At Berkshire Hathaway’s shareholder meeting, Buffett once again expressed his dissatisfaction with inflation, which he said deceived everyone.

But in fact, most people’s cognition of inflation is relatively superficial. Inflation has a huge negative impact on our personal wealth. It can be said that inflation is the biggest obstacle to our road to financial freedom!

Next, I will calculate a few accounts for you, and you will understand why. After reading it, you will be jaw-dropping.

1. Those who receive retirement wages are the saddest

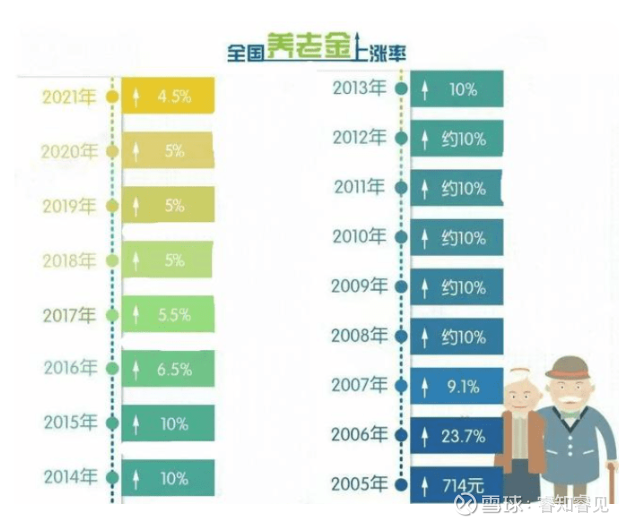

In the early years, the annual growth rate of pensions was about 10%.

Honestly, this is pretty impressive. After 7 years, wages can double.

But what about 2021? Only 4.5%! That means it takes 16 years to double.

Only 4% this year!

Suppose an old man retires at the age of 60, the average retirement salary is 3,300 yuan, and the average age is 77 years old. Then the old man will only double at most in the remaining days.

Please note that the growth rate of retirement wages will definitely be lower than 4% in the future, so an old man may not see his pension doubled until he dies.

Do you think this is over?

Assuming the CPI is 2%, this means that the real growth rate of pensions is only 2.5% (calculated at 4.5%), which means that it will take 29 years for pensions to double! If the nominal growth rate of pensions continues to decline, it is estimated that we will not see the day when real retirement wages double.

However, it seems that it only takes a few years for a bun to double.

Recognizing that retirement life is so sad, we realize how important it is to learn to invest and manage money at a young age! Because by the time our generation of young people retire, pensions cannot be counted on.

2. How does inflation deceive you?

When our income has a balance, we will definitely invest the money in financial management. And I hope that one day I can achieve financial freedom through investment and financial management, but do you know how difficult it is?

As investors, we must understand that we will face two risks that cannot be eliminated, one is market risk and the other is inflation risk.

The so-called market risk is the volatility of prices, and the inflation risk is the risk of property devaluation that we rarely feel, but is eroding our wealth all the time.

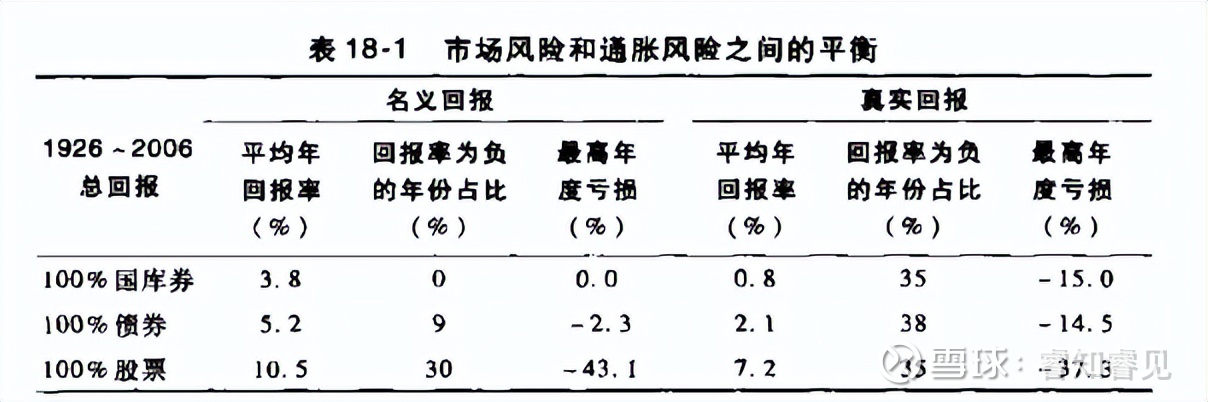

I found a set of data, which is a comparison table of the impact of these two risks on investment returns during the 80 years from 1926 to 2006 in the United States.

The first three columns are the nominal returns for the three assets, and you can see that the detailed returns for stocks are 3 times that of Treasury bills and 2 times that of bonds.

But don’t be fooled by the nominal rate of return.

Real returns, adjusted for inflation, are just 0.8% for Treasury bills, 2.1% for bonds and 7.2% for stocks.

That is, if you look at real returns, stocks are 10 times more than Treasury bills and 3.5 times more than bonds! Investing in stocks can double assets in 10 years, while investing in Treasury bills takes 90 years to double, and investing in bonds takes 35 years to double.

Have you been intimidated? I believe you will now feel that the bank’s 3% deposit interest rate is simply a robbery!

Therefore, whether you like it or not, you must learn to invest in equity, otherwise you will definitely suffer the loss of property certainty.

Besides, do you think it is absolutely safe to put your money in the bank or buy government bonds?

If you only invest in treasury bills, and there is no one-year nominal return loss in 80 years, stocks will lose money for 30 years, and the maximum loss will reach 43.1%. Most people feel that the stock is so dangerous when they see it!

But if you look at the actual rate of return, investing in treasury bills has a 35-year loss, with a maximum loss of 15%, while stocks also have a 35-year loss, with a maximum loss of 37.3%.

If you compare it like this, you will find out how ridiculous it is to buy government bonds and save in banks. You think you have no losses, but in fact you are losing nearly half of the time, which is no better than investing in stocks.

In China, the vast majority of people don’t invest much in stocks, but only like to save money. At most, they buy some bank financing. Are you saying this leads to financial freedom?

Of course it is impossible! To achieve financial freedom, you must learn how to invest in equity assets.

From the above discussion, we can also draw a conclusion:

The market risk of stocks, that is, the volatility of stock prices, is actually not a risk at all from a long-term perspective. The long-term nominal annualized return on the stock market is around 10%! The premise is that you have nothing to do with the band.

Inflation risk is a real risk that will shrink your assets every year!

This is not the end, even if you just want to store value, it is absolutely impossible to save in a bank.

3. How were households with ten thousand yuan eliminated?

We know that in the 1980s, households with 10,000 yuan were quite remarkable, at least they were worth a few million now.

But after the 1990s, no one mentioned ten thousand yuan households again. How were they eliminated?

Let’s look at inflation rates in the late 1980s and early 1990s.

From 1985 to 1995, the inflation rate was high. In the past 10 years, if you only hold cash, 10,000 yuan will only be left with 2,394 yuan, which has shrunk by nearly 80%!

So, in an environment of high inflation, our wealth will be looted!

And will there be a sudden outbreak of high inflation for several years in the future?

do not know! But it’s definitely possible.

During the same period, our Shanghai Composite Index rose from 100 points in 1991 to 555 points in 1995, an increase of 5.5 times in five years. The annualized rate of return is 41%!

So many times, people always follow what others say, and stay away from the stock market when inflation comes. It’s all mindless following.

Whether inflation will affect the stock market in the long run depends on two aspects:

1. Intensity and duration.

2. The valuation level of the stock market. Inflation has a strong lethal force on stocks with high valuations. For example, this year’s hottest is like this.

These 10,000-million-dollar households were a sight to behold at that time. But in the face of inflation, they are just children.

These people who seemed to have achieved financial freedom at the time were actually wiped out by inflation!

4. Summary: How to plan for financial freedom?

Achieving financial freedom is everyone’s dream.

But when we formulate financial freedom plans, we must fully take into account the impact of inflation.

For example, why do I not recommend that you invest in U.S. stocks this year?

First, the valuation is too high, and the nominal expected return is negative;

Second, inflation is too high, and the actual expected return will be reduced by another 6%!

Those who didn’t listen to the advice, probably regret it now. At the beginning of the year, I was beaten up by A shares, and then I switched to buy US stocks and continued to be beaten up.

There are a few key points to keep in mind when planning for financial freedom:

1. Your ROI must deduct the effects of inflation (including taxes);

After adjusting for inflation, long-term real returns for stocks and bonds are around 7% and 2%, respectively. But bond yields will keep getting lower and lower.

Real estate is about 5%. If you consider loan interest and depreciation, investing in real estate now is a loss of money.

Gold and commodities have negligible returns over the long term, and their primary role is to reduce portfolio volatility.

2. The money that will not be used for 10 years must be invested in stocks; the money that will not be used for 5 years can be invested through a portfolio of stocks and bonds; the money that will not be used in the short term can only be invested in monetary funds or bank deposits.

3. The amount withdrawn from the investment portfolio every year should not exceed 4% of the total amount, otherwise your investment portfolio will not be able to increase in value and maintain its value.

4. Make an investment plan based on your principal, income, expenses, investment time and inflation rate, otherwise you cannot achieve financial freedom. (Most people don’t have a plan)

In short, inflation is a hurdle that we cannot overcome to achieve financial freedom, and must be seriously considered!

Reward is voluntary, 1 cent is silent support, haha!

There are 45 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1843761023/221371840

This site is for inclusion only, and the copyright belongs to the original author.