I have been reflecting on it recently. Why did I talk about infrastructure construction for so long this year, and the building materials sector has not started? (Building materials include cement, glass, gypsum board, waterproofing, hardware, etc.), but some local construction companies, such as Zhejiang Construction Investment, Anhui Construction Engineering, Sichuan Road and Bridge, have increased greatly. In addition, national construction companies, such as China Construction , China Railway, China Railway Construction, etc., the increase is not much this year, is this year, although the infrastructure has been stimulated, but the actual landing volume is not enough, the performance is not very eye-catching?

Is it possible to increase in the future? Possibly, because of the special debt.

First of all, what is a special bond? The following data is taken from Xinda Securities. If there is any infringement, please contact.

To introduce: special bonds are a type of bonds, which are equivalent to issuing government bonds. The interest is higher than that of bank deposits, and it is safer. Banks are willing to buy them as wealth management products, and people are also willing to invest in wealth management products. It is equivalent to the government borrowing national money, borrowing money from banks, but not spending money in society. The government borrows and spends it, invests in infrastructure, stimulates economic development, and obtains more tax revenue. The difference between special bonds and ordinary bonds is that they have special projects. to invest)

Why so much focus on special bonds this year? It’s because of the loosening of control and control of the epidemic abroad and the increase in resumption of work and production, which naturally affects our exports, not to mention consumption. There are a lot of stories of companies going bankrupt and shops being transferred. Then only the government will spend the money to make a big deal.

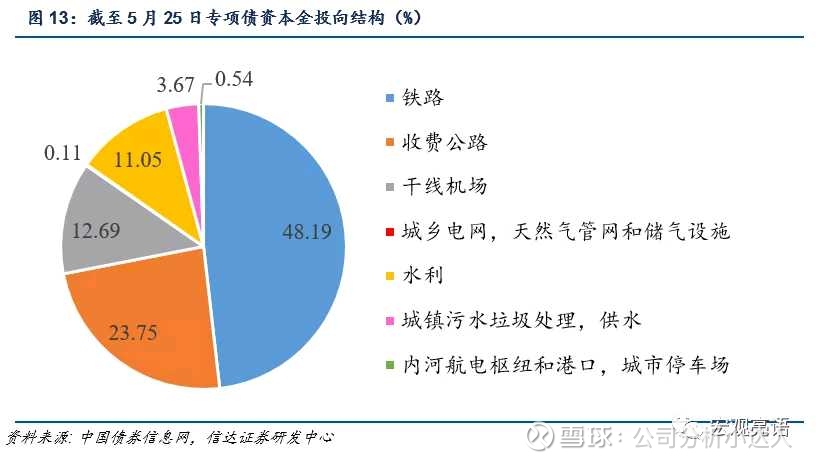

You can look at the expenditure structure of special bonds:

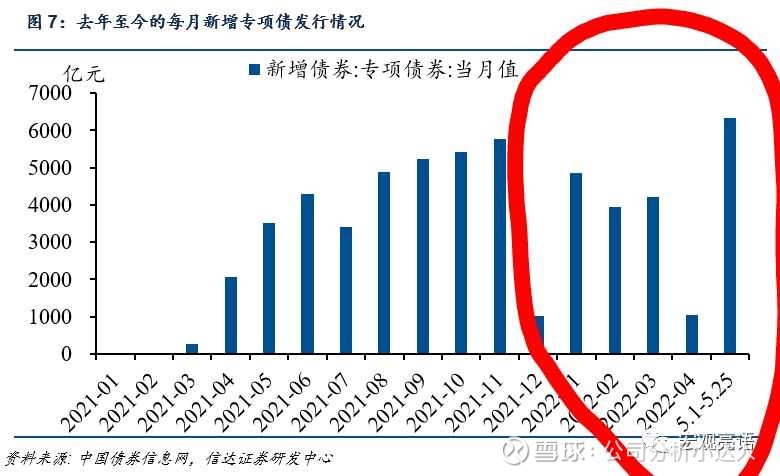

So let’s take a look, what is the size of this year’s special debt?

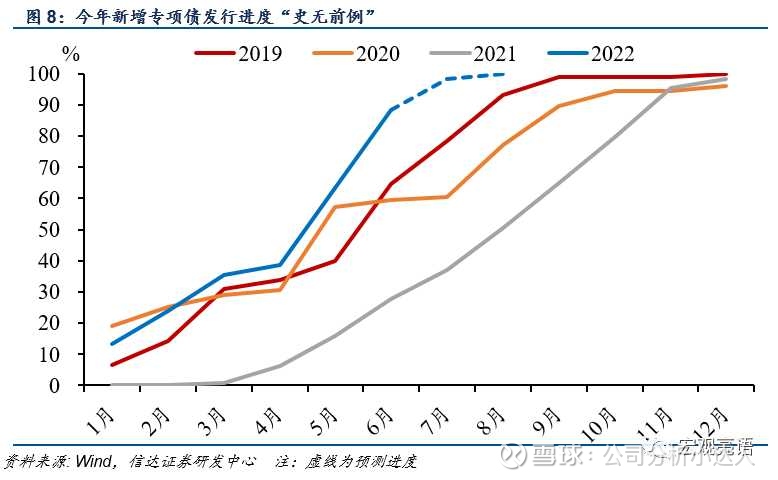

It can be seen that the issuance of bonds this year is pre-emptive, and the scale of issuance is large. Also, some of the ones posted last year were useless and carried over to this year, so the scale is not small.

Combining with the national requirements that the issuance of special bonds this year will be completed by the end of June and will be basically used by the end of August, it can be expected that the growth rate of fixed assets will be very fast in June, July and August, especially in August.

Although the scale from November last year to March this year was not small, and the time lag of about one month from the issuance of special bonds to the landing of investment, the expenditure in the first half of the year was affected by the Spring Festival in February and the large-scale epidemic in March 4.5. Traffic is regulated, and projects across the country are operating at a low rate, so the hope is postponed until the third quarter.

The main line of logic is as follows:

1. Policy (the central government clearly supports the appropriate development of advanced infrastructure investment)

2. Banks release water (cut interest rates, lower interest rates, open the floodgates)

3. The order has been placed (observing various construction companies, the order situation is relatively good)

4. Cement demand rises, steel consumption rises, asphalt consumption rises, and the inventory of these raw materials decreases (representing an increase in operating rate)

5. Waterproofing began to be used, pipes and other building materials began to be used

6. Gypsum board, glass started to be used (representing completion)

At present, 1.2.3 has been satisfied, and 4 has not moved, so 1.2.3 is relatively stable at present, but 4.5.6 is still oscillating sideways and has a continuous downward trend.

But will 4.5.6 come? That’s for sure, demand will only be delayed, not lost.

$Beixin Building Materials(SZ000786)$ $Oriental Yuhong(SZ002271)$ $Weixing New Materials(SZ002372)$

This topic has 7 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7308280666/221247494

This site is for inclusion only, and the copyright belongs to the original author.