Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text / Yang Xuran

Source: Juchao WAVE (ID: WAVE-BIZ)

If it is said that BYD has carried the banner of “integration” by itself, then Huawei is the representative of “enabling car companies with an open ecosystem”.

Vertical integration or open external supply, this “problem” that was not a problem in the era of traditional automobiles, in the era of electric vehicles, has become two diametrically opposed or even opposing path choices.

Despite its efforts to promote the external supply of its products, Trillion BYD is still caught in the profit dilemma of vertical integration. Its sales have continued to explode, and the explosive growth has attracted much attention – but if government subsidies are excluded, the profit figures of BYD’s auto business will be greatly reduced.

Huawei, on the other hand, empowers car companies through technology, channels, and brands, trying to adopt an industrial model that is completely different from BYD. The positive side of this model is that there are jewels from Bosch and other companies ahead, but the problem is that so far this path has not been fully proven and is still in the early stage of its development.

As the executive chairman of Shenzhen New Energy Automobile Industry Association, Liu Hua has conducted in-depth research on the two modes of the automobile industry. He bluntly said that the root cause of BYD’s current increase in revenue but not profit is “the disconnect between a company and the entire industry chain”. But at the same time, he also said that in the early stage of industrial development, we should not be too entangled in the battle of models. New energy vehicles, new businesses and new formats are constantly spewing, and it will also follow the underlying laws of the automobile manufacturing industry. “Let’s go and see.”

BYD, the integration dilemma?

Once BYD’s opening strategy fails to meet expectations, it will become more difficult to reduce the cost of its important accessories such as batteries and chips.

“Are we supporting an enterprise or an industrial chain?” In the face of BYD’s vertical integration model, this is the most important question to ask.

In 2021, the government’s “reward” to BYD’s subsidy “big red envelope” is as high as 2.263 billion yuan. If it is excluded, BYD’s net profit will be less than 800 million yuan. Combined with the gross profit margin of 13% and the net profit margin of 1.84%, we will find that:

For the world’s second-largest new energy vehicle company with an annual sales volume of 600,000, profitability has always been a key point of concern for the outside world.

In the whole year of 2021, BYD’s new energy vehicle sales reached 603,783 units, a year-on-year increase of 218.3%; in the first five months of this year, BYD’s new energy vehicles sold 507,314 units, a year-on-year increase of nearly 3.5 times, and continued to make great progress. At the end of March, Wang Chuanfu pointed out: “It is conservatively estimated that BYD’s orders this year will reach 1.5 million vehicles. If the supply chain is well done, it may hit 2 million vehicles.”

The 2 million units are 3.3 times BYD’s new energy vehicle sales last year, and more than twice Tesla’s global sales (936,000 units).

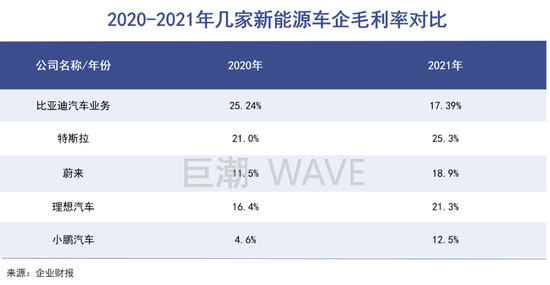

But the other side of the coin is that BYD’s profitability has yet to rise. The gross profit margin of the automotive business dropped from 25.24% in 2020 to 17.39% last year; the company’s overall net profit margin also dropped from 3.84% in 2020 to 1.84% in 2021, and to 1.36% in the first quarter of 2022.

In the same face of the pressure of rising raw materials, the gross profit margins of Tesla, Weilai, Ideal and Xiaopeng increased instead of decreasing. On the one hand, it proves that the price increase strategy is accepted by the market. For example, the ideal L9 is priced at 460,000, and it is still popular;

On the other hand, due to the bargaining power of the supply chain brought about by the increase in sales, Wei Xiaoli will reach sales of about 100,000 in 2021, which brings them a lot of bargaining chips.

However, BYD, which is self-developed and produced by the full stack, hopes to reduce costs and increase efficiency through integration, but has not seen clear results so far. According to the first-quarter financial report and car sales estimates, Tesla makes a net profit of $10,700 (72,400 yuan) per car sold; while BYD is less than 2,000 yuan, a full 70,000 yuan difference.

In addition, BYD is also caught in the quagmire of “human sea tactics”, and the per capita output efficiency is low.

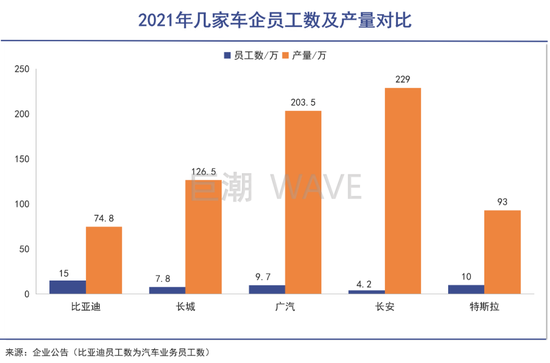

In 2021, BYD will produce 748,000 vehicles with 288,000 employees (according to the proportion of revenue, no less than 150,000 employees in the automotive business). BYD will also recruit 150,000 people in 2022.

During the same period, the number of employees of Great Wall, GAC and Changan was 78,000, 97,000 and 42,000 respectively, and their output was 1.7 times, 2.7 times and 3.1 times that of BYD respectively.

Tesla has 100,000 employees worldwide and produces over 930,000 vehicles. The Shanghai factory has about 8,000 employees and produces 480,000 vehicles. Wei Xiaoli has only about 15,000 employees in total.

In fact, as early as 2018, BYD was aware of the above problems and began to promote the external supply of batteries; in 2020, five subsidiaries of the Fudi Department and BYD Semiconductor were established, but the results of external supply are limited so far.

BYD Semiconductor is the vanguard of BYD’s “reform and opening up”, but BYD’s status as a car company makes its external supply strategy encounter the most basic business trap – as a competitor, it will hardly consider purchasing when it is not necessary and monopolized.

As a result, as of the end of June 2021, Xiaopeng, Dongfeng Lantu, and Yutong Motor have only purchased a mere 600,000 yuan, 1.29 million yuan, and more than 2.4 million yuan. BYD Semiconductor, which has now entered the IPO registration stage, still relies on BYD for 60% of its revenue. In addition, BYD’s financial system is still used, and the gross profit margin of related sales of similar products is higher than that of non-related sales.

In addition, although BYD claims to supply batteries to Tesla, Tesla has already denied it – the external supply of batteries may repeat the mistakes of semiconductors. Once BYD’s opening strategy fails to meet expectations, its batteries, chips, etc. It will be harder to drop the cost of important accessories.

Huawei ecology, stealing the “soul” of car companies?

After much thinking, Huawei still reiterates that it does not build cars, but empowers car companies.

“Huawei provides auto companies with an overall solution for autonomous driving technology. In this way, it becomes the soul and SAIC becomes the body. SAIC cannot accept such a result.” For this reason, SAIC Chairman Chen Hong refused to talk to Huawei. Cooperation.

The reality is that the sales of Huawei-powered car companies have skyrocketed, and their stock prices have hit record highs. With the halo of Huawei, the stock prices of Changan Automobile and Xiaokang shares have climbed to record highs.

Huawei is still expanding its “circle of friends”. Currently, Xiaokang Celis, Changan, BAIC, GAC, Chery and JAC have in-depth cooperation with Huawei.

Huawei’s “circle of friends” is expanding

Huawei has always had internal disagreements about car building. Xu Zhijun and Wang Jun are keen to be Tier 1 giants like Bosch, while Yu Chengdong advocates the end of car building. But after much thinking, Huawei still reiterated that it does not build cars, but empowers car companies.

Liu Hua believes that the rapid development from the automobile manufacturing industry to the new energy automobile industry, and the emergence of innovative new business formats in the intelligent interconnection industry, “the future Huawei, the accumulation of the overall solution provider, and the new business trend on the market side, It may allow Huawei to enter the terminal of new energy vehicle manufacturing. This is the inevitable development of the new energy vehicle industry, we will wait and see.”

A cruel reality is that the sales of cars dominated by Huawei have soared, and the sales of cars lacking Huawei elements will slump. The most typical case is the Celis brand. By the end of 2021, only 8,169 units of the Celis SF5 had been delivered, which was not satisfactory and was immediately hidden.

Unfavorable in the apprenticeship, Huawei began to fully dominate the new AITO brand and launched the Wenjie M5. Under the guidance of Yu Chengdong, Huawei’s intelligent terminal business department has provided all-out assistance, from pre-design to post-sales, almost all handled by Huawei. Huawei’s mobile phone team and software engineers all participated in the design of the M5.

The almost fully Huaweiized Wenjie M5 sold 13,923 units in the first five months, a 13-fold increase year-on-year. It is even regarded by the outside world as Huawei’s “pro son”.

However, in this way, Xiaokang has basically become a “foundry”, and the situation of BAIC Polar Fox is also close. If Xiaokang can come back to life, he is naturally willing to stay behind the scenes, but Chen Hong’s worries are inevitable for a large state-owned company like SAIC.

Daimler’s CEO has publicly stated that he will never be “Google’s Samsung”. The implication is that Mercedes-Benz will not be a hardware supplier to any company. Even in the years of poor performance, Daimler still goes all out to develop intelligent operating systems and driverless technology, and claims that “the future Mercedes-Benz will become the Microsoft of the automotive industry.”

Daimler’s intelligent operating system and driverless technology planning

Daimler’s intelligent operating system and driverless technology planningSAIC is not rejecting cooperation with Huawei. What it rejects is actually an “integrated solution of intelligent technology, brand, channel and marketing”, because in this way, SAIC will completely become a “body without a soul”. The judgments of other large car companies will be similar. Only small and medium-sized car companies with weak R&D capabilities are willing to cooperate with Huawei, but these car companies have problems with quality control and branding. This is the internal logic of Liu Hua’s belief that Huawei will build cars in the future.

On the other hand, Huawei has also developed a new cooperation model – unlike parts giants such as Bosch and ZF, Huawei is not a pure supplier. For example, Avita, co-created by Changan, Huawei, and CATL, integrates the technologies of the three in the fields of complete vehicles, intelligent driving and batteries, which is equivalent to using a modular approach to “build high-rise buildings” and quickly build a competitive advantage. The brand adapts to the historical period of the early development of new energy vehicles.

It is worth noting that although Huawei has made every effort to support technology, it has not invested in Xiaokang, BAIC, and Changan, which shows the responsibility and attitude of a national-level enterprise focused on the industry.

Who understands manufacturing best?

Apple is the super player who controls the “top code” of manufacturing in this era.

The automobile industry is a typical industrial product of the globalized division of labor and globalized supply chain, and intelligent electronics has brought this model to the extreme.

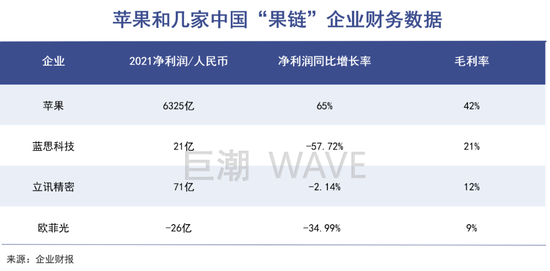

It can be said that Apple is the super player who controls the “top password” of manufacturing in this era. Relying on “Designed by Apple in California, Assembled in China” (“California design, China assembly”), Apple occupies the top of the smile curve, grabbing high profits.

Apple does not produce a needle and a thread, but it can monitor the industrial chain 24/7 like the king of an empire, from as small as a component to as large as ordering suppliers to collectively migrate to Southeast Asia, all with the goal of producing the highest quality products at the lowest cost.

In 2021, when the cost of raw materials has risen sharply, Apple’s net profit will be 94.68 billion US dollars (632.5 billion yuan), a year-on-year increase of 65%, and the gross profit margin will rise to 42%. However, China’s “fruit chain” enterprises can only become Apple’s “pass on costs”. scapegoat”.

Since 2014, Apple has been rumored to build a car for 8 years. Building a car or providing a smart solution has always haunted Apple Car. Volkswagen CEO Herbert Diess said recently that he is not sure if Apple really plans to produce a car, but they do want to provide smart software.

In the era of “software-defined cars”, whoever masters the core intelligent driving technology will have more initiative. As Herbert Diess said, “It will take 10 years for automakers to achieve 90% software self-sufficiency.” But smart technology, software, and industrial chain integration are Apple’s strengths.

Apple, which has already occupied the top of the smart hardware industry, can replicate the success of the iPhone industry chain to the Apple Car project. It is rumored that Apple will commission Hon Hai (Foxconn) to carry out the car assembly business, and the release date may be in 2024-2025.

The current Tesla seems to be following the essence of fellow American. Elon Musk puts almost all of his research and development in his California base. Advanced manufacturing technologies such as batteries, transmissions, and electronics are all nurtured here, helping it to improve its process up to 50 times a week.

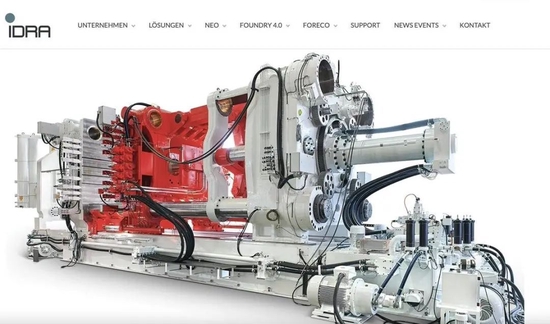

Tesla has teamed up with industrial machinery giant IDRA to develop an aluminum casting die-casting machine. This kind of machine with a clamping force of up to 6000T can die-cast more than 70 parts into two or even one part. The complex production process of welding 1,000 to 1,500 times has become a die-casting process, which makes welding two hours into one. Die casting for two minutes, simplifying the production process and saving 20% of the cost.

IDRA Aluminum Casting Process Die Casting Machine

IDRA Aluminum Casting Process Die Casting MachineSimilarly, Apple also supplies equipment to foundries. In 2012, in order to push the all-metal body, Apple brought CNC (Numerical Control Machine Tool) into the mobile phone industry chain, and instantly became a popular star in the manufacturing field.

By devoting themselves to research and development, Tesla and Apple can stand on a higher dimension to improve the manufacturing efficiency of their factories and make profits.

In contrast to domestic electric vehicle companies, BYD tries to be self-sufficient by integrating and closing the supply chain, but the end result is that it is difficult to dump costs to the supply chain, and it can only profit from the inside.

This closed-door model is contrary to the attributes of the global layout of auto parts. Under the influence of the epidemic, the value and significance of self-insurance and supply in the integrated model have become prominent. However, if this short-term industry chain disturbance factor disappears, the profitability comparison with other car companies will be even more dazzling.

From the perspective of industrial policy, is it to support a certain company to make it a “Big Mac”, or to form a larger-scale new energy vehicle industry cluster to prosper the entire industry? This requires more thought.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-07-01/doc-imizmscu9632411.shtml

This site is for inclusion only, and the copyright belongs to the original author.