The global food price index fell to its lowest level since January.

WTI crude is down nearly 27% since its June high.

July 1: SHIBOR traded at 1.4410% overnight, down 46.00 basis points. The 7-day SHIBOR was at 1.7980%, down 40.20 basis points. The 3-month SHIBOR was at 2.0000%, up 0.00 basis points.

SHIBOR reported 1.0190% overnight on August 5, down 0.60 basis points. The 7-day SHIBOR was at 1.3840%, up 0.30 basis points. The 3-month SHIBOR was at 1.6990%, down 3.00 basis points.

Crude oil + food prices, two important factors of global inflation, are both falling sharply, and the cost side has dropped, which is also the result of global interest rate hikes. But there has always been a voice, that is deflation. Deflation is an early warning of an economic crisis. The decrease in demand and the rise in prices are a devastating blow to the stability of the entire production and supply system.

At this stage, the choice is mainly based on demand growth, and it is necessary to have an in-depth understanding of the industry and individual stocks. For example, the growth of new energy vehicles is a contrarian growth in an environment of reduced overall demand, which is why it has risen well. Semiconductor chips have risen sharply in recent days, especially today, is there a new breakthrough in domestic chips or what? This is not clear, but combined with the domestic software boom, it will be found that it is the logic of domestic substitution and also belongs to the growth market.

Several of the data categories just followed a bottom rebound. The real rise should be resonated in the three aspects of policy guidance + industry investment + performance improvement.

Policies for the digital economy are emerging one after another, and industry investment has temporarily entered a bottleneck period due to the economic downturn. It is better to wait for the mid-term report to make an expected assessment based on the report.

The next day Shibor showed that there was a lot of money in the bank, mainly in two aspects: 1. The country eased the currency, but because of the suppression of real estate and did not ease credit, the backlog of money was idling in the bank; 2. In the first half of the year, RMB deposits increased by 18.82 trillion yuan , an increase of 4.77 trillion yuan year-on-year, of which household deposits increased by 10.33 trillion yuan; both the country and the people are pouring money into the bank, a lot of money, but not enough money.

In such a low interest rate market, it is easy to spawn a bull market, and borrowing money to speculate in stocks is likely to happen, especially in today’s low-level riots. Confidence is particularly important at this time. Most people experience a bull market that can take the class up one or two levels.

The agency forecast data in July is good, but the manufacturing industry is relatively stagnant. If the M2 data for three months is above 10%, then it must be a large position to hold shares. I mentioned this in a recent article, three months of capital Investment, autumn is the harvest season, especially the investment in the case of upstream prices falling. At this time, the general industry does not dare to invest money rashly. Those who dare to invest enjoy the rapid increase in market share and the gradual decline in cost. This is also the front My article mentioned the logic of Jiu Mao Jiu.

The current expansion is the guarantee of subsequent profits.

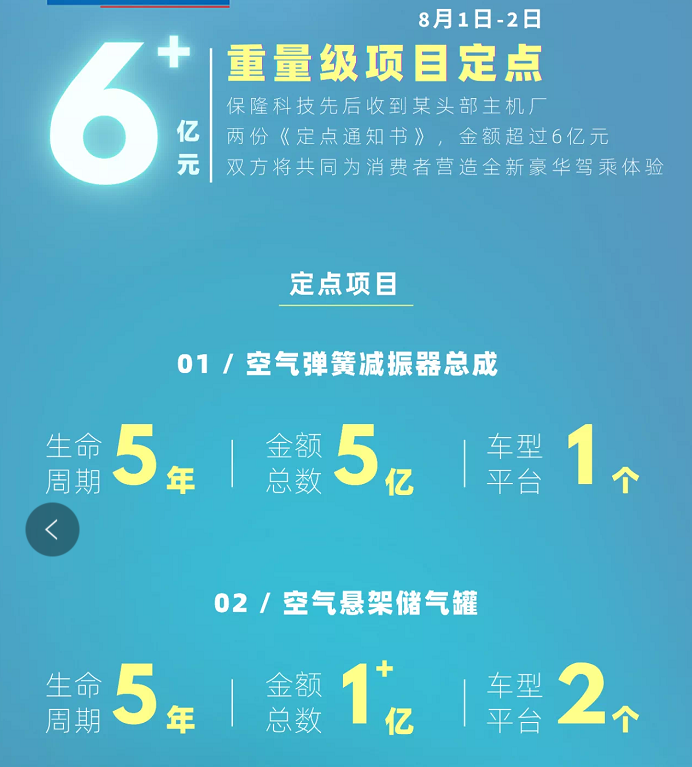

On Friday, Baolong Technology released a new order. It is calculated that the shipment of bicycle models is close to 30,000 units, and BYD’s high-end models are blindly guessed.

In addition, several low-level votes in the network layout have been continuously increased by foreign capital. Maybe the market is about to start, but it should be noted that foreign investment in the new energy sector retreated in June and sharply increased the financial sector, especially bank real estate. Negative real estate data in late June and July followed one after another. Foreign capital chose to withdraw, and almost the entire July showed a state of net outflow. Low-level bargain hunting also needs to be combined with the right time and place. It has never been so easy to be on the left side.

According to the original plan, to return to the original position and increase the position, the most important thing is to see the specific situation of several network-linked targets in the second quarter. I have given target prices for all three of the network-linked targets, especially NavInfo, but this Blocks are temporarily unavailable for public speaking.

Recently, a friend suffered a loss due to prematurely moving the warehouse to the network, and asked me for a psychological massage. I said that buying cheap is one of the reasons for maximizing the profit. In addition, if the company has great growth expectations, then the low + High growth is Davis double-clicking, and maybe more will be won in the end. Cheap can now see that future growth requires investors to dig deep into the company’s layout, which is the capital investment I have talked about many times in this article. When you invest a lot of manpower, material resources and money in the downturn of the industry, and at the same time can ensure the good operation of the company, then when the industry and the company usher in a stage of unbalanced supply and demand, it is the stage of soaring profits and stock prices.

The title of the article ” foreseeing the future” means that you can predict the rapid development of a certain industry in the future. This belongs to the common saying that investment is the realization of cognition. This cognition also includes “based on the present”, the company you invest in is the future What kind of layout is made for the profit of , and it is the most core piece.

There are 18 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5363546624/227396812

This site is for inclusion only, and the copyright belongs to the original author.