Liang Xiaoyongkang is probably one of the big Vs that I followed earlier in the stock market. I like his articles very much. He has always been calm, and his growth experience is a bit similar, so I have been paying attention to what he wrote. Later He also slowly made investments, got to know more big Vs, read many investment books, and read many annual reports of companies. Although some of his views are not completely consistent with his, on the whole, he has a long-term view on the company’s long-term investment. Observation and tracking, the evaluation of some companies still have their own insights.

After seeing the post of his clearance of Vanke yesterday, I was very surprised at first, because I read his Weibo more than a month ago and said that after reading the annual report of Vanke, I continued to hold it calmly, drinking tea and reading books. I didn’t expect the clearance so quickly. Of course, I didn’t expect that it would arouse so many people’s comments. There are quite a lot of people who follow him. There may be a considerable number of Vanke or Gree stocks bought with him. I also hold Vanke myself. Although my position is small, I have always heard Buffett Munger and other bigwigs talk about the importance of independent thinking. I think in reverse. When a point of view comes out, think critically. Think, maybe more important. For example, Liang You has an article about pig raising in Vanke. I feel a little worried about adding new words and saying that everything starts from the user, which is funny in my opinion. Of course, who is right and who is wrong? Regardless, I’m just saying don’t base your investment entirely on someone else’s analysis, it’s hard to hold on to that.

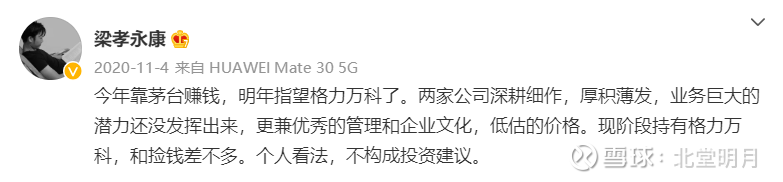

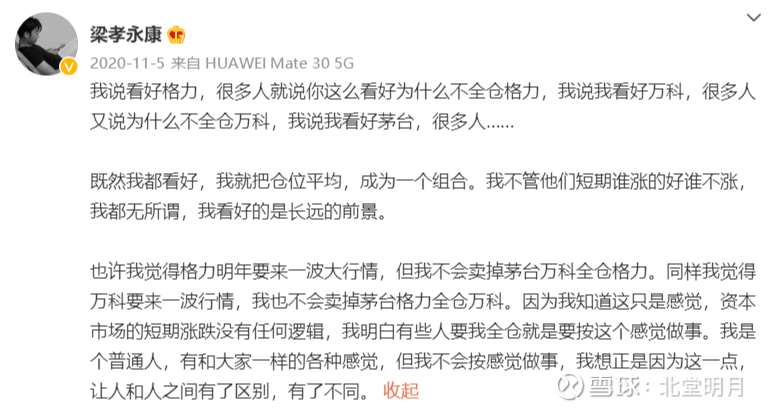

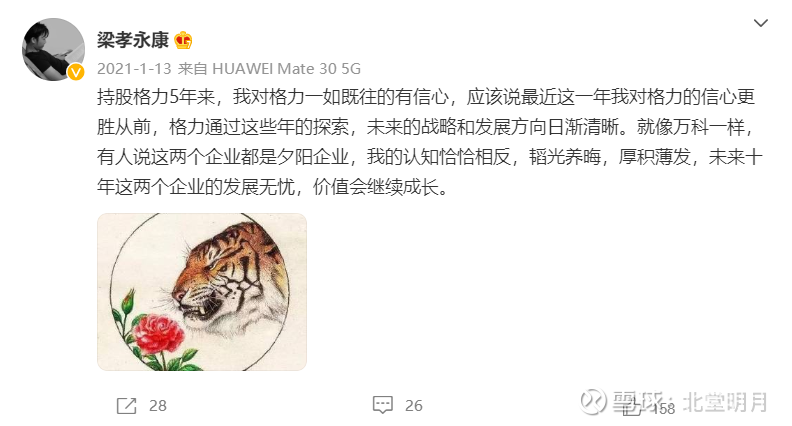

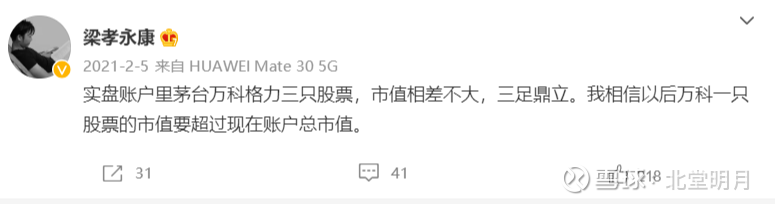

So what are my personal thoughts on the incident of Liang Xiaoyongkang’s clearance of Vanke? It’s quite a coincidence. I have been looking back at some big V’s about the process of building a warehouse and some thinking in the process. Liang built the warehouse about three years ago. He himself said that he followed Vanke for more than ten years. I selected a few Weibo posts after he opened a position. In it, he has a series of comments on scattered positions, Vanke’s intrinsic value, stock price, etc., and I can probably see the changes in a person’s psychology and thinking.

1. This article is about the impact of stock prices on investment decisions. It talks about the classic words about whether it is expensive to look at ten years. In fact, think about it, who has the ability to really look at ten years? It is very difficult to hold a stock for three years, let alone ten years.

2. This is about the stock price. At that time, the stock price of Vanke remembered that it had been very strong, and the highest price was more than 30 yuan. It was difficult to wait for the price of 25 and 26 in those few months. The strong boy at that time probably did not expect that the stock price of Vanke would reach about 17 yuan.

3. At that time, Liang was riding on the Long March, and with the trident in his hand, he didn’t need to watch the market and sleep peacefully. I think the influence of watching the market and the market price will have a place in his decision-making factors recently? So sometimes it’s a good thing to say staying away from the market.

4. The author mentioned the reasons for investing in Vanke. Although he also stated in the post of Clearing Vanke the day before yesterday, his views on Vanke have not changed, but holding a position is an attitude. Apart from these advantages, he must have seen some uncertainties in other aspects. factor. Of course, in my opinion, Vanke’s excellent corporate culture and management, sound financial management, these competitive advantages have not changed.

5. For such comments from big V, you must think independently, because it is difficult or impossible to see the future clearly.

6. The division and holding of positions has always been a very controversial topic. Today, Liang said that he has increased the position of Maotai, which is to further concentrate the position. Before I saw the big V such as fun and leisurely sitting in the S talk, Maotai is holding a position. Zhongdu accounts for more than 80%. It seems that mature investors are becoming more and more concentrated?

7. Last year, Liang Shi had been selling Moutai and Vanke. After a look, Maotai’s stock price was around 2000 and Vanke’s stock price was around 28. These two operations must be a loss from a purely current perspective.

8. At present, the price-earnings ratio of Moutai is around 40, and that of Vanke is around 8. Liang still values the price-earnings ratio, or at least it is one of his determinants. The current operation may have other considerations besides the price-earnings ratio. In fact, after all It is very likely that there is a new view on the future prospects of Vanke. So now, when you change to Maotai, are you ready to make no money in the next few years?

9. The reason for holding Vanke – corporate culture. Looking at Liang Xiaoyongkang’s early morning article, he seems to pay special attention to corporate culture and management’s character, and likes the solid and steady style. Combined with his article two days ago and the recent major economic situation, compared to the business model , these may be more fragile. The business model is one of the most important factors, and this is the view of many big names such as Buffett.

10. In the recent Weibo posts about Vanke, we can see that Liang Xiaoyongkang is still optimistic about Vanke as always, especially after the release of Vanke’s annual report, he said that he will continue to hold it, and he is comfortable with drinking tea and reading books every day. , but in a Weibo post at the end of April, he said that people have been asking him if he has cleared the stock. Unexpectedly, after more than a month, he really cleared the warehouse. I don’t know what changes happened in this process, but the influence of the surrounding environment and the opinions of others, it is impossible to say that it has no influence on myself at all.

Judging from the changes in Liang Xiaoyongkang’s Vanke holdings over the past few years, it may provide a perspective for many of us to invest in, and bring us a lot of thinking and reference, about decentralized and centralized, about independent thinking and independent decision-making, and about an industry. A company’s future changes, business model and management and the impact of corporate culture on investment and so on.

#万科A# #Kweichow Moutai# #Gree Electric#

There are 37 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1271059393/221925649

This site is for inclusion only, and the copyright belongs to the original author.