First Release: Minxing Investment

After a period of decline, the bubble of pig farming has gradually been squeezed, so today I will post the review data from 2 months ago.

This round of pig cycle seems a little out of place in the face of the sluggish market. Today, we will continue with the previous introductory article, and then review the situation of the pig cycle and market trends.

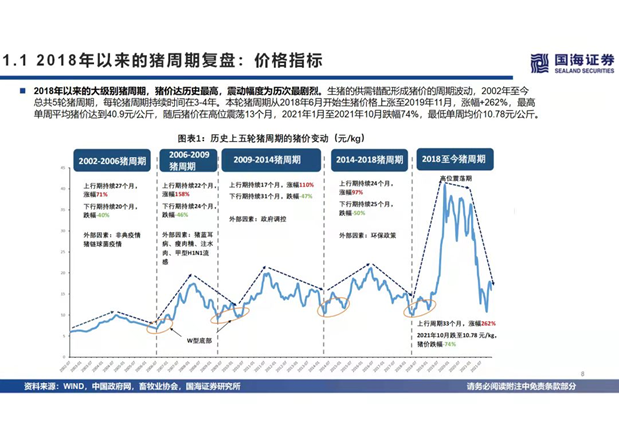

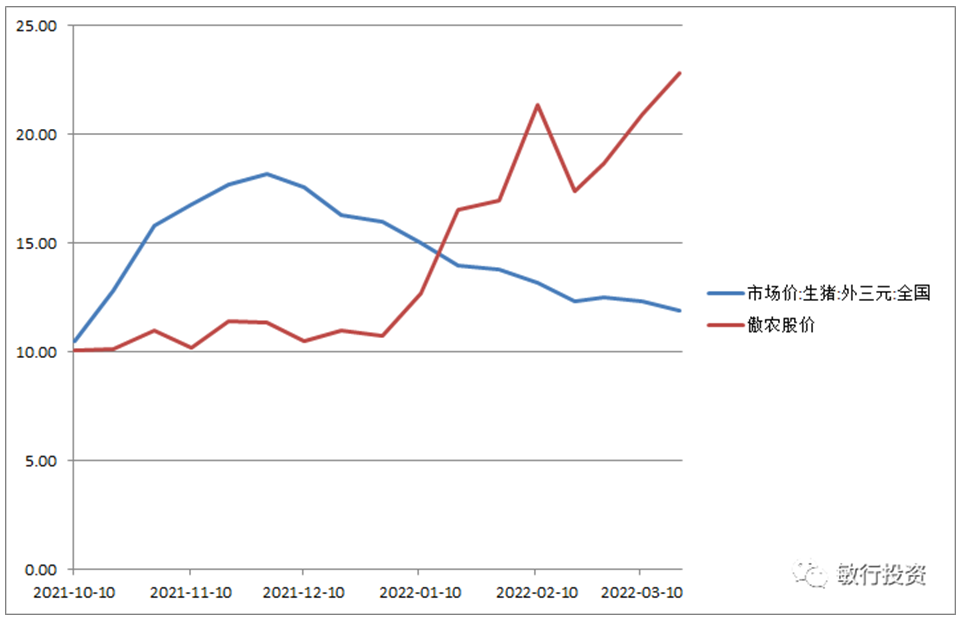

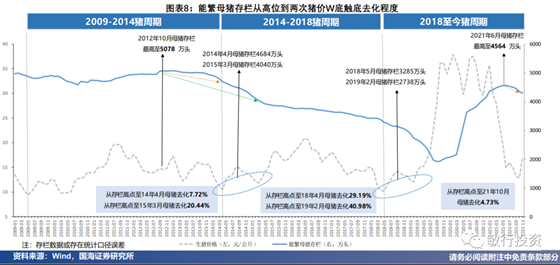

Let’s first look at the price chart of several rounds of pig cycles

Let’s take a look at the trend of pig prices and stock prices

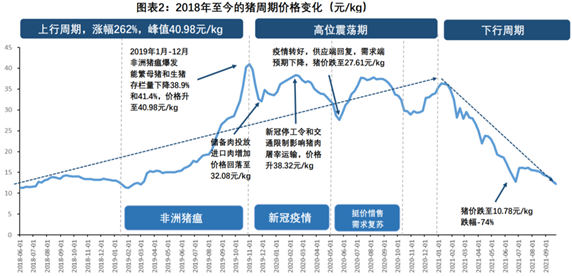

1. 2018-present pig cycle

Source: wind, compiled by Guohai Securities

The price is the most obvious performance in the pig cycle. If it is more scientific, it should be to look at the ratio of pig to grain, because the fluctuation of grain price is also very large, and these details will not be considered for the time being. From this picture, we can see that the price of pigs bottomed out for the first time on June 1, 2018, and then began to rise slowly, and then began to decline slowly. On February 1, 2019, the price of pigs began to bottom out for the second time, and then began to rise. , 2021-1-1 peaked and began to fall, 2021-7-1 began to bottom and began to rise slightly, and then fell all the way. Make a form like this

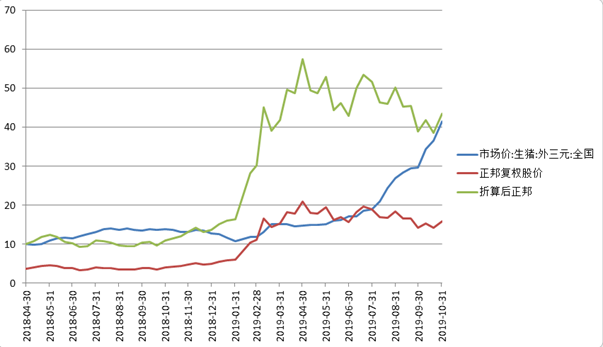

1.1 Zhengbang Technology

Then I made such a picture for Zhengbang Technology

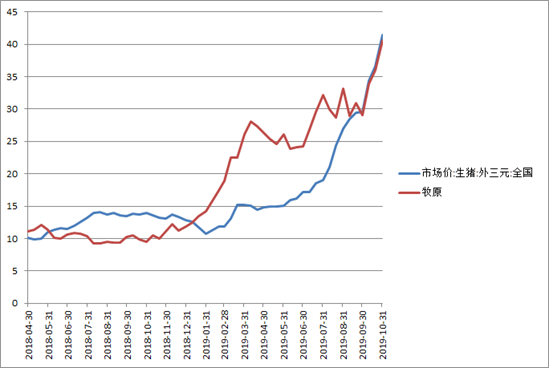

Time span: 2018-4-30~2019-10-31 pig price low to high trend ( 18 months )

Comparison description: The blue line is the price of live pigs, and the starting price is 10.10 yuan/kg

The red line is the stock price trend of Zhengbang, the starting price is 3.70 yuan

The green line is mainly a contrast line set to be the same as the starting point of the pig

That means you only have to look at the blue and green lines.

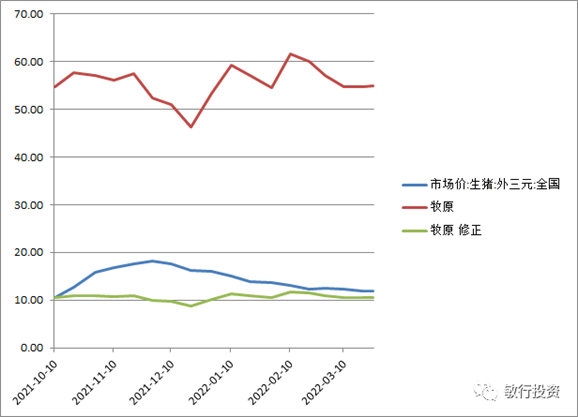

1.2 Muyuan Shares

Arrangement: Minhang Investment

2. Pig cycle from 2014 to 2018

2.1 Muyuan

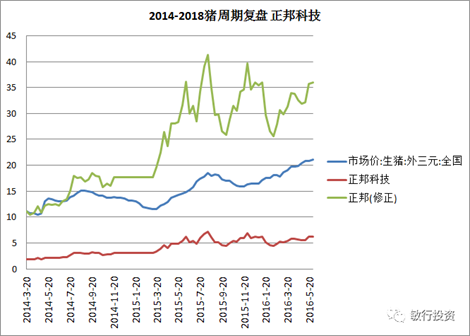

2.2 Zhengbang Technology

Summary: The two companies have similar growth rates, but the ASF cycle has similar growth rates. However, it should be noted that before May 2015, these small and medium-sized stocks happened to be in a big bull market. It is very likely that this bull market overdrafted the gains. , so when the pig price broke through the previous high in the second stage, the pig stock price did not break through the previous high.

3. Pig cycle from 2021 to present

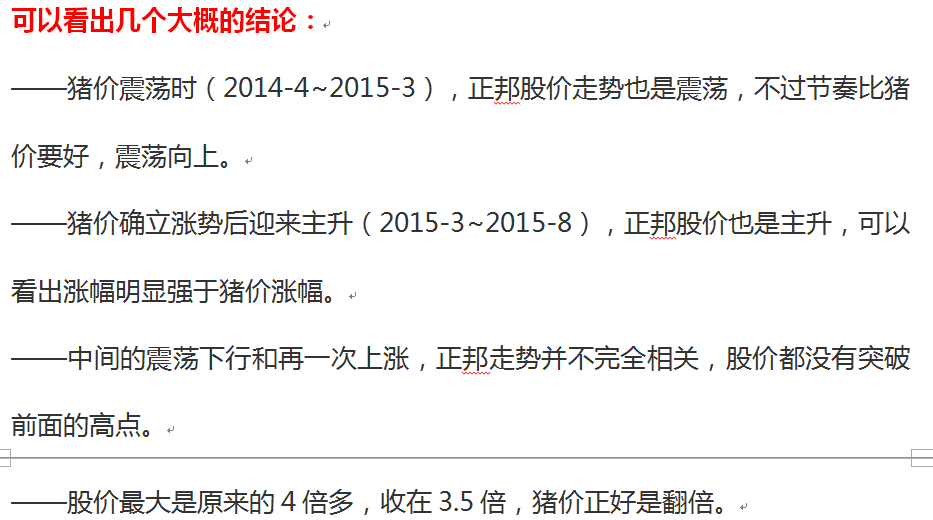

3.1 Aonong Bio

The above stock price data is as of the close of 22-3-25.

3.2 Muyuan Shares

The above stock price data is as of the close of 22-3-25.

Summary: This trend is a bit confusing. This round of Muyuan basically did not move, and Aonong was close to 2.3 times the original.

4. Conclusion

The pig cycle is in addition to the bottom starting point of the cycle and the price of pigs. For listed companies, if they need to exceed the amount, they need to increase the slaughter volume, which will increase one latitude. The above review does not consider the impact of the increase in the slaughter volume on the stock price.

In addition, the situation of each round of the pig cycle is different. For example, the huge gap brought about by the previous super cycle has brought historically high prices. Will the accumulated capital cost cause these farmers to have stronger capital to resist the down cycle?

We will continue to observe how this and previous pig cycles will play out.

This topic has 10 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7580740929/221275853

This site is for inclusion only, and the copyright belongs to the original author.