I participated in the #雪ball private equity excellence fund tea party# event on Wednesday. I was very happy and met a few good friends. Thank you very much for the organization of Xueqiu, and I also thank Zhang Zhuo, founder of Zhuozhi, and Dong Ziwei, head of the marketing department, for their time and patience. I have learned a lot, especially some thoughts on evaluating the quantitative excess.

The quantitative company has the DNA of a technology company. Here, employees can be seen walking around in big pants and slippers. There are several massage chairs in one corner of the office and fitness equipment on the other. What a relaxing work environment.

Zhuo Zhang, the founder of Zhuozhi, is a veritable scholar. He has won the first prize of the special scholarship of Tsinghua University, and holds a Ph.D. in the Department of Electronic Engineering of Princeton. His research direction is artificial intelligence and machine learning. After working at Knight Capital Group for a year and a half, he returned to China and founded Aspire Capital.

The path of Zhuozhi quantitative investment is the same as that of the renaissance of the quantitative industry leader, and it also started with commodity futures. Acuity started to do commodity futures in September 2016, relying on excellent high-frequency strategies to obtain stable returns. In 2018, the stock alpha strategy was launched, and the management scale exceeded 10 billion in August this year.

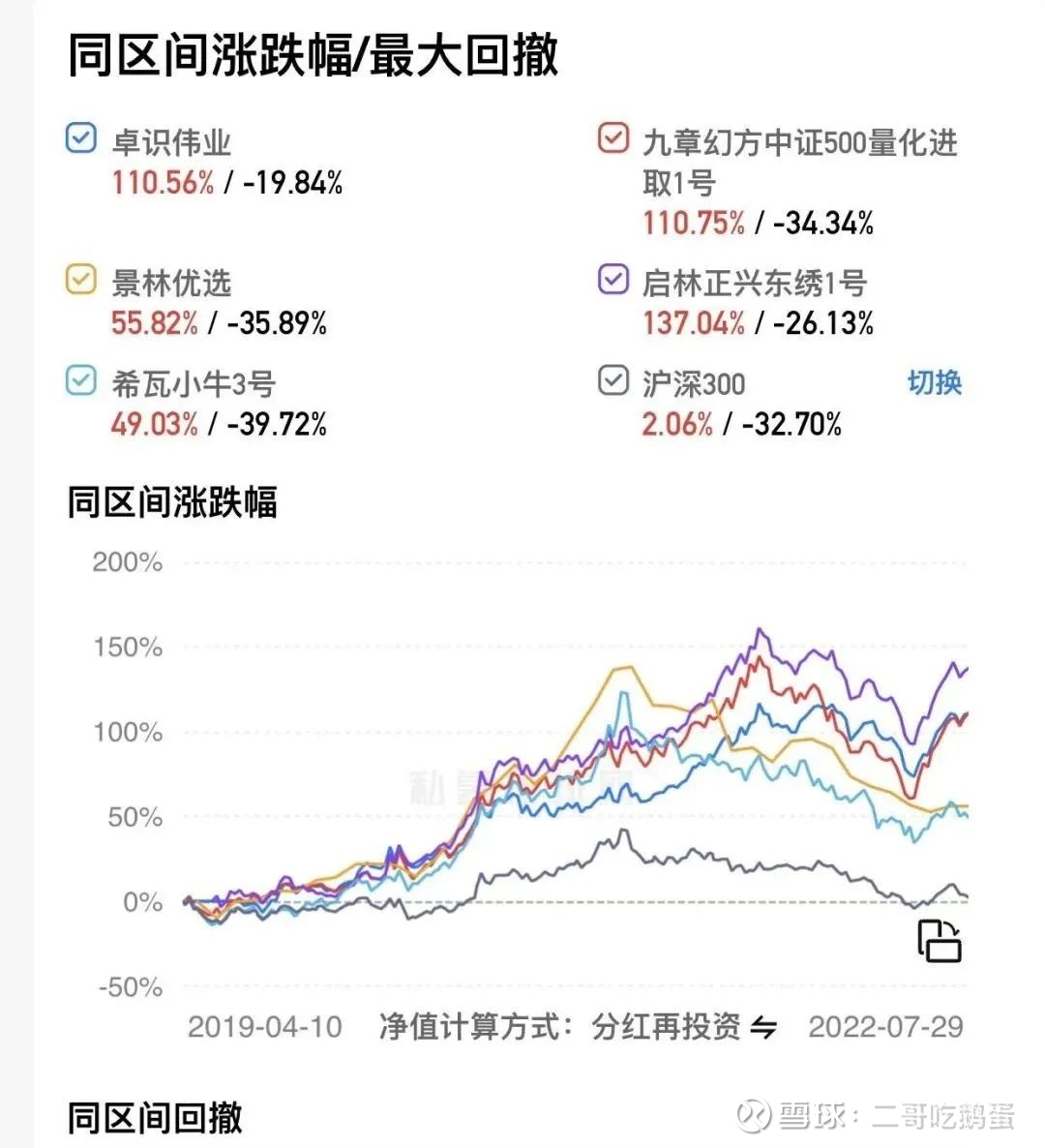

How to evaluate this company? Without further ado, let’s take a look at the results (April 10, 2019 to August 19, 2022):

Here is a comparison of the other two top quantitative private placements I hold, a well-known subjective long private placement with the best long-term performance, and a private tens of billions private placement that I have observed and tracked for many years. It can be seen that in the past three years, the performance of the three quantitative funds far outperformed the two subjective bulls, Zhuoshi and Magic Square were tied, and Qilin won slightly.

In terms of maximum drawdown, Zhuozhi far outperformed the other four.

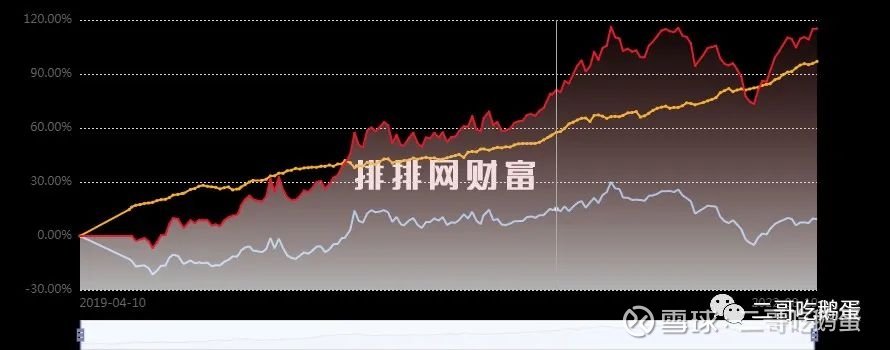

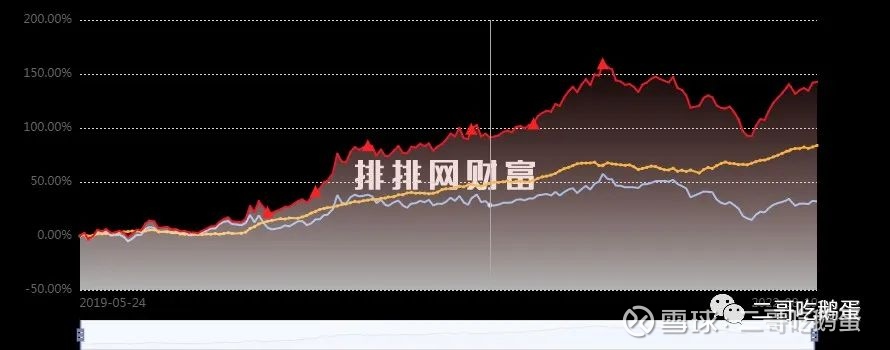

The comparison of the excess of the three quantitative private placements (the yellow line in the figure is the excess, the blue line is the CSI 500, and the red line is the net value) is as follows:

It will be found that the yellow line in Figure 1 is the most stable, which is wisdom. Figure 2 is the most volatile. There has been a huge excess drawdown in 21 years. From January to early May this year, the excess has almost no change.

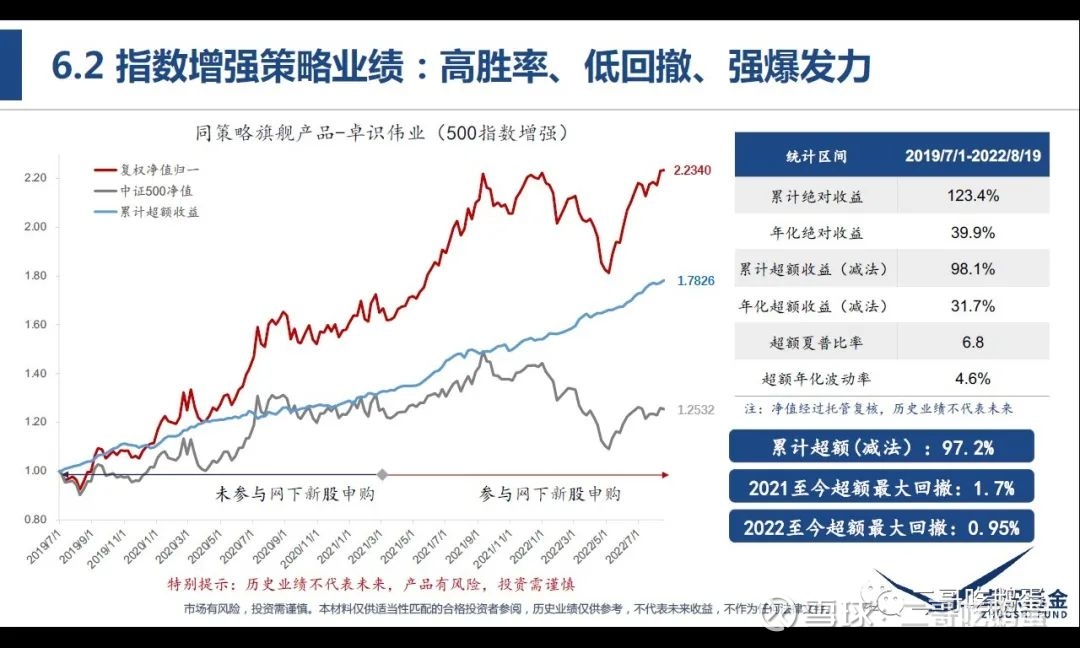

We got the same information from Dr. Zhang Zhuo’s introduction. He believes that the biggest feature and advantage of Aspire is its excess stability, which requires an effective combination of richness, stability, strict risk control, and powerful trading strategies of factor strategies.

When choosing quantitative products, it is necessary to distinguish between two sources of excess returns: one is pure alpha, and the other is style exposure. The quantification of several public offerings that have been in the limelight in the past two years is a typical excess due to style exposure. It can be seen from the excess curve that the two private equity quantifications compared above also have different degrees of style exposure, one is relatively small and the other is too large.

Zhuozhi’s excess stability is really impressive, with a maximum excess drawdown of 1.7% (less than 3% from 2019 to the present), excess annualized volatility of 4.6%, and excess Sharp above 6. Dr. Zhang Zhuo said that companies pursue excess value for money, and for them the risk is to bring additional volatility without additional benefit.

The stable excess comes not only from the rich strategy, but also from the implementation of the strategy. Quantitative companies mainly have two directions in IT investment, one is the improvement of computing power, such as the supercomputing data center computer room invested by Magic Square before. The improvement of computing power is very important for strategy factor development and backtesting. What can be verified by running a normal system for several hours may be completed in a few minutes using a supercomputer.

The other is the investment in the trading system, Zhuozhi specifically mentioned its own low-latency IT system. The company continues to invest heavily in IT infrastructure, including FPGA hardware acceleration, dedicated line network optimization, system architecture reorganization, multi-dimensional data procurement, and hosting servers in multiple locations. The trading system guarantees the implementation of trading strategies. Without the support of a strong trading system, many strategies look good, but cannot be implemented due to shock costs. For example, from January to March at the beginning of the year, when the transaction volume declined, the transaction slippage had an impact on many companies, resulting in orders being issued but unable to complete transactions. Renaissance Corporation places great emphasis on trading algorithms and systems.

Zhuozhi’s own funds are 3-4 billion, which I also pay special attention to. why? First, it shows that they have made money, and the market has proved the long-term effectiveness and iterative ability of their strategy. Up to now, Zhuozhi is still an important participant in the high frequency of futures. Second, the company’s own funds can support the company’s effective investment and do many long-term right things. It also prevents them from being overly influenced by the market and channels.

I started buying quantitative private equity in 2020, and spent some time researching quantitative private equity managers in the past two years. Judging from the performance of the past few years and the current situation of the U.S. market, there is a high probability that most of the subjective long private placements of more than 10 billion yuan in the next five years will not be able to outperform excellent quantitative funds. At this point, friends Amy and Xiao Yang are finally foresight.

I personally plan to increase the position of quantitative private equity to about 30%, and Zhuozhi will also be one of the goals I focus on tracking and considering.

@雪ball private equity @today’s topic @boyan2020 @ hongshaomeng@lianchengZ @explosion point investment @laifu dog dad

@Excellence Fund

This topic has 4 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1843647871/229206415

This site is for inclusion only, and the copyright belongs to the original author.