Welcome to the WeChat subscription account of “Sina Technology”: techsina

Text / Xiaojia

Source: 一DU Finance (ID: yiducaijing2021)

Following the “car-making style” of mobile phone manufacturers, the automotive industry is now blowing up a “mobile phone-making style”.

Not long ago, Li Bin, CEO of Weilai Automobile, once again mentioned Weilai’s plan to build mobile phones when attending an event, and said: Weilai has already established mobile phone business teams in Shanghai and Shenzhen, and the progress is relatively smooth. In fact, as early as July this year, he disclosed the news that the company’s mobile phone business was advancing, and declared that he would develop a new mobile phone every year, just like Apple.

As the originator of smartphones, Apple has always been a role model for mobile phone manufacturers. When Li Bin uttered the “like an apple” declaration, the matter became interesting.

01

Why make a mobile phone?

As a well-known domestic auto brand, why does NIO want to make mobile phones across borders?

Li Bin’s positioning for NIO’s mobile phone is: NIO’s mobile phone will be the best mobile phone for NIO’s car, and NIO’s mobile phone will collide with NIO’s car to create more “smart gameplay”.

Coincidentally, Li Bin’s idea is quite similar to that of Geely, which entered the mobile phone industry earlier this July.

On July 4 this year, Geely Automobile’s Xingji Times officially signed a contract with Meizu Technology. The former holds 79.09% of the latter’s controlling stake and obtains sole control of Meizu Technology.

Regarding cross-border manufacturing of mobile phones, Li Shufu, chairman of Geely Holding Group, said to the outside world: The new round of technological and industrial revolution has spawned a large number of new businesses and new models. The technological innovation and ecological integration of the consumer electronics industry and the automotive industry are imperative. Through the layout of the mobile phone business, Geely can achieve deep integration of the consumer electronics industry and the automotive industry, and create a user ecological chain across borders, thereby achieving super synergy.

Compared with domestic car companies actively embracing mobile phones, Tesla’s declaration of making mobile phones is somewhat “a last resort”.

On November 26, 2022, when asked about the solution to “if Twitter is removed from the app store by Apple/Google”, Musk suddenly claimed that if there is no other choice in the end, he will build a “replacement app”. cell phone”.

Musk’s “big mouth” seems outrageous, but judging from past experience, his statements often hide great purpose. This has been confirmed by Dogecoin in the past and the acquisition of Twitter this year, so the outside world speculates that he made a mobile phone is very likely to be true.

However, in the eyes of the outside world, most of the mobile phones made by Musk are not “built for Twitter” as he said, but are very likely to want to further open up Tesla’s ecology at the software level.

After all, as early as 2021, Musk claimed that “I don’t like the current two major mobile phone systems, iOS and Android, and want to build the user’s favorite mobile phone system. Of course, this mobile phone system can become Tesla cars, brain-computer devices , the connection point of the Starlink system, rather than relying on other apps.”

Now, his idea may be coming into reality.

02

Dimensionality reduction strike or new challenge?

Smart cars and smart phones have a strong connection at this moment. But from making cars to making mobile phones, is it really a blow to dimensionality reduction?

“The difficulty of the mobile phone industry is far lower than that of complete vehicles in terms of research and development costs and maturity of the supply chain,” Mr. Yang, who has been engaged in mobile phone research and development for many years, told YiDU Finance: “But the difficulty of the mobile phone industry may be even greater on another level. “

In his view, the development of smartphones for nearly two decades has stagnated in both form and function: it is difficult for mobile phone manufacturers to make breakthroughs in innovation, such as weight, battery life, performance, etc. The same is true, “The homogenization of mobile phones is becoming more and more serious, changing the logo is another brand of mobile phone.”

In order to achieve differentiation, major mobile phone manufacturers have begun to invest heavily in research and development, and as a result, the industry’s involution has been pushed to a new level.

Severe homogenization and extreme involution in the industry have always been the two curses that the domestic mobile phone industry cannot escape, and it is also a problem that auto manufacturers will soon face.

After Geely acquired Meizu through Xingji Times, Xingji Times announced at this year’s Qualcomm new-generation flagship chip conference that it will invest 10 billion yuan to build a flagship phone of Geely’s own brand this year.

10 billion yuan, what is the concept of building a mobile phone.

As a former subversive in the mobile phone industry, Xiaomi’s total R&D investment in 2021 will be around 13 billion yuan; as early as 2019, OPPO executives announced that they would invest 50 billion yuan in research and development in three years. On average, in the past three years, its annual research and development expenses have been around 13.3 billion yuan. Let’s look at vivo again. In 2020, the relevant person in charge of the company said that the research and development funding for that year will also be on the order of 10 billion yuan.

It can be seen that 10 billion yuan may seem like a lot, but it is actually just a “standard configuration”.

In addition to continuous high investment in research and development, mature mobile phone manufacturers have already accumulated a considerable amount of performance.

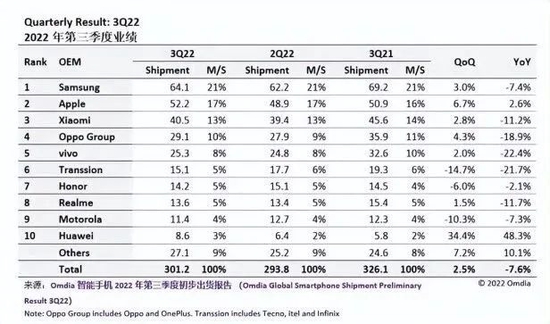

The global mobile phone brand sales list released by the market research organization Omdia shows that among the top ten global mobile phone sales lists in the second and third quarters of 2022, except for Apple and Samsung, the remaining 8 seats are all embraced by Chinese brands. Xiaomi, OPPO , vivo, Honor, Realme, Huawei, etc. are all on the list.

In terms of market share, domestic mobile phone brands accounted for as high as 53%, ranking first in the world, more than the sum of the two major mobile phone brands Apple and Samsung.

Looking at the domestic market again, the performance of each company is different.

Take the third quarter of 2022 as an example. Vivo returned to the top position in the domestic mobile phone market with a market share of about 14.2 million units and a total of 19.9%; OPPO, despite a decline in shipments, still ranks second in the market with an 18% share; independent from Huawei “Two years later, Honor has gradually built its own brand influence. According to statistics from Counterpoint, Honor ranked third in China with a market share of 17.2% in the third quarter of this year. And while the performance is rising steadily, the shadow of “Huawei” on Honor is also fading; after Xiaomi experienced both revenue and profit declines in the second quarter, it seems that the third quarter has not improved yet, but its 100 yuan machine, The thousand yuan phone is still the most popular model among consumers; Huawei is the last one. Statistics from a number of research institutions show that after withdrawing from the ranks of the top five mobile phone manufacturers in the world, Huawei’s domestic mobile phone shipments will drop significantly in the third quarter of 2022, and its market share will be less than 10%.

It can be seen from this that after the mobile phone industry has experienced the severe test in 2022, industry competition has become unprecedentedly fierce. Judging from various data, among the top five manufacturers in the market, vivo and OPPO have secured the first and second places, and Honor is steadily catching up. Although Xiaomi and Huawei are temporarily lagging behind, their shipments and market share should not be underestimated.

This also means that it is really not easy for new car-making forces to get a share of the market structure of “multi-strong coexistence”.

Many people in the industry expressed “not optimistic” about this. After all, the current domestic smartphone market has become saturated, and the top players are strong and have already occupied the mainstream position. New players are likely to be buried.

03

Betting on ecology, what are the odds?

From the perspective of entry motivation, car companies all value “the synergy between self-developed mobile phones and smart car ecology”. Behind this, the essence is to make cars and mobile phones the “core” of the Internet of Things.

According to their ideas, making mobile phones is not simply creating a mobile phone brand, but building an intelligent ecosystem centered on cars. In short, mobile phones serve the closed-loop ecosystem of its cars.

Smart cars have always been regarded as the “third space” among car companies, and the competition in the future will be the ecological capabilities of the Internet of Vehicles and Things. However, it should be noted that the loading capacity of the car machine is much less than that of the smartphone, so it is difficult to independently support the ecology.

“The strategy of car companies entering the smartphone field is correct. The key point is to realize car-machine interconnection and greatly expand the ecosystem of car companies,” said Mr. Zhang, the technical backbone of a smart car company. But he also emphasized that this process cannot be completed overnight, the key is how much car owners use it, and this market will not be particularly large. “The most important thing for car companies to consider is whether the input and output are cost-effective.”

In addition, it should be noted that for traditional car companies, the fault tolerance rate for entering the technology field is relatively high, but the main business of new car manufacturers has not yet entered a stable stage. question mark.

Weilai Automobile’s financial report data for the third quarter of 2022 shows that Weilai Automobile’s cash reserves reached 51.4 billion yuan; Geely Automobile’s mid-year report shows that the company’s net cash flow is 22 billion yuan; Tesla’s cash flow in the third quarter of this year is 3.3 billion US dollars (about 23.3 billion yuan).

Purely from the book view, all three companies have the strength to fight, but in the actual operation, it is still full of unknowns.

Although Weilai Automobile has enough cash, it is under great performance pressure. According to the financial report data for the third quarter of this year, Weilai Automobile had a net loss of 3.49 billion yuan, a year-on-year increase of 514.2%. During the reporting period, Weilai Automobile sold 31,607 vehicles, which is equivalent to an average loss of 110,000 yuan per car sold. Moreover, since 2019, NIO has suffered consecutive losses. From this point of view, it is more or less like “sluggish main business, betting on sideline business”.

In contrast, Geely Auto is much less stressed. Financial report data show that Geely Automobile’s current total assets have reached 510 billion yuan. In the first half of this year, Geely’s revenue was 58.1 billion yuan, a year-on-year increase of 29%, and its net profit was 1.552 billion yuan. Moreover, the acquisition of Meizu to obtain the advantages of relevant industrial chain resources is also more advantageous in the early stage of research and development. However, the extent to which Meizu can achieve synergy with Geely Automobile in the future is also unknown.

On this track full of unknowns, whether car companies can succeed may only be left to time.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2022-12-06/doc-imqmmthc7198972.shtml

This site is only for collection, and the copyright belongs to the original author.