Do you believe in miracles? Some people believe it, some don’t, because there are two groups of people with different perceptions that compete in this market to generate transactions. That is to say, it is because of the game that this market has differences. Of course, reality will bring two different groups of people back from the game back to reality.

I think most people are tired of reading all kinds of financial report analysis online last night. I am an investor, not an analyst, and I have my own value judgment. Today’s article of mine no longer simply analyzes traditional financial analysis, which is of little significance.

On August 27, I posted a post. I judged that Gree’s overall net profit in the first half of this year should be around 11 billion from the information I obtained through my own channels. I didn’t write about the revenue because I didn’t expect Gree to grow much. Staying the same or increasing by 5% would be good. The environment is here.

Let’s talk with data. According to data from Aowei Cloud, in the first half of the year, the retail sales of domestic air conditioners was 72.7 billion yuan, down 15.3% year-on-year. %. Gree has recently been revamping its distribution channels and promoting the reform of its sales system to improve its own profitability.

That is to say, the entire air-conditioning market is declining as a whole, but it does not mean that Gree is declining. Many people here have doubts? Several meanings you are.

You can look at my title today, ” Breaking Through the Information Cocoon Room”. We are now in a society with an information cocoon. If we don’t take the initiative to acquire knowledge, what we passively acquire is actually correct or wrong concepts, which will be subconsciously strengthened by ourselves, so we simply For example, if we choose the right direction, we will continue to strengthen a correct concept. If there is a problem with the direction of the concept, we will continue to go in the wrong direction. Therefore, choosing the right direction is more important than details. important.

Yesterday, the world-renowned corporate leader Kazuo Inamori left us today. He is a real master. He is a leader with a strong grasp of the direction. His choice of direction is based on the diversity of information sources, not because of his own preferences. Thereby opting to discard other information. For example, his most important sentence is: go to the scene, there are gods on the scene. What does this sentence mean? This means that our managers cannot simply obtain the book profits of the company they want to see from the financial statements, but also look at the overall composition of these financial statements. The correct answer does not necessarily have the correct process, but if you don’t know the process is correct, your answer is wrong if you change a coefficient or parameter.

As an investor, I have been to two Gree shareholder meetings, and I have also visited some dealers on the front line, whether they are shopping malls or community stores, I have visited and investigated, and Gree’s provincial agents have also talked a lot about Gree question.

Therefore, Kazuo Inamori’s greatest contribution is that he took the initiative to break the information cocoon room. Now there are many information cocoon rooms in the whole world, and all kinds of true and false information on the Internet are mixed.

I have said this many times before, Gree’s ice washing and small household appliances are currently impossible to do, because Gree’s advantage lies in the air-conditioning channel, and the most profitable one is the air-conditioning, and Gree’s small household appliances are all auxiliary. Including the ice wash, Dong Mingzhu’s entire team actually has a very clear idea. They know where Gree’s advantages are and where are its shortcomings. The advantage is that Gree is the first in the air-conditioning industry. Gree has full coverage of commercial, household, large-scale equipment, military, and nuclear power. This is Gree’s advantage. There are countless brands competing in the small home appliance market. Even if Midea spends about 30 billion in sales each year, it does not say that it has a firm grasp of the market position in the small home appliance market, because the threshold for small home appliances is too low and there is no moat. Your opponent can Easy entry, and various market demands, eventually lead to vicious competition.

Not to mention the ice wash, Midea, Haier, Siemens, Panasonic, Rongsheng and other brands are all staring at their own positions. If you want to fight with them, you need not only excellent products, but also strong channels. The struggle here is too complicated.

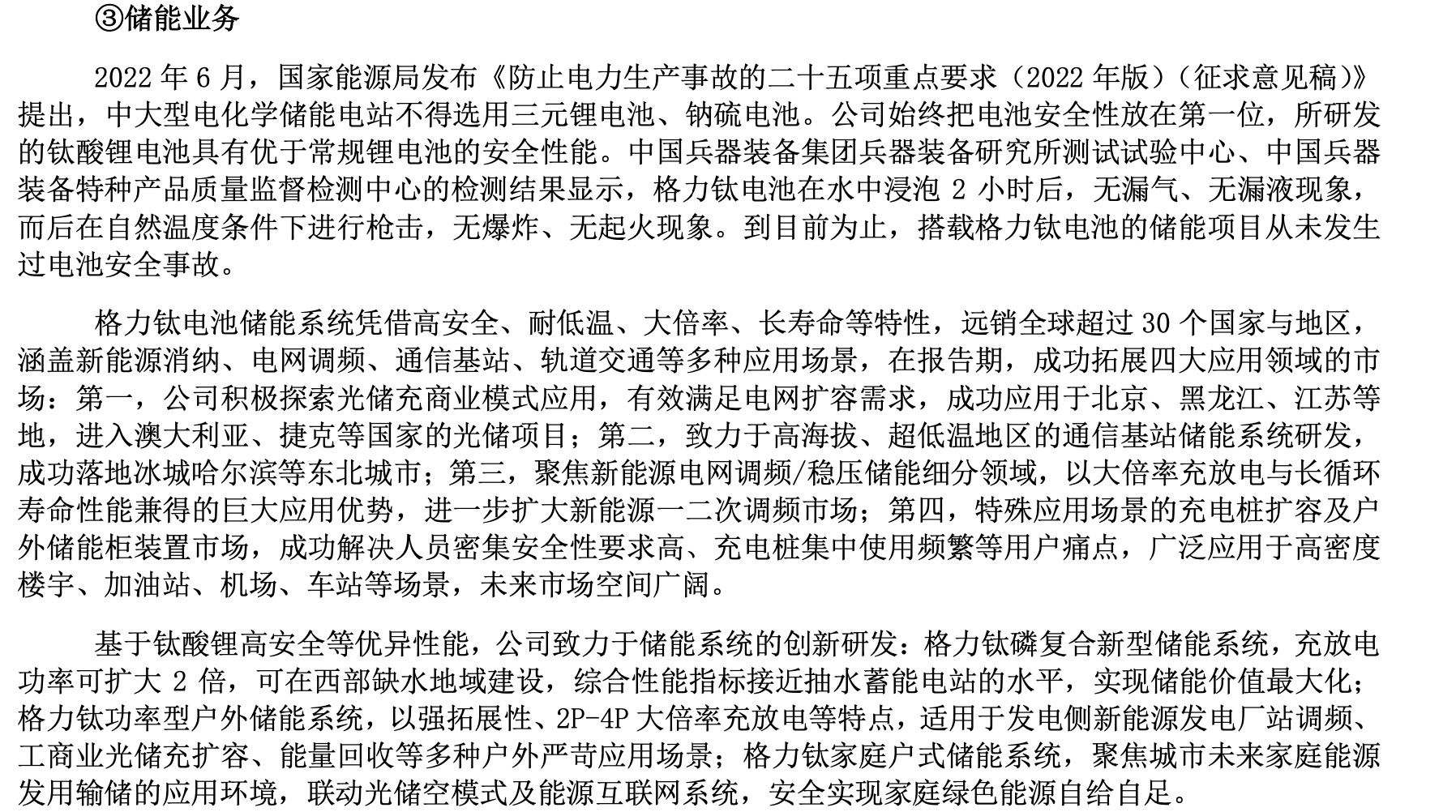

I actually don’t expect Gree to build ice washing and small household appliances on a large scale, because the cost is too high, and I hope Gree can build the new energy industry.

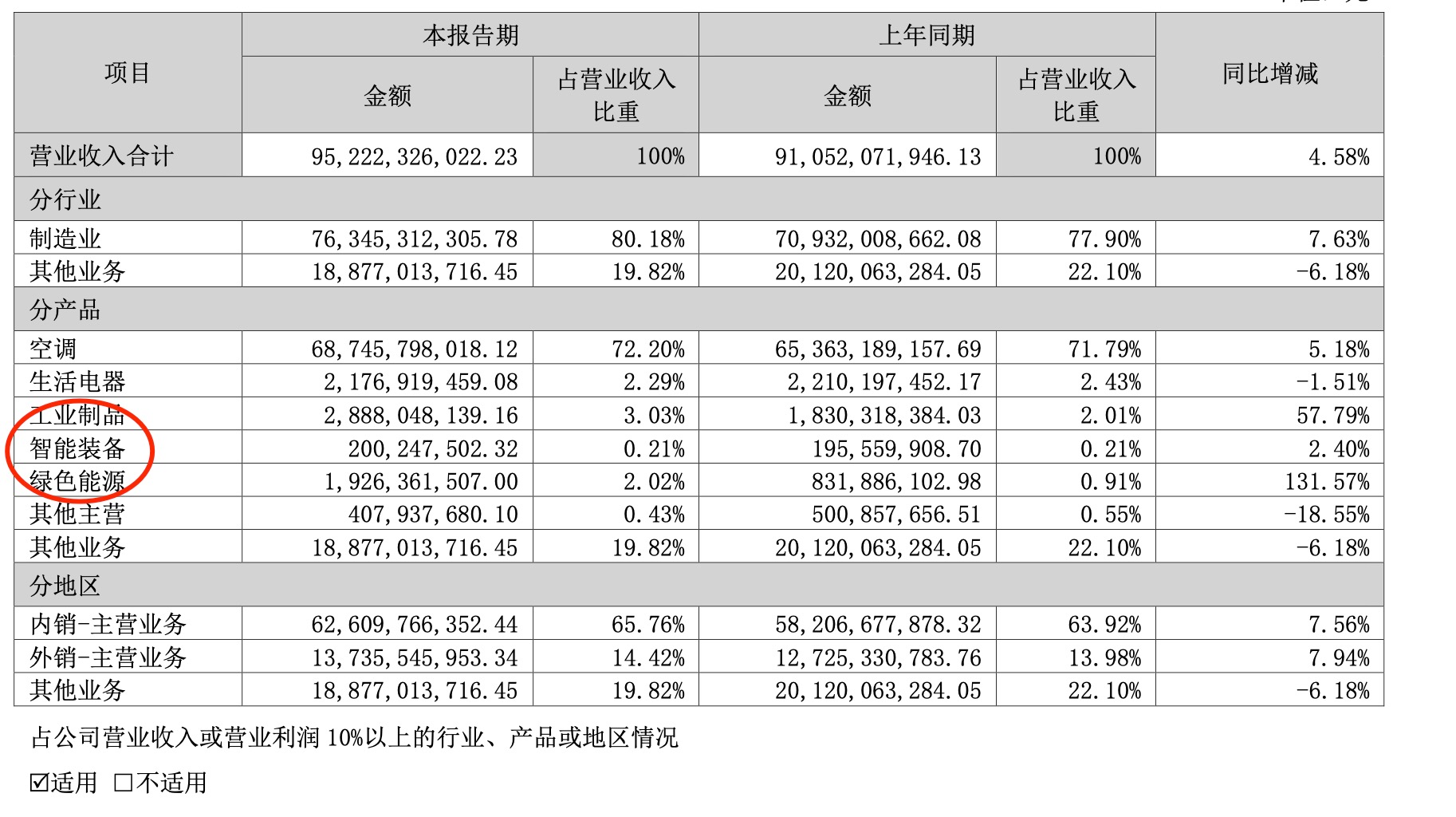

Compared with the bitter life appliances, Gree Electric can still perform well in industrial products, equipment, and green energy business. It is gradually exploring and developing gradually under the condition that the air conditioner is basically stable. This is what I have been doing. Said light storage empty plate.

Energy storage and photovoltaic (storage) air conditioning sector (from Gree Electric 2022 Interim Report)

This business is the focus of Gree’s future efforts, and it is also an advantage that Gree needs to overweight its main business. Well, having said so much, it is actually to sort out the entire business structure of Gree Electric Appliances, and also tell you what my current view of Gree is. In general, it is to stabilize the basic disk of air conditioners, develop core business around air conditioners, and stabilize air conditioners. The stable development of the basic disk, the auxiliary development of household appliances, and the expansion of the fields of equipment, new energy, and industrial products are the core logic of Gree’s real development towards the Industrial Electric Group. This is the underlying logic of Gree.

Many people here are very strange. Isn’t the air conditioner already on the ceiling? Can it still grow? Didn’t they say that the market is going down?

When we look at problems, we cannot think in one direction. As I mentioned above in my article, we actively break the information cocoon.

We want to look at the overall economic trend in the future from multiple perspectives, and the most important trend is “differentiation”. This differentiation occurs in almost all industries. Good companies or ordinary companies will appear, no matter whether you are in a traditional economy or a new economy, or a first- or second-tier city, especially in real estate, there is also a great differentiation in the value of enterprises. Good stocks and bad stocks in the stock market will also go out of completely different trends, which are affected by many factors.

The high-quality development of the supply side in the past few years and the supporting industrial chain are essentially to eliminate part of the backward production capacity, and the law of the market itself is like this. There is obvious differentiation, and this differentiation is concentrated in a few companies, especially a very small number of high-quality companies and leading companies.

The liquor industry is the most obvious industry with this characteristic in the past few years. Let us take the liquor industry as an example (note that this is an example). 2016 was a peak in the production of the entire liquor industry, with an annual output of more than 13 million tons, and the next five to six years. The development has taken a sharp turn for the worse. In the past few years, it has dropped to more than 7 million tons, and now it is still around 7 million tons to the output. That is to say, the entire liquor industry is overcapacity at this stage, or the market demand has declined, and many production capacities have been eliminated, especially many small local wineries have been closed.

But at the same time, several leading liquor companies, Maotai, Wuliangye, Luzhou Laojiao, Shanxi Fenjiu, and Yanghe, have all seen their volume and price rise, and you can look at the stock market. Liquor companies will raise prices, and the stock market’s response is that the stock price has skyrocketed, so we can see that although the production of liquor has dropped by more than 6 million tons, the sales of the entire liquor industry are still as high as 600 billion. This is such a process of eliminating the market and concentrating on leading companies in just a few years.

In fact, we can briefly summarize that there is a serious overcapacity in the market, and the market is fragmented and concentrated in leading companies. The most important thing here is that the market has been severely fragmented. Liquor is more obvious than other industries. The major famous liquors in the liquor industry have passed through Hundreds of thousands of years of precipitation, compared with those liquors that have not experienced brand precipitation, the gap between market perception and consumer reputation is very huge.

Once the market is saturated, the difference between the head companies and the tail companies will be very huge. In the previous incremental stage, it was hello and me or common prosperity. In fact, it was an illusion. For the head brands, their The demand may not be fully met. For other small businesses, people used to eat meat and you drank soup, but now it is estimated that they can’t even drink soup. In the future, the story of the liquor industry will be staged in many industries.

The overall market capacity is limited, and most industries have reached a peak position. Including the wave of consumer Internet, the competitiveness of leading companies themselves is extremely strong, and they now have the best resources, including research and development, markets, channels, brand influence, talents, and capital. These are actually barriers for small businesses. Therefore, there is no possibility of a counterattack in most industries. The industry itself is involution, the boss and the second are competing, but the third and fourth have disappeared. In the past, everyone liked to gather around to eat melons and watch the fun. , the entire market was dominated by them.

In such a large market in our country, it is a natural development trend of a market, and the same is true for the air-conditioning industry. We can see that Gree and Midea are basically taking over 70% of the entire air-conditioning industry. This concentration is increasing, so the future of the air-conditioning industry is basically set, that is, the two powers will compete for hegemony. Gree’s complete monopoly of the first echelon. What about the small factory in the back? For example, Chigo Air Conditioning, how long do you think Chigo can live? In the stock market game, the final result of you falling behind is to be eaten. So to sum up, the most obvious trend of our future economy is “serious differentiation”.

After talking about the stock game in the entire market, let’s take a look at Gree’s financial report. The net profit of 11.4 billion in the first half of the year exceeded my expectation of 400 million. So how do I judge the profit of about 11 billion? Here we need to superimpose multiple factors such as the decline in raw material prices and the reform of corporate channels. A single drop in raw material prices can increase Gree’s net profit by about 1.3 to 1.5 points. The gross profit in the second quarter of 2022 is basically the same as that in the third quarter of 2021. I personally think that Gree’s net profit in the third quarter and the fourth quarter will be further improved. Coupled with the continuous deepening of channel reform, Gree will continue to refresh orders under cost reduction and efficiency enhancement. The quarterly net profit is expected to be 26.5 billion for the whole year. In the stock game market, the trend of leading players will become more and more obvious.

Here I will talk about channel reform, while Gree Electric focuses on sorting out sales channels and reducing profits deposited in middle-tier dealers. Since the reform of the sales system began in 2019, Gree has cancelled provincial, municipal and county-level agents in many provinces across the country, focusing on promoting the flattening of channels. Recently, as Hebei Province Daixu spontaneously “leaved” Philips air conditioners, Gree Electric followed suit to build a new sales company in Hebei, intending to hand over Hebei’s sales channels to Zhuhai Huange Digital Technology Co., Ltd. with an e-commerce background to deepen the reform of the sales system .

What is the effect of the reform? You can also see in the financial statements that the sales expenses in the first half of the year decreased by nearly 2 billion year-on-year. This is the core capability of Gree Electric Appliances. I won’t comment much here, everyone knows it well. The substantial increase in cash flow and the continued rise in currency reserves are obvious to all.

Finally, I would like to talk about my short-term outlook for Gree in the second half of the year. The focus is on the channel reform of the basic market, which will be completed before the second quarter of 2023. It will completely transform Gree’s past dealer channels from 2019 to 2023, and it will completely transform Gree in five years. Complete the channel reform. The core is to expand the new energy, industry, and equipment manufacturing industry upwards, which are the cores that can support Gree’s great development in the future. Gree is not required to do anything in terms of revenue, and an annual growth of 5-10% is a very good result. At the same time, the net profit keeps growing, with an expectation of around 26.5 billion for the whole year, and the transformation of the enterprise is fully completed.

Thank you for watching. Regarding Gree Electric, I still maintain a cautious attitude. As long as there is no problem with the basic market, Gree is still the top 5 A-share companies that are most suitable for our retail investors to buy. @Buddha Petty Bourgeoisie @Stock Crash Witness @Red Tantan$Gree Electric Appliances (SZ000651)$ $Midea Group (SZ000333)$ $Haier Zhijia (SH600690)$

This topic has 20 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/9251252462/229616762

This site is for inclusion only, and the copyright belongs to the original author.