Today is June 12. It has been 7 years since the Shanghai Composite Index (SH000001) hit 5,178 points in 2015. The market is still struggling at 3,300 points, and public funds have already surpassed the previous “mountain”, and 99 funds have doubled their performance . , of which there are 91 active equity funds (flexible allocation funds + common stock funds + partial equity hybrid funds + balanced hybrid funds), China Merchants Anrun Flexible Allocation Mix A, Essence Advantage Growth Mix A, E Fund New Income Mix A Waiting for 6, the increase is more than 200% .

If we consider the maximum retracement, Anxin Advantage Growth Mix A is in the leading position.

As of June 10, the fund had accumulated a return of 243.59%, with a maximum drawdown of 28.84%.

Source: Choice, as of 20220610

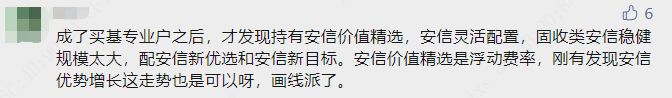

When I met Anxin Fund with you earlier, some partners noticed the growth of Anxin’s advantages.

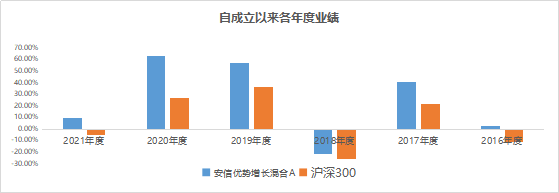

Essence Advantage Growth was established on May 20, 2015, just before the high point of the last round of bull market, after the ups and downs of the market. In terms of annual performance, it has outperformed the CSI 300 Index for six consecutive years .

Source: Fund quarterly reports, as of end-2021

With its excellent performance, Essence Advantage Growth was awarded the ” Five-Year Open-Ended Hybrid Continuously Winning Golden Bull Fund ” award in the 18th China Fund Industry Golden Bull Award by China Securities Journal in September 2021.

The helm of this fund, Nie Shilin , is a highly skilled fund manager, but he is often too low-key and humble and is easily missed by everyone.

Strong research foundation

It can be learned from public information that in 2008, Nie Shilin had just graduated from Shanghai Jiaotong University with a master’s degree and encountered the global financial crisis. Fortunately, with his solid professional ability, he got an offer from Essence Securities and served as researcher and investment assistant of Essence Securities. Later, he joined as a researcher at the beginning of the establishment of Essence Fund.

During his tenure as a researcher, Nie Shilin mainly tracked and covered industries including real estate, automobiles, agriculture, media and catering and tourism, regardless of cycle, consumption or TMT.

This is related to the investment and research training system of Essence Fund. In the process of advanced researcher, cross-study will be conducted to broaden the circle of competence and accumulate for investment management . Star fund managers including Chen Yifeng and Zhang Jing are also internally cultivated by Anxin Fund through this model.

Since graduation, Nie Shilin has accumulated a full 8 years in the research position. On February 18, 2016, Nie Shilin took over Anxin Advantage Growth, the first public fund he managed. The fund’s name also matches his investment strategy – digging deep into competitive companies and reap the rewards of corporate growth.

In the early stage of management, Nie Shilin paid more attention to the combination of the growth of individual stocks and the prosperity of the industry . He was often able to find more aggressive targets, and his positions changed rapidly. 2017 was the first full year for Nie Shilin to manage the growth of Anxin Advantage, and the investment performance once ran to a very high position. Choice data shows that in 2017, the annual return of Anxin Advantage Growth A was 40.58%, ranking 28/1243.

Nie Shilin was not satisfied with this year’s performance, especially in terms of retracement . At the end of 2017, there was a wave of adjustment in Anxin’s Advantage Growth Mix A. This experience made him think, if he felt that the performance fluctuated greatly, what would the holders think? Can they withstand such volatility?

We are not satisfied with the short and medium-term high-quality performance, but reflect on the investment framework based on the immediate interests of the holders. This allows Nie Shilin’s investment system to “evolve”, which is the key to creating the long-term performance of Anxin’s advantageous growth.

Evolutionary growth value

Nie Shilin said in public reports that the most effective risk control measure is to choose a good company for in-depth research . He will continue to deepen his understanding of key companies to help the portfolio cross the bulls and bears.

At the level of stock selection, Nie Shilin downplayed the prosperity and trend that he valued when he “made his debut”. Instead , it focuses more on the three levels of corporate competitiveness, management, and business model, and digs out truly good companies from the bottom up .

He will buy heavy positions and hold them for a long time when really good companies have cheap prices, and make dynamic comparisons and balanced allocations at reasonable valuations. Focusing on growth value and adhering to a balanced style is also more in line with the future trend of stock market structural changes under the background of industrial upgrading and consumption upgrading.

(1) For the competitive advantage of an enterprise, Nie Shilin believes that the key lies in the monopoly advantage and the replicable advantage.

A monopoly in a narrow sense means having what others do not have, and can naturally obtain excess returns; in a broad sense, monopoly means having advantages that others cannot or cannot do well, such as reflected in the yield rate of production, such as drug research and development, chip design and other fields, with certain advantages. companies with technical barriers. The replicable advantage refers to the company’s ability to rapidly expand its products and services at low cost, thereby consolidating its leading position. This trait is very obvious in some industries (such as the Internet).

Doing a good job of comparing the competitive advantages of enterprises can better grasp the timing of the advance and retreat of individual stocks. From Nie Shilin’s adjustments to car companies in 2020 and 2021, it can be seen that the decisions are made from changes in the company’s competitive advantages.

(2) Pay special attention to the management of the enterprise . In the final analysis, investing in companies is investing in people. A good company usually has a relatively good entrepreneur or a good management. Nie Shilin believes that good entrepreneurs can make significant excess returns even in a traditional industry. Give higher valuations to companies with excellent management, and leave companies with flawed management untouched.

This idea is also the consensus of outstanding growth value players. The more companies with long-term growth potential, the higher the requirements and dependence on the company’s management.

(3) Understand the business model and give a reasonable valuation. No matter how good a company is, it is difficult to avoid being affected by changes in macro, industry and market cycles. Only by knowing how the listed company makes money can we maintain our determination and hold the stocks that should be taken.

Through in-depth research on the selected stocks, Nie Shilin will eventually consciously control the proportion of positions in different sub-sectors in the configuration of the portfolio, and maintain a certain degree of dispersion, so as to reduce the net value drawdown of the portfolio during market adjustments.

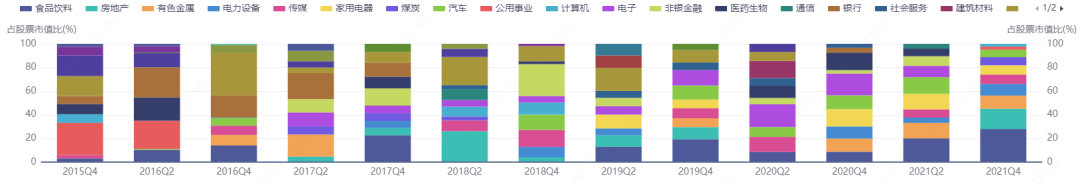

It can be seen from the combined data of Anxin Advantage Growth’s interim report and annual report that after 2017, the industry allocation has become more balanced.

Source: iFinD, as of 20211231

underrated master

As of June 10, 2022, Nie Shilin has been in management for more than 6 years, and Anxin Advantage Growth Mix A has achieved a return of 226.02%, with an annualized return of 20.57%, exceeding the benchmark by 189.48% .

Source: iFinD, as of 20220610

This should be a report card enough to be among the ten billion equity fund managers.

However, as of the end of the first quarter of this year, Nie Shilin’s active equity product management scale was less than 2 billion, which was greatly underestimated by the market.

I listened to an online survey of Nie Shilin this year, and the biggest impression was his simplicity and honesty. His ideal value investment is to appropriately increase the concentration and hold the most promising companies for a long time. However, the management of public funds must pay attention to the experience of holders, and it is inevitable to bear the pressure of relative ranking. Therefore, at this stage, it is also necessary to feed their crops (long-term optimistic companies) through dispersal and occasional “hunting” (moderate participation in some phased opportunities with high certainty).

Nie Shilin said frankly that he is very aware of the boundaries of his abilities, and only companies that are particularly confident will hold heavy positions and long-term holdings. He also honestly faces his own shortcomings, is not good at macro timing, and is not good at verbal expression. Some stocks are bought too little or sold too early because they are too cautious.

But this simple and humble character, is it not a kind of protection for investors? Those who knew Nie Shilin favored him; those who didn’t know him were easy to miss.

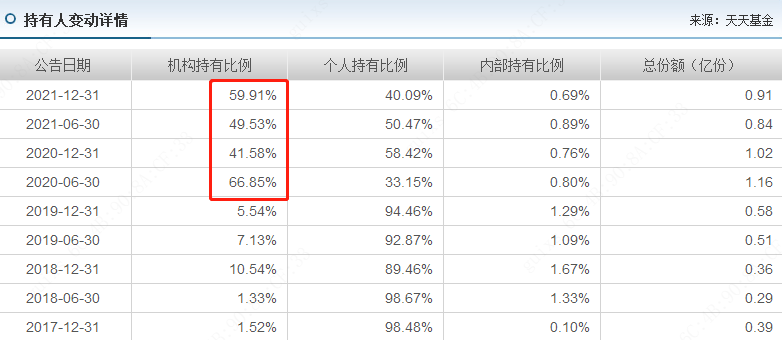

Nie Shilin’s balanced investment style has the characteristics of both offense and defense, and is deeply loved by institutions. The 2021 annual report shows that the institutional holding ratio of Anxin Advantage Growth Mix is 59.91% .

His investment portfolio is also progressing in his ideal direction. It can be seen from his management of the Essence Value Growth Mixed Fund (compared to Essence’s advantageous growth, which can be invested in Hong Kong Stock Connect), under the premise of maintaining a balanced style, he dares to invest heavily when high-quality companies fall, and the concentration is significantly improved. value characteristics .

Source: Wind, Anxin Value Growth Quarterly Report

Disclaimer #雪ball star plan public offering talent# #雪ball ETF star push officer# #Creator Center#

The fund has risks, past performance does not indicate future performance, investment should be cautious. The above views only represent the author’s personal opinion, do not represent the position of the fund company, and do not constitute investment advice for readers. The content of the article is for research and learning purposes only, and the stocks, funds, etc. involved do not constitute any investment advice $Anxin Advantage Growth Mix (F001287)$ @雪ball Fund @Today’s topic @雪ball Creator Center

There are 2 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1762638610/222378861

This site is for inclusion only, and the copyright belongs to the original author.