Source | Value Institute

2022 is still an extraordinary year for the new economy and the Internet industry. Many outlets have been shattered, many companies have collapsed, and the big factories standing at the top of the food chain have not had a better life than before. Just because there are too many changes and turmoil this year, timely sorting out the dynamics of these industry giants at the end of the year may help us understand the current status of the entire industry and grasp the future direction of the market.

For this reason, the Value Research Institute specially launched the “2022 Annual Review” series to review the annual dynamics of each Internet giant. Today’s protagonist is ByteDance, an “Internet money printing machine” that has been extremely active throughout the year with constant actions and troubles.

At a recent general meeting, ByteDance CEO Liang Rubo delivered a speech:

“This year, the company’s revenue growth has slowed down, and the product DAU is increasing, but the growth rate is lower than the target set at the beginning of the year. We will continue to promote the organization’s ‘reducing fat and reducing weight’.”

The key point in Liang Rubo’s speech is very clear: Byte’s performance in 2022 failed to meet expectations, and personnel optimization, cost reduction and efficiency increase will not stop. Although the growth trajectory of Byte is perfectly staggered with that of Tencent, Ali and other major companies, their winter rhythm is exactly the same when the overall Internet environment is cold.

There is no doubt that 2022 is not a very good memory for ByteDance. Revenue is still highly dependent on the advertising business, especially the single platform of Douyin; the B-side business has not made much progress, and the strength of cloud computing is still far behind that of Ali, Tencent, Huawei, etc.; a large number of new and old businesses and products have been shut down. Haven’t found the next hit yet…

But on the other hand, the byte has not stopped beating, and investment activities have not stopped in social, e-commerce, metaverse, medical and other tracks.

In front of the heavy fog, Byte seems to be still waiting for the light that pierces the darkness.

Revenue is lower than expected, and a large number of projects are aborted

Byte beats hard

Regarding this year’s performance level, ByteDance has not disclosed much information. However, based on Liang Rubo’s statement, revenue and net profit in previous years, and the revenue target exposed by the media at the beginning of the year, the loss is almost certain.

In the last fiscal year, ByteDance’s revenue increased by 80% year-on-year to US$61.7 billion, and its net loss increased by nearly 87% year-on-year to US$84.9 billion. According to the “Wall Street Journal” report earlier this year, ByteDance’s performance in the first quarter of this year still maintained a year-on-year growth of 54%, reaching nearly 18.3 billion US dollars, and the problem of losses has not been resolved.

Judging from the expenditure structure of ByteDance over the years, sales and marketing expenses, general administrative expenses and research and development expenses account for a large proportion, which has always been the main cause of losses. The crux behind this points to the ever-increasing business and products of ByteDance, as well as the longer and longer front.

Every time a new service or product is launched, it is necessary to build a supporting team, and then invest a lot of resources in promotion, constantly increasing the cost pressure of Byte. Under Liang Rubo’s efforts to reduce fat and increase weight, reducing investment and abolishing redundant projects have become Byte’s key tasks this year.

The first ones that were used by high-level executives were fringe businesses and products that were not closely related to the main business of the group and whose income was not stable, such as investment and real estate.

Among them, the most completely abandoned one is the securities business. On January 19, ByteDance’s investment department was abolished as a whole; in the second half of the next month, Byte sold its two products, Dolphin Stock and Wenxing Online, to Hualin Securities for 20 million yuan, completely launching the securities market.

Secondly, even in the fields of content, social networking, and e-commerce that he is still good at, Byte has carried out drastic reforms without any nostalgia.

For example, the content community “Knowledge Zone”, which has been online for less than 8 months, officially came to an end on December 7; in September, the trendy e-commerce app Douyin Box was shut down; when it was launched in March, it made a fully preheated soda For music, the Grass Planting APP Kersong, which was exploded for internal testing in July, now has very few publicity resources available.

Finally, for those businesses and products that are unwilling to give up in a short period of time, it is inevitable to streamline manpower and reduce resources. The first to bear the brunt are games and education, two businesses that have been impacted by policies and peers.

Let’s first look at the situation of vigorous education. According to reports, as of the third quarter of this year, the size of the byte education business team has shrunk by nearly 80% compared with its peak period, leaving only about 1,000 employees. In June of this year, some media broke the news that Byte had once again carried out large-scale layoffs for the education sector, involving most of the teams in the four sectors of Dali Intelligence, Intelligent Learning, Lifelong Education and Career Development, and Education and Public Welfare. The proportion of layoffs in many business lines was as high as 80 %-90%, which is basically the equivalent of uprooting.

Although Byte still retains the tinder of the education business, there are very few projects that are actually underway. Judging from the distribution of the remaining projects, Byte has given up its hardware efforts and put its focus back on vocational education and youth knowledge products. Xuelang and Kaiyan English, whose development prospects are not bad, have become the last hope of the whole village.

In the game, the situation is not optimistic. Also in June, Byte withdrew Studio 101 located in Shanghai, the center of the game industry, which had launched Byte’s first self-developed mobile game “Moon of the Heart of Flowers”. The exit of 101 Studio also means that Byte has given up the old strategy of rapidly iterating new games and focusing on self-development.

However, in Byte’s view, reducing investment does not mean giving up completely, it just shows that the game business needs to be reformed. In mid-December, the byte game department carried out a new round of organizational structure adjustments. The two business lines of domestic distribution and overseas distribution were merged, and the global distribution studio ONE Publishing Studio was established to improve administrative efficiency.

Of course, whether it is games or education, it is destined to only play a marginal role for a long time. Reducing fat and thinning internal organizations and reducing operating costs will of course help Byte control the speed of losses and allow more time for the growth of these businesses. But when it comes to making money, we still can only focus on one APP – Douyin.

The hope of the whole village

Where has the commercialization of Douyin come?

As we all know, the public awareness of the name ByteDance was not high in the early days of its establishment, and the popular APP Jinri Toutiao has always been synonymous with this Internet upstart. It wasn’t until the group’s business continued to expand that the huge logo of Jinri Toutiao on the roof of the Beijing headquarters was successfully retired, and the big-character signboard of ByteDance was hung.

Perhaps it can be said that the company’s external publicity caliber, publicity materials, and the replacement of the headquarters logo have always reflected ByteDance’s strategic changes. Then in 2022, the trend of Douyin replacing Byte will become more and more obvious.

On May 6 this year, ByteDance (Hong Kong) Co., Ltd. announced that it had changed its name to Douyin Group (Hong Kong) Co., Ltd.; shortly thereafter, Beijing ByteDance Technology Co., Ltd. was also found to have changed its name to Beijing Douyin Information Service Co., Ltd. After the news came out, the calls for Douyin’s independent listing are also increasing day by day.

There are indications that Douyin is becoming more and more important to ByteDance. On the other hand, if Byte’s annual performance growth is lower than expected, Douyin will inevitably be blamed.

Advertising and e-commerce are the main means of Douyin’s commercialization. However, these two markets will encounter great challenges in 2022.

In the advertising revenue map of Douyin, the three sections of screen-opening advertisements, brand information flow advertisements and bidding information flow advertisements support almost all revenues, and the latter two types of advertisements account for a higher proportion. According to the media’s calculations, in 2020 and 2021, Douyin’s bidding information flow advertising revenue has achieved a substantial growth of more than 60%, and last year’s brand information flow advertising revenue directly doubled.

Although the short video platform is still deeply loved by advertisers, and Douyin’s DAU, average daily usage time and other data can still be obtained, but the general environment of the real economic recession and the decline of traffic dividends is irreversible. The Internet advertising market has come to the most difficult days, and the era of high growth can no longer be replicated.

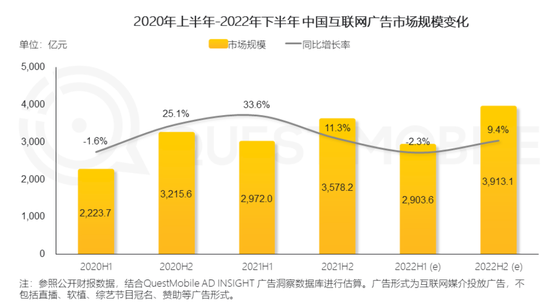

QuestMobile’s report pointed out that the scale of China’s Internet advertising market in the first half of this year was about 290.36 billion yuan, down 2.3% year-on-year, and it is expected to rebound slightly in the second half of the year. Among them, short video platform advertising revenue accounted for about 39.9%, which was only a slight increase of 0.9% compared with the same period last year.

(picture from QuestMobile)

Another popular business, Douyin e-commerce, has many new and old problems.

The old problems are still those familiar formulas: the proportion of self-operated GMV is too low, out of stock, lack of supply chain, and lack of supporting warehousing and logistics measures; to doubt.

The old and new brothers make friends, and Dongfangxuan goes out and enters Taobao successively at the end of the year, which is more or less a kind of harm to Douyin. Although Liu Genghong, who became popular in the second quarter, is also moving towards the road of live broadcasting, but the realization effect is not satisfactory. In the end, he established the “ViVi Fat Oil Kakadao” live broadcast room on Taobao to prepare for entering Taobao.

In view of this, Douyin has also made many changes this year, actively strengthening its shortcomings and repairing loopholes.

At the beginning of the year, Douyin proposed the goal of allowing all the top 2,000 brands in Tmall sales to enter Douyin Mall. The completion rate is already over 90%, and the brand overlap between Douyin e-commerce and Amoy e-commerce is over 80%. . In order to retain big anchors and support new anchors, Douyin also makes long-term dynamic adjustments to multi-traffic distribution rules, and provides more exposure for products entering the homepage.

By the end of the year, Douyin’s e-commerce landscape is constantly expanding through measures such as increasing graphic content and building e-commerce scenes on shelves. However, just tinkering with e-commerce is still unable to meet the needs of bytes. In order to make money, Byte still puts too much pressure on Douyin, adding more and more, revising, upgrading, and stuffing more functions and pages, which also makes Douyin more and more bloated.

It’s just that new businesses such as local life, same-city wine tours, and food delivery that Douyin has placed high hopes on are still difficult to bring in substantial profits. Among them, the local life business, which has the most promising development prospects, still needs Douyin to burn money to maintain expansion, and is facing the siege and interception of rivals such as Meituan and Ele.me.

Douyin, which has more and more links with goods and more and more functions, has caused dissatisfaction among some users. And putting all the burden of revenue on Douyin is not healthy for the long-term development of the group. Byte really needs to think about finding a new engine to reduce the burden on Douyin’s shoulders.

Unfinished Ambition: Metaverse, Offline and Going to Sea

Who can share the pressure of Douyin in the future? Byte has also been anxiously looking for answers over the past year.

Although Byte announced its entry into the B-side last year, focusing on the development of cloud computing projects, there are not many resources left for the B-side this year. After Volcano Engine announced in July this year that it would replace its brand slogan with “New Power for Growth on the Cloud” and launch basic products focusing on the six major industries of finance, automobiles, consumption, entertainment, medical care, and communication media, there have been no more new initiatives.

Feishu, another blockbuster product oriented to the B-end, does not currently regard commercialization as its main task, but is still actively developing customer sources and expanding its influence. After all, the advantage of Byte is still on the C side, dealing with users. Under the background of controlling investment, reducing costs and increasing efficiency, Byte has gradually collected limited resources into several hottest tracks this year: metaverse, offline and overseas.

It goes without saying that Tik Tok has played a very important role. More and more countries are launching Tik Tok Shop, and the team size of the North American office has been expanding. However, Tik Tok is still very cautious about the live streaming that Douyin is best at, and has not spread it on a large scale in overseas markets.

As for the Metaverse business, following the acquisition of the VR hardware company PICO last year, Byte launched a variety of Metaverse social products and virtual human products this year, and placed them in the three sub-tracks of hardware, games, and social networking, which are the most popular concepts in the Metaverse. own power.

Party Island, a social APP launched in January, provides a series of functions such as avatars and online immersive social interaction, and is regarded as an important product to benchmark against competing products such as Baidu Xiyang. The hardware research and development of PICO has also been continuing, and the shipment target for this year has been raised to 1.8 million units, and the global market share is second only to Oculus under Meta.

On the offline side, Meizhong Yihe, which was acquired with a lot of money, and the second-hand car brokerage business that was exploded at the beginning of the year, all rely on ByteDance’s ambition to enter the offline scene.

In September this year, ByteDance wholly owned Beijing Meizhong Yihe Medical Management (Group) Co., Ltd. through its subsidiary Xiaohe Health Related Co., Ltd. and Xiaohe Health Technology (Beijing) Co., Ltd. The equity transfer plan cost close to 10 billion Yuan. Founded in 2006, Meizhong Yihe currently has 7 women’s and children’s hospitals, 2 comprehensive outpatient centers and 5 confinement centers. It is a private chain medical institution with a mid-to-high-end positioning.

However, these three businesses are still facing great challenges. In order for them to support a new growth curve, Byte needs to prescribe the right medicine to solve the most core problems: For example, what should PICO do if it has hardware but lacks content, how to manage the supply chain of Tik Tok’s e-commerce business, and how online traffic is? Assist in doing a good job in offline medical business.

In fact, some linkages between old and new businesses are already happening quietly. QuestMobile’s report once pointed out that among the user groups of Douyin, Xigua Video, and Toutiao, which are owned by Byte, young women in high-tier cities account for a high proportion. Taking Douyin as an example, female users account for more than 50%, and 51% of them are young and middle-aged women aged 19-40-this part of users happens to overlap with the main users of Meizhong Yihe.

It can be seen that the acquisition of Byte is definitely targeted, and the linkage between the medical business and other businesses will definitely increase. This year’s hard days are indeed difficult, but after getting through it, the potential of Byte is still worth looking forward to.

write at the end

Bytedance’s growth dilemma is also directly reflected in the valuation of the primary market.

In September of this year, ByteDance announced that it would use no more than US$3 billion in cash to repurchase shares at a price of no more than US$177 per share, and at the same time expand the option pool reserved for employees. Based on this repurchase price conversion, ByteDance’s overall valuation is around US$300 billion. The practice of expanding the option pool and repurchasing stocks is tantamount to implying employees in disguise to prepare for being unable to go public for a longer period of time.

Although in the major well-known lists, ByteDance is still the super unicorn with the highest valuation and the most anticipated listing prospect in the world. But compared with its own peak valuation, the shrinkage has been quite obvious.

It is said that the valuation myth of the Internet industry has been shattered, and the dream of getting rich with options has come to a midnight dream, but the outside world still hopes that ByteDance, a wealth-creating machine, can retain a glimmer of hope for the industry. However, the reality is far more cruel than the dream, and it is really difficult for ByteDance to return to its peak period.

Of course, the bytes never stop beating. Internally, the fine-tuning of the organizational structure and the reduction of fat and thinness are still continuing; externally, it is actively looking for commercialization paths to improve liquidity. Although it is difficult to reproduce the golden age of the Internet industry, Byte, which is running at full capacity, has not given up hope of catching up.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-26/doc-imxxyezh8016465.shtml

This site is only for collection, and the copyright belongs to the original author.