Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text|Edited by Maria|Pai Gongzi

Source: Pai Finance

Recently, according to multiple media reports, Weilong Holdings is considering launching an initial public offering in the Hong Kong stock market as early as October. The financing scale may reach 500 million US dollars, and the target valuation is 4.7 billion US dollars (about 3.3 million yuan).

After reading the announcement on the official website of the Hong Kong Stock Exchange, the application for Weilong Holdings and the post-hearing materials submitted on June 28, 2022 have been approved, indicating that they are being processed.

According to its updated prospectus, Weilong Holdings’ revenue in 2021 is about 4.8 billion yuan, a year-on-year increase of 16.5%; its net profit is 827 million yuan, an increase of 1%.

However, matters related to the listing of Weilong Holdings are still under discussion, and the scale and timing of the specific IPO may also change.

This is Weilong’s third IPO news.

Twice the IPO failed

As early as May last year, Weilong Holdings submitted an application form to the Hong Kong Stock Exchange, but due to the delay in submitting the listing materials, it “automatically expired”.

However, on the same day that the materials expired, Weilong Holdings submitted a listing application to the Hong Kong Stock Exchange again, and the second application passed the listing hearing two days later. But half a year later, the second application was marked as “invalid” status.

Regarding the reasons for the failure of Weilong’s first two listings, the industry attributed it to the limited growth space in the market where it was located and the inability to attract enough investment demand.

In this regard, Shen Meng, executive director of Chanson Capital, once told the media, “Weilong’s spicy tiao products have a large scale, and the future growth space may be limited. For investors, the return potential is slightly insufficient. The mutual needs of investors are the key to determining the success of the listing, so the first two failures cannot be ruled out as being unable to attract sufficient investment demand.”

A year later, Weilong launched the third IPO shock. On June 28, 2022, the Hong Kong Stock Exchange disclosed that Weilong had passed the listing hearing, with Morgan Stanley, CICC and UBS as contacts. Sponsor.

Before going public, Weilong announced its first round of Pro-IPO financing for the first time, with a financing amount of up to US$590 million, led by CPE Yuanfeng (CITIC Industrial Fund) and Hillhouse, and followed by Sequoia China, Tencent, and Yunfeng Fund. cast.

The prospectus shows that after the completion of this round of financing, CPE Yuanfeng holds 4.26% of the shares, Shanghai Hongluo and Hillhouse hold 2.26%, Tencent and Yunfeng Fund hold 1.23% respectively, Sequoia China, Duckling Fund and Housheng Investment respectively Holding 0.55%, Seapine Capital holds 0.41%, and CWL Management XVIII Limited holds 0.21%. Weilong Future Development, a corporate employee incentive platform, holds 2.04% of the shares.

The brothers Liu Weiping and Liu Fuping, who hold 84.45% of the shares through Hehe Global Capital, are still the controlling shareholders with highly concentrated ownership and management rights, and the foundation of the family business remains untouched.

However, family businesses also have certain drawbacks, and the market is often worried that they will infringe on the interests of investors by virtue of their absolute financial control.

Data show that from 2018 to 2020, Weilong’s shareholder dividends reached 335 million yuan, and dividends of 25.8 million yuan, 308 million yuan and 1.4 million yuan were paid in 2018, 2019 and 2020 respectively.

Obviously, Wei Long’s book is not bad money. Regarding the motive of Weilong’s listing, it stated in its prospectus that the funds raised are used to expand and upgrade production facilities and supply chain systems, invest in and acquire companies that have synergistic effects on the company’s business, expand sales and marketing networks, and brands. Construction, product research and development, digital and intelligent business construction, and supplementary working capital, etc.

But in fact, the capacity utilization rate of Weilong’s four existing factories is not saturated. As of last year, Weilong’s designed annual production capacity totaled 346,700 tons, and the actual capacity utilization rate was 70.7%. The capacity utilization rate of the company’s four factories was not saturated. Among them, the Luohe Weilai factory capacity utilization rate was only 59.8%.

After the Pre-IPO round of financing, Weilong suddenly announced a dividend of 560 million yuan to existing shareholders other than the new round of investors, saying that the dividend is planned to be paid in May 2021.

This move has led to speculation that its founding team will “cash out” early and leave the market.

It is worth mentioning that the two brothers Liu Weiping and Liu Fuping will be listed on the 2021 “Hurun Rich List” with a worth of 28 billion respectively, ranking 223 together and becoming the second richest person in Henan Province.

Is Weilong Overrated?

After the Pre-IPO round of financing, Weilong’s valuation was once fired to 60 billion. This valuation is based on Weilong’s net profit in 2020, which was estimated at 819 million yuan. Based on this calculation, the static price-earnings ratio reached It is about 73 times higher than the industry’s highest expected value by more than 2 times.

According to multiple media reports, the latest valuation given to Weilong by the capital market before the listing was US$4.7 billion (about 3.3 million yuan). But this valuation is still higher than the market level.

According to the rational price of non-essential consumption given by the Hong Kong stock market recently, the price-earnings ratio of 30 times is close to the highest expected value of the market. If calculated on this basis, Weilong’s valuation should be around 25 billion.

Comparing it with Want Want Group, which is listed on the Hong Kong stock market, the revenue of both businesses is highly dependent on super-large single products. Often, the revenue and profit are 5 times that of Weilong, and the price-earnings ratio is only 15-20 times.

It can be seen that Wei Long is undoubtedly overrated.

Moreover, at the moment when the Hong Kong stock market is in a downturn, the market value of snack foods is shrinking sharply, and Weilong’s high valuation may add a lot of resistance to its smooth listing.

From the perspective of business models, the capital market’s concerns about its earnings prospects are unfounded.

Weilong is an old snack food enterprise with a history of 21 years. It was established in Luohe, Henan Province in 2001. Its well-known product is spicy strips.

The spicy snack food industry is a traditional light industry with no technical content, and the ceiling is limited. This is also directly reflected in its financial data. In recent years, although Weilong’s revenue has increased, the growth rate of net profit has slowed down significantly.

The prospectus shows that from 2019 to 2021, Weilong Holdings achieved operating income of 3.385 billion yuan, 4.12 billion yuan, and 4.8 billion yuan respectively, with a compound annual growth rate of 19.1%, much higher than the 9.6% in the Frost & Sullivan report. Industry compound growth rate.

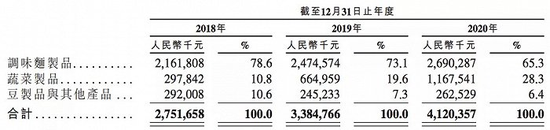

Seasoning products represented by “spicy sticks” are currently Weilong’s largest source of revenue. From 2019 to 2021, Weilong’s seasoned noodle products have revenue of 2.475 billion yuan, 2.69 billion yuan and 2.918 billion yuan, respectively accounting for the total revenue. 73.1%, 65.3% and 60.8% of revenue;

The other two major sectors are vegetable products and soy products and other products. The revenue of vegetable products is 665 million yuan, 1.168 billion yuan and 1.664 billion yuan, accounting for 19.6%, 28.3% and 34.7% of the total revenue respectively; soy products and Revenues from other products were 245 million yuan, 263 million yuan and 218 million yuan respectively.

“Marketing”-driven Internet celebrity Weilong

But it is worth noting that behind the high growth is an over-reliance on the product price increase strategy.

The prospectus shows that from 2018 to 2020, the price of Weilong spicy strips will increase from 13.90 yuan/kg to 18.8 yuan/kg, increasing year by year. The well-known Weilong Spicy Tiao has risen from 5 cents a pack back then to 6 yuan a pack today.

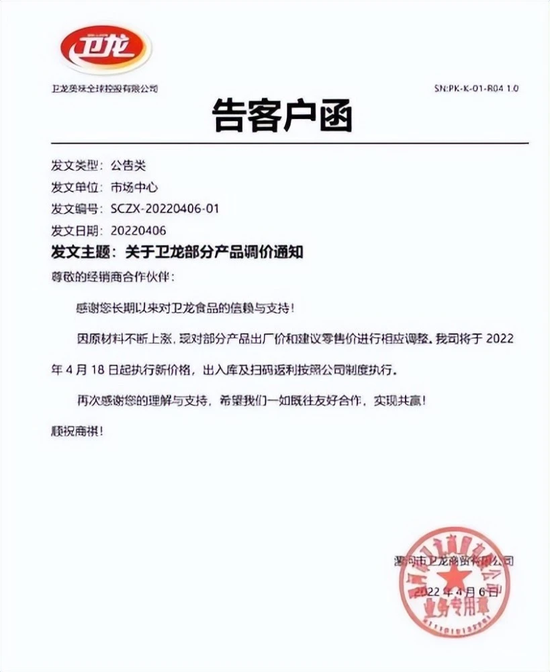

In April this year, before the IPO, Weilong raised the price of its products twice again. In this regard, Weilong explained that in order to cope with the increase in the purchase price of some raw materials used in production, it is part of the upgrade of the entire product line and the adjustment of the business strategy.

Accompanying this is the decline in the growth rate of gross and net profit margins.

The prospectus disclosed that from 2018 to 2021, Weilong’s gross profit margins were 34.7%, 37.1%, 38% and 37.4%, respectively, with little change, and even a decline in the past two years. In this regard, Weilong explained in the prospectus that the decline in gross profit margin was mainly dragged down by seasoned noodle products, which contributed the bulk of its revenue, and the procurement cost of soybean oil, the raw material of such products, increased significantly.

Correspondingly, the growth rate of net profit is also falling off a cliff. From 2019 to 2021, Weilong’s net profit was 658 million yuan, 819 million yuan, and 827 million yuan, up 38.18%, 24.41%, and 0.97% year-on-year, respectively.

Among the reasons, in addition to the rising costs of raw materials and packaging materials, there are also due to inventory expiration, inventory value decline or inventory write-off, and the continuous increase in sales expenses such as advertising.

In other words, the increase in selling expenses and administrative expenses has eroded a considerable part of profit margins.

In 2021, Weilong’s sales expenses will reach 521 million yuan, a year-on-year increase of 40.3%, and management expenses will reach 359 million yuan, a year-on-year increase of 78.6%.

The advertising expenses part of the sales expenses is growing rapidly. In 2019, 2020 and 2021, promotion and advertising expenses were 30.8 million yuan, 46.7 million yuan and 78.7 million yuan respectively, a rapid increase of 2.5 times in just three years. Its overall sales expenses accounted for 8.31%, 9%, and 10.85% of revenue, respectively.

This has also transformed Weilong into a marketing-driven food company.

Another use of whether it is raising prices or paying huge advertising expenses is to try to tear off the label of “junk food” from the outside world and improve the overall brand tonality.

In addition, a big risk for Weilong is its heavy reliance on offline dealers. Weilong also admitted in its prospectus that if there are fluctuations in the distributors, it will have an adverse impact on the financial condition and operating results of Weilong Holdings.

However, the situation will improve in 2021. From 2018 to 2021, Weilong’s revenue from offline dealers accounted for 91.6%, 92.6%, 90.7%, and 88.5% of total revenue; online dealers’ sales accounted for 4.5%, 4.2%, 5.6% and 6.3%.

At the same time, while Weilong is rapidly occupying market share, it also has many risks due to unconventional marketing, food safety and other issues.

In recent years, Weilong has gained a lot of goodwill among young consumers by linking IP, touching porcelain iPhones, and self-deprecating.

However, the big tree attracts the wind, and the status of a super Internet celebrity has also brought him a lot of trouble.

In March 2022, some netizens broke the news that Weilong spicy sticks were printed with words such as “About”, “thief”, “tough” and other words for vulgar marketing, playing a pornographic edge. In response to this, Weilong said that the content of the layout copy of the product packaging caused controversy among some netizens. He apologized and decided to stop the production of the controversial copy and packaging, and at the same time, optimize the layout copy and design.

In addition, Weilong Holdings has also been caught in food safety turmoil for many times.

From October 2015 to June 2021, in the quality sampling inspection of seasoned noodle products announced by the national and provincial market supervision and administration bureaus, a total of 401 batches of seasoned noodle products failed the sampling inspection, involving excessive microorganisms, oil rancidity, excessive Use of preservatives, sweeteners, colors, etc. in excess or in excess. Among them, Weilong’s seasoned noodle products had seven unqualified records.

The data shows that 95.0% of Weilong’s consumers are 35 years old and below, and 55.0% of consumers are young people aged 25 and below, which means that young people are the main purchasing force of Weilong.

At present, young people are paying more and more attention to food health. Spicy sticks with heavy oil and salt are classified as junk food, which is contrary to the trend of consumers pursuing healthy consumption. For Weilong, it is necessary to increase product innovation and shape healthy food brands. It is the focus of its next strategic layout.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-10-18/doc-imqmmthc1312970.shtml

This site is for inclusion only, and the copyright belongs to the original author.