Welcome to the WeChat subscription number of “Sina Technology”: techsina

In the past, it was a benchmark in the sea, but now it is full of crises

Written by Chen Dengxin Edited by Xu Wei

Source: Zinc Scale

As the double global champion of electric balance car and electric scooter, No. 9 Company is quite eye-catching in the Xiaomi system.

A few days ago, No. 9 Company announced that its operating income in 2021 will be 9.146 billion yuan, a year-on-year increase of 52.36%; its net profit will be 411 million yuan, a year-on-year increase of 458.84%.

The performance is not bad, but it has hardly boosted the company’s market value.

From the review point of view, after the No. 9 company reached a new high of 79.78 billion yuan in market value at the beginning of 2021, it fell all the way. As of May 8, 2022, the market value was only 25.519 billion yuan, far lower than the listing on October 29, 2020. 33.696 billion yuan on the first day.

No. 9 Company, known as a model for local enterprises to go overseas, why is the transcript handed over not recognized by the capital market? Can electric two-wheelers hold up the “second curve” of No. 9 company? Will robots become the next “battlefield” of No. 9 Company?

“Double Champion” bid farewell to high growth and fell into a stagflation moment

In fact, the performance of No. 9 Company is mixed with joy and worry.

In terms of operating income, in the fourth quarter of 2021, it was 1.944 billion yuan, down 21.74% from the previous quarter; in the first quarter of 2022, it was 1.917 billion yuan, down 1.39% from the previous quarter.

From the perspective of net profit, the fourth quarter of 2021 was 22.3091 million yuan, compared with 134 million yuan in the previous quarter, down 83.35% from the previous quarter; in the first quarter of 2022, it was 38.4466 million yuan, up 72.34% from the previous quarter.

This means that No. 9’s operating income has shrunk for two consecutive quarters, and its net profit has been weak for two consecutive quarters.

In this regard, No. 9 Company explained to Zinc Scale: “In 2022, due to the repeated impact of the epidemic, logistics in some parts of the country will be interrupted, resulting in shortages and delayed delivery of some of the company’s important raw materials, components and core equipment. The performance has an impact, but the company’s operations are generally sound and sound.”

However, there is also a voice that has a lot to do with alienating Xiaomi.

Dongguan Securities said: “The year-on-year growth rate of the company’s revenue and profit in the first quarter of 2022 has slowed down, which is expected to be mainly affected by the decline in revenue from Xiaomi’s customized product distribution business.”

In fact, since 2017, the proportion of Xiaomi’s revenue contribution to No. 9 Company has been declining from 73.76%. Now this trend shows signs of acceleration: in the first quarter of 2022, Xiaomi’s customized product distribution revenue was 290 million yuan, a year-on-year decrease. 62%.

In other words, No. 9 Company is eager to “de-Xiaomi”, but at the same time, it is unable to get rid of Xiaomi dependence.

The reason why No. 9 Company is alienated from Xiaomi is that it relies on Xiaomi’s popularity and mature channels in the initial stage, and thus has a high starting point. However, after the wings have grown, they figured out how to stand on the shoulders of “giants” and surpass “giants”, so it was born. The demand for independent brands and channels has been fulfilled.

Strangely, the gross profit margins of No. 9 Company from 2018 to the first quarter of 2022 were 28.86%, 27.42%, 27.69%, 23.23%, and 22.03%, respectively, showing a trend of decreasing year by year, which is in contrast to the independent pursuit of higher profits. The original intention seems to be the opposite.

Gross profit margin declines year by year

Gross profit margin declines year by yearMore importantly, the gross profit margins of No. 9’s four business lines in 2021 will all decrease year-on-year, which means that the challenges it faces are comprehensive rather than single product issues.

Regarding this, No. 9 Company replied to Zinc Scale in this way: “Continued to be affected by the new crown epidemic in 2021, the shipping costs incurred by overseas sales will increase, resulting in an increase in operating costs over the previous year, which in turn leads to a year-on-year decline in gross profit margins. This is a major environmental impact, not only Only our company is affected, but the company is also actively solving the problem of rising shipping costs, including increasing the container loading rate (from 70% to 95%), reducing the cost of transportation per unit, and changing the logistics supplier selection strategy The freight forwarding (intermediary) mode of transportation has been transformed into a strategy of shipowners as the main freight forwarder, and freight forwarding can be saved by reducing intermediate links in freight transportation.”

It should be noted that the company’s electric balance car and electric scooter account for up to 70% of the revenue, and many cities across the country have issued regulations restricting the use of related products on the road, and the prospect of its basic market is not optimistic.

In this regard, No. 9 Company also warned in its 2021 annual report: “If the relevant policies of various countries or regions are further tightened in the future, and the scope of countries or regions that implement the prohibition of electric balance vehicles and electric scooters on the road is further expanded, it may be It will have a certain adverse impact on the company’s future product sales and continuing operations.”

“Yadis” besieged, two-wheeled electric vehicles can’t support the second curve

In this context, No. 9 Company planned Plan B early and entered the two-wheeled electric vehicle track in December 2019, eager to pull out the “second curve” to hedge against unknown risks.

“The reason why No. 9 Company chose the two-wheeled electric vehicle industry is because the new national standard has been implemented and the industry has been reshuffled, which has created greater opportunities.” Gao Lufeng, chairman of No. 9 Company, said.

According to public data, the “Technical Specifications for Electric Bicycle Safety” was officially implemented on April 15, 2019. According to the new regulations, domestic two-wheeled electric vehicles will usher in a trade-in trend, which provides latecomers with opportunities to overtake on curves.

It can be seen that the No. 9 company has high hopes for two-wheeled electric vehicles.

However, the sales volume of two-wheeled electric vehicles of No. 9 Company in 2021 will be 420,000, contributing 1.2 billion yuan in operating income, accounting for 13.12% of the revenue, and the total operating income of 6.405 billion yuan with electric balance vehicles and electric scooters is still Can’t be compared.

More importantly, the two-wheeled electric vehicle business of No. 9 Company is currently facing three major challenges.

First of all, the blood sea market is difficult to break through.

Two-wheeled electric vehicles have already moved from the Red Sea market to the sea of blood. No. 9 Company has to compete with the old forces such as Yadi and Emma, as well as with the new forces such as Mavericks and Harrow, and the fight is quite brutal.

Although No. 9 Company has resorted to the “intelligent + high-end” style of play, and has become the youngest important player in the two-wheeled electric vehicle track, it has not erased the first-mover advantage of its opponents.

For example, the threshold for the second tier of the industry is 2 million vehicles per year, and No. 9 company is still far from this threshold, not to mention the sales volume of the industry’s “first brother” Yadi is 13.86 million vehicles per year.

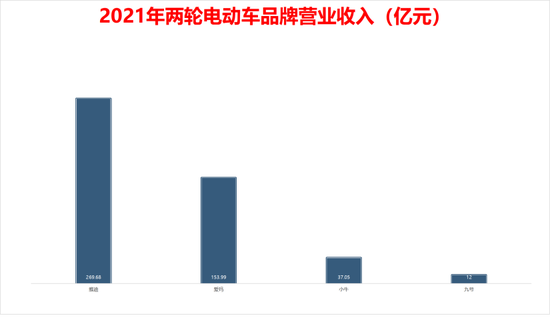

For another example, in 2021, Yadi’s operating income will be 26.968 billion yuan, Emma’s operating income will be 15.399 billion yuan, and Maverick’s operating income will be 3.705 billion yuan. The gap between No. 9 Company and the naked eye is obvious.

Company No. 9 is still small

Company No. 9 is still smallSecond, the moat is not wide enough.

The background color of No. 9 Company is intelligence. Its products are highly intelligent and have higher prices. Unfortunately, intelligence is not an insurmountable technical gap. Build a “people-vehicle-road-cloud” ecosystem.

Taking Yadea as an example, the high-end product GN series also has functions such as cycling navigation, safe travel, sensorless unlocking, and intelligent security, while the high-end VFLY series is based on the “full-scene AI intelligent system” as its selling point.

In short, opponents are also making up for shortcomings.

In this regard, iResearch said: “New power brands such as Mavericks and No. 9 are mainly intelligent models with relatively high prices, and the market sales scale is far less than that of low-priced models. The market space for intelligent models will be larger.”

Again, offline channels are relatively weak.

The audience of No. 9 Company’s basic market does not overlap with two-wheeled electric vehicles, and the latter is a track that is more dependent on offline, so a lot of work is needed on the store layout.

At present, the number of domestic specialty stores of No. 9 Company has expanded to 1,700+, but it is still far from the number of thousands and tens of thousands of its competitors.

Will Service Robots Be a “Lifesaver”?

It can be seen from the above that two-wheeled electric vehicles are temporarily unable to support the “second curve” that No. 9 company is eagerly awaiting, and a new story is urgently needed to save the field.

On April 20, 2021, it was reported by Jiwei.com that No. 9 Company is adding more code to the market to manufacture new energy vehicles, and its car-making path is more recognized by the market, but more than a year has passed and there is no following, but the news of the added code robot has come. : On April 26, 2022, No. 9 Company released two To B-end robots, with the official guide price starting from 19,999 yuan.

In fact, betting on robots is far more reliable than building cars.

At the beginning of the listing of No. 9 Company, it wanted to use the name “Robot No. 9”, but it had to give up because the proportion of robot business revenue was too small.

Gao Lufeng once said: “Many of the company’s early founders came from Beihang University, and they all came from robots. The entire technical team actually has a special love and feelings for robots.”

According to data from the International Federation of Robotics, from 2016 to 2020, the global sales of service robots increased from US$4.3 billion to US$9.46 billion, with a compound annual growth rate of 21.79%. It is expected to grow to US$20.18 billion by 2023.

It’s a pity that the No. 9 company got up early, but caught a late set.

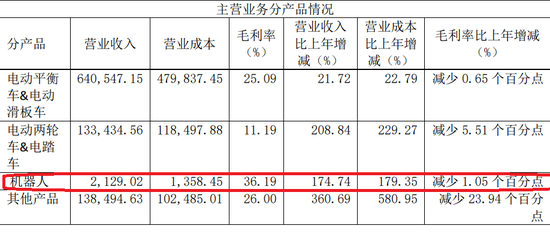

Since its end in 2015, although the No. 9 company has repeatedly increased its weight on the service robot track, it has not caused much waves. In 2021, the robot business contributed 21.2902 million yuan, and the revenue accounted for only 0.23%, which is better than nothing.

Robot business talk is better than nothing

Robot business talk is better than nothingNot to mention, it is against To B-end players such as Yunji Technology, Qinglang Intelligence, Youdi Technology, Purdue Technology, and Orion Star.

According to the “2022 Overview of China’s Catering Delivery Robot Industry” released by the Toubao Research Institute, the market share of Qinglang Intelligence is 51%, and the rest of the market is divided up by Purdue Technology and Orion Star.

According to public data, Yunji Technology is the leader in the field of hotel hospitality robots, with a market share of over 90%.

According to industry insiders, No. 9 Company cannot be on a par with the above-mentioned opponents, and the two directions of the increase this time are not optimistic.

And a private equity person told Zinc Scale: “The No. 9 company has been unable to open the situation for a long time, because the competition in high-tier cities is fierce, and the market cake is almost completely divided. Lower prices break the game, and maybe you can find a way to survive in the sinking market.”

In a nutshell, Company Nine may want to win on price, not innovation.

This can be confirmed from the proportion of R&D investment. The proportion of R&D investment of No. 9 Company in 2021 is 5.51%, a year-on-year decrease of 2.19 percentage points; the proportion of R&D investment in the first quarter of 2022 is 6.05%, which is only an increase of 0.32 percentage points.

The problem is that this style of play tests the cash flow of No. 9 Company.

As of March 31, 2022, it held monetary funds of 1.959 billion yuan, inventory value of 2.507 billion yuan, and net operating cash flow of -4348 trillion, which means that No. 9 Company’s cash flow is not easy.

Then, why the tight cash flow can support its price war on the To B side is a big question mark.

In this regard, No. 9 Company told Zinc Scale: “The net cash flow from operating activities decreased compared with the same period of the previous year, mainly due to the advance of stocking at the end of the current period, the increase in inventory, the increase in prepaid supplier purchases for locking the goods and the increase in export tax rebates receivable. Cash flow is healthy right now.”

All in all, No. 9 Company is eager to improve its business structure. On the one hand, it promotes “de-milletization”, but faces the risk of “stalling” revenue. On the other hand, it seeks a “second curve”, but whether it is a two-wheeled electric vehicle or a service robot , at this stage are embarrassing to use.

Then, it is reasonable that the capital market does not want to see No. 9 Company.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-05-09/doc-imcwipii8896527.shtml

This site is for inclusion only, and the copyright belongs to the original author.