging e-commerce platforms such as Xiaohongshu, Douyin, and Kuaishou, user evaluations will directly affect store ratings. Generally speaking, store rating consists of three dimensions: product experience, after-sales experience, and customer service experience. Most of the products Huiyuan sells are standard products, and the first item is not a big problem. So in the final analysis, the core of this score is logistics.

In fact, Huiyuan has launched a cloud warehouse test at the end of 2020, but the efficiency improvement is extremely limited. Especially when it comes to the New Year’s Day and the 618 promotion, 10 factories have to split up to find different express delivery, and the communication cost is high.

In addition, when consumer brands enter the live broadcast room, JD Logistics will also become a bonus item. According to Huiyuan staff, users in its official live broadcast room generally have a mentality, “When he knows that Huiyuan’s juice is delivered by JD.com and delivered to his door, this must be an important decision-making factor that prompts him to place an order.”

Word of mouth is the most valuable intangible asset of an enterprise, and it needs to be accumulated over the years. But it is one of the strongest moats in business competition, and it will also be the high-efficiency fuel needed for growth.

Back to JD Logistics, when the test questions it got changed from “independence” to “continuous growth”, embracing the broader business world requires not only technical accumulation and service system as hard power, but also social value and word of mouth as soft power , the two form a dual engine, and one is indispensable.

Today, JD Logistics is also contributing its own strength in richer scenarios. For example, helping once poor counties achieve business growth.

Pingyi County, Shandong Province has excellent resources such as honeysuckle, yellow peach, and stone. However, due to the high logistics cost and weak distribution system, the industry’s profitability is not strong. In 2020, Pingyi County reached a strategic cooperation with JD Logistics, which reduced logistics costs by more than 50% through the digital and intelligent supply chain infrastructure built locally. That year, Pingyi County rose from 99th to 23rd in the national online retail list of agricultural products.

With the continuous expansion and deepening of the business territory, JD Logistics will also reach more new fields. Continued growth is inseparable from continued opening up. And past accumulation is the most reliable cornerstone of growth. At the historical node of industrial digital transformation, the stability and improvement of supply chain capabilities will determine the appearance of the new competitive landscape and the ranking of the winners.

The code of victory will always be revealed in time.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-05-21/doc-imizirau3963276.shtml

This site is for inclusion only, and the copyright belongs to the original author.