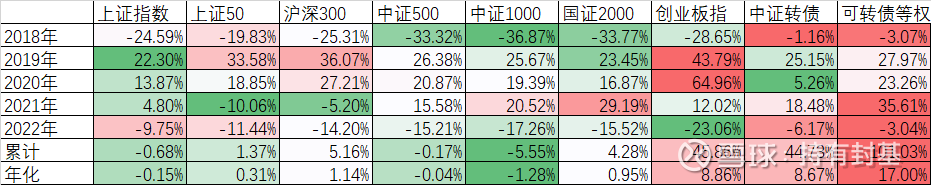

Let’s first look at the following table:

This is a table from the close of December 31, 2017 to the close of June 10, 2022. Compare the major broad-based indices. From the bear market in 2018 to the bear market in 2022, we have experienced a bull and bear market. In the cycle, the best ChiNext index is 8.86%. Except for the ChiNext Index, where did the other broad-based indexes come from or where did they go back.

Looking at the CSI Convertible Bond Index, although the 4-year semiannualization of 8.67% is similar to the ChiNext Index, the actual feeling is much better, because in the two bear markets of 2018 and 2022, the ChiNext Index fell by 28.65% and 23.06% respectively, while The CSI Convertible Bond Index fell only 1.16% and 6.17%. Few people can manage the skyrocketing rise and fall of the ChiNext, while the CSI Convertible Bond Index is much more stable, an index that can pass through the bulls and bears with a full position.

In fact, our Xiaosan can do better than the CSI Convertible Bond Index, because the CSI Convertible Bond Index is a weighted index, which is completely kidnapped by the convertible bonds of banks and other giants. What is more meaningful for our small business is the equal weight index of convertible bonds, because for our small business, the opportunity for each convertible bond is fair, and there are few low-level, low-volume transactions. Bought convertible bonds. The equal weight index comes from Jisilu. Its statistical method is to exclude the newly listed convertible bonds on the day, and make a simple arithmetic average of the increase of all convertible bonds. It far exceeds the ChiNext Index and the CSI Convertible Bond Index.

In fact, it is difficult for publicly offered convertible bond funds to beat the equal-weight index of convertible bonds. According to the statistics of Tiantian Fund, from December 31, 2017 to June 10, 2022, among the 70 convertible bond funds, the best-performing Penghua Convertible Bond Fund’s net value rose by 89.49%, although it outperformed CSI. 44.73% of the convertible bonds, but still underperformed the 101.03% of the convertible bond equal rights index.

The reason is not that the level of fund managers is not as good as ours, but that there are many constraints. For example, due to risk control, public funds can only buy high-grade convertible bonds, such as the Penghua convertible bonds mentioned above. The fund has a heavy position in the convertible bonds of Hangyin, Suyin, Daqin and other giants. However, among the convertible bonds, there is a phenomenon of good stocks, bad debts, bad stocks and good debts, which leads to the fact that the yield will not be particularly good. In addition, the trading volume of some convertible bonds is not active, and the public funds are too large to enter and exit smoothly, and can only be abandoned. The convertible bonds abandoned due to risk control and transaction volume often perform better than the convertible bonds of the Big Mac, which leads to an abnormal phenomenon in the field of convertible bonds: the result of the convertible bonds operated by Xiaosan himself Often more than public funds.

Compared with the four and a half years from December 31, 2017 to June 10, 2022, among the 6,850 publicly offered hybrid funds, the convertible bond equal rights index of 101.03% can beat 92.47% of them. Raised funds. Of course, past achievements cannot represent the future, but the reference significance is still very large.

Some people say that the current convertible bond premium rate is too high and the risk is too high. In fact, it is mainly due to the high premium rate of double-high hot money bonds. The high premium of low-priced bonds is not terrible, and there is a debt bottom protection below. Only high premiums on high-priced bonds are truly scary.

The friendliness of convertible bonds to retail investors is reflected in many aspects:

If you don’t understand, you can participate in the brainless new game; if you are timid, you can use low-price and high-ytm strategies; if you are daring, you can use low-premium strategy, or even dance with hot money and wolves; if you can quantify, you can use more Factor strategy; if you have time to watch the market, you can sell in the pulse to increase your income; if you don’t have time to watch the market, you can adopt a stick-and-hold strategy; if the underlying stock has fallen for a long time, you can expect to revise down the stock price; if it falls below 100 yuan, you can wait for a return. Sell; if there are positive stocks, if there is a negative premium, you can take risk-free arbitrage; if you deeply research the positive stocks, you can hold a few convertible bonds; In short, Xiaosan can always find a method in convertible bonds that meets their needs.

This is also the only type of A-share market that may pass through bulls and bears and defeat professional fund managers. It is hoped that convertible bonds will not follow in the footsteps of graded funds and pure bonds.

This topic has 76 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/6146592061/222375506

This site is for inclusion only, and the copyright belongs to the original author.