Welcome to the WeChat subscription account of “Sina Technology”: techsina

Author| Su Qi Editor| Jin Yufan

Source: Open Pineapple Finance

Throughout the year, “Black Friday Cyber Monday” is the most important day for cross-border sellers, and the time extends from “Black Friday (the day after Thanksgiving in the United States)” to “Cyber Monday (the Monday after Black Friday)”. Its importance is no less than the Double Eleven and Double Twelve that domestic sellers participate in every year.

And Black Friday Cyber Monday is also of extraordinary importance to the e-commerce platform Amazon. In previous years, Amazon has occupied the top position in the Black Friday consumption list in the United States. Domestic cross-border sellers often push the “last KPI of the year” to these few days.

This year, Amazon’s Black Friday Cyber Monday was held from November 18th to December 1st. It was first launched in Europe, and then launched in Australia, the Middle East, North America, Japan and other global sites. Among them, the Black Friday Cyber Monday event on the US main site is from November 24th to November 28th. Data show that this year’s Black Friday Cyber Monday is the highest peak of online shopping spending in the United States, with sales increasing by 2.8% year-on-year.

But what many users feel is that this year’s Black Friday shopping season is relatively deserted both online and offline. The reason is that since October, major offline shopping malls and online platforms have frequently promoted promotions, and consumers have “stocked up enough discounted goods”. Inflation has made many people take the initiative to downgrade consumption and reduce expenditures.

With the multiple buffs of Thanksgiving at the end of the year and the World Cup every four years, many Amazon sellers are looking forward to “explosive orders” for this year’s Black Friday. But after Black Friday ended, many sellers said that the results of the US site were acceptable, while the European site could be described as “dismal”.

At the same time, on the eve of Black Friday, Amazon announced an increase in logistics and warehousing fees, which forced some sellers to avoid participating in this year’s Black Friday Cyber Monday due to the pressure of profitability.

And Amazon itself can be described as dangerous. This year, Amazon made a rare fall from the throne of the “Black Friday Brother”, and its Black Friday search ranking fell from the first to the fourth place, ranking behind Walmart, Target and Kohl’s. A week before Black Friday, Amazon also launched the largest round of layoffs in the company’s history, including its core retail division.

On the one hand, sellers are dissatisfied and the company is in turmoil, and on the other hand, new rivals Pinduoduo and TikTok have launched challenges. Is the “moat” accumulated by Amazon during the Black Friday shopping season and even the cross-border e-commerce industry for many years still there?

The longest Black Friday is also the “coldest” Black Friday

The popularity of Black Friday in the global market this year is different from previous years.

According to the tradition of earlier years, consumers would usually queue up at the entrance of the shopping mall on Thanksgiving night, waiting for the business to open for snapping up, but this year, the scene of “scrambling” has disappeared. On social platforms, many users posted photos of few people in the shopping mall, saying that “the price is good, but it is deserted” and “some shopping malls are not as crowded as expected, and there is no need to line up for checkout.”

The online Black Friday Cyber Monday data has saved some face for this year’s Black Friday. According to statistics from Adobe Analytics, American consumers spent $9.12 billion online on Black Friday this year, higher than the $8.92 billion in 2021 and $9.03 billion in 2020. The growth drivers are mainly mobile phones, toys, fitness Great discounts on equipment. In addition, this year’s Cyber 1 sales reached 11.2 billion US dollars, which is also higher than last year’s 10.7 billion US dollars.

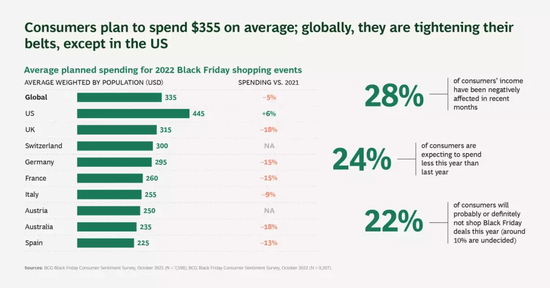

However, the United States is already a market that performed well during Black Friday. According to a survey conducted by Boston Consulting on more than 9,000 consumers in 9 countries, European consumers have significantly reduced their “Black Five” budgets this year. Among them, British consumers black Five spending will decrease by 18% year-on-year, German and French consumers will cut their budgets by 15%, Spanish consumers are expected to decrease by 13%, and the United States will increase slightly by 6% compared with the same period last year.

Except for the United States, the Black Friday budgets of consumers in other countries have declined year-on-year. Source/Boston Consulting Report

Except for the United States, the Black Friday budgets of consumers in other countries have declined year-on-year. Source/Boston Consulting Report“Consumers are basically indifferent to big promotional festivals this year.” Deng Shubo, a cross-border e-commerce seller who has been in the business for ten years, and several sellers with annual sales of over 100 million have the same feeling.

They observed that this year’s peak season has been delayed, and festivals such as Halloween and Christmas, which have been the hottest sales in previous years, are also “unable to sell”.

From an analysis point of view, the lengthening of the cycle, the decline in discounts, and inflation are all the reasons why Black Friday is no longer popular.

This year’s promotions are no longer limited to the days before and after Black Friday Cyber Monday, which also increases consumers’ choices and disperses orders.

This promotion even started in October. Offline retail giants such as Macy’s, Walmart, Target, and Best Buy launched weeks-long promotions as early as October. Amazon also unprecedentedly launched the Prime Members Early Enjoyment Day promotion at the same level as the Prime Membership Day in October. However, data shows that Amazon’s revenue from this event has decreased by about 40% compared with the Prime Member Day in July.

Deng Shubo said that the previous peak season was already very obvious in the middle and late October. This year, it was 20-25 days late, and the sellers had a large backlog of inventory. They wanted to wait for the peak season to start clearing the inventory, but the result was that there was a feeling of “no peak season”. Feel. What he didn’t expect was that the sales of Halloween products in the US market were average, and the sales in the European market dropped by about 40%.

Compared with previous Black Friday shopping seasons, when inflation pushed up the prices of some categories of products, this year’s price cuts have actually weakened, suppressing consumer demand.

Clothing was the only category that was cheaper this year compared to last year’s Black Friday, according to e-commerce analytics firm DataWeave, with inflation pushing up prices on appliances, beauty products, electronics, furniture and toys. Retailers are not offering enough discounts in these categories to offset inflation, meaning consumers are still paying more than they were a year ago.

In October, U.S. inflation reached its highest level in 40 years, and inflation data in the euro zone also hit a record high.

A consumer who has lived in Germany for many years told Pineapple Finance that she, like many Germans, has been working from home for a long time during the epidemic, with less demand, electronic products and home appliances are not updated frequently, and she has no desire to buy clothes and bags. He placed an order for daily necessities when he saw the fit during the usual promotional activities, so he didn’t wait until Black Friday, and didn’t want to stock up.

“The more you sell, the more you lose”, sellers “escape” from Black Friday

Amazon’s Black Friday is no longer popular, but also because sellers are starting to flee.

Black Friday Cyber Monday at the end of the year was supposed to be a “timely rain” and a good opportunity for sellers to boost their performance. Due to the increase in tax payment costs last year, in the first half of this year, most Amazon sellers have not recovered from losses, and the backlog of inventory has increased the pressure.

However, “Many sellers did not even participate in Black Friday because the prices were too low,” Song Zhuang, an electronics seller on Amazon for six years, told Pineapple Finance.

“Desolate” and “the most difficult Black Friday” are the feelings of many cross-border sellers about this year’s Black Friday Cyber Monday. A seller said that in previous years, the traffic and order volume of all categories would increase during Black Friday, and the headlines were even more “explosive orders”, but this year there is no such feeling.

Among the sellers who participated in the Black Friday event, the performance of sellers on the US site was about three times that of usual, and the overall growth rate was slower than last year, while the sales of sellers on the European site were dismal. Many sellers who participated in Black Friday said that the profits of Black Friday and Cyber Monday this year have dropped significantly compared with last year, mainly due to the increase in logistics and warehousing costs.

On the eve of Black Friday, Amazon’s US station issued a price increase notice, saying that from January 17, 2023, Amazon’s logistics costs will be adjusted. Specifically, Amazon Logistics’ outbound fees, off-peak storage fees, storage usage surcharges, overage inventory surcharges, and increased removal and disposal fees will increase in 2023.

“It is often said in the industry that ‘doing Amazon is a pile of inventory’. Now Amazon’s price increase will disrupt the seller’s Black Friday stocking and delivery plans, and it will also make many sellers with a large amount of inventory miserable.” Song Zhuang analyzed. , Amazon wants to pass on its own operating costs to sellers.

Song Zhuang and some of his peers originally felt fortunate that the cost of domestic first-leg logistics (shipment of domestic goods to Amazon’s FBA warehouse) this year was at least 30% lower than last year, but they did not expect that due to faster logistics this year, most sellers will deliver goods in advance in peak season Many of them arrived a month in advance, so Amazon’s storage fees surged.

Deng Shubo said that as Amazon’s FBA warehouses were severely depleted, in October this year, Amazon charged three times the usual amount of peak season storage fees, limiting warehouse capacity and increasing storage fees, allowing sellers to replenish best-selling products and clear inventory products. , facing double challenges, especially the pressure to clear inventory. In addition, some sellers said that the storage capacity of FBA warehouses has decreased, and Amazon has begun to push the official overseas warehouse AWD, in disguise to grab the business of third-party overseas warehouses.

A number of sellers said that, coupled with the increasing advertising fees on the Amazon platform year by year, “doing Amazon is getting more and more expensive”, and profits continue to be compressed. This also forces sellers to no longer put the performance pressure on the big promotion, and the expectation of the big promotion itself has become drainage, ranking or inventory clearance.

“Sellers have participated in activities on the Amazon platform in the past two years, and they spend more money to buy traffic.” Miao Miao, a seller of Amazon’s home furnishing category, said that the effect of this year’s drainage is similar to previous years. “Black Friday Cyber Monday, we will not use the most important products for discounts, but take the opportunity to destock at low prices. The core purpose is to improve the ranking of our stores and promote subsequent natural orders.”

“The home furnishing category and the low-to-medium price range are not too affected by promotional activities. For boutique sellers who sell mid- to high-priced products, fewer people usually buy, and the effect of the Black Friday promotion will be better.” Miao Miao Miao said.

Black Friday is still important to sellers, but sellers treat it more rationally. Deng Shubo gave an example. In previous years, on Black Friday, many companies would spend the night fighting Black Friday and pull up banners in the company to cheer up their employees. Now, few companies do this. picture”.

More sellers no longer pin their hopes on the “Black Friday” these days, but are more pursuing overall sales. After Black Friday, sellers have to start preparing for the Christmas season again. Many sellers expressed that they hope that by the end of December, the US site can achieve a small profit, and the European site can maintain the status quo.

Black Friday is no longer crazy, Amazon is “stressful”

It is not difficult to see from Amazon’s performance and its first launch of the second Prime Membership Day this year that Amazon’s e-commerce business has encountered difficulties.

The financial report shows that Amazon’s Q3 revenue in 2022 will be US$127.1 billion, which is lower than market expectations of US$127.64 billion; net profit will be US$2.872 billion, a year-on-year decrease of 9%.

Amazon’s first three quarters of the year were less rosy. Following its first loss in seven years in Q1 this year, it has accumulated losses of US$3 billion in the first three quarters of this year. In 2021 and 2020, Amazon’s net profit will be $33 billion and $21 billion, respectively.

After the announcement of the Q3 financial report in 2022, Amazon’s stock price fell from a high of US$120.6 per share in October to a low of US$86.14 per share. After Black Friday, it rose to the current US$95.5 per share. The high of US$1.88 trillion in July 2021 has fallen to US$974.3 billion, and the market value has evaporated by nearly US$1 trillion.

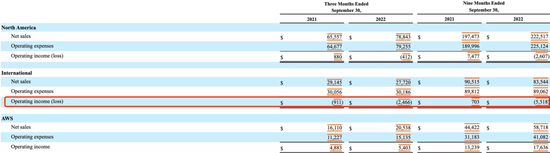

Amazon’s losses were concentrated in its e-commerce business. In the third quarter of this year, its global market losses expanded by 171% year-on-year, and its North American market losses expanded to $412 million. AWS, as the main pillar of Amazon’s profits, is also slowing down.

In the third quarter of this year, Amazon’s global market suffered serious losses Figure source / Amazon’s 2022 Q3 financial report

In the third quarter of this year, Amazon’s global market suffered serious losses Figure source / Amazon’s 2022 Q3 financial reportAnother reason for Amazon’s losses is that “expenditures such as labor and logistics continue to rise.”

The financial report shows that during the epidemic, due to the outbreak of online delivery demand, Amazon’s employees increased from 800,000 in 2019 to 1.6 million in 2021. But this year, the global epidemic has slowed down, and consumers have returned to offline consumption. In the first two quarters of this year, Amazon reduced its employees by 99,000 people. Just a week before Black Friday, according to media reports, Amazon laid off about 10,000 people. In equipment organization, human resources and core retail departments.

Li Ren, an investment manager who focuses on the field of going overseas, said that optimistically, Amazon’s actions are returning to the essence of corporate management, focusing on reducing costs and increasing human efficiency, and no longer blindly expanding. However, before such an important promotion as Black Friday, the layoff of retail department staff may be due to the pressure on the financial performance of the next quarter. He believes that there are indications that Black Friday’s pull on Amazon has been limited.

The difficulties faced by Amazon include the competitive pressure from its rivals. It lost its “Black Friday No. 1” position in the US domestic market, and its colleagues also face the “siege” of cross-border e-commerce players who have been to China.

Captify’s data shows that this year’s Black Friday online shopping Walmart ranked first in the United States, while Amazon fell from the first place last year to the fourth place this year.

Among Chinese cross-border e-commerce players, in addition to the old players AliExpress, Lazada, Shopify, Shopee, etc., Shein and other platforms that go overseas in the form of independent stations are also trying to share Amazon’s cake. In addition, in September this year, Temu, a subsidiary of Pinduoduo, entered the US “outside the Fifth Ring Road” market; in November, TikTok’s US store was officially launched, adding the “little yellow car” function.

“If these cross-border e-commerce companies want to grow bigger, they have to go the same way that Amazon has gone.” Li Ren predicted that Temu’s low-price positioning and crazy promotions may take away some of Amazon’s users. Small-scale sellers may also turn to Temu to enjoy traffic bonuses or clear goods, but Temu will not be able to shake Amazon in the short term, and more of it will cause “involution” effects on other cross-border e-commerce platforms.

However, as the platform where cross-border e-commerce sellers gather the most, many sellers expressed the hope that Amazon will keep its moat and return to the moment of profitability.

Some sellers researched the segmentation opportunities on Amazon. “At this stage, the market share in a sub-category exceeds 30%, deeply cultivate a certain vertical supply chain, and transform towards the brand direction.” Deng Shubo is more optimistic about the opportunities of channel brands.

For sellers, Amazon is still a very important channel. They even have a close relationship with Amazon. What they can do now is to repair their teams and products during the epidemic, and wait for the market to warm up to seize opportunities.

*The title picture is from Visual China. At the request of the interviewees, Song Zhuang, Li Ren, and Miao Miao are pseudonyms in this article.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-02/doc-imqmmthc6838492.shtml

This site is only for collection, and the copyright belongs to the original author.