Bank of Jiangsu became the champion of last year’s increase, and some people said it was second. It doesn’t matter, the first and second are about the same, in short, it is right that the price rises well. It’s normal that it will cause heated discussions if it rises well.

I hold Bank of Jiangsu. I started with a cost of 6 yuan in the first half of 2021, and now it has become a cost of 4.55 yuan. I am quite satisfied with the floating profit. I will neither deliberately discredit Bank of Jiangsu, nor dare to deliberately raise it. I must look at it objectively. This is an attitude of being responsible to myself. Even if you try to be objective, you may not be able to achieve it due to ability problems. If you are biased subjectively, problems will inevitably occur!

The following is my own “objective” view, welcome to question, do not abuse.

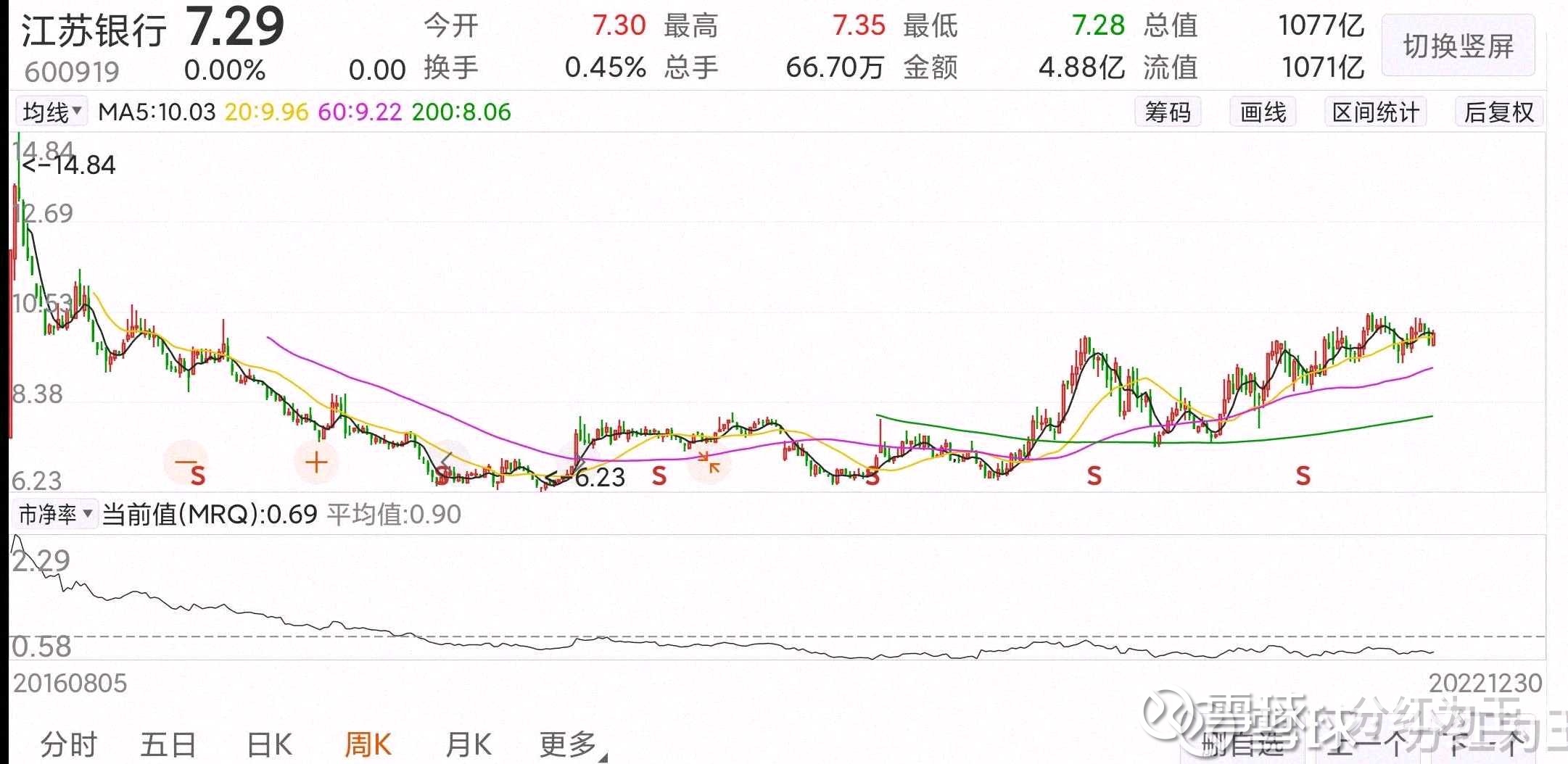

First of all, Bank of Jiangsu was listed on August 2, 2016. The IPO price was 6.27 yuan, which is not cheap. The software shows that as of now, it has raised 82 billion yuan and paid out 21.8 billion yuan in dividends.

I want to get the 82 billion clear. The results found include: 20 billion convertible bonds will be issued in 2019, and 14.8 billion will be issued in 2020. In 2017, non-public issuance of preferred shares was 20 billion yuan, and in 2016, IPO raised 7.238 billion yuan. It adds up to about 620, where did the other 200 go? Take a look, there are always things you don’t understand, friends who know it, please remind me, thank you!

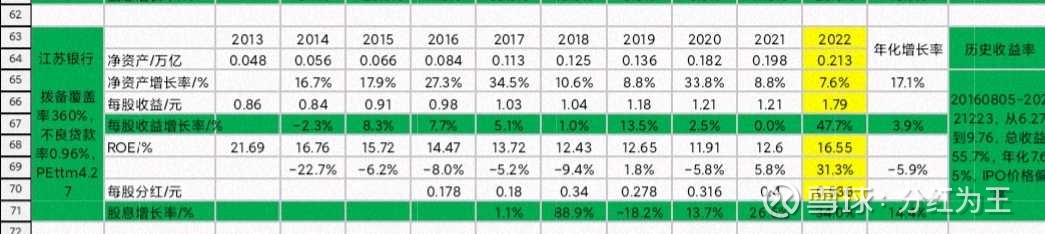

Similar to the analysis of ICBC, first look at the increase in net assets, from 48 billion in 2013 to 198 billion in 2021, an increase of 1980/480-1=3.125 times, an annualized rate of 17.1%, which is ruthless. ROE has fallen fast enough from 21.69% in 2013 to 12.6% in 2021. Earnings per share will increase from 0.86 yuan in 2013 to 1.21 yuan in 2021, an increase of 1.21/0.86-1=40.7%, an annualized rate of 3.47%, which is very small. The dividend per share is from 0.178 yuan in 2016 to 0.4 yuan in 2021, an increase of 0.4/0.178-1=125%, and an annualized rate of 14.4%. Great! The rapid growth of the dividend rate comes from the growth of net profit on the one hand, and the increase of the dividend rate on the other hand. The post-reinstatement stock price has increased from 6.27 yuan at the time of listing to 10.09 yuan at the end of 2022, an increase of 10.09/6.27-1=60.9%, and the annualized rate of return on market value=7%. That is to say, the listed IPO price gets the current annualized rate of return of 7%. If you rush to raise funds (the highest point after the restoration of rights is 14.84), you have not yet solved the problem!

Use annualized earnings per share of 3.5% + annualized dividend income of 5% = 8.5%. At the time of listing, pe8.32, now pe=4.38, the difference between 8.5% and 7% comes from changes in pe, including the rapid growth in the past two years.

Special note: Bank of Jiangsu will issue additional allotment shares at the end of 2020, and the number of shares will increase from 11.54 billion shares to 14.77 billion shares, an increase ratio of 147.7/115.4-1=28%. The direct consequence is that the total net profit in 2021 will increase by 30%, but the earnings per share will not increase, it will only be the same as in 2020, and the growth rate will be zero! Fortunately, the growth rate in 2022 is good. This is also the main reason why Bank of Jiangsu became the growth champion last year. It can be seen that the market is not stupid!

The rapid growth of Bank of Jiangsu’s total profit in the past two years is inseparable from the contribution of the issuance of additional allotment shares and the issuance of convertible bonds. It remains to be seen how it will develop in the future, and we should not be too optimistic!

Let me explain again that the investment income of the convertible bond holders in 2019 and the rights issue in 2020 is quite good. We must look at the advantages and disadvantages of bond issuance and rights issue objectively, and we can’t call it bad if we don’t see the additional issuance. Specifically, from the issue price of 100 to the current price of 123, the growth rate of convertible bonds is 23%, and the premium rate is only 2%. Downward adjustment, this year’s 6% dividend + 1.5% debt interest is definitely available. Rights issue investors are more suitable. The allocation price is 4.68. After two dividends, the return is 0.316+0.4=0.716. The cost has become less than 4 yuan. This year, the dividend will be 0.5 yuan. Think about it, it can’t be more beautiful!

The earnings per share growth rate of 30% this year is basically a foregone conclusion. How about the future growth rate?

After the convertible bonds are converted into shares, the creditors have become ordinary shareholders. I don’t know how the growth rate will change. I use common sense to judge that in the past 10 years, the Bank of Jiangsu was at most a middle-level student for most of the time. It is a question whether the excellence in the past one or two years can be sustained?

Anyway, I dare not be too optimistic. My goal is to have an annualized growth rate of 10% in the next 10 years, plus a dividend rate of about 5%, which is very good. As long as the stock price does not rise too much, I will always hold it, and of course I need to be vigilant at all times. Fortunately, the current cost has reached below 5, and losing money will basically not happen!

Welcome friends who are really knowledgeable to criticize and correct!

I would like to add that I am convinced by brother @-飞虎-飞虎brother’s analysis of excellent banks. Although I didn’t copy the homework, it is very valuable as an important reference!

The above analysis is very superficial, the only useful thing may be a cautious attitude, copying homework is likely to fall into the pit, please learn from friends!

There are 53 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/8713641876/239006525

This site is only for collection, and the copyright belongs to the original author.