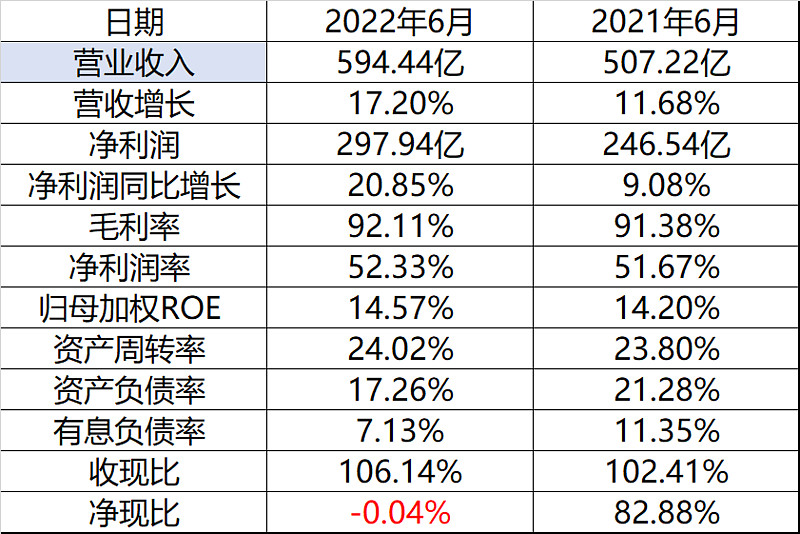

It is the financial report season again. Last week, Kweichow Moutai took the lead in releasing the 2022 semi-annual report. It is expected to achieve a total operating income of 59.44 billion yuan in the first half of 2022, a year-on-year increase of 17.2%, and a net profit attributable to the parent of 29.79 billion yuan, an increase of 20.8%. Among them, the total operating income in the second quarter was 26.26 billion yuan, a year-on-year increase of 15.9%; the net profit attributable to the parent was 12.55 billion yuan, a year-on-year increase of 17.3%. Consistent with the operating conditions previously disclosed by the company.

This article mainly interprets the interim report from several aspects, such as the increase in the proportion of direct sales, the acceleration of channel reform, the analysis of base wine production capacity, the quality of semi-annual operations, and the forecast and valuation of annual performance.

1. The proportion of direct sales has increased to 40%, and i Moutai has become a weapon to break the game

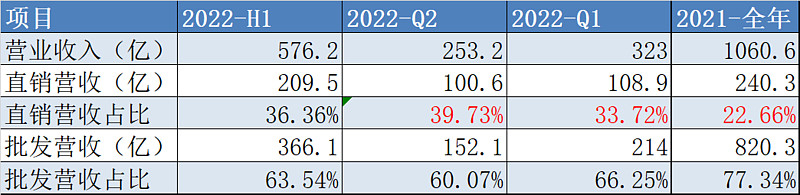

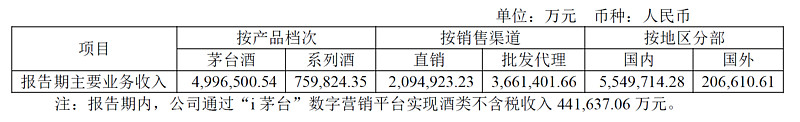

In the first half of 2022, the direct sales channel revenue was 20.95 billion, a year-on-year increase of more than 120%, and the revenue accounted for 36.36%. Among them, the direct sales channel revenue in the second quarter of 2022 was 10.06 billion yuan, a year-on-year increase of 5.3 billion (+112.9%), and the proportion of direct sales revenue increased from 22.66% in 2021 to 40% quarter by quarter . It fell 10.8% to 15.21 billion yuan.

There are some changes here that need to be noted. Moutai wholesale agency channels refer to social dealers, supermarkets, e-commerce and other channels , while direct sales channels mainly refer to the official flagship store of Jingdong Moutai, Tmall Moutai flagship store and other large-scale shopping platforms. , and since the beginning of this year, the “i Moutai” digital marketing platform channel has been added.

E-commerce channels such as JD.com and Tmall are so-called public domain traffic. In fact, customers are all platforms and need to pay traffic diversion fees. The newly launched “i Moutai” this year is private domain traffic, and the customers who have settled down are all Moutai. You can directly face customers and improve the efficiency and accuracy of marketing, which is also the trend of Internet brand marketing in the future.

According to the interim report, in the first half of the year, the “i Moutai” digital marketing platform achieved 4.42 billion yuan of tax-exclusive alcohol revenue, accounting for 17.4% of the total revenue in the second quarter and 44% of the direct sales revenue in the second quarter ( Considering the launch on March 31), it will contribute to the main revenue increase in Q2, and at the same time, the proportion of direct sales will be significantly increased by 17pcts to 39.7%.

Judging from the current feedback, “i Maotai” is still very successful.

According to the official Weibo of Kweichow Moutai, “i Moutai” has been put into trial operation since March 31 this year. On the first day, it attracted more than 2.29 million people and 6.22 million people to make reservations. On May 19, Moutai “i Moutai” was officially launched.

According to Moutai officials, as of July 9, the number of registered users of i Moutai reached 19 million, with more than 2.8 million users making reservations every day, and nearly 4 million daily active users. In the past 100 days, Moutai 1935 has achieved a cumulative sales of nearly 900 million yuan, and Xiaofeitian Moutai 100ml has accumulated more than 1.2 million bottles and achieved sales of nearly 500 million yuan .

On the evening of July 22, according to the official WeChat news of i Moutai, since the trial operation of “i Moutai” on March 31, the number of registered users has exceeded 20 million, the daily active users have reached 4 million, and the sales revenue has exceeded 5.6 billion yuan.

At the 2022 Yabuli China Entrepreneur Forum Tianjin Summit on the evening of August 2, Ding Xiongjun, Secretary of the Party Committee and Chairman of Moutai Group, said that the “i Moutai” APP has been online for more than two months, with a turnover of more than 6 billion yuan and more than 20 million registered users.

Based on the above information, i Moutai reported 4.4 billion untaxed income for half a year, with an average monthly revenue of less than 1.5 billion. If the 6 billion yuan mentioned by Dong Ding on August 2 is also tax-free, then the monthly revenue in July will exceed 1.6 billion. With the arrival of the peak season of liquor sales in the third and fourth quarters, i Moutai is expected to achieve 10 billion in the second half of the year. The above revenue, according to the 96% gross profit margin of direct sales last year, can contribute nearly 10 billion gross profit.

It is worth noting that the iMoutai platform sells not the core product of Kweichow Moutai “Feitian 53% 500ml Kweichow Moutai”, but the Year of the Tiger Zodiac Moutai, Rare Moutai, new Moutai 1935 and Feitian 53% 100ml Kweichow Moutai, but sales are still It is very popular, and a bottle is hard to find.

Its significance is not only to open up a new battlefield for self-operated channels, but also to ensure that consumers can buy real Moutai, and to anchor the market price of Moutai products. Among them, the most eye-catching is the 53-degree 100ml Feitian Moutai, which is priced at 399 yuan per bottle. If it is converted into 500ml of the main Pu Maotai, it is 1995 yuan per bottle, which is 33% higher than the official guide price of 1499. The main force of Pu Mao’s price increase has made a good advance. According to industry data, within 3 days after the launch of 53-degree 100ml Feitian Moutai on May 19, the market price of 53-degree 500ml Feitian Moutai continued to rise.

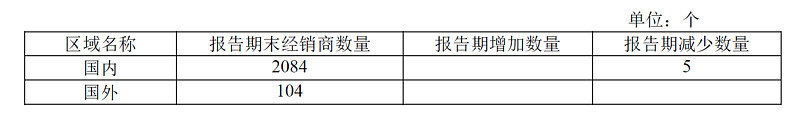

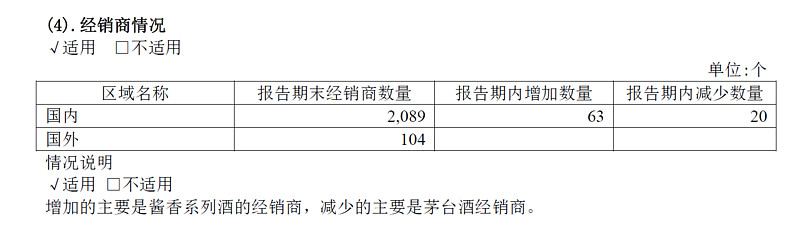

While increasing direct sales, we have seen that since last year, Moutai has been intentionally controlling the development of dealer channels and increasing its control over dealers. The number of dealers decreased by 5 in the first half of this year and 20 last year, most of which were cancelled in violation of Maotai’s regulations.

In the future, with the increase in the volume of i Moutai and the improvement of its control over the dealers (accordingly), if Moutai announces the price increase of 500ml Pu Maotai, it can also use i Moutai to launch the 500ml Feitian Moutai to anchor the market price and prevent the dealers from rising. Excessive price increases, thereby reducing negative market opinion.

2. The sauce-flavored wine series recorded a high growth, with 20% of the large two pairs recorded in the first half of the year

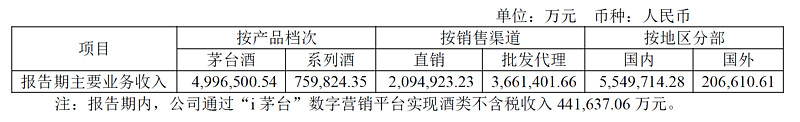

In the first half of the year, the revenue of Moutai liquor and series liquor reached: 49.965 billion yuan and 7.598 billion yuan respectively, a year-on-year increase of 16.34% / 25.38 %; in the second quarter, the growth rate of Moutai liquor and series liquor was: 14.97% / 22.03% , both achieved double-digit growth, and the series of wines achieved 20+ large double-doubles, the growth rate was slightly faster than the previous forecast.

In the third quarter, with the easing of the epidemic and the arrival of the peak season for traditional liquor consumption, it is expected that sales and prices will still have room and momentum to increase. According to the caliber of “double over half” disclosed by Moutai’s semi-annual work conference, the annual revenue of series wines is expected to hit 15 billion. Since the semi-annual reports of most wine companies have not been released at present, referring to the performance of the first half of last year, we found that the revenue of Moutai series wines in the first half of the year of 7.6 billion has ranked sixth in the industry , and its strength should not be underestimated.

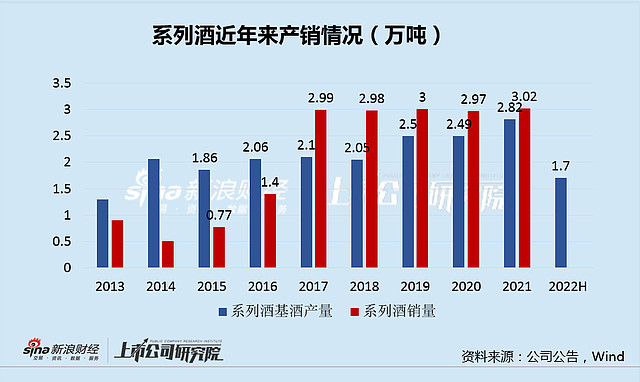

In terms of production capacity construction, before 2017, the base wine output of the series of wines was significantly higher than the sales volume. However, with the boom of sauce-flavored wine since 2017, the sales volume of the series wine has been at the level of 30,000 tons. Obviously, this level is limited by the insufficient production of base wine in the early stage.

In fact, until the end of 2021, the designed and actual production capacity of the series of wine-based wines are still only 31,700 tons and 28,200 tons. Although they have improved, they still cannot meet the sales demand. The sales of Maotai series wines are actually consuming inventory. .

The mid-year newspaper only mentioned that the 30,000-ton Maoxiang series wine project is progressing in an orderly manner. Check the construction in progress, and the current completion progress is 70%. Considering the production process of Maoxiang wine, it is estimated that it will not be completed by the end of this year, and it is expected to be completed in 2023. It will take until 2025 for this part of the newly added base wine production capacity to be converted into actual sales. In the short term, the sales of series wines will still rely on the old inventory to digest the old stock, so it is difficult to increase the short-term sales volume significantly.

3. The output of Moutai base wine is stable, and the short-term production capacity of series wine is tight

At the Tianjin Summit of the 2022 Yabuli China Entrepreneurs Forum on the evening of August 2, Ding Xiongjun, Secretary of the Party Committee and Chairman of Moutai Group, said that Moutai has long-term storage of high-quality base wine resources, and hundreds of thousands of tons of base wine are stored in the wine warehouse. If the market value is calculated, it is many trillions. What is the actual situation?

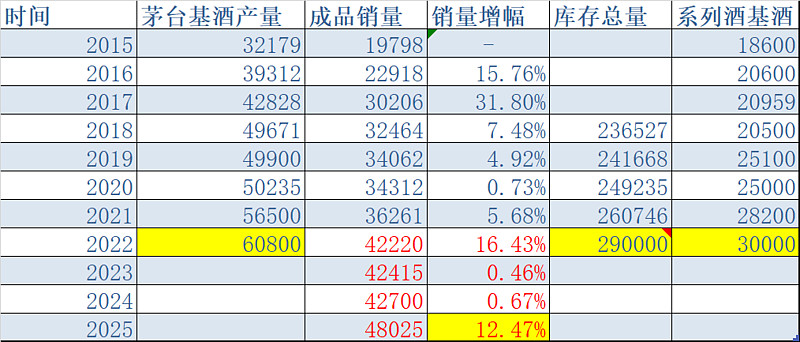

According to Moutai’s semi-annual report, the production of Moutai-based liquor will be 42,500 tons in the first half of 2022. Since the brewing process cycle of Maotai liquor is basically based on the process, the first half of Moutai’s production in the past three years accounted for 67% of the whole year. -73%, so the actual production capacity in 2022 should be between 58,200 and 63,400 tons, and the median annual output will reach 60,800 tons.

According to the operating data of Kweichow Moutai over the past years (predicted values for 2022 and beyond) that I have collected, the total inventory in 2021 will be 261,000 tons, 60,800 tons of Moutai base wine will be added in 2022, and 42,000 tons of finished wine will be sold. , the series of wines have been produced and sold, and the total inventory is expected to increase by 18,000 tons by the end of this year, reaching a level of 290,000 tons, which is basically the hundreds of thousands of tons of base wine that Ding Xiongjun said.

It is worth mentioning that some of the more than 200,000 tons of base wines are series of wines with lower market value than Moutai. If roughly from 2013 to 2021, the total sales volume of the series of wines is about 18.5%. 10,000 tons, and the base wine output in the same period was 192,000 tons, basically all base wine was consumed.

In addition, the storage period of the series of wines is shorter. Therefore, the current inventory of the series of wines is basically about 70,000 tons of base wines produced in the last two years.

Therefore, there are about 190,000 tons of Moutai in the current inventory of about 260,000 tons of Moutai. According to one ton of Moutai filling 2124 bottles of 500ML Pu Mao, a bottle of 1499 yuan, the market value is more than 600 billion, plus the series of wine should be 700-800 billion, Ding Dong’s trillions are still somewhat watery.

4. Steady operation quality, contract liabilities increased month-on-month

Overall, the quality of the company’s financial statements in the first half of the year was relatively high. Revenue and net profit increased simultaneously, gross profit margin and net profit margin both increased slightly year-on-year, and the debt ratio decreased slightly and remained low. At the end of the second quarter, contract liabilities were 9.67 billion yuan, an increase of 1.35 billion yuan from the end of the first quarter, laying a solid foundation for the third quarterly report. The only abnormal net operating cash flow was 6.86 billion yuan, down 70.4%, which was mainly due to the outflow of cash flow from the finance company (mainly Xijiu) and had little to do with sales activities.

5. Top ten tradable shareholders

As of the end of June, among the top ten tradable shareholders, Northbound Capital and two private equity funds Jinhui Rongsheng and Ruifeng Huibang “No. 3 Fund” increased their positions (institutions), and two index funds reduced their positions (Jimin). The two sides looked at each other and said something to each other.

6. Valuation and performance forecast

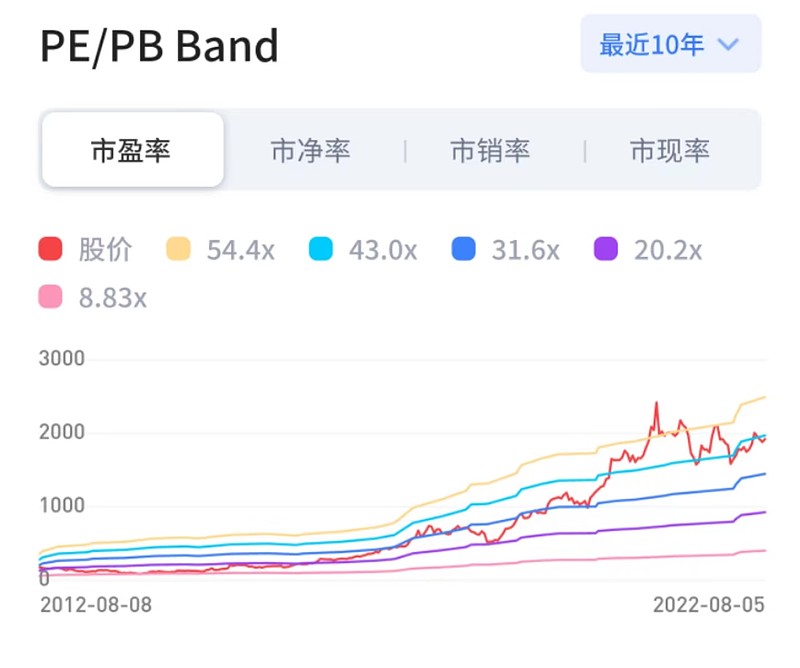

With the better-than-expected performance of i Moutai, the proportion of direct sales is expected to further increase in the future to increase profits. I slightly raised the net profit in 2022/2023 to 63 billion/72.5 billion, and the current price of 1911 yuan corresponds to the 2022/2023 price-earnings ratio of 38x/33x. The dynamic valuation of 38x in 2022 is slightly more expensive, but when it switches to the 2023 valuation at the end of September, considering the long-term certainty and rarity of Maotai, 33xPE is in a reasonable state. In the next two years, the stock price will rely more on performance to drive growth.

[Reading Tips] The content of this article is only for personal investment and research purposes, and does not serve as any investment advice or suggestion. Buy and sell according to this at your own risk.

——————————————————–

If you think the article is good, please like/retweet it. This is an important driving force to promote the birth of the next article.

@Today’s topic $Kweichow Moutai(SH600519)$

This topic has 23 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7815672011/227515183

This site is for inclusion only, and the copyright belongs to the original author.