Jia Haonan from Fujia Temple

Smart car reference | public account AI4Auto

In just two months, the third major accident occurred in lidar.

Quanergy, bankrupt.

It is one of the veterans and star companies of lidar. As early as 2016, it made a big splash with the Mercedes-Benz E-class project.

OPA (Optical Phased Array) all-solid-state lidar is Quanergy’s first mass production.

10 months ago, Quanergy had just gone public with much fanfare.

Bankruptcy, all of a sudden.

before and after bankruptcy

Quanergy’s bankruptcy was not seeking investment to continue its life, but a complete shutdown and liquidation.

According to the news published on Quanergy’s official website, the company first filed for bankruptcy protection in Delaware bankruptcy court on Tuesday.

Immediately afterwards, Quanergy initiated the sale of the business in accordance with the US Bankruptcy Code.

The third point, Quanergy CEO Kevin J. Kennedy announced his official retirement on December 31.

His responsibilities were handed over to Lawrence Perkins, a professional manager from a consulting company who specializes in providing corporate finance and legal intermediary services.

Lawrence Perkins’ title is Chief Restructuring Officer and President.

In addition, as part of the bankruptcy process, Quanergy laid off almost all employees at one time, including co-founder and chief development officer Tianyue Yu (Yu Tianyue), chief financial officer Patrick Archambault, chief marketing officer Enzo Signore and senior vice president of operations Kevin Amiri .

Only a team of about 15 people was left to go through the final bankruptcy procedure.

This also directly proves that Quanergy’s bankruptcy is a complete shutdown with little room for maneuver.

That’s a stark contrast from when Quanergy went public just 10 months ago.

The situation has changed so quickly that it is astonishing.

What did Quanergy experience during the NYSE tour in October?

In February of this year, Quanergy was listed on the New York Stock Exchange through a SPAC.

It is the Capital Acquisition Company (CCAC) of China CITIC Capital that provides the “shell” of the listed company.

Under the agreement, existing shareholders will transfer their entire shares to CITIC Capital Acquisition Company. Quanergy’s current shareholders will own approximately 72% of the combined business, while CITIC Capital Acquisition’s public shareholders will own approximately 20% of the company, with the remainder held by PIPE investors and CITIC Capital Acquisition’s founders.

In other words, Quanergy is a reverse backdoor, and CCAC acquires Quanergy shares.

After the merger was completed, the company was listed on the New York Stock Exchange under the latest stock code of “QNGY”, which directly increased the available liquidity of about US$175 million in the account, with a valuation of US$1.1 billion.

The advantage of SPAC listing is that it does not need to go through the conventional IPO procedures and can quickly realize capitalization operations.

But the disadvantage is that the financing cannot be obtained immediately, and it needs to be obtained by issuing additional shares after listing.

The lack of an IPO roadshow also makes investors more cautious about the company’s business prospects, especially in the context of the reshuffle of the entire industry this year.

In the financial report disclosed after Quanergy’s listing, the company’s losses in the second quarter and the third quarter reached US$25.7 million and US$17.7 million respectively.

Revenues were $1.2 million and $2.3 million, respectively.

As of the end of the third quarter, Quanergy had only US$7.1 million left in its account, which obviously could no longer support operations in the fourth quarter.

In October, Quanergy’s stock price had fallen to $1.25, a 99% drop from the $200 when it first went public. So Quanergy conducted a 20:1 reverse stock split, the main purpose of which was to increase the company’s trading price per share so that the company could meet the listing requirements of the New York Stock Exchange on the minimum stock price.

But this still cannot save Quanergy’s decline. The stock price in the capital market has been falling all the way. In November, it received a delisting warning from the New York Stock Exchange. The stock price is currently only $0.074, and the company’s market value is almost cleared:

Bankruptcy is inevitable.

Who is Quanergy?

At the end of 2012, the three co-founders Louay Eldada, Yu Tianyue and Angus Pacala started their business in the garage of Eldada’s home.

Louay Eldada graduated from Columbia University’s Department of Optics. He was the head of research and development at Honeywell, and later founded several optical imaging technology companies.

Yu Tianyue is an alumnus of the Department of Chemical Physics of the University of Science and Technology of China, a winner of the Guo Moruo Award, and received a doctorate in nanomaterials from Cornell University in the United States in 2002. Served as CTO of Quanergy.

We are already familiar with Angus Pacala. He left Quanergy in 2015 and founded Ouster. He announced the merger with Velodyne some time ago.

At the beginning of Quanergy’s entrepreneurship, it has made great strides all the way, won multiple rounds of financing, and its valuation was once as high as 2 billion U.S. dollars.

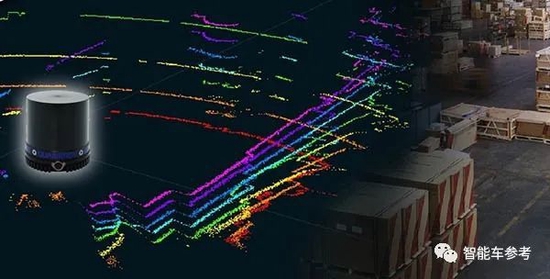

It was highly sought after because it provided another technical idea for the lidar market at that time: solid-state lidar. This new form of product is smaller and less expensive than traditional mechanical rotating lidars.

And Quanergy is taking the solid-state CMOS sensor route based on optical phased array (OPA) technology. It can realize full low-light integration from transmission, scanning to reception, which greatly improves its reliability, greatly improves the anti-interference ability, and reduces system power consumption at the same time.

Compared with the FLASH route, OPA is considered to be a more suitable solution for vehicle lidar.

With this concept, Quanergy made its debut quickly.

At the CES show in 2016, Quanergy released the so-called ‘world’s first solid-state lidar sensor’ S3, which was mounted on the Mercedes-Benz E.

Quanergy said at the time that each S3 would cost $200. If the order quantity is 10,000 units, the cost of each lidar is expected to be kept below $100.

Such stories are extremely attractive to investors and even to the entire industry.

However, the road to getting Quanergy products into cars did not go smoothly as expected.

The cooperation with Mercedes-Benz and Koito (the largest automotive lighting company in Japan) broke down successively, and the order was snatched by another competitor, Cepton.

The reason itself is that the index parameters have shrunk again and again, from 300 meters in December 2014 to 200 meters in January 2017; 6 months later, it dropped to 150 meters; at the end of 2017, Quanergy changed this parameter to For “very far”.

In terms of delivery, it has not been able to achieve stable mass production.

In 2015, Angus Pacala fell out with the team and left to start Ouster. At that time, he was ridiculed by Louay Eldada for “doing not understand lidar at all”.

Under various twists and turns, Quanergy was in trouble for the first time in 2020 and had no money to burn.

The final solution is for founder Louay Eldada to leave, and Kevin J. Kennedy became CEO and raised another $175 million for Quanergy to renew his life.

At this time, Yu Tianyue is the only one left in the founding team, who is fully responsible for Quanergy’s technology research and development and product roadmap.

But looking back at the history since its establishment, Quanergy has never actually achieved mass production and shipment of a product. The promising vehicle-mounted solid-state lidar did not receive any orders from car companies.

Later, it was reported that he intended to participate in the US-Mexico border wall project, but there was no follow-up.

Until now, Quanergy has been shut down and liquidated, and Yu Tianyue himself has lost his job.

LiDAR shuffle

Since October, we have paid close attention to three “failure stories” in the lidar field:

Ibeo, the originator of the industry, went bankrupt and fell on the eve of mass production.

Velodyne, the monopoly giant that once “covered the sky with one hand”, fell into a quagmire last year. In November, it announced a merger with another poorly managed Ouster to survive.

Now, the star company Quanergy has declared its inability to recover.

The reshuffle of the lidar industry has begun the most intense stage.

The four companies that had problems first, the specific problems were different:

Ibeo is taking too big a step, aiming at all-solid-state lidar, which is technically difficult, but at the same time, the performance has not opened up the gap with the semi-solid-state products of Chinese start-up companies.

Velodyne and Ouster are resting on their laurels. They have always used mechanical lidar as their main product, which is expensive and not available. Robotaxi’s business is in trouble after the cold, and there is nothing to do in the face of the wave of passenger car lidar.

Quanergy is constantly turbulent in terms of operation and personnel, which makes the product development progress and technical indicators repeatedly discounted, and loses the best opportunities.

But they all have one thing in common: only car, no car regulations.

Ibeo and Quanergy represent two routes of all-solid-state LiDAR, and their technological leadership is beyond doubt.

Regardless of whether it is all solid-state or semi-solid-state, the mass production of lidar needs to cooperate with car companies, and currently the largest market and the main lidar on-board are in China.

However, after weighing product cost performance, mass production engineering capabilities, and supply chain security, most of China’s car companies have chosen domestically produced lidar.

Even if a company like Quanergy has the best technology and team, it cannot meet the needs of mass production scenarios and OEMs, and it is still hard to escape the fate of being eliminated.

The reshuffle of the vehicle-mounted lidar industry will continue. The four industry pioneers who have been dumped have asked all the players who are still running for a long time. Three questions about the “soul”:

Can it meet the car regulations?

Can it be mass-produced stably?

Is the cost reasonable enough?

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-15/doc-imxwtxrr3039561.shtml

This site is only for collection, and the copyright belongs to the original author.