In 2018, it began to build a position in LONGi Green Energy, and gradually increased its position to 15% in 20 years. After nearly two years of in-depth and continuous research, in June 2020, it was decided to significantly increase its proportion in the portfolio, reaching 60% within one to two days, and reaching a maximum of 82% in the portfolio in 21-22 years. By December 30, 2022, the proportion of LONGi’s position has dropped to 68%, mainly due to the decline in net worth. The brokerage did not adjust the cost of holding positions afterwards), and returned all the previous large profits. Our 20-year and 21-year portfolio returns (160% and 54%) are mainly contributed by Longji’s holdings. The 22-year portfolio loss also mainly comes from this position. A summary of the combination will be written separately. This article mainly wants to review why it suffered a severe setback this year, and at the same time, after re-examining, why should we stick to the basic principles of the established investment model.

First of all, let’s take stock of the major events related to LONGi Green Energy in the past year or even about a year and a half:

The mass production of new technology batteries that the market is looking forward to has been repeatedly postponed. Lost European Patent Litigation. U.S. exports are blocked. Yunnan electricity tariff policy changes. The progress of BIPV has been greatly delayed due to standard issues, the resistance of the construction industry and the twists and turns of the initial product run-in. Of course, the biggest problem is the soaring price of silicon materials. At the same time, as the largest module shipper, LONGi actively accepts profit damage and significantly reduces the operating rate from silicon wafers to modules in order to abide by the futures contract. It was also during this period that a large number of new entrants with heavy capital came flocking in, causing the competition situation to become more and more complicated. Judging from the financial report, LONGi’s profit growth rate and ROE changes from the second half of 21 to the third quarter of 22 are also weaker than those of competitors.

Of course, there were positive events in 2022, but on the whole, negative factors dominated. Especially with the six-fold increase in 20 years, game funds are becoming more cautious, and gradually tend to be more consistent and bearish. From 21 to 22, LONGi underperformed BK 1031. Since August 22, it has also underperformed the Shanghai Stock Exchange Index and CSI 300.

The above is a summary of the review. Undoubtedly, at least from the perspective of the whole year of 2022, there is a major problem in my judgment, which has brought a major adverse impact on the earnings of the whole year of 2022. So what is the main mistake?

First, there is a kind of inertial thinking, which mistakenly believes that the trend of Longji’s stock price in this one-year cycle will continue the trend of the past three years after a pullback in one to two quarters.

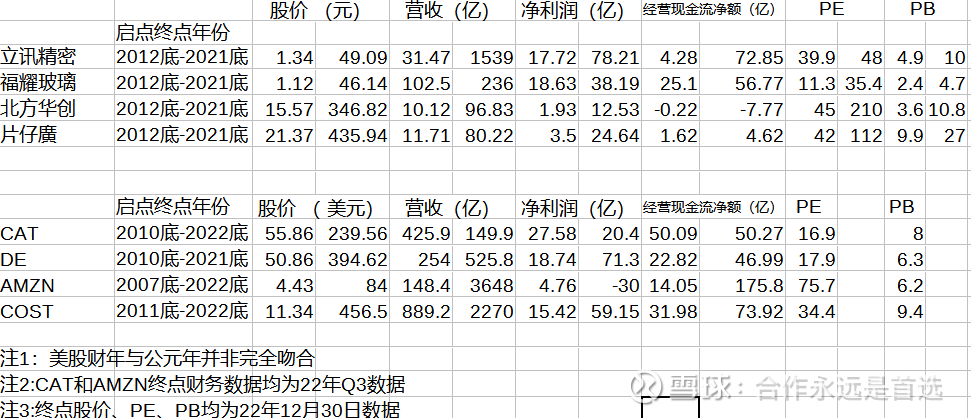

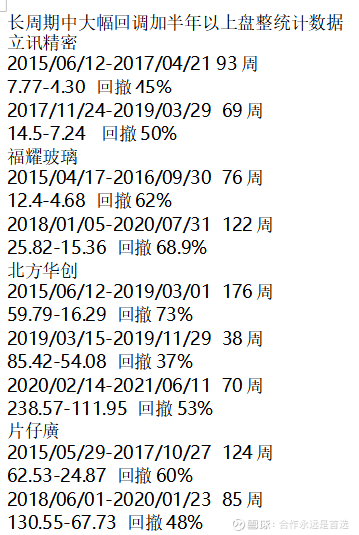

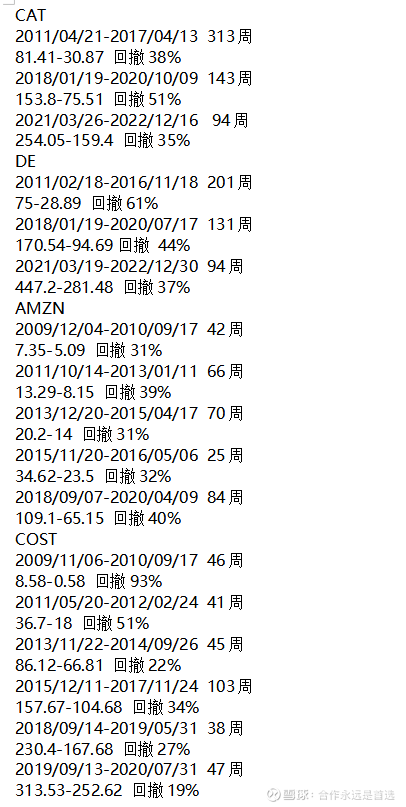

In the process of reflecting on the lessons learned, select several companies that have grown over a long period of time like Longi and have become industry leaders for comparative analysis. The first four are Chinese companies, except for Pien Tze Huang, which are all toB machinery processing and manufacturing companies. CAT and DE in American companies also belong to this category. The reason for choosing Pien Tze Huang is that there is an individual shareholder who has held the position since 2009 and has not changed much. Their growth is relatively excellent, no matter from the perspective of financial indicators or the perspective of stock price rises that last ten years or more. However, even so, in this long cycle, they have all experienced sharp retracements and sideways adjustments for one to two years or even longer without exception.

Therefore, in 23 years, we must cultivate and strengthen our grasp of the periodicity of such long-term growth stocks. For this kind of target, we can insist on long-termism. At the same time, investors with our amount of funds can also do some phased increase and decrease of positions.

Second, keep a full position all the time, and increase your position substantially in relatively shallow pullbacks many times. From September 24, 2020 to November 21, the positions were increased substantially several times. On September 24, 20, the average cost of increasing positions was about five yuan higher than the closing price of the day. After that, many large positions were increased, regardless of whether they were profitable at that time or in a short period of time after that, all of them were in a state of loss in the past year or so. It is necessary to explore specific methods for position management and control in 23 years. Pay attention to the rhythm of adding and reducing positions, and pay attention to overcoming the over-optimism about short- and medium-term fluctuations due to optimism about the long-term.

While correcting errors, also pay attention to reminding yourself again and again, don’t overcorrect .

In the past 22 years, many investors have left LONGi for strategic reasons. This cannot be overstated. However, all kinds of bearish comments are overwhelming, and it seems that Longji will never recover from this fall. In the past year and a half, criticism and even attacks on Longi have become the norm. It can be guessed that most investors have established the view that Longi is out of date. The largest market value of the photovoltaic industry itself is a minus item in the domestic investment industry. The growth rate has slowed down again, so it is natural to abandon it. In addition, the number of shareholders of Longji is abnormally high. The stronger reason for avoiding is that Longji has become weak in competition. In this “low threshold and lack of differentiation” industry, many new entrants who hold a lot of money can get new technology and new equipment as soon as they enter, and this advantage seems to be overwhelming.

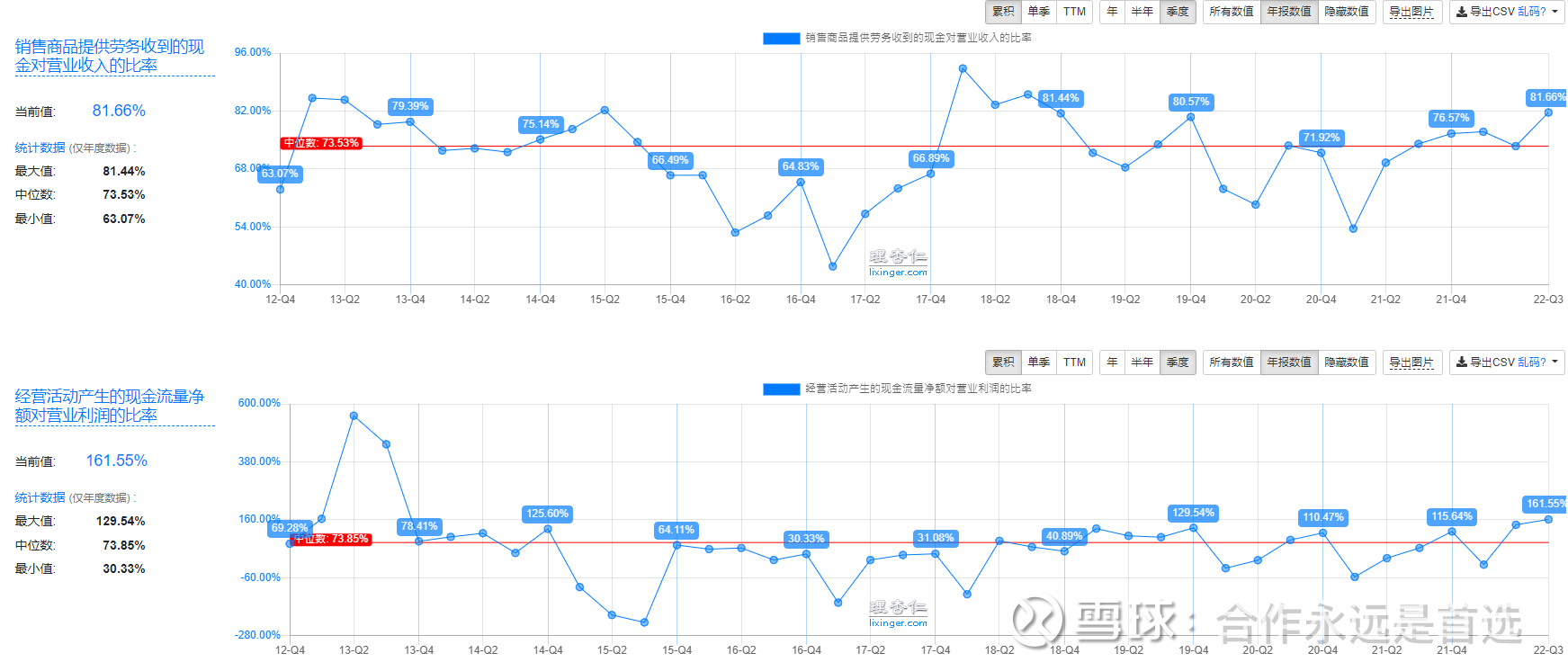

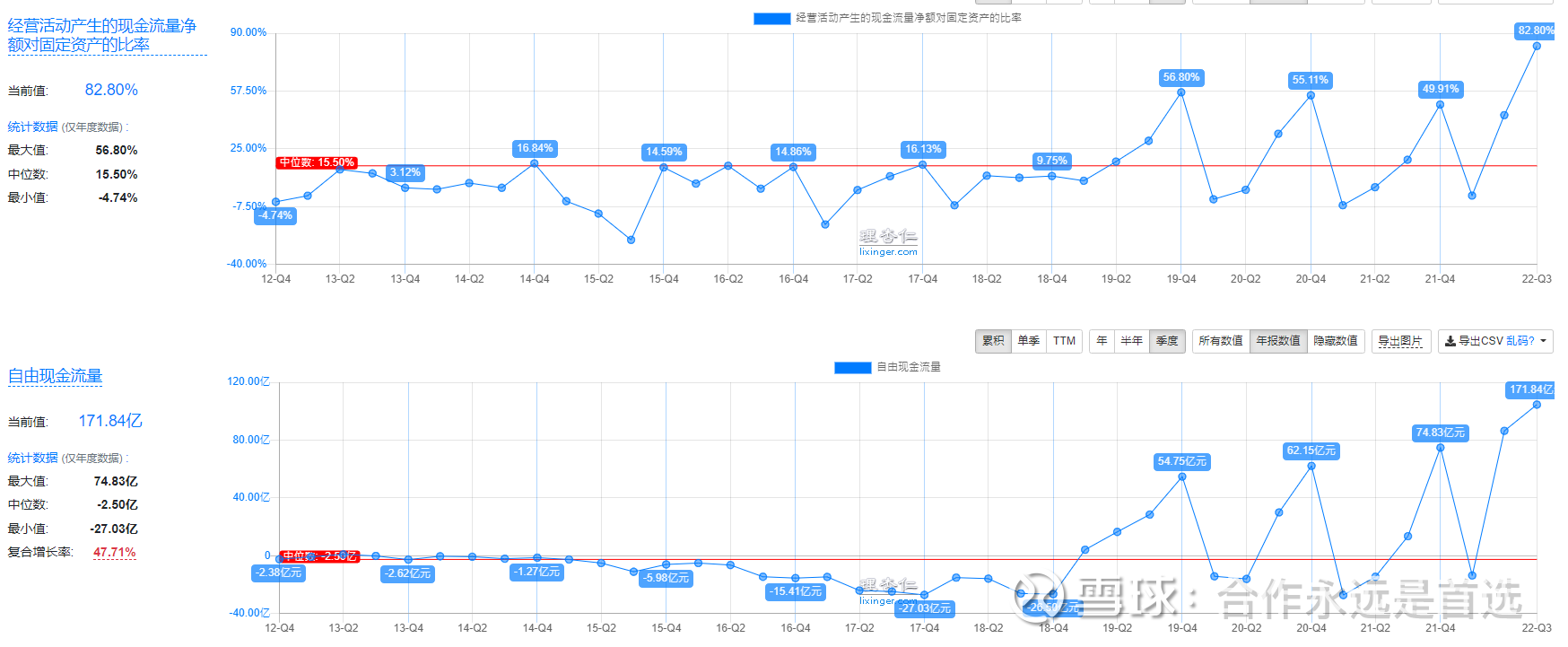

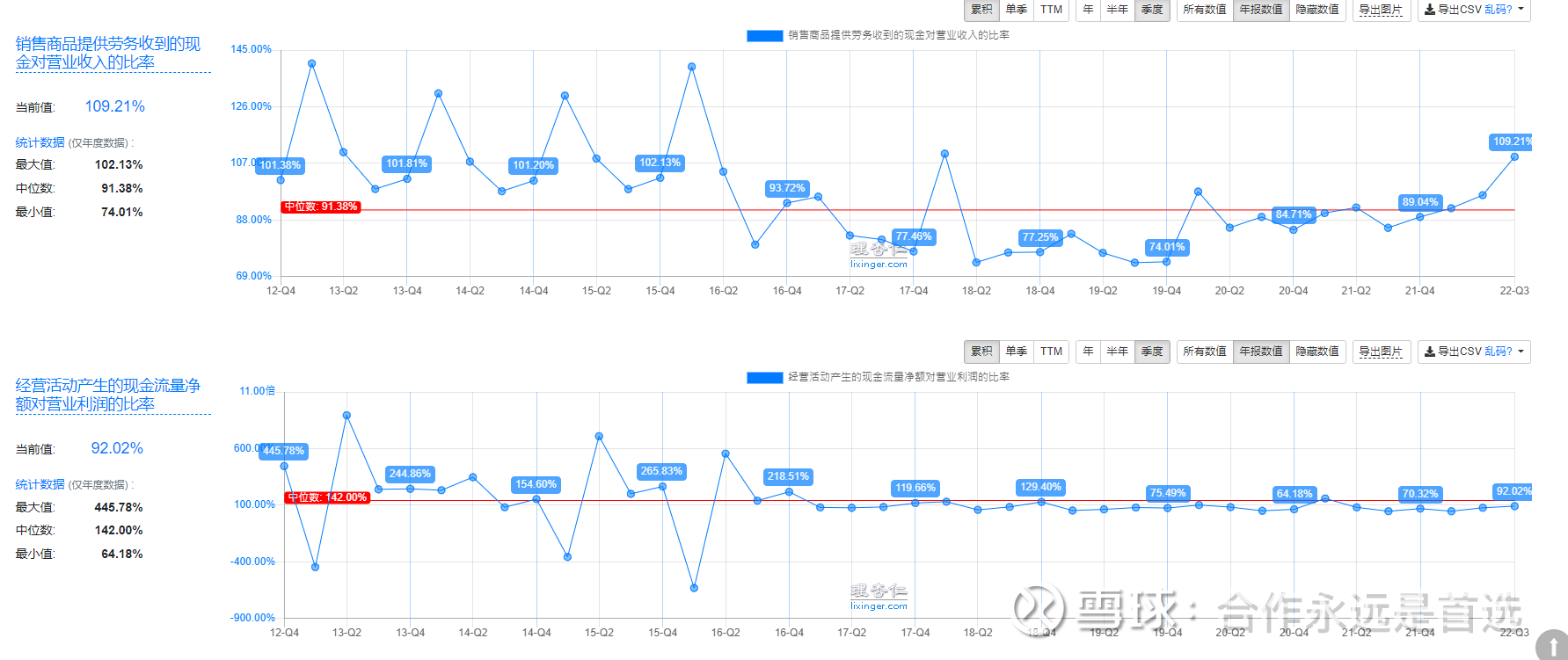

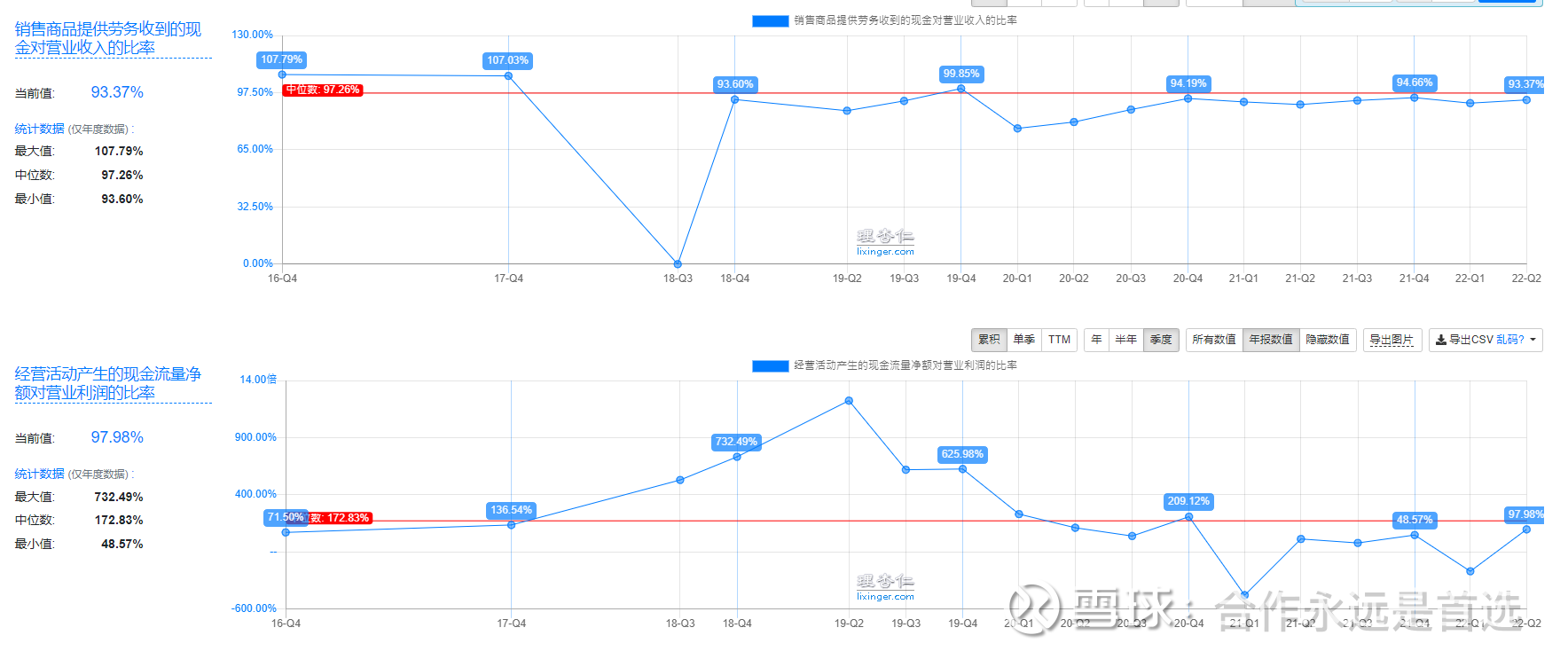

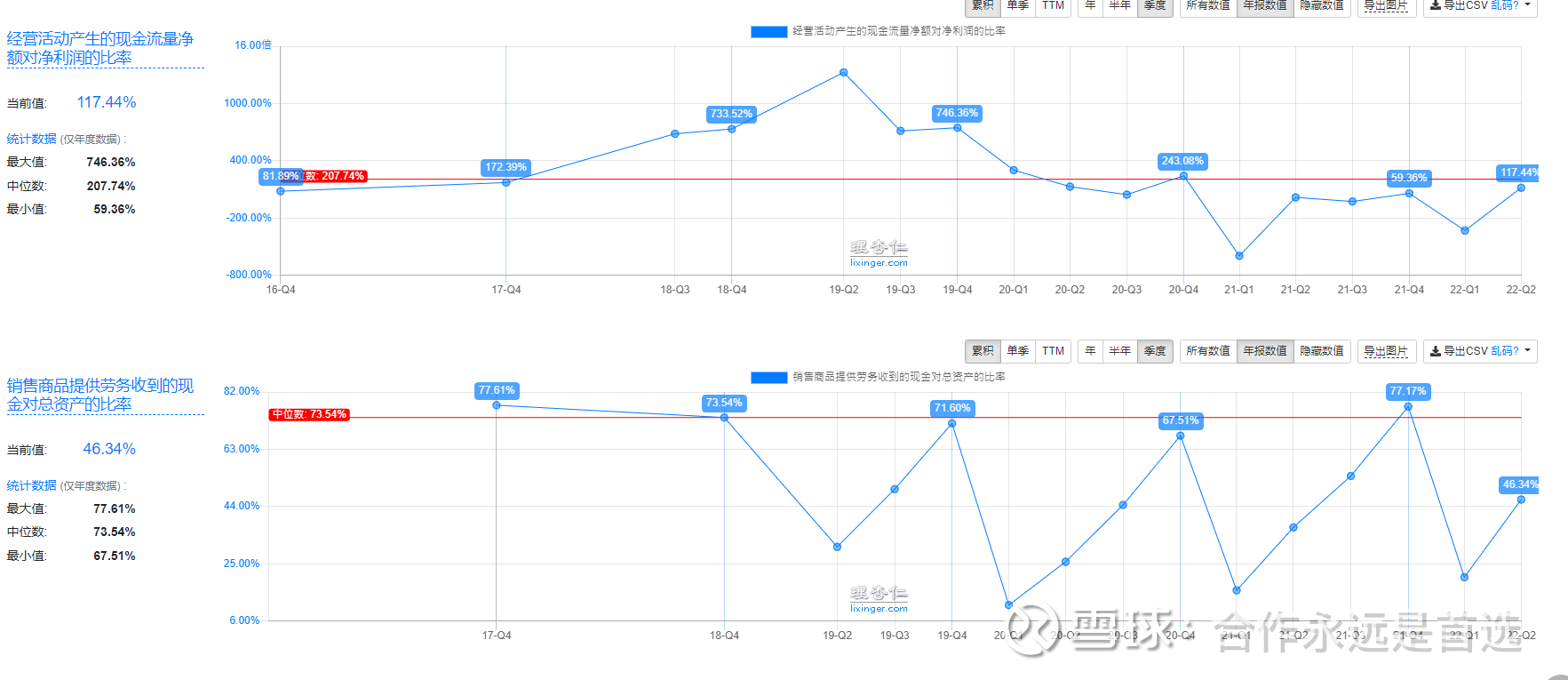

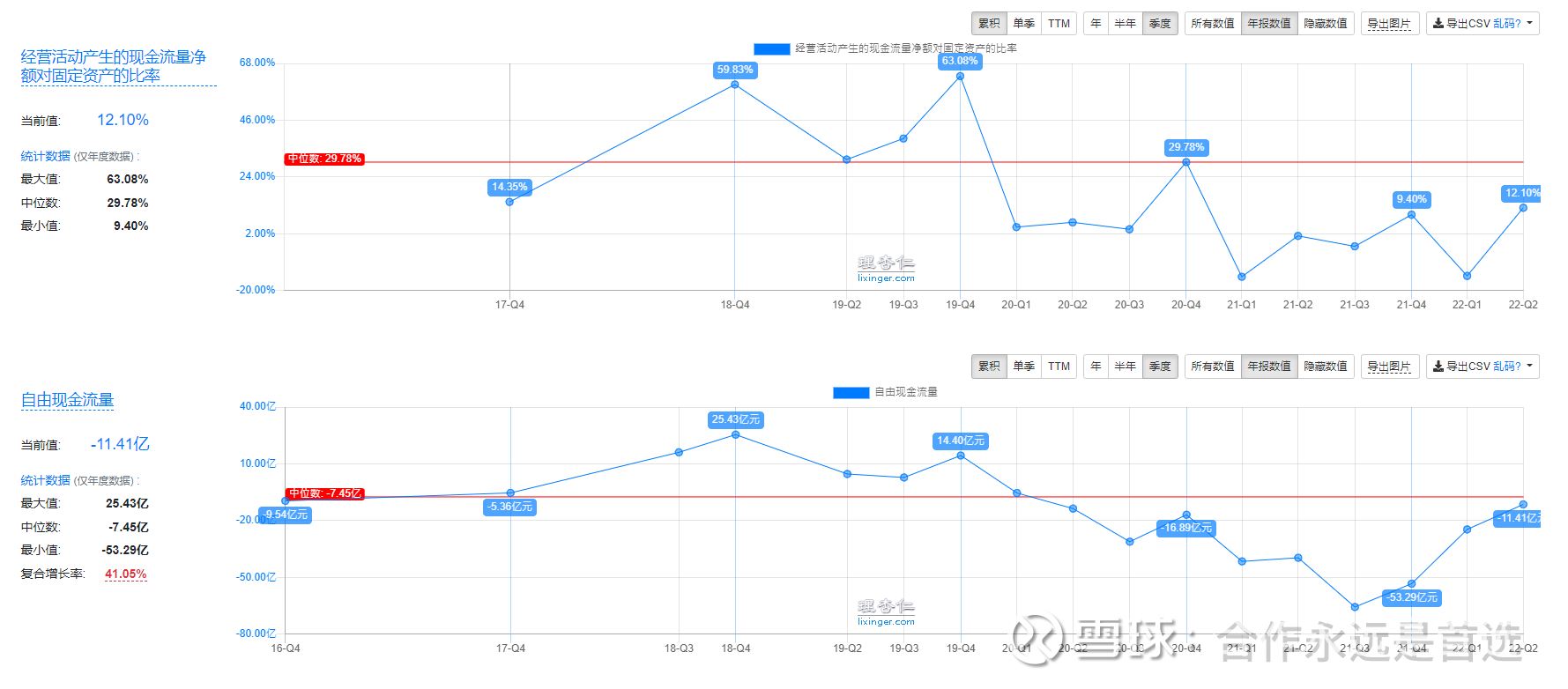

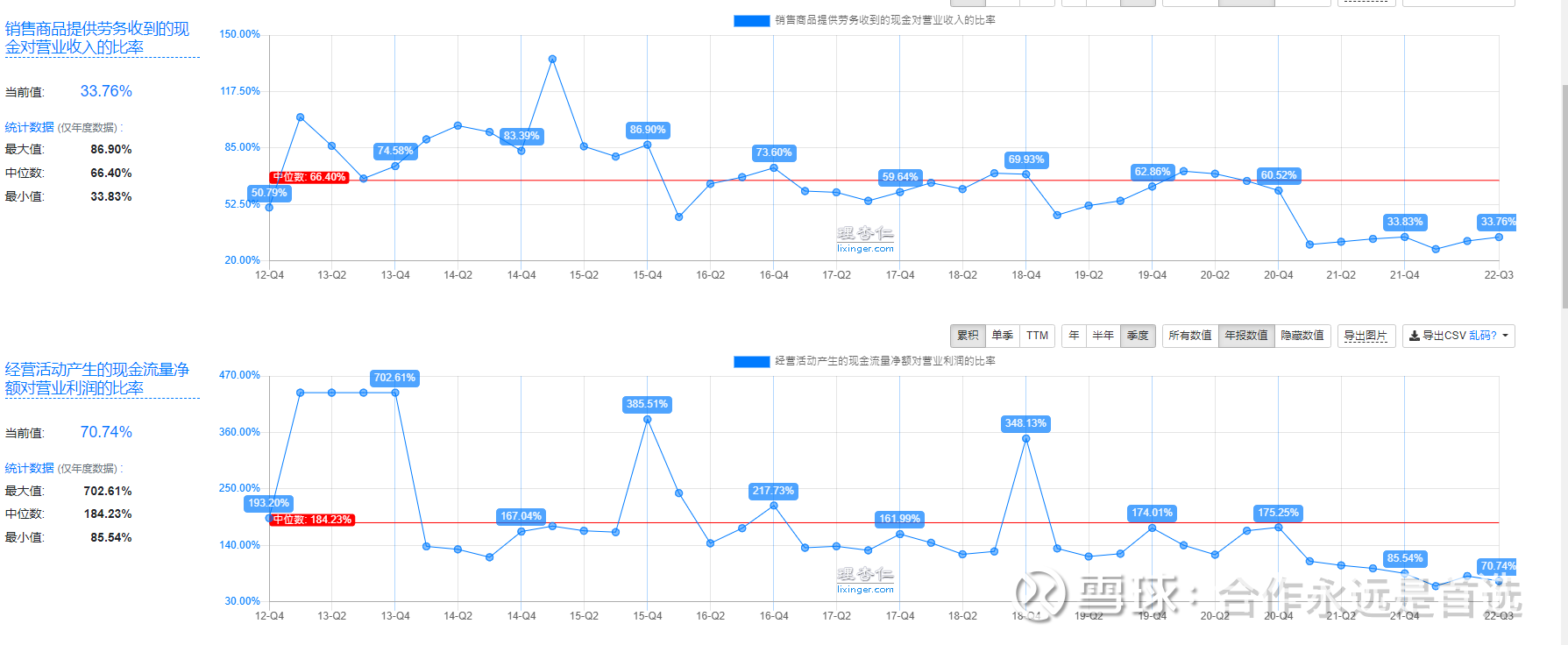

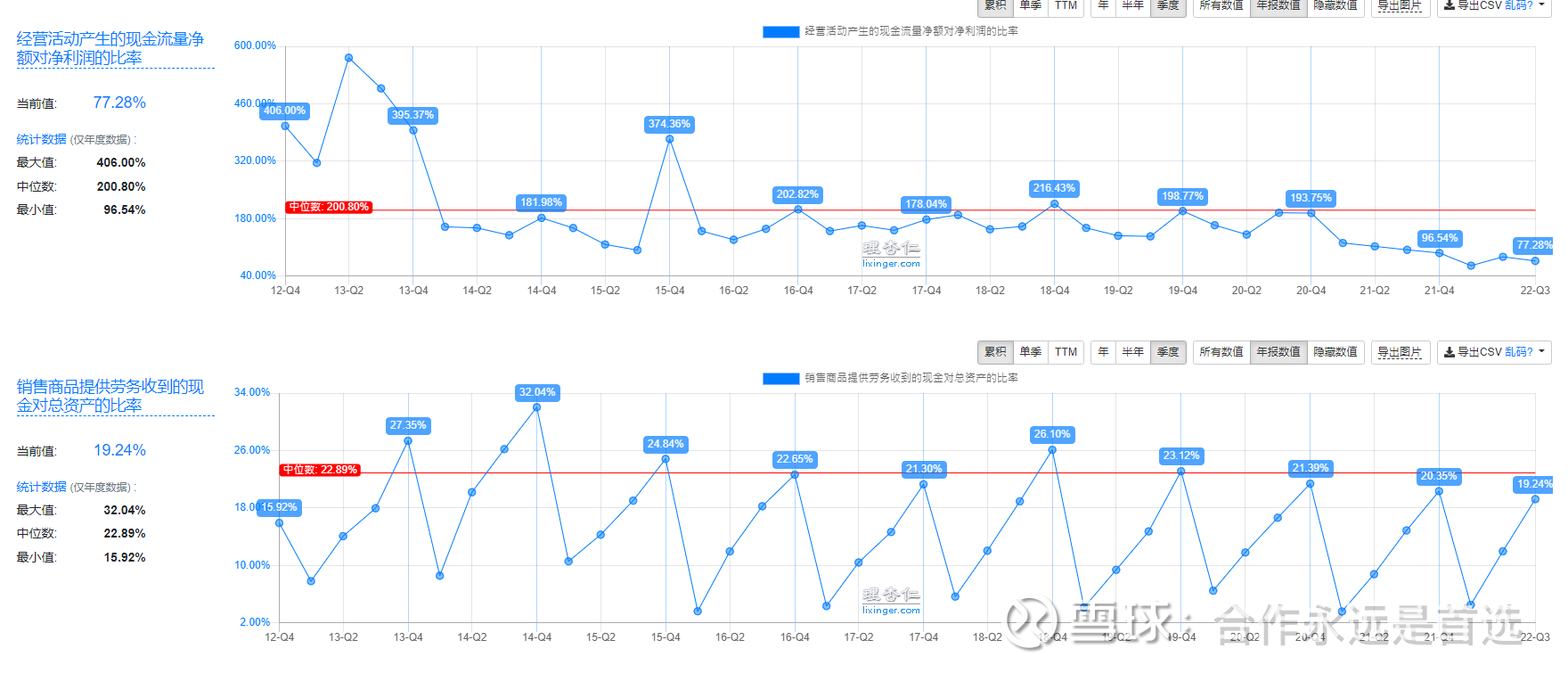

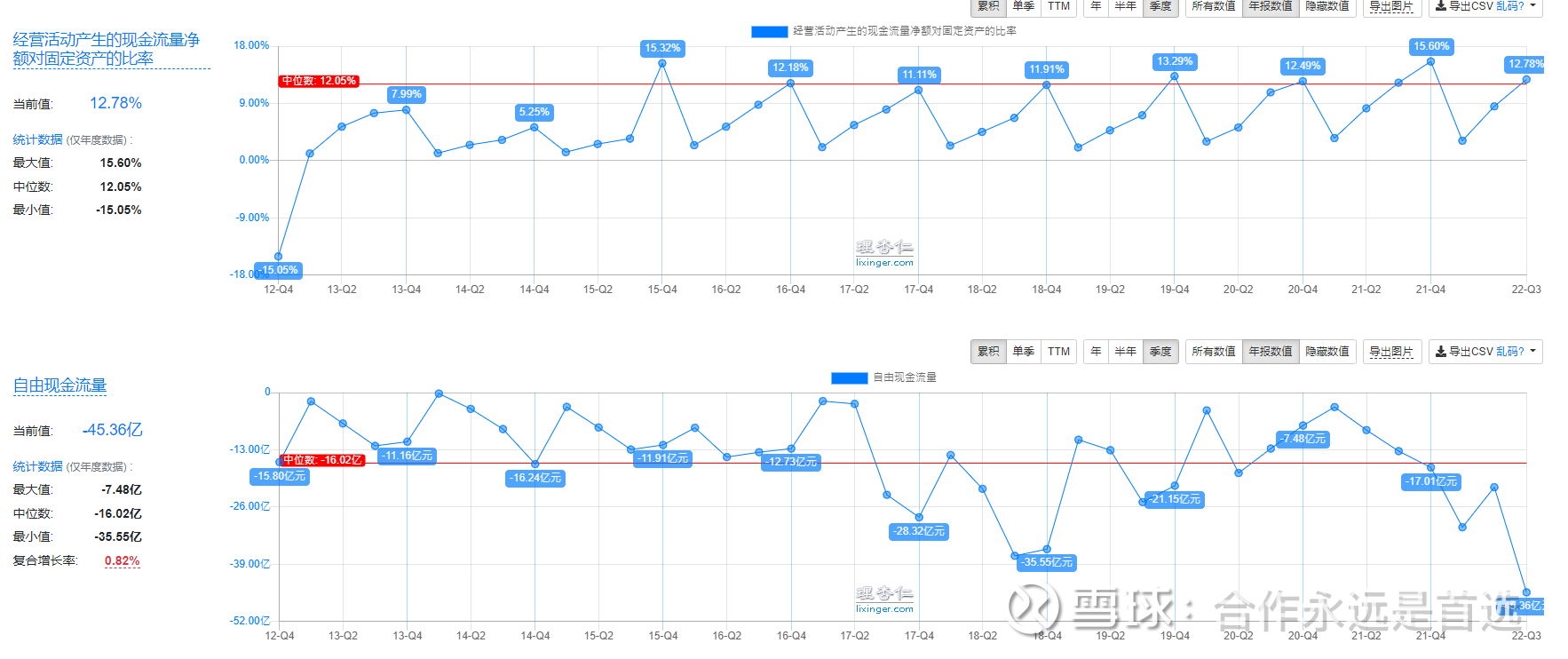

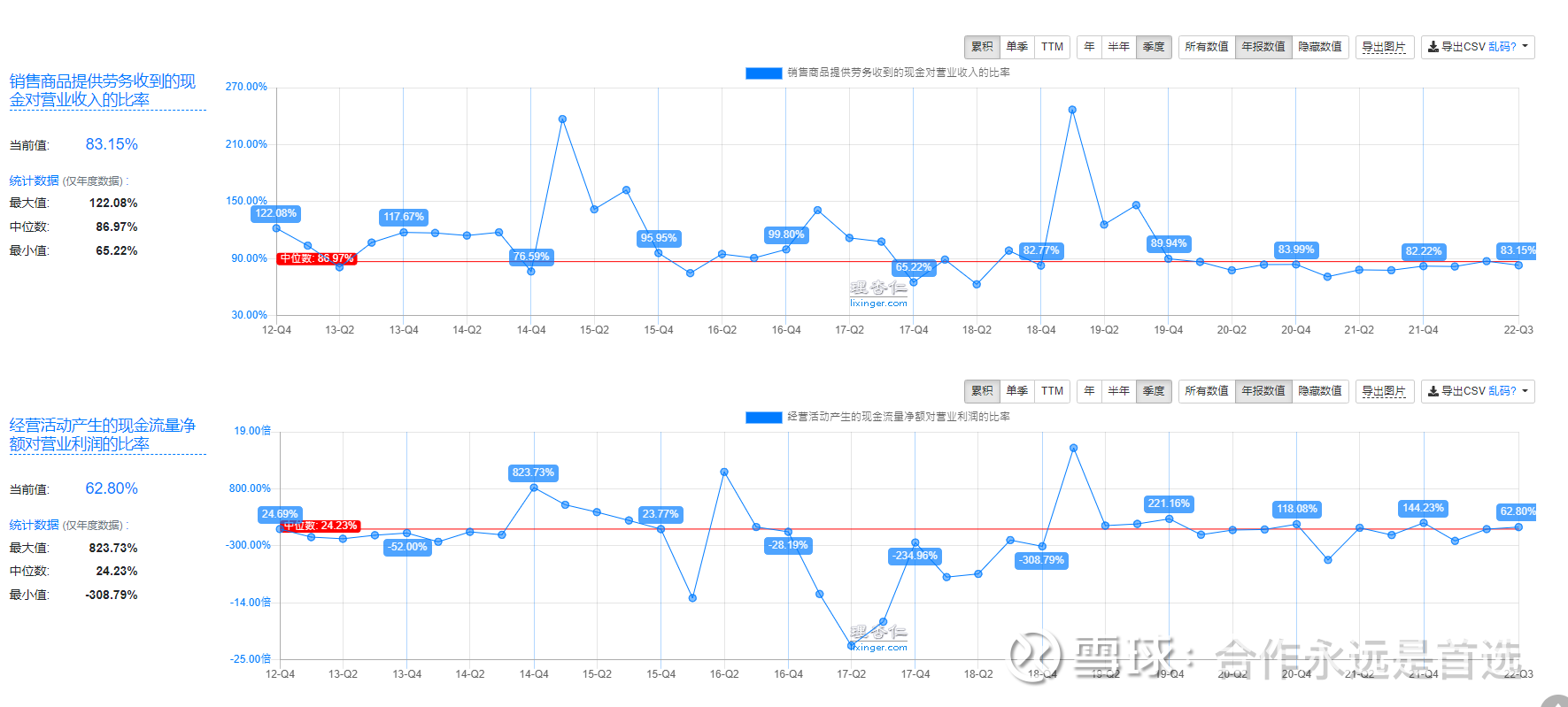

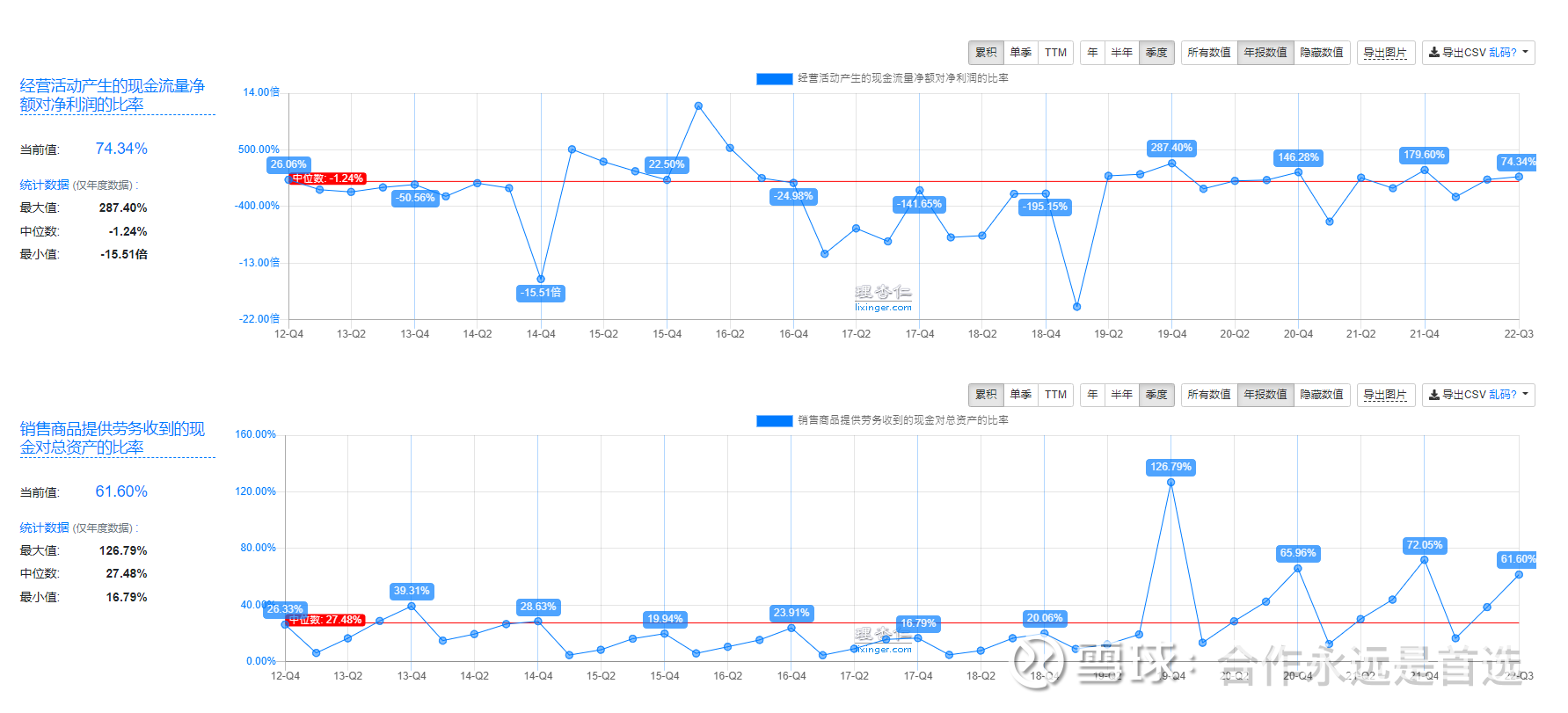

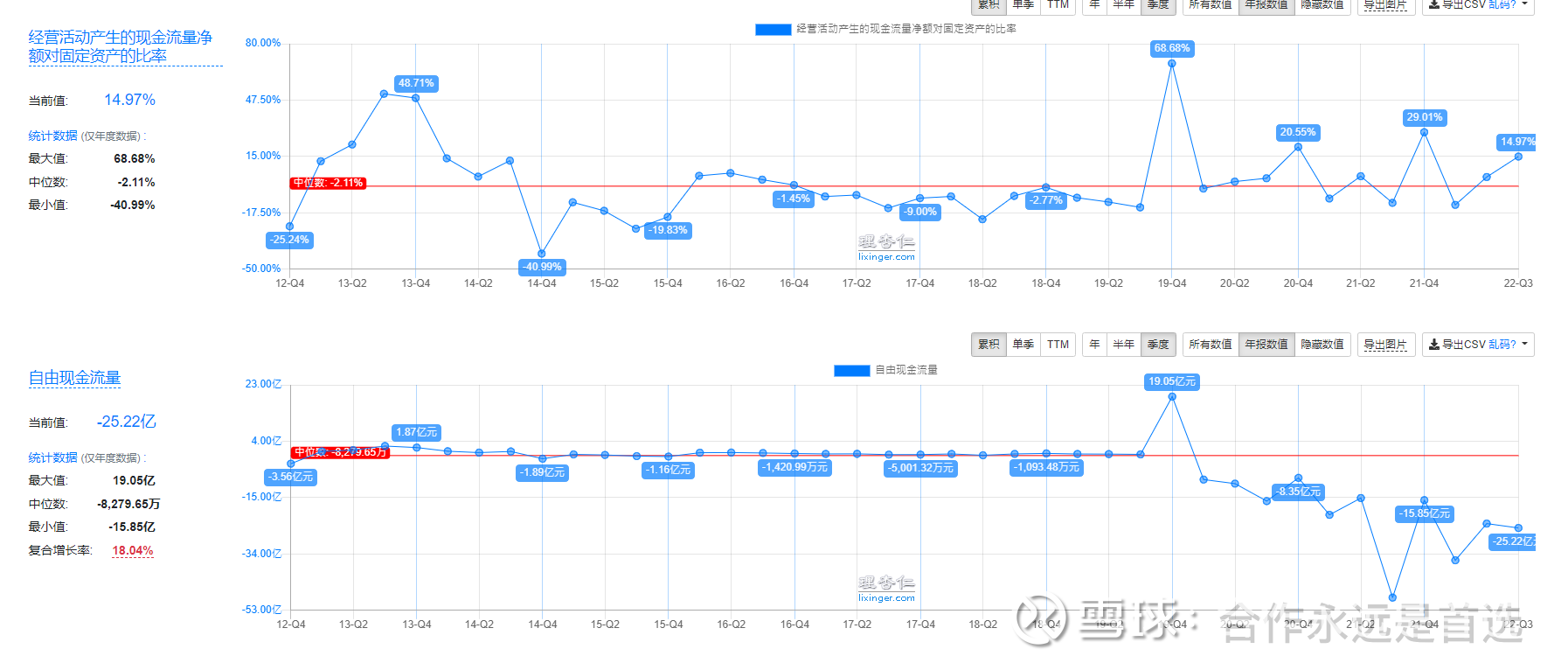

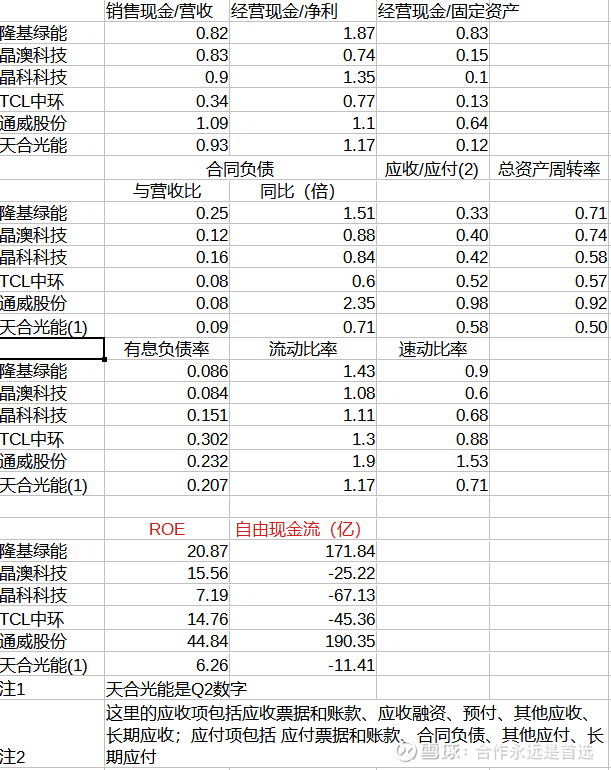

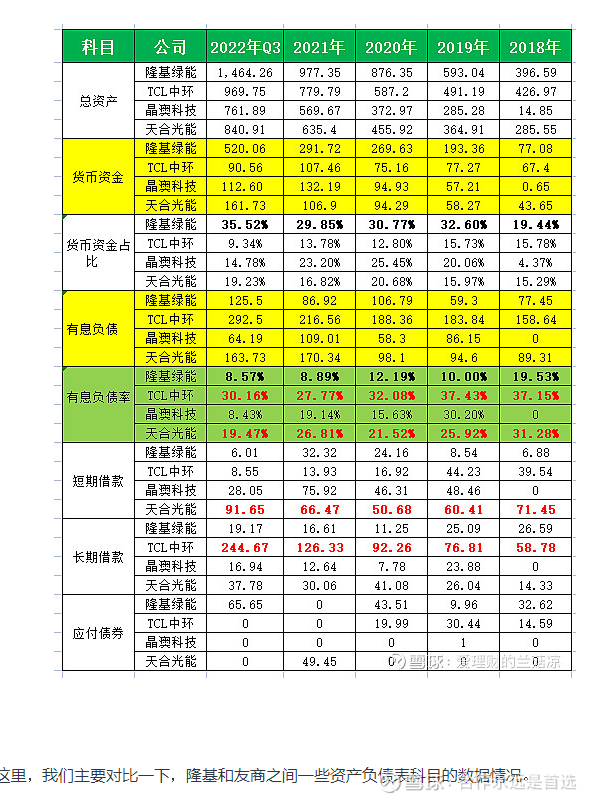

However, this point of view is not true from several major data in the Q3 financial report in 2022. Let’s look at cash flow first. LONGi has always insisted on financial stability and reliability. This can be fully proved from its own and its long-term historical data trend (whether it is relatively stable and long-term improvement) compared with its peers:

Longji

Tongwei

TRW

Central

JA Solar

The above data charts are all from Li Xingren

Judging from the latest Q3 data, LONGi’s competitive position and growth prospects have been further confirmed.

The above data is based on relevant financial reports and Oriental Fortune

The above table is from @爱财财的蓝菌鲜

The data on the ratio of receivables to payables in the Q3 financial report clearly reveals LONGi’s current position in the industry. From here, there is no sign of its industry status looking down. Leading indicators such as contract liabilities are even more telling. Industry advance payment is generally between 10% and 30%. We take the median value, and we can see that as of Q3, LONGi has locked in revenue of more than 100 billion, so it is not too optimistic to assume that the annual revenue exceeds 120 billion (although a certain proportion of the contract liability data is for projects delivered in 24 years), which means The 22-year revenue growth rate is 50% year-on-year. According to this, there is a high probability that the annual profit will be 15 billion to 16 billion. If the median value is 15.5 billion, the profit will increase by about 75% year-on-year. This growth rate is hardly the growth rate of a declining company. Looking forward to 23 years, LONGi’s new battery technology will be fully mass-produced. BIPV has also begun to increase in volume. Even without considering the favorable conditions of industry changes, the growth rate of revenue and profitability should be considerable.

Mr. Zhong clearly announced that “LONGi will not retain units without global competitiveness.” Judging from the consistent style of Mr. Zhong and Mr. Li, such a statement is definitely not just a casual talk.

Competitiveness is a very important topic in business discussions. Much of what has been said about type factors makes sense. However, there is still insufficient understanding of the core competitiveness of enterprises that can grow and occupy a leading position for a long time. What is a company that can grow and occupy a leading position for a long time ? There is no need to prove itself here, so we can look at Zijin Mining. (The two examples of Amazon and Kaishike mentioned above are also to illustrate that one is in the retail e-commerce industry and the other is in the traditional retail industry. The two companies in the most open field of competition have become this long-term high-end market in different models. growing business)

I agree that the core of competitiveness lies in people, not capital, nor is it a business model that is divorced from specific people, technology that is divorced from specific people, brand that is divorced from specific people, or channels that are divorced from specific people. The people here first refer to the core management of the enterprise. These people need to have the quality of integrity, far-reaching strategic vision, and reliable operational capabilities. As far as the concept is concerned, the duo of Li Zhenguo and Zhong Baoshen have always emphasized the primacy. The first nature and stage nature are two very different things, just as the essence and appearance of things can be very different. Therefore, from a long-term perspective, Longji’s style of play is often different from most, even from a relatively short-term perspective.

Of course, a modern enterprise cannot rely on only a few core executives to dominate the world. The concepts established and led by them need to run through all strategic methods, rules and measures of the enterprise, and promote their penetration among all employees of the entire organization. This is the most difficult thing to do, and it is also the thing that requires the most continuous effort. This not only requires the idea of being healthy and energetic and paying close attention to the essence of things, but also needs to put the construction of corporate culture at a very high position. In the long run, why is the moat created in this way not deep enough?

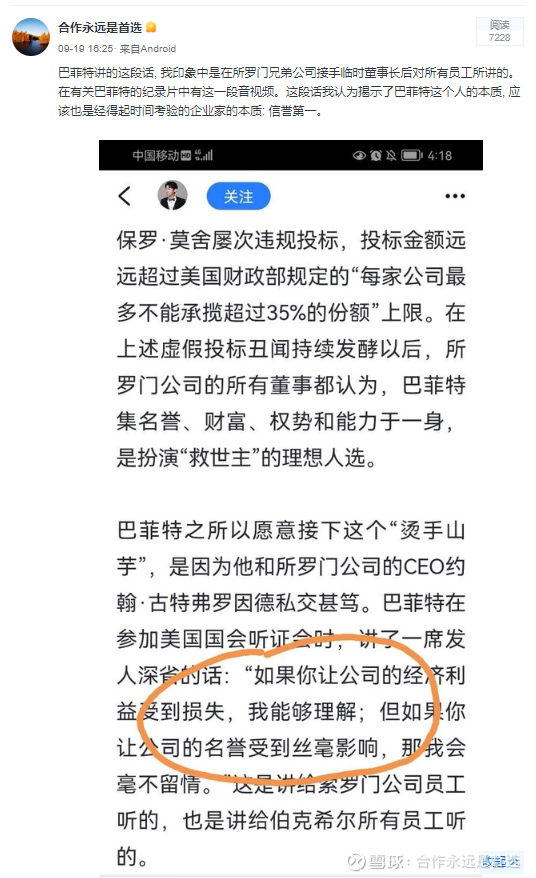

You can see what people who have established long-term brilliant business performance talk about

Ren Zhengfei: Even in a highly technology-intensive enterprise like Huawei, the management platform is regarded as the first core asset. Technology is created by people, improved by people, used by people, taught by people, and leaked by people. So how to see the technical route clearly, how to stimulate people’s motivation, how to coordinate the interests of people, and how to organize the interaction between groups, all rely on organization and management. If you have excellent management, you don’t have to worry about not having excellent technology.

Dario: “There is nothing more important and nothing more difficult than getting a great culture and great people.”

Munger: “The highest form of civilization is a seamless network woven by well-deserved trust. In this network, there are not many measures and details, only people who are completely reliable and trust each other.” Munger takes the market opener as an example Example: From a small company, it took less than a few decades to achieve its growth rate and reach its size. Culture is one of the reasons for its development. Their culture is to spare no effort to pursue cost, quality, efficiency and honor, and all good things are the goals they pursue. The result is naturally that these have contributed to its rapid growth and expansion. “Culture matters.”

It should also be noted that I do not think that Longi management will not make mistakes. You can take an example of my recent criticism of Longi.

People can not escape from doing wrong. A major difference between people and between companies lies in the level of error correction ability. First of all, do you have a self-knowledge, can recognize or recognize your mistakes in time. Second, do you have the correct cognitive decisions and methods to effectively correct mistakes. Also, do you have sufficient resources to help you correct your mistakes. I think Longi is outstanding in these three aspects. Therefore, people are now discussing or arguing or speculating about the mistakes Longji has made in the past two years, whether they are mistakes or not, I am afraid it is not that important. The key is whether Longi can correct it.

There are 23 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/1057232810/239020572

This site is only for collection, and the copyright belongs to the original author.