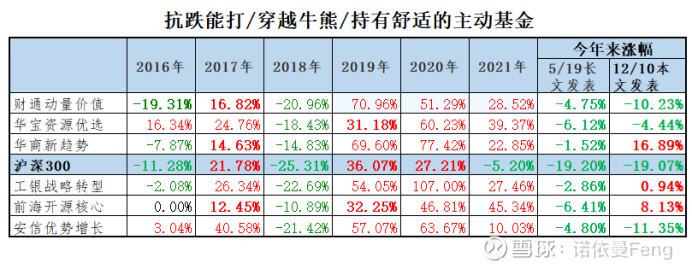

On May 19th, the long article ” Find those active funds that are “resistant to falling, able to fight through bulls and bears, and hold comfortable”” was well received by golfers. Naturally, funds have also attracted much attention, as listed below:

The above table lists the changes in the net value of these six funds from the publication of the first article on May 19 to the publication of this article (December 10). During the period, the Shanghai and Shenzhen 300 Index rose slightly by 0.13%, Huashang New Trend rose by 18.41%, Qianhai Kaiyuan Core Resources rose by 14.54%, ICBC’s strategic transformation rose by 3.80%, Huabao Resources Optimal rose slightly by 1.68%, and the remaining two products fell during the period.

Before this article, four of the funds have been analyzed:

ICBC’s strategic transformation:

March 30 ” Leader of Mesozoic Fund Managers: How to Build a Fund with 30% Annualized Return in Five Years?” “

New trend of Chinese businessmen:

May 25th ” Those Active Funds That Are “Resisting Falls, Going Through Bulls and Bears, and Holding Comfortably”, Analysis (1) “

Qianhai open source core resources:

August 17th ” Those Active Funds That Are “Resisting Falls, Going Through Bulls and Bears, and Holding Comfortably”, Analysis (2) “

Huabao Resources Preferred :

November 21, ” Those active funds that are “resisting the fall, going through bulls and bears, and holding comfortably”, analysis (3) “

(For the above article, you can directly click on the title to read the original text)

This article analyzes ” Anxin Advantage Growth A “

This time, instead of reviewing the fund from beginning to end as before, we will analyze several characteristics of the fund.

The biggest feature of ” Anxin Advantage Growth A ” is ” stable “. The performance is stable and the retracement is small. This is also the common feature of these six “resisting falls, being able to fight through bulls and bears, and being comfortable to hold”.

1. Briefly describe the performance of the fund

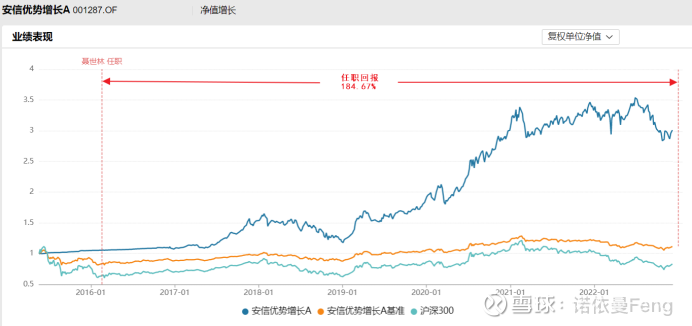

1. Nie Shilin began to work as the fund manager of Anxin Advantage Growth on February 28, 2016. It has been 6 years and 296 days since then, with a return of 184.67% and an annualized return of 16.6%. It ranks 49th among 848 similar fund managers and is at the top 5.78% position.

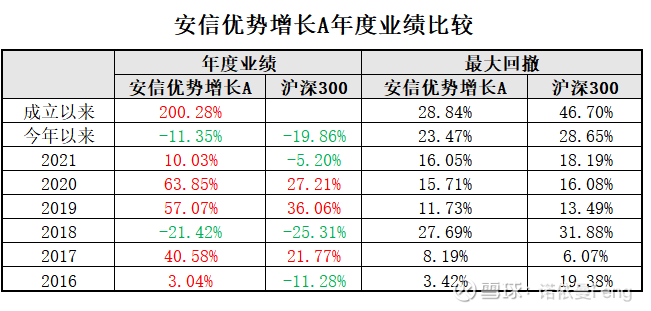

2. Since the establishment of the fund, the performance has outperformed the CSI 300 every year, but the largest drawdown is smaller than the CSI 300

The cumulative performance return of the fund since its establishment is 200.28%; the annual performance since 2016 has outperformed the Shanghai and Shenzhen 300 Index; the bull market (2017, 2019, 2020) has more excess returns, and the bear market (2018, 2021, 2022) has less excess returns Some;

The largest retracement, except for 2017, which was slightly larger than the CSI 300, was smaller than the CSI 300 in other years

2. Is Anxin Advantage Growth a balanced style fund?

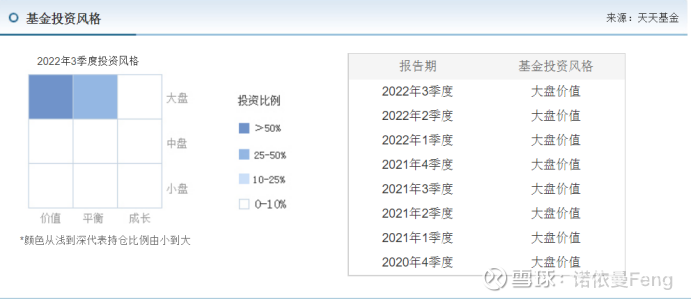

When discussing on various platforms, most of them will classify Anxin Advantage Growth as a balanced fund, and Nie Shilin will also be classified as a balanced fund manager.

I searched for a basis for a long time, and finally found a little shadow of a balanced fund:

The performance comparison benchmark of this flexible allocation fund is: return rate of Shanghai and Shenzhen 300 Index * 50% + return rate of China Securities Composite Bond Index * 50% ;

It is estimated that this performance comparison benchmark makes everyone think that he is a balanced fund with a balance between stocks and debts.

First of all, he has not had a “stock-debt” balance .

Nie Shilin took over the fund when the fund was still in the period of building positions (February 28, 2016), and for most of the time after taking over, he invested his main assets in bonds, waiting for an opportunity.

Until the fourth quarter (2016), 63.06% of stocks were allocated, but bonds were liquidated. After that, the high allocation of stocks all the way was more than 80% (only the half position in the first quarterly report of 2020), until 92.69% in the third quarterly report of this year!

Moreover, except for 2016, the bond allocation has never exceeded 7%.

Secondly , according to the analysis of Morningstar Fund’s investment style box (Jiugongge), its investment style basically belongs to the “big market value” type .

The following figure shows the investment style of the fund according to the statistics of Tiantian Fund Network:

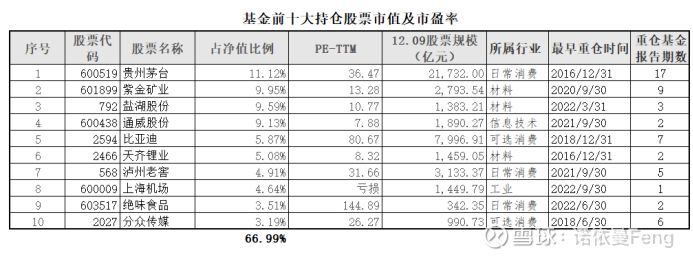

Third, from the top ten positions of the fund, we can also see its typical “big market value” style

The stock market capitalization of the top 10 holdings of the fund amounted to 4.3 trillion, and only 2 were less than 100 billion. The industry distribution was relatively concentrated, of which the consumer industry accounted for half (5), followed by resources (3).

2. Fund income mainly comes from the accumulation of stock transactions

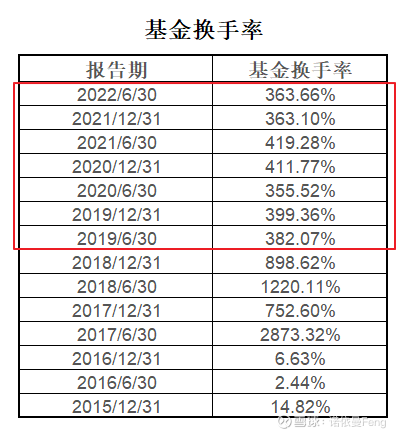

Although the investment style of the fund is “big market value type”, the fund manager Nie Shilin is a ” trading type ” player, which can be seen from his relatively high turnover rate:

Since 2019, the fund turnover rate has basically remained between 300-400

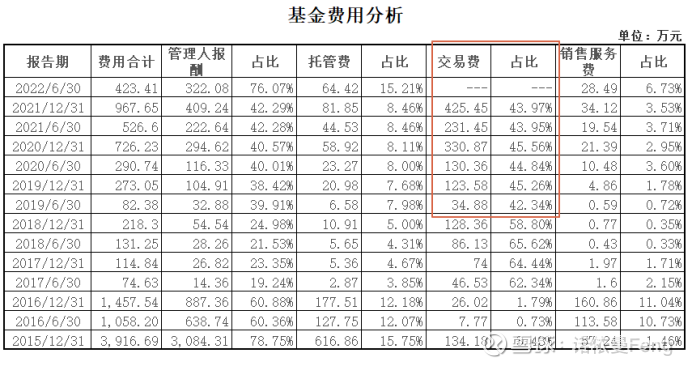

The higher the frequency of stock transactions, of course, the higher the transaction costs. After 2019, when the turnover rate is basically stable, the proportion of transaction costs in fund expenses is also basically stable, but the proportion of transaction costs is as high as 40%.

After paying such a high proportion of transaction fees, has the fund actually gained any income from frequent stock transactions? Let’s take a look at the composition of the fund’s income:

From the financial report of the fund, the income of the fund mainly consists of the following four items:

1. Interest income , including ” deposit interest income ” and ” bond interest income “

“Deposit interest income” is cash bank deposit interest;

“Bond interest income” is the interest earned after the bond is held to maturity;

2. Investment income , including ” stock investment income “, ” bond investment income ” and ” dividend income “

“Stock investment income” is the income from stock trading;

“Bond investment income” is the income from bond transactions;

“Dividend income” is the dividend paid during the holding period of the stock;

3. The income from changes in fair value refers to the price change between the target still held and the price at the time of purchase; simply put, it is the difference between the current price of the target and the price at the time of purchase.

4. Other income is not explained.

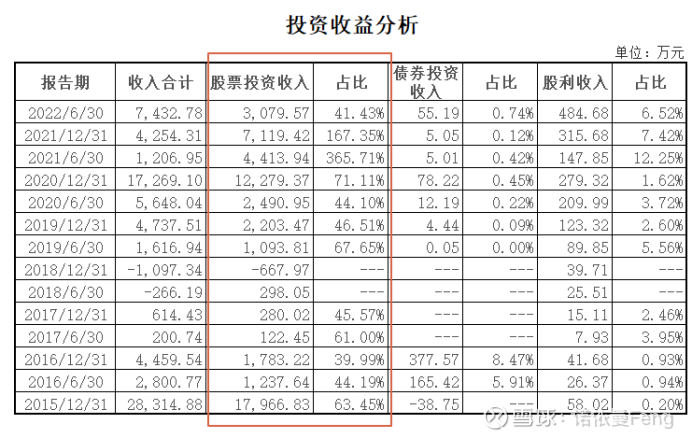

The following table lists the percentage of ” investment income ” in the Fund’s total income.

We found that ” stock investment income ” has always been the most important source of fund income, and can be called the largest source of income; the proportion has always been relatively high, always above 40%.

And we found that, except for the 2018 annual report, the stock investment income was negative, and all other reporting periods were positive;

That is to say, no matter whether the stock market goes up or down, Nie Shilin’s stocks are frequently traded, and he can “buy low and sell high” as a whole.

3. Essence’s advantage growth, stable investment style and excellent performance return, won the recognition and favor of institutional investors

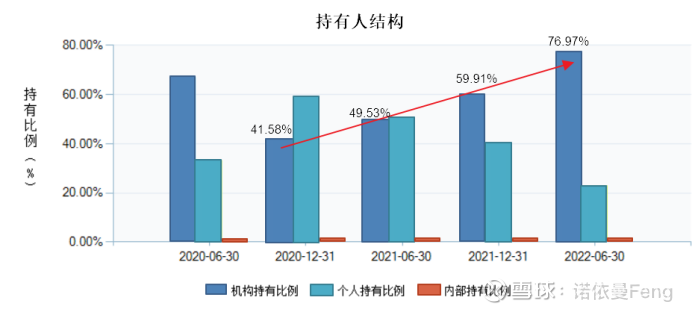

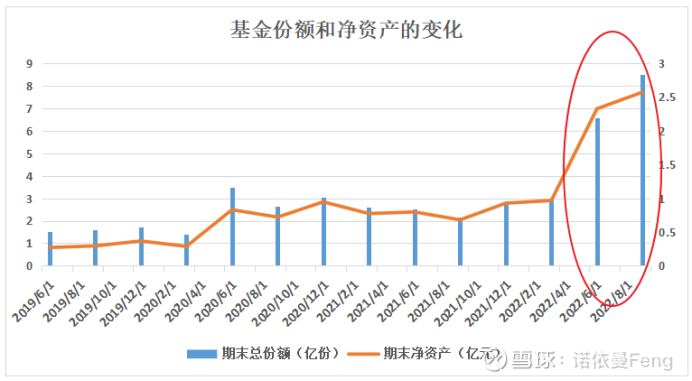

Since the 2020 annual report, the proportion of institutional investors has continued to increase, from 41.58% in the 2020 annual report to 76.97% in the 2022 mid-term report.

Especially this year, when the fund share and total assets have increased significantly, the proportion of institutional investors has continued to increase; it shows that the increased share of institutional investors exceeds that of individual holders.

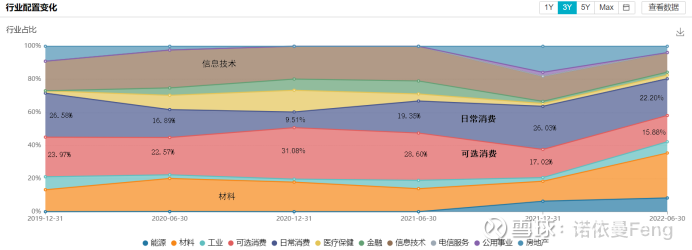

4. The industry allocation of Anxin’s advantageous growth is relatively concentrated, and the long-term high-allocation industries: daily consumption, optional consumption, materials, information technology

According to WIND’s first-level industry classification, if “daily consumption + optional consumption” is combined into one as the “consumption” industry, the allocation ratio of funds in the consumer industry is at least 33.05%, nearly one-third; the highest is more than 50% %; that is to say, the consumer industry is the main allocation of the fund industry.

As can be seen from the figure below, the other two long-term allocations of the fund, with relatively high allocation ratios, are the two industries of materials and information technology.

As mentioned earlier, the industry distribution of fund holdings is highly concentrated, mainly in daily consumption, optional consumption, materials, and information technology.

The changes in the proportions of the top four industries are shown in the figure below.

Before 2021, the proportion of the top four industries will reach 80%, and this year has declined slightly, but it is still above 70%

However, the proportion of the largest industry and the top two industries did not show a significant downward trend.

Among the top four industries in the above reporting period, except that the fourth largest industry in the 2020 annual report is healthcare (replacing daily consumption), and the third largest industry in the 2021 annual report is real estate (replacing materials), the rest of the period is The above-mentioned long-term high allocation industries are daily consumption, optional consumption, materials, and information technology.

5. Nie Shilin is a low-key “Taurus” fund manager

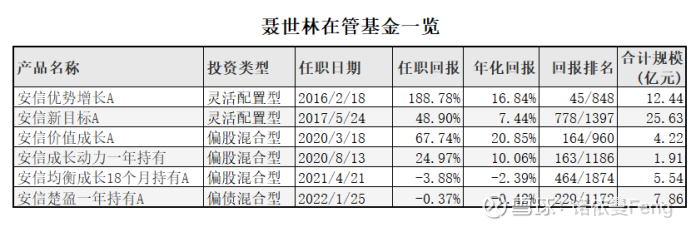

Nie Shilin has been a fund manager for 6.8 years. It can be said that he is a Mesozoic fund manager. In the circle of strong fund managers, Nie Shilin is not outstanding, but his outstanding and stable performance in recent years has gradually been recognized by investors. It currently manages 6 funds with a management scale of 5.76 billion.

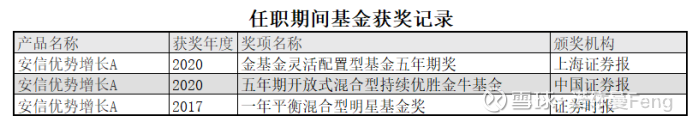

Anxin Advantage Growth A is not only its first show, but also the one with the best performance. During its management period, it has won three fund trophies: a Golden Bull Award, a Star Fund Award, and a Golden Fund Award.

(full text)

Series of articles on “Active Funds that Can Resist Falls, Overcome Bulls and Bears, and Hold Comfortably” :

(Click on the title below directly to read the original text)

2. ” Leader of Mesozoic Fund Managers: How to Make a Fund with 30% Annualized Return in Five Years?” “

(Note: 1. The content of this article only represents my point of view. It can only be used for reference. It does not constitute investment advice. It cannot be used as a recommendation or guarantee for buying, selling, or subscribing securities or other financial instruments. 2. Comments are welcome for criticism and discussion. 3. Information and data sources: Wind Financial Terminal; Tiantian Fund Network; Xueqiu Platform)

@雪球创作者中心@今日话题@球友福利@雪球基金@安信基金$ Anxin advantage growth mix (F001287)$ #雪球星计划公园达人#

This topic has 0 discussions in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/3179670287/237541730

This site is only for collection, and the copyright belongs to the original author.